others

Gold price consolidates near two-week top, looks to US NFP for fresh impetus – Crypto News

- Gold price continues with its struggle to gain any meaningful traction on Friday.

- Investors opt to wait on the sidelines ahead of the release of the US NFP.

- September Fed rate cut bets undermine the USD and lend support to the metal.

Gold price (XAU/USD) extends its consolidative price move during the Asian session on Friday and remains well within the striking distance of the highest level since June 21 touched earlier this week. The recent softer US macro data reaffirmed market bets that the Federal Reserve (Fed) will begin cutting rates in September. This keeps the US Dollar (USD) depressed near a three-week low and turns out to be a key factor acting as a tailwind for the non-yielding yellow metal.

That said, the prevalent risk-on environment keeps a lid on any meaningful appreciating move for the safe-haven Gold price. Traders also seem reluctant to place aggressive bets and prefer to wait for the release of the US monthly employment details, due later today. The popularly known as the Nonfarm Payrolls (NFP) report will influence expectations about the Fed’s future policy decision and in turn, help in determining the next leg of a directional move for the XAU/USD.

Daily Digest Market Movers: Gold price traders remain on the sidelines ahead of the US NFP report

- Expectations for an imminent start of the Federal Reserve’s rate-cutting cycle in September weigh on the US Dollar for the fourth straight day on Friday and continue to lend support to the non-yielding Gold price.

- The market bets were lifted by this week’s softer US macroeconomic releases, which pointed to signs of weakness in the labor market and a loss of momentum in the economy at the end of the second quarter.

- That said, hawkish signals from a slew of influential Fed officials, along with the minutes of the June FOMC policy meeting, suggest that policymakers were still not confident about bringing down lending costs.

- Furthermore, the underlying bullish sentiment across the global equity markets holds back traders from placing fresh bullish bets around the safe-haven precious metal ahead of the closely-watched US employment data.

- The popularly known Nonfarm Payrolls report is due for release later during the North American session and is expected to show that the US economy added 190K jobs in June as compared to the 272K previous.

- Meanwhile, the unemployment rate is anticipated to hold steady at 4%, while Average Hourly Earnings growth could see a modest dip, rising by the 3.9% yearly rate as compared to the 4.1% increase recorded in May.

- The crucial data will play a key role in influencing market expectations about the Fed’s future policy decisions, which, in turn, will drive the USD demand and provide a fresh directional impetus to the XAU/USD.

Technical Analysis: Gold price seems poised to appreciate further while above 50-day SMA breakpoint

From a technical perspective, Wednesday’s sustained breakout through the 50-day Simple Moving Average (SMA) was seen as a fresh trigger for bullish traders. Adding to this, oscillators on the daily chart have again started gaining positive traction and suggest that the path of least resistance for the Gold price is to the upside. Some follow-through buying beyond the $2,365 area will reaffirm the constructive outlook and allow the XAU/USD to reclaim the $2,400 mark. The momentum could extend further towards challenging the all-time peak, around the $2,450 zone touched in May.

On the flip side, weakness back towards the 50-day SMA resistance breakpoint, around the $2,339-2,338 region, could be seen as a buying opportunity. This is followed by support near the $2,319-2,318 area, which if broken decisively could make the Gold price vulnerable to weaken further below the $2,300 mark and test the $2,285 horizontal zone. Failure to defend the said support levels might expose the 100-day SMA, currently near the $2,258 area, and the $2,225-2,220 support before the XAU/USD eventually drops to the $2,200 round-figure mark.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

-

Blockchain1 week ago

Blockchain1 week agoThe Quantum Clock Is Ticking on Blockchain Security – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Metaverse5 days ago

Metaverse5 days agoStop panicking about AI. Start preparing – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTether Launches Dollar-Backed Stablecoin USAT – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoUS Storm Smashes Bitcoin Mining Power, Sending Hash Rates Tumbling – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoKalshi Expands Political Footprint with DC Office, Democratic Hire – Crypto News

-

Technology1 week ago

Bitcoin And XRP Price Prediction Ahead of FOMC Meeting Tomorrow, Jan 28 – Crypto News

-

Technology1 week ago

Bitcoin And XRP Price Prediction Ahead of FOMC Meeting Tomorrow, Jan 28 – Crypto News

-

Technology1 week ago

Bitcoin And XRP Price Prediction Ahead of FOMC Meeting Tomorrow, Jan 28 – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIs AI eating up jobs in UK? New report paints bleak picture – Crypto News

-

others1 week ago

others1 week agoZetaChain 2.0 Launches With Anuma, Bringing Private Memory and AI Interoperability to Creators – Crypto News

-

others1 week ago

others1 week agoZetaChain 2.0 Launches With Anuma, Bringing Private Memory and AI Interoperability to Creators – Crypto News

-

others1 week ago

others1 week agoZetaChain 2.0 Launches With Anuma, Bringing Private Memory and AI Interoperability to Creators – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTrump family-backed American Bitcoin achieves 116% BTC yield – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRiver price defies market downturn, explodes 40% to new ATH – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCourt Crushes Lawsuit Against Ripple – Crypto News

-

Blockchain15 hours ago

Blockchain15 hours agoPolymarket Taps Circle to Support Dollar-Denominated Settlements – Crypto News

-

Technology1 week ago

Bitcoin And XRP Price Prediction Ahead of FOMC Meeting Tomorrow, Jan 28 – Crypto News

-

Business1 week ago

Bitcoin Faces Renewed Volatility as Investors Explore Options Like Everlight – Crypto News

-

Business1 week ago

XRP Payments Utility Expands as Ripple Launches Treasury Platform – Crypto News

-

Technology1 week ago

Technology1 week agoElon Musk says ‘WhatsApp is not secure’ amid Meta privacy lawsuit; Sridhar Vembu cites ‘conflict of interest’ – Crypto News

-

others1 week ago

others1 week agoUS Dollar hits 2022 lows as ‘Sell America’ trade intensifies ahead of Fed’s decision – Crypto News

-

Technology1 week ago

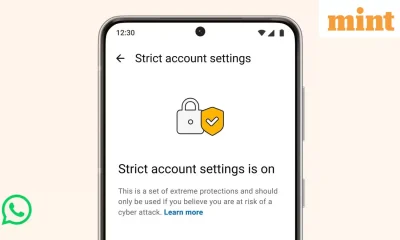

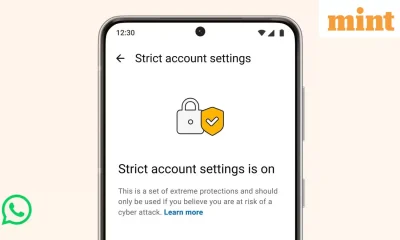

Technology1 week agoWhatsApp launches ‘Strict Account Settings’: How to enable the new lockdown-style mode? – Crypto News

-

others1 week ago

others1 week agoMichael Saylor’s Strategy Buys Another $264,100,000 in Bitcoin (BTC) Amid Crypto Market Downturn – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCrypto Laundering On Centralized Exchanges Declines: Report – Crypto News

-

others1 week ago

others1 week agoFundstrat’s Tom Lee Says Earnings Growth, Dollar Weakness Primed To Drive Stocks Higher – Here’s His Target – Crypto News

-

others1 week ago

others1 week agoQXMP Labs Announces Activation of RWA Liquidity Architecture and $1.1 Trillion On-Chain Asset Registration – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoHow to avoid common AI pitfalls in the workplace – Crypto News

-

Blockchain1 week ago

Blockchain1 week ago‘Most Reliable’ Bitcoin Price Signal Hints at a 2026 Bull Run – Crypto News

-

others1 week ago

Breaking: USDT Issuer Tether Launches GENIUS Act-Compliant USAT Stablecoin – Crypto News

-

others1 week ago

Jerome Powell Speech Tomorrow: What to Expect From Fed Meeting for Crypto Market? – Crypto News

-

Business1 week ago

Strategic Bitcoin Reserve: South Dakota Introduces Bill to Invest in BTC as U.S. States Explore Crypto – Crypto News

-

Business1 week ago

Trump’s Crypto Adviser Confirms Probe Into Alleged Theft From U.S. Crypto Reserve – Crypto News

-

Technology1 week ago

Technology1 week agoWhatsApp launches ‘Strict Account Settings’: How to enable the new lockdown-style mode? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHyperliquid: The frontend wars – Blockworks – Crypto News

-

Technology1 week ago

Solana Price Targets $200 as $152B WisdomTree Joins the Ecosystem – Crypto News

-

others1 week ago

others1 week agoCrypto Exchange Kraken Announces DeFi-Level Yields for Users in US, EU and Canada – Crypto News

-

Technology3 days ago

Fed Rate Cut Uncertainty Mounts as BLS Delays Jobs Report Amid Shutdown – Crypto News

-

others2 days ago

Crypto Market Bill Set to Progress as Senate Democrats Resume Talks After Markup Delay – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHyperliquid explained: The $3 trillion DEX that’s shaking up crypto trading – Crypto News

-

Cryptocurrency1 week ago

Pi Network Price Prediction as 134M Token Unlock in Jan 2026 Could Mark a New All-Time Low – Crypto News

-

Technology1 week ago

Pi Network Price Prediction as 134M Token Unlock in Jan 2026 Could Mark a New All-Time Low – Crypto News

-

Technology1 week ago

Pi Network Price Prediction as 134M Token Unlock in Jan 2026 Could Mark a New All-Time Low – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBNB Chain’s Prediction Markets Soar As Volume Crosses $20B – Crypto News

-

Technology1 week ago

Trump Speech in Iowa Today: Possible Impact on Stocks and Crypto Market – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEthereum Price Breaks Back To $3K As Traders Question Follow-Through – Crypto News

-

others1 week ago

Shiba Inu Price Outlook As SHIB Burn Rate Explodes 2800% in 24 Hours – Crypto News

-

Blockchain1 week ago

Blockchain1 week ago4 In 10 US Merchants Now Accept Crypto – Crypto News