others

Gold price drops to over one-week low amid reduced Fed rate cut expectations – Crypto News

- Gold price remains depressed for the third straight day on Monday, albeit lacks follow-through.

- Expectations that the Fed will keep rates higher for longer continue to undermine the XAU/USD.

- Geopolitical risks help limit the downside ahead of the key FOMC policy decision on Wednesday.

Gold price (XAU/USD) trades with a negative bias for the third straight day on Monday and drops to the $2,050 level, or over a one-week low during the Asian session. The stronger inflation data released from the US last week fuelled speculations that the Federal Reserve (Fed) will stick to its higher-for-longer interest rates narrative. The outlook remains supportive of elevated US Treasury bond yields, which, in turn, acts as a tailwind for the US Dollar (USD) and undermines the non-yielding yellow metal.

The markets, however, are still pricing in a greater chance that the Fed will start cutting interest rates in June. This, along with geopolitical risks, should help limit the downside for the safe-haven Gold price and should limit deeper losses. Traders might also prefer to wait for more cues about the Fed’s rate-cut path before placing fresh directional bets. Hence, the focus remains glued to the outcome of the highly anticipated two-day FOMC monetary policy meeting, scheduled to be announced on Wednesday.

Daily Digest Market Movers: Gold price is pressured by hawkish Fed expectations, bears seem non-committed

- Data released last week from the US pointed to some stickiness in inflation and might force the Federal Reserve to keep rates elevated, which, in turn, is seen weighing on the non-yielding Gold price.

- The University of Michigan’s preliminary survey showed on Friday that one-year and five-year inflation expectations were little changed in March, while the US Consumer Sentiment Index eased to 76.5.

- The CME Group’s FedWatch Tool, meanwhile, indicates that the possibility of an interest rate cut at the June policy meeting stands at around 60% and holds back the USD bulls from placing fresh bets.

- Geopolitical risks remain elevated on the back of the protracted Russia-Ukraine war and conflicts in the Middle East, which is seen lending additional support to the perceived safe-haven precious metal.

- Ukraine last week stepped up drone strikes on Russian oil refineries, while Israeli Prime Minister Benjamin Netanyahu confirmed that he will proceed with plans to push into Gaza’s Rafah enclave.

- Traders might refrain from placing aggressive directional bets and now look forward to the outcome of the highly anticipated FOMC monetary policy meeting on Wednesday for some meaningful impetus.

Technical Analysis: Gold price could slide further once the $2,145-2,144 horizontal support is broken

From a technical perspective, any further decline is likely to find some support near the $2,145-2,144 region, below which the Gold price could accelerate the fall to the next relevant support near the $2,128-2,127 zone. The corrective slide could extend further towards the $2,100 round figure, which should act as a strong base for the XAU/USD.

On the flip side, the $2,175-2,176 region now seems to have emerged as an immediate strong barrier, which if cleared should allow the Gold price to challenge the record peak, around the $2,195 area touched last week. Some follow-through buying beyond the $2,200 mark will set the stage for the resumption of the uptrend witnessed since the beginning of this month.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

-

Technology1 week ago

Technology1 week agoSam Altman says OpenAI is developing a ‘legitimate AI researcher’ by 2028 that can discover new science on its own – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Price Gains Traction — Buyers Pile In Ahead Of Key Technical Breakout – Crypto News

-

De-fi7 days ago

De-fi7 days agoBittensor Rallies Ahead of First TAO Halving – Crypto News

-

De-fi1 week ago

De-fi1 week agoNearly Half of US Retail Crypto Holders Haven’t Earned Yield: MoreMarkets – Crypto News

-

Technology1 week ago

Technology1 week agoMicrosoft ‘tricked users into pricier AI-linked 365 plans,’ says Australian watchdog; files lawsuit – Crypto News

-

De-fi1 week ago

De-fi1 week agoAI Sector Rebounds as Agent Payment Systems Gain Traction – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBig Iran Bank Goes Bankrupt, Affecting 42 Million Customers – Crypto News

-

Business1 week ago

Crypto Market Rally: BTC, ETH, SOL, DOGE Jump 3-7% as US China Trade Talks Progress – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin Accumulation Patterns Show Late-Stage Cycle Maturity, Not Definite End: CryptoQuant – Crypto News

-

Technology1 week ago

Ethereum Supercycle Strengthens as SharpLink Gaming Withdraws $78.3M in ETH – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoIBM Set to Launch Platform for Managing Digital Assets – Crypto News

-

others1 week ago

others1 week agoGBP/USD floats around 1.3320 as softer US CPI reinforces Fed cut bets – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWestern Union eyes stablecoin rails in pursuit of a ‘super app’ vision – Crypto News

-

De-fi1 week ago

De-fi1 week agoNearly Half of US Retail Crypto Holders Haven’t Earned Yield: MoreMarkets – Crypto News

-

others1 week ago

Platinum price recovers from setback – Commerzbank – Crypto News

-

others1 week ago

Indian Court Declares XRP as Property in WazirX Hack Case – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana Eyes $210 Before Its Next Major Move—Uptrend Or Fakeout Ahead? – Crypto News

-

De-fi1 week ago

De-fi1 week agoREP Jumps 50% in a Week as Dev Gets Community Support for Augur Fork – Crypto News

-

De-fi7 days ago

De-fi7 days agoBitcoin Dips Under $110,000 After Fed Cuts Rates – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoUSDJPY Forecast: The Dollar’s Winning Streak Why New Highs Could Be At Hand – Crypto News

-

Technology1 week ago

Technology1 week agoBenQ MA270U review: A 4K monitor that actually gets MacBook users right – Crypto News

-

De-fi1 week ago

De-fi1 week agoNearly Half of US Retail Crypto Holders Haven’t Earned Yield: MoreMarkets – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP/BTC Retests 6-Year Breakout Trendline, Analyst Calls For Decoupling – Crypto News

-

others1 week ago

Is Changpeng “CZ” Zhao Returning To Binance? Probably Not – Crypto News

-

Business1 week ago

Crypto ETFs Attract $1B in Fresh Capital Ahead of Expected Fed Rate Cut This Week – Crypto News

-

De-fi1 week ago

De-fi1 week agoTokenized Nasdaq Futures Enter Top 10 by Volume on Hyperliquid – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoNEAR’s inflation reduction vote fails pass threshold, but it may still be implemented – Crypto News

-

Technology1 week ago

Technology1 week agoSurvival instinct? New study says some leading AI models won’t let themselves be shut down – Crypto News

-

De-fi1 week ago

De-fi1 week agoMetaMask Fuels Airdrop Buzz With Token Claim Domain Registration – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoGold Price Forecast 2025, 2030, 2040 & Investment Outlook – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCitigroup and Coinbase partner to expand digital-asset payment capabilities – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoInside Bitwise’s milestone solana ETF launch – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Is Pi Network’s (PI) Price Up by Double Digits Today? – Crypto News

-

others1 week ago

Can ASTER Price Rebound 50% as Whale Activity and Bullish Pattern Align? – Crypto News

-

Technology6 days ago

Technology6 days agoGiving Nvidias Blackwell chip to China would slash USs AI advantage, experts say – Crypto News

-

Business6 days ago

Business6 days agoStarbucks Says Turnaround Strategy Drives Growth in Global Sales – Crypto News

-

others1 week ago

others1 week agoGold weakens as US-China trade optimism lifts risk sentiment, focus turns to Fed – Crypto News

-

De-fi1 week ago

De-fi1 week agoCRO Jumps After Trump’s Truth Social Announces Prediction Market Partnership with Crypto.Com – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoKERNEL price goes vertical on Upbit listing, hits $0.23 – Crypto News

-

Technology1 week ago

Breaking: $2.6B Western Union Announces Plans for Solana-Powered Stablecoin by 2026 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoVisa To Support Four Stablecoins on Four Blockchains – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Edges Lower While US Stocks Hit New Highs – Crypto News

-

others1 week ago

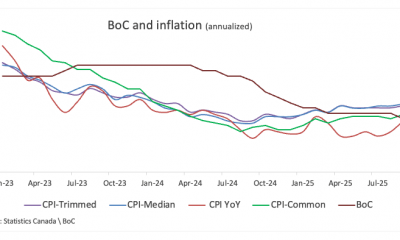

others1 week agoBank of Canada set to cut interest rate for second consecutive meeting – Crypto News

-

others5 days ago

others5 days agoMETA stock has lower gaps to fill – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoThe Next Era Of Crypto Belongs To Decentralized Markets – Crypto News

-

Technology1 week ago

Technology1 week agoInstagram finally lets you relive every Reel you’ve watched with ‘Watch History’ feature – Crypto News

-

Business1 week ago

Trump Tariffs: Secretary Bessent Declares ‘Fantastic’ Trump–Xi Talks, Bitcoin Breaks $113,000 – Crypto News

-

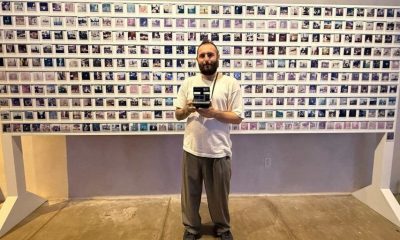

Cryptocurrency1 week ago

Cryptocurrency1 week ago‘Moments of the Unknown’: Justin Aversano Shares Globetrotting Love Letter to Humanity – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoThe Bitcoin Stock-To-Flow ModelIsn’t the Best BTC Forecast Model: Analyst – Crypto News

-

others1 week ago

GBP flat vs. USD with notably muted reaction to retail sales & PMI data – Scotiabank – Crypto News