others

Gold struggles to capitalize on intraday recovery from multi-week low; remains below $3,050 – Crypto News

- Gold price reverses an Asian session slide to over a three-week low, though it lacks follow-through.

- Recession fears continue to weigh on investor sentiment and benefit the safe-haven commodity.

- Bets for more aggressive Fed rate cuts undermine USD and also lend support to the XAU/USD pair.

Gold price (XAU/USD) attracts some buyers near the $2,972-2,971 area, or a nearly four-week low touched earlier this Monday, and for now, seems to have stalled its retracement slide from the all-time peak touched last week. A broader meltdown across the global financial markets, triggered by US President Donald Trump’s sweeping reciprocal tariffs announced last week, offers some support to the safe-haven commodity. Adding to this, data published earlier today showed that the People’s Bank of China (PBOC) increased its state Gold reserves for the fifth straight month, which further acts as a tailwind for the commodity.

The anti-risk flow, along with expectations that a tariffs-driven US economic slowdown might force the Federal Reserve (Fed) to resume its rate-cutting cycle soon, leads to a further steep decline in the US Treasury bond yields. This, in turn, fails to assist the US Dollar (USD) to build on Friday’s move higher from a multi-month low. This, along with persistent geopolitical risks, turns out to be another factor benefiting the non-yielding Gold price. Traders, however, continue to liquidate their long positions and raise cash to cover losses elsewhere, which, in turn, caps the upside for the precious metal and warrants some caution.

Daily Digest Market Movers: Gold price bulls remain on the sidelines despite risk-off mood; weaker USD

- The widening global trade war continues to fuel concerns about a global economic recession and leads to an extended sell-off in equity markets across the world. This, in turn, prompted traders to liquidate their long positions around the Gold price and raise cash to cover losses elsewhere.

- According to data released this Monday, the People’s Bank of China (PBOC) added gold to its reserves for a fifth consecutive month in March. In fact, the People’s Bank of China’s holding rose by 0.09 million troy ounces last month amid rising global trade and geopolitical turmoil.

- US President Donald Trump imposed reciprocal tariffs of at least 10% on all imported goods late last Wednesday, with China facing 54% levies under this new regime. In response, China’s Commerce Ministry announced on Friday that they will levy additional tariffs of 34% on all US imports.

- Meanwhile, US Commerce Secretary Howard Lutnick confirmed on Sunday that the tariffs would not be postponed and the policy would remain in place for days and weeks. Adding to this, Trump stated that there would be no deal with China unless the trade deficit is solved.

- The US Dollar struggles to capitalize on Friday’s modest recovery move from a multi-month low that followed the release of the better-than-expected US Nonfarm Payrolls (NFP) report. In fact, the closely-watched jobs data showed that the economy added 228K jobs in March vs. 117K previous.

- Meanwhile, Federal Reserve (Fed) Chair Jerome Powell said that that inflation is closer to target but still slightly elevated. Powell added that Trump’s tariffs could have a strong inflationary impact and that the Fed’s job is to avoid temporary price hikes turning into persistent inflation.

- Investors, however, are still pricing in the possibility that the US central bank will resume its rate-cutting cycle in June and also lower borrowing costs at least four times this year. This, along with the anti-risk low, keeps the yield on the benchmark 10-year US government bond below the 4.0% mark.

- This, in turn, holds back the USD bulls from placing aggressive bets and assists the non-yielding yellow metal to stage a modest intraday bounce from a nearly four-week low touched during the Asian session on Monday. The lack of follow-through, however, warrants caution for bulls.

Gold price seems vulnerable to prolong the corrective slide; $3,055 support-turned-resistance holds the key

From a technical perspective, last week’s sharp retracement slide from the all-time peak stalls ahead of the 61.8% Fibonacci retracement level of the February-April strong move up. The subsequent move up, however, falters near the $3,055 horizontal support breakpoint, now turned resistance. The latter should now act as a key pivotal point for intraday traders, above which the Gold price could climb to the $3,080 region en route to the $3,100 round figure.

On the flip side, the $3,000 psychological mark, which coincides with the 50% retracement level, now seems to protect the immediate downside ahead of the $2,972-2,971 area, or the multi-week low touched earlier this Monday. This is closely followed by the 50-day Simple Moving Average (SMA), around the $2,946 area, which if broken decisively might shift the near-term bias in favor of bearish traders and pave the way for a further depreciating move.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.27% | 0.13% | 0.45% | -0.06% | 0.65% | 0.27% | -0.44% | |

| EUR | 0.27% | 0.69% | 1.35% | 0.84% | 0.85% | 1.17% | 0.41% | |

| GBP | -0.13% | -0.69% | -0.62% | 0.14% | 0.15% | 0.48% | -0.24% | |

| JPY | -0.45% | -1.35% | 0.62% | -0.48% | 1.15% | 1.06% | -0.54% | |

| CAD | 0.06% | -0.84% | -0.14% | 0.48% | 0.36% | 0.33% | -0.66% | |

| AUD | -0.65% | -0.85% | -0.15% | -1.15% | -0.36% | 0.33% | -0.46% | |

| NZD | -0.27% | -1.17% | -0.48% | -1.06% | -0.33% | -0.33% | -0.72% | |

| CHF | 0.44% | -0.41% | 0.24% | 0.54% | 0.66% | 0.46% | 0.72% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhale Sells $407K TRUMP, Loses $1.37M in Exit – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoRobinhood Dealing With Fallout of Tokenized Equities Offering – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoSatoshi-Era Bitcoin Whale Moves Another $2.42 Billion, What’s Happening? – Crypto News

-

Technology6 days ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoStrategy Resumes Bitcoin Buys, Boosting Holdings to Over $72 Billion in BTC – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin Breaches $120K, Institutional FOMO Takes and House Debate Propel Gains – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoRipple and Ctrl Alt Team to Support Real Estate Tokenization – Crypto News

-

Technology6 days ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Cryptocurrency1 week ago

Why Is Bitcoin Up Today? – Crypto News

-

others6 days ago

others6 days agoEUR/USD recovers with trade talks and Fed independence in focus – Crypto News

-

Business5 days ago

XRP Lawsuit Update: Ripple Paid $125M in Cash, Settlement Hinges on Appeal – Crypto News

-

Business4 days ago

XLM Is More Bullish Than ETH, SOL, And XRP, Peter Brandt Declares – Crypto News

-

Technology1 week ago

Hyperliquid Hits Record $10.6B OI As HYPE Price Records New ATH – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoZiglu Faces $2.7M Shortfall as Crypto Fintech Enters Special Administration – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCardano’s $1.22 target: Why traders should be aware of THIS ADA setup – Crypto News

-

Business7 days ago

Pepe Coin Rich List June 2025: Who’s Holding Highest PEPE as it Nears Half a Million Holders? – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoWhy voice is emerging as India’s next frontier for AI interaction – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoNvidia’s Jensen Huang says AI ‘fundamental like electricity’, praises Chinese models as ‘catalyst for global progress’ – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoBitcoin trades near $119K after new all-time high; Coinbase rebrands wallet to ‘Base App’ – Crypto News

-

Cryptocurrency1 week ago

XRP, Solana and ADA Rally, Is Altcoin Season Back This July 2025? – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle, Anthropic, OpenAI and xAI join US defence to tackle national security with AI – Crypto News

-

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://dripp.zone/news/wp-content/uploads/2025/07/Stellar-XLM-bulls-exhausted-after-rally-Is-a-pullback.webp-400x240.webp)

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://dripp.zone/news/wp-content/uploads/2025/07/Stellar-XLM-bulls-exhausted-after-rally-Is-a-pullback.webp-80x80.webp) Cryptocurrency1 week ago

Cryptocurrency1 week agoStellar [XLM] bulls exhausted after rally – Is a pullback nearby? – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoIt’s a Statement, Says Bitfinex Alpha – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

Business6 days ago

Ethereum Price Prediction- Bulls Target $3,700 As ETH Treasury Accumulation Soars – Crypto News

-

others5 days ago

others5 days agoTop Crypto Exchange by Trading Volume Binance Announces Airdrop for New Ethereum (ETH) Ecosystem Altcoin – Crypto News

-

De-fi5 days ago

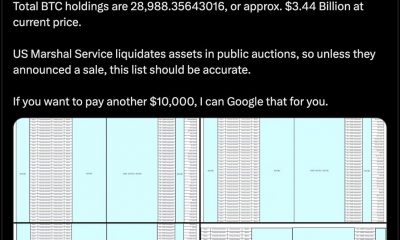

De-fi5 days agoU.S. Marshals Peg Federal Bitcoin Holdings at 28,988 Tokens Worth $3.4 B – Crypto News

-

others5 days ago

others5 days agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

others5 days ago

others5 days agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

Cryptocurrency5 days ago

Russia’s $85 Billion Sberbank to Launch Crypto Custody Services – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoNasdaq Exchange Files SEC Form to List Staking Ethereum ETF – Crypto News

-

Business1 week ago

Next Week To Make US The “Crypto Capital”, Says Bo Hines – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin and Ethereum ETFs record $3.6B inflows this week – Crypto News

-

Technology1 week ago

Peter Schiff Reignites Bitcoin Criticism, Calls 21M Supply Arbitrary – Crypto News

-

Technology1 week ago

Technology1 week agoAmazon Prime Day Sale 2025: Best earphones and headphone deals with up to 70% off – Crypto News

-

others1 week ago

others1 week agoJPMorgan Chase CEO Says Traders May Be Seriously Mistaken on Fed Rate Cuts: Report – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoFriday charts: The rise of zero-sum thinking – Crypto News

-

others1 week ago

others1 week agoCrypto Hacker Who Drained $42,000,000 From GMX Goes White Hat, Returns Funds in Exchange for $5,000,000 Bounty – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoPump.fun Concludes $500M ICO in 12 Minutes — But Something Doesn’t Add Up – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Are So Many Crypto Games Shutting Down? Experts Weigh In – Crypto News

-

De-fi1 week ago

De-fi1 week agoRobinhood Opens Ether and Solana Staking to US Users – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoUK Banks Should not Issue Stablecoins – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoDonald Trump Jr. backs social media startup aiming to become a crypto powerhouse – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTop 3 altcoins under $1 worth watching: Sei, Ethena, Arbitrum – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoThe Bitcoin Liquidity Supercycle Has Just Begun: Hedge Fund CEO – Crypto News

-

Business1 week ago

CME XRP Futures Hit $1.6B In Total Trading Volume Since Launch – Crypto News

-

others1 week ago

Bitcoin Critic Vanguard Becomes Strategy’s (MSTR) Largest Shareholder – Crypto News

-

Technology1 week ago

Technology1 week agoV Guard INSIGHT-G BLDC fan review: Cool performer with a premium look – Crypto News

-

Cryptocurrency1 week ago

Fed’s Hammack Raises Inflation Concerns Amid Push For Interest Rate Cut – Crypto News

others

Gold struggles to capitalize on intraday recovery from multi-week low; remains below $3,050 – Crypto News

- Gold price reverses an Asian session slide to over a three-week low, though it lacks follow-through.

- Recession fears continue to weigh on investor sentiment and benefit the safe-haven commodity.

- Bets for more aggressive Fed rate cuts undermine USD and also lend support to the XAU/USD pair.

Gold price (XAU/USD) attracts some buyers near the $2,972-2,971 area, or a nearly four-week low touched earlier this Monday, and for now, seems to have stalled its retracement slide from the all-time peak touched last week. A broader meltdown across the global financial markets, triggered by US President Donald Trump’s sweeping reciprocal tariffs announced last week, offers some support to the safe-haven commodity. Adding to this, data published earlier today showed that the People’s Bank of China (PBOC) increased its state Gold reserves for the fifth straight month, which further acts as a tailwind for the commodity.

The anti-risk flow, along with expectations that a tariffs-driven US economic slowdown might force the Federal Reserve (Fed) to resume its rate-cutting cycle soon, leads to a further steep decline in the US Treasury bond yields. This, in turn, fails to assist the US Dollar (USD) to build on Friday’s move higher from a multi-month low. This, along with persistent geopolitical risks, turns out to be another factor benefiting the non-yielding Gold price. Traders, however, continue to liquidate their long positions and raise cash to cover losses elsewhere, which, in turn, caps the upside for the precious metal and warrants some caution.

Daily Digest Market Movers: Gold price bulls remain on the sidelines despite risk-off mood; weaker USD

- The widening global trade war continues to fuel concerns about a global economic recession and leads to an extended sell-off in equity markets across the world. This, in turn, prompted traders to liquidate their long positions around the Gold price and raise cash to cover losses elsewhere.

- According to data released this Monday, the People’s Bank of China (PBOC) added gold to its reserves for a fifth consecutive month in March. In fact, the People’s Bank of China’s holding rose by 0.09 million troy ounces last month amid rising global trade and geopolitical turmoil.

- US President Donald Trump imposed reciprocal tariffs of at least 10% on all imported goods late last Wednesday, with China facing 54% levies under this new regime. In response, China’s Commerce Ministry announced on Friday that they will levy additional tariffs of 34% on all US imports.

- Meanwhile, US Commerce Secretary Howard Lutnick confirmed on Sunday that the tariffs would not be postponed and the policy would remain in place for days and weeks. Adding to this, Trump stated that there would be no deal with China unless the trade deficit is solved.

- The US Dollar struggles to capitalize on Friday’s modest recovery move from a multi-month low that followed the release of the better-than-expected US Nonfarm Payrolls (NFP) report. In fact, the closely-watched jobs data showed that the economy added 228K jobs in March vs. 117K previous.

- Meanwhile, Federal Reserve (Fed) Chair Jerome Powell said that that inflation is closer to target but still slightly elevated. Powell added that Trump’s tariffs could have a strong inflationary impact and that the Fed’s job is to avoid temporary price hikes turning into persistent inflation.

- Investors, however, are still pricing in the possibility that the US central bank will resume its rate-cutting cycle in June and also lower borrowing costs at least four times this year. This, along with the anti-risk low, keeps the yield on the benchmark 10-year US government bond below the 4.0% mark.

- This, in turn, holds back the USD bulls from placing aggressive bets and assists the non-yielding yellow metal to stage a modest intraday bounce from a nearly four-week low touched during the Asian session on Monday. The lack of follow-through, however, warrants caution for bulls.

Gold price seems vulnerable to prolong the corrective slide; $3,055 support-turned-resistance holds the key

From a technical perspective, last week’s sharp retracement slide from the all-time peak stalls ahead of the 61.8% Fibonacci retracement level of the February-April strong move up. The subsequent move up, however, falters near the $3,055 horizontal support breakpoint, now turned resistance. The latter should now act as a key pivotal point for intraday traders, above which the Gold price could climb to the $3,080 region en route to the $3,100 round figure.

On the flip side, the $3,000 psychological mark, which coincides with the 50% retracement level, now seems to protect the immediate downside ahead of the $2,972-2,971 area, or the multi-week low touched earlier this Monday. This is closely followed by the 50-day Simple Moving Average (SMA), around the $2,946 area, which if broken decisively might shift the near-term bias in favor of bearish traders and pave the way for a further depreciating move.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.27% | 0.13% | 0.45% | -0.06% | 0.65% | 0.27% | -0.44% | |

| EUR | 0.27% | 0.69% | 1.35% | 0.84% | 0.85% | 1.17% | 0.41% | |

| GBP | -0.13% | -0.69% | -0.62% | 0.14% | 0.15% | 0.48% | -0.24% | |

| JPY | -0.45% | -1.35% | 0.62% | -0.48% | 1.15% | 1.06% | -0.54% | |

| CAD | 0.06% | -0.84% | -0.14% | 0.48% | 0.36% | 0.33% | -0.66% | |

| AUD | -0.65% | -0.85% | -0.15% | -1.15% | -0.36% | 0.33% | -0.46% | |

| NZD | -0.27% | -1.17% | -0.48% | -1.06% | -0.33% | -0.33% | -0.72% | |

| CHF | 0.44% | -0.41% | 0.24% | 0.54% | 0.66% | 0.46% | 0.72% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhale Sells $407K TRUMP, Loses $1.37M in Exit – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoRobinhood Dealing With Fallout of Tokenized Equities Offering – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoSatoshi-Era Bitcoin Whale Moves Another $2.42 Billion, What’s Happening? – Crypto News

-

Technology6 days ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoStrategy Resumes Bitcoin Buys, Boosting Holdings to Over $72 Billion in BTC – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin Breaches $120K, Institutional FOMO Takes and House Debate Propel Gains – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoRipple and Ctrl Alt Team to Support Real Estate Tokenization – Crypto News

-

Technology6 days ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Cryptocurrency1 week ago

Why Is Bitcoin Up Today? – Crypto News

-

others6 days ago

others6 days agoEUR/USD recovers with trade talks and Fed independence in focus – Crypto News

-

Business5 days ago

XRP Lawsuit Update: Ripple Paid $125M in Cash, Settlement Hinges on Appeal – Crypto News

-

Business4 days ago

XLM Is More Bullish Than ETH, SOL, And XRP, Peter Brandt Declares – Crypto News

-

Technology1 week ago

Hyperliquid Hits Record $10.6B OI As HYPE Price Records New ATH – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoZiglu Faces $2.7M Shortfall as Crypto Fintech Enters Special Administration – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCardano’s $1.22 target: Why traders should be aware of THIS ADA setup – Crypto News

-

Business7 days ago

Pepe Coin Rich List June 2025: Who’s Holding Highest PEPE as it Nears Half a Million Holders? – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoWhy voice is emerging as India’s next frontier for AI interaction – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoNvidia’s Jensen Huang says AI ‘fundamental like electricity’, praises Chinese models as ‘catalyst for global progress’ – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoBitcoin trades near $119K after new all-time high; Coinbase rebrands wallet to ‘Base App’ – Crypto News

-

Cryptocurrency1 week ago

XRP, Solana and ADA Rally, Is Altcoin Season Back This July 2025? – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle, Anthropic, OpenAI and xAI join US defence to tackle national security with AI – Crypto News

-

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://dripp.zone/news/wp-content/uploads/2025/07/Stellar-XLM-bulls-exhausted-after-rally-Is-a-pullback.webp-400x240.webp)

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://dripp.zone/news/wp-content/uploads/2025/07/Stellar-XLM-bulls-exhausted-after-rally-Is-a-pullback.webp-80x80.webp) Cryptocurrency1 week ago

Cryptocurrency1 week agoStellar [XLM] bulls exhausted after rally – Is a pullback nearby? – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoIt’s a Statement, Says Bitfinex Alpha – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

Business6 days ago

Ethereum Price Prediction- Bulls Target $3,700 As ETH Treasury Accumulation Soars – Crypto News

-

others5 days ago

others5 days agoTop Crypto Exchange by Trading Volume Binance Announces Airdrop for New Ethereum (ETH) Ecosystem Altcoin – Crypto News

-

De-fi5 days ago

De-fi5 days agoU.S. Marshals Peg Federal Bitcoin Holdings at 28,988 Tokens Worth $3.4 B – Crypto News

-

others5 days ago

others5 days agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

others5 days ago

others5 days agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

Cryptocurrency5 days ago

Russia’s $85 Billion Sberbank to Launch Crypto Custody Services – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoNasdaq Exchange Files SEC Form to List Staking Ethereum ETF – Crypto News

-

Business1 week ago

Next Week To Make US The “Crypto Capital”, Says Bo Hines – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin and Ethereum ETFs record $3.6B inflows this week – Crypto News

-

Technology1 week ago

Peter Schiff Reignites Bitcoin Criticism, Calls 21M Supply Arbitrary – Crypto News

-

Technology1 week ago

Technology1 week agoAmazon Prime Day Sale 2025: Best earphones and headphone deals with up to 70% off – Crypto News

-

others1 week ago

others1 week agoJPMorgan Chase CEO Says Traders May Be Seriously Mistaken on Fed Rate Cuts: Report – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoFriday charts: The rise of zero-sum thinking – Crypto News

-

others1 week ago

others1 week agoCrypto Hacker Who Drained $42,000,000 From GMX Goes White Hat, Returns Funds in Exchange for $5,000,000 Bounty – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoPump.fun Concludes $500M ICO in 12 Minutes — But Something Doesn’t Add Up – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Are So Many Crypto Games Shutting Down? Experts Weigh In – Crypto News

-

De-fi1 week ago

De-fi1 week agoRobinhood Opens Ether and Solana Staking to US Users – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoUK Banks Should not Issue Stablecoins – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoDonald Trump Jr. backs social media startup aiming to become a crypto powerhouse – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTop 3 altcoins under $1 worth watching: Sei, Ethena, Arbitrum – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoThe Bitcoin Liquidity Supercycle Has Just Begun: Hedge Fund CEO – Crypto News

-

Business1 week ago

CME XRP Futures Hit $1.6B In Total Trading Volume Since Launch – Crypto News

-

others1 week ago

Bitcoin Critic Vanguard Becomes Strategy’s (MSTR) Largest Shareholder – Crypto News

-

Technology1 week ago

Technology1 week agoV Guard INSIGHT-G BLDC fan review: Cool performer with a premium look – Crypto News

-

Cryptocurrency1 week ago

Fed’s Hammack Raises Inflation Concerns Amid Push For Interest Rate Cut – Crypto News

others

Gold struggles to capitalize on intraday recovery from multi-week low; remains below $3,050 – Crypto News

- Gold price reverses an Asian session slide to over a three-week low, though it lacks follow-through.

- Recession fears continue to weigh on investor sentiment and benefit the safe-haven commodity.

- Bets for more aggressive Fed rate cuts undermine USD and also lend support to the XAU/USD pair.

Gold price (XAU/USD) attracts some buyers near the $2,972-2,971 area, or a nearly four-week low touched earlier this Monday, and for now, seems to have stalled its retracement slide from the all-time peak touched last week. A broader meltdown across the global financial markets, triggered by US President Donald Trump’s sweeping reciprocal tariffs announced last week, offers some support to the safe-haven commodity. Adding to this, data published earlier today showed that the People’s Bank of China (PBOC) increased its state Gold reserves for the fifth straight month, which further acts as a tailwind for the commodity.

The anti-risk flow, along with expectations that a tariffs-driven US economic slowdown might force the Federal Reserve (Fed) to resume its rate-cutting cycle soon, leads to a further steep decline in the US Treasury bond yields. This, in turn, fails to assist the US Dollar (USD) to build on Friday’s move higher from a multi-month low. This, along with persistent geopolitical risks, turns out to be another factor benefiting the non-yielding Gold price. Traders, however, continue to liquidate their long positions and raise cash to cover losses elsewhere, which, in turn, caps the upside for the precious metal and warrants some caution.

Daily Digest Market Movers: Gold price bulls remain on the sidelines despite risk-off mood; weaker USD

- The widening global trade war continues to fuel concerns about a global economic recession and leads to an extended sell-off in equity markets across the world. This, in turn, prompted traders to liquidate their long positions around the Gold price and raise cash to cover losses elsewhere.

- According to data released this Monday, the People’s Bank of China (PBOC) added gold to its reserves for a fifth consecutive month in March. In fact, the People’s Bank of China’s holding rose by 0.09 million troy ounces last month amid rising global trade and geopolitical turmoil.

- US President Donald Trump imposed reciprocal tariffs of at least 10% on all imported goods late last Wednesday, with China facing 54% levies under this new regime. In response, China’s Commerce Ministry announced on Friday that they will levy additional tariffs of 34% on all US imports.

- Meanwhile, US Commerce Secretary Howard Lutnick confirmed on Sunday that the tariffs would not be postponed and the policy would remain in place for days and weeks. Adding to this, Trump stated that there would be no deal with China unless the trade deficit is solved.

- The US Dollar struggles to capitalize on Friday’s modest recovery move from a multi-month low that followed the release of the better-than-expected US Nonfarm Payrolls (NFP) report. In fact, the closely-watched jobs data showed that the economy added 228K jobs in March vs. 117K previous.

- Meanwhile, Federal Reserve (Fed) Chair Jerome Powell said that that inflation is closer to target but still slightly elevated. Powell added that Trump’s tariffs could have a strong inflationary impact and that the Fed’s job is to avoid temporary price hikes turning into persistent inflation.

- Investors, however, are still pricing in the possibility that the US central bank will resume its rate-cutting cycle in June and also lower borrowing costs at least four times this year. This, along with the anti-risk low, keeps the yield on the benchmark 10-year US government bond below the 4.0% mark.

- This, in turn, holds back the USD bulls from placing aggressive bets and assists the non-yielding yellow metal to stage a modest intraday bounce from a nearly four-week low touched during the Asian session on Monday. The lack of follow-through, however, warrants caution for bulls.

Gold price seems vulnerable to prolong the corrective slide; $3,055 support-turned-resistance holds the key

From a technical perspective, last week’s sharp retracement slide from the all-time peak stalls ahead of the 61.8% Fibonacci retracement level of the February-April strong move up. The subsequent move up, however, falters near the $3,055 horizontal support breakpoint, now turned resistance. The latter should now act as a key pivotal point for intraday traders, above which the Gold price could climb to the $3,080 region en route to the $3,100 round figure.

On the flip side, the $3,000 psychological mark, which coincides with the 50% retracement level, now seems to protect the immediate downside ahead of the $2,972-2,971 area, or the multi-week low touched earlier this Monday. This is closely followed by the 50-day Simple Moving Average (SMA), around the $2,946 area, which if broken decisively might shift the near-term bias in favor of bearish traders and pave the way for a further depreciating move.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.27% | 0.13% | 0.45% | -0.06% | 0.65% | 0.27% | -0.44% | |

| EUR | 0.27% | 0.69% | 1.35% | 0.84% | 0.85% | 1.17% | 0.41% | |

| GBP | -0.13% | -0.69% | -0.62% | 0.14% | 0.15% | 0.48% | -0.24% | |

| JPY | -0.45% | -1.35% | 0.62% | -0.48% | 1.15% | 1.06% | -0.54% | |

| CAD | 0.06% | -0.84% | -0.14% | 0.48% | 0.36% | 0.33% | -0.66% | |

| AUD | -0.65% | -0.85% | -0.15% | -1.15% | -0.36% | 0.33% | -0.46% | |

| NZD | -0.27% | -1.17% | -0.48% | -1.06% | -0.33% | -0.33% | -0.72% | |

| CHF | 0.44% | -0.41% | 0.24% | 0.54% | 0.66% | 0.46% | 0.72% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhale Sells $407K TRUMP, Loses $1.37M in Exit – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoRobinhood Dealing With Fallout of Tokenized Equities Offering – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoSatoshi-Era Bitcoin Whale Moves Another $2.42 Billion, What’s Happening? – Crypto News

-

Technology6 days ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoStrategy Resumes Bitcoin Buys, Boosting Holdings to Over $72 Billion in BTC – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin Breaches $120K, Institutional FOMO Takes and House Debate Propel Gains – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoRipple and Ctrl Alt Team to Support Real Estate Tokenization – Crypto News

-

Technology6 days ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Cryptocurrency1 week ago

Why Is Bitcoin Up Today? – Crypto News

-

others6 days ago

others6 days agoEUR/USD recovers with trade talks and Fed independence in focus – Crypto News

-

Business5 days ago

XRP Lawsuit Update: Ripple Paid $125M in Cash, Settlement Hinges on Appeal – Crypto News

-

Business4 days ago

XLM Is More Bullish Than ETH, SOL, And XRP, Peter Brandt Declares – Crypto News

-

Technology1 week ago

Hyperliquid Hits Record $10.6B OI As HYPE Price Records New ATH – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoZiglu Faces $2.7M Shortfall as Crypto Fintech Enters Special Administration – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCardano’s $1.22 target: Why traders should be aware of THIS ADA setup – Crypto News

-

Business7 days ago

Pepe Coin Rich List June 2025: Who’s Holding Highest PEPE as it Nears Half a Million Holders? – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoWhy voice is emerging as India’s next frontier for AI interaction – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoNvidia’s Jensen Huang says AI ‘fundamental like electricity’, praises Chinese models as ‘catalyst for global progress’ – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoBitcoin trades near $119K after new all-time high; Coinbase rebrands wallet to ‘Base App’ – Crypto News

-

Cryptocurrency1 week ago

XRP, Solana and ADA Rally, Is Altcoin Season Back This July 2025? – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle, Anthropic, OpenAI and xAI join US defence to tackle national security with AI – Crypto News

-

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://dripp.zone/news/wp-content/uploads/2025/07/Stellar-XLM-bulls-exhausted-after-rally-Is-a-pullback.webp-400x240.webp)

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://dripp.zone/news/wp-content/uploads/2025/07/Stellar-XLM-bulls-exhausted-after-rally-Is-a-pullback.webp-80x80.webp) Cryptocurrency1 week ago

Cryptocurrency1 week agoStellar [XLM] bulls exhausted after rally – Is a pullback nearby? – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoIt’s a Statement, Says Bitfinex Alpha – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

Business6 days ago

Ethereum Price Prediction- Bulls Target $3,700 As ETH Treasury Accumulation Soars – Crypto News

-

others5 days ago

others5 days agoTop Crypto Exchange by Trading Volume Binance Announces Airdrop for New Ethereum (ETH) Ecosystem Altcoin – Crypto News

-

De-fi5 days ago

De-fi5 days agoU.S. Marshals Peg Federal Bitcoin Holdings at 28,988 Tokens Worth $3.4 B – Crypto News

-

others5 days ago

others5 days agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

others5 days ago

others5 days agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

Cryptocurrency5 days ago

Russia’s $85 Billion Sberbank to Launch Crypto Custody Services – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoNasdaq Exchange Files SEC Form to List Staking Ethereum ETF – Crypto News

-

Business1 week ago

Next Week To Make US The “Crypto Capital”, Says Bo Hines – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin and Ethereum ETFs record $3.6B inflows this week – Crypto News

-

Technology1 week ago

Peter Schiff Reignites Bitcoin Criticism, Calls 21M Supply Arbitrary – Crypto News

-

Technology1 week ago

Technology1 week agoAmazon Prime Day Sale 2025: Best earphones and headphone deals with up to 70% off – Crypto News

-

others1 week ago

others1 week agoJPMorgan Chase CEO Says Traders May Be Seriously Mistaken on Fed Rate Cuts: Report – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoFriday charts: The rise of zero-sum thinking – Crypto News

-

others1 week ago

others1 week agoCrypto Hacker Who Drained $42,000,000 From GMX Goes White Hat, Returns Funds in Exchange for $5,000,000 Bounty – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoPump.fun Concludes $500M ICO in 12 Minutes — But Something Doesn’t Add Up – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Are So Many Crypto Games Shutting Down? Experts Weigh In – Crypto News

-

De-fi1 week ago

De-fi1 week agoRobinhood Opens Ether and Solana Staking to US Users – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoUK Banks Should not Issue Stablecoins – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoDonald Trump Jr. backs social media startup aiming to become a crypto powerhouse – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTop 3 altcoins under $1 worth watching: Sei, Ethena, Arbitrum – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoThe Bitcoin Liquidity Supercycle Has Just Begun: Hedge Fund CEO – Crypto News

-

Business1 week ago

CME XRP Futures Hit $1.6B In Total Trading Volume Since Launch – Crypto News

-

others1 week ago

Bitcoin Critic Vanguard Becomes Strategy’s (MSTR) Largest Shareholder – Crypto News

-

Technology1 week ago

Technology1 week agoV Guard INSIGHT-G BLDC fan review: Cool performer with a premium look – Crypto News

-

Cryptocurrency1 week ago

Fed’s Hammack Raises Inflation Concerns Amid Push For Interest Rate Cut – Crypto News