others

Gold weakens as US Dollar, bond yields recovers with eyes on US core PCE inflation – Crypto News

- Gold price tumbles to $2,340 as investors worry that Fed rates will remain higher for longer.

- The US Dollar and bond yields rise as traders pare Fed rate-cut bets for September.

- Investors shift focus to the US core PCE price index data for fresh guidance on Friday.

Gold price (XAU/USD) falls sharply to near $2,340 in Wednesday’s New York session. The precious metal weakens after the recovery move to near $2,360 stalled. The yellow metal falls back as Federal Reserve (Fed) policymakers emphasize keeping interest rates higher for longer.

Meanwhile, investors turn cautious as the focus shifts to the United States (US) core Personal Consumption Expenditure Price Index (PCE) data for April, which will be published on Friday. The Fed’s preferred inflation measure is forecasted to have grown steadily on both monthly and annual basis at 0.3% and 2.8%, respectively.

The expected growth in the underlying inflation data would prompt the likelihood of interest rates remaining at higher levels. This scenario bodes poorly for the Gold price given that the opportunity cost of holding investments in non-yielding assets, such as Gold, rises. The condition would be favorable for yields on interest-bearing assets and US Dollar.

At the time of writing, the US Dollar rises to 104.70 and the 10-year US Treasury yields post fresh three-week high around 4.57% on cautious market sentiment.

Daily digest market movers: Gold price tumbles after Fed Kashkari’s hawkish guidance

- Gold price resumes its downside journey after a short-lived pullback move to near $2,360. The precious metal comes under pressure as traders redeem significant bets favouring the Fed to begin lowering interest rates from the September meeting. The confidence of traders towards the Fed reducing borrowing rates from September has been shaken by the Fed’s hawkish guidance on interest rates.

- The CME FedWatch tool shows that traders see a 46% chance that the central bank will reduce interest rates from their current levels in September. The odds have come down from 57.5% recorded a week ago.

- Fed officials want to be patient with the current interest rate framework as they lack evidence that inflation will sustainably return to the desired rate of 2%. Despite a decline in inflationary pressures in April after remaining hot for the entire first quarter, policymakers want interest rates to remain elevated. Policymakers worry that the slowdown won’t be long-lasting given the strength in the labor market.

- Meanwhile, Fed policymakers are also open to tightening policy further if progress in the disinflation process stalls or price pressures revamp again. On Tuesday, Minneapolis Fed Bank President Neel Kashkari said in an interview with CNBC broadcast, “I think the odds of us raising rates are quite low, but I don’t want to take anything off the table.”

- When asked about what conditions will boost the confidence of the Fed for rate cuts this year, Kaskari said: “Many more months of positive inflation data, I think, to give me confidence that it’s appropriate to dial back,” Reuters reported.

Technical Analysis: Gold price weakens after inverted flag breakdown

Gold price weakens after the breakdown of an Inverted Flag chart formation on an hourly timeframe. A breakdown of the above-mentioned chart pattern suggests that the downside trend has resumed after the entry of fresh sellers. The near-term outlook is uncertain as the Gold price has slipped below the 50-period Exponential Moving Average (EMA), which trades around $2,350.

The 14-period Relative Strength Index (RSI) has shifted into the bearish range of 20.00-40.00, suggesting that a bearish momentum has been established.

If the Gold price breaks below the May 24 low of around $2,320, more downside will appear. However, a recovery move above the May 28 high of around $2,365 would put bulls in the driving seat.

Economic Indicator

Core Personal Consumption Expenditures – Price Index (YoY)

The Core Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US). The PCE Price Index is also the Federal Reserve’s (Fed) preferred gauge of inflation. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The core reading excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures.” Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

-

Technology4 days ago

Technology4 days agoChatGPT users are mass cancelling OpenAI subscriptions after GPT-5 launch: Here’s why – Crypto News

-

Technology1 week ago

Binance to List Fireverse (FIR)- What You Need to Know Before August 6 – Crypto News

-

Technology1 week ago

Technology1 week agoBest computer set under ₹20000 for daily work and study needs: Top 6 affordable picks students and beginners – Crypto News

-

Technology1 week ago

Beyond Billboards: Why Crypto’s Future Depends on Smarter Sports Sponsorships – Crypto News

-

Cryptocurrency1 week ago

Cardano’s NIGHT Airdrop to Hit 2.2M XRP Wallets — Find Out How Much You Can Get – Crypto News

-

others1 week ago

others1 week agoBank of America CEO Denies Alleged Debanking Trend, Says Regulators Need To Provide More Clarity To Avoid ‘Second-Guessing’ – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoEthereum Hits Major 2025 Year Peak Despite Price Dropping to $3,500 – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle DeepMind CEO Demis Hassabis explains why AI could replace doctors but not nurses – Crypto News

-

Business1 week ago

Analyst Spots Death Cross on XRP Price as Exchange Inflows Surge – Is A Crash Ahead ? – Crypto News

-

others1 week ago

Pi Network Invests In OpenMiind’s $20M Vision for Humanoid Robots- Is It A Right Move? – Crypto News

-

Business1 week ago

Pi Network Invests In OpenMiind’s $20M Vision for Humanoid Robots- Is It A Right Move? – Crypto News

-

De-fi1 week ago

De-fi1 week agoTON Sinks 7.6% Despite Verb’s $558M Bid to Build First Public Toncoin Treasury Firm – Crypto News

-

De-fi1 week ago

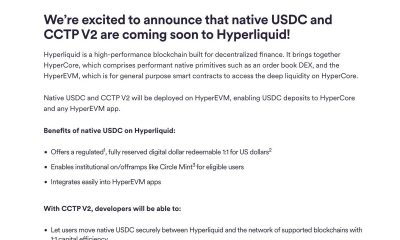

De-fi1 week agoCircle Extends Native USDC to Sei and Hyperliquid in Cross-Chain Push – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Must Hold $2.65 Support Or Risk Major Breakdown – Analyst – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Must Hold $2.65 Support Or Risk Major Breakdown – Analyst – Crypto News

-

Business1 week ago

Is Quantum Computing A Threat for Bitcoin- Elon Musk Asks Grok – Crypto News

-

Technology1 week ago

Technology1 week agoElon Musk reveals why AI won’t replace consultants anytime soon—and it’s not what you think – Crypto News

-

others1 week ago

Japan CFTC JPY NC Net Positions down to ¥89.2K from previous ¥106.6K – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHow to Trade Meme Coins in 2025 – Crypto News

-

others1 week ago

others1 week agoIs Friday’s sell-off the beginning of a downtrend? – Crypto News

-

Technology1 week ago

Technology1 week agoOppo K13 Turbo, K13 Turbo Pro to launch in India on 11 August: Expected price, specs and more – Crypto News

-

Blockchain1 week ago

Shiba Inu Team Member Reveals ‘Primary Challenge’ And ‘Top Priority’ Amid Market Uncertainty – Crypto News

-

Technology1 week ago

Technology1 week agoOpenAI releases new reasoning-focused open-weight AI models optimised for laptops – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoCrypto Market Might Be Undervalued Amid SEC’s New Stance – Crypto News

-

Metaverse7 days ago

Metaverse7 days agoChatGPT won’t help you break up anymore as OpenAI tweaks rules – Crypto News

-

De-fi6 days ago

De-fi6 days agoCoinbase Pushes for ZK-enabled AML Overhaul Just Months After Data Breach – Crypto News

-

Cryptocurrency4 days ago

DWP Management Secures $200M in XRP Post SEC-Win – Crypto News

-

others1 week ago

SharpLink Buys the Dip, Acquires $100M in ETH for Ethereum Treasury – Crypto News

-

others1 week ago

others1 week agoVisa and Mastercard’s Payment Dominance Not Threatened by Stablecoins, According to Execs – Crypto News

-

Business1 week ago

Breaking: U.S. CFTC Kicks off Crypto Sprint, Explores Spot and Futures Trading Together – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoLido Slashes 15% of Staff, Cites Operational Cost Concerns – Crypto News

-

others1 week ago

MetaPlanet Launches Online Clothing Store As Part of ‘Brand Strategy’ – Crypto News

-

Technology7 days ago

Technology7 days agoiPhone users alert! Truecaller to discontinue call recording feature for iOS from September 30. Here’s what you can do… – Crypto News

-

Technology7 days ago

Technology7 days agoiPhone users alert! Truecaller to discontinue call recording feature for iOS from September 30. Here’s what you can do… – Crypto News

-

others6 days ago

others6 days agoUS President Trump issues executive order imposing additional 25% tariff on India – Crypto News

-

Business6 days ago

Analyst Predicts $4K Ethereum Rally as SEC Clarifies Liquid Staking Rules – Crypto News

-

De-fi6 days ago

De-fi6 days agoSEC Says Some Stablecoins Can Be Treated as Cash, but Experts Warn of Innovation Risk – Crypto News

-

Business6 days ago

XRP Price Prediction As $214B SBI Holdings Files for XRP ETF- Analyst Sees Rally to $4 Ahead – Crypto News

-

others5 days ago

others5 days agoEUR firmer but off overnight highs – Scotiabank – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoTrump to Sign an EO Over Ideological Debanking: Report – Crypto News

-

De-fi5 days ago

De-fi5 days agoRipple Expands Its Stablecoin Payments Infra with $200M Rail Acquisition – Crypto News

-

others5 days ago

others5 days agoRipple To Gobble Up Payments Platform Rail for $200,000,000 To Support Transactions via XRP and RLUSD Stablecoin – Crypto News

-

Cryptocurrency4 days ago

Cryptocurrency4 days agoHarvard Reveals $116 Million Investment in BlackRock Bitcoin ETF – Crypto News

-

Technology4 days ago

Technology4 days agoHumanoid Robots Still Lack AI Technology, Unitree CEO Says – Crypto News

-

Technology1 week ago

Technology1 week agoAmazon Great Freedom Festival Sale 2025 vs Flipkart Freedom Sale: Comparing MacBook deals – Crypto News

-

Business1 week ago

India’s Jetking Targets 21,000 Bitcoin By 2032 As CFO Foresees $1M+ Price – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Markets Stall as Trump’s Crypto Policy Report Fails to Spark Momentum – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSharpLink Buys $54M in ETH, Holdings Reach $1.65B – Crypto News

-

Business1 week ago

Major U.S. Banks Now pushing “Chokepoint 3.0” to Kill Crypto: a16z Partner – Crypto News

-

others1 week ago

United States CFTC Oil NC Net Positions climbed from previous 153.3K to 156K – Crypto News