others

How long will the ECB keep cutting interest rates? – Crypto News

- The European Central Bank is on track to deliver another 25 bps interest rate cut on Thursday.

- The focus remains on the ECB’s updated economic forecasts and President Christine Lagarde’s words.

- The EUR/USD pair braces for intense volatility on the ECB policy announcements.

The European Central Bank (ECB) will announce its March interest rate decision on Thursday at 13:15 GMT. The central bank is set for its sixth-rate reduction since June 2024. Updated staff economic projections will be published at this meeting.

ECB President Christine Lagarde will hold a press confe rence at 13:45 GMT. At this conference, she will deliver the prepared statement on monetary policy and take questions from the media.

The Euro (EUR) remains poised for a big reaction to the ECB announcements against the US Dollar (USD).

Follow our Live Coverage here

What to expect from the European Central Bank interest rate decision?

The ECB is on track to deliver another 25 basis points (bps) cut following its March policy meeting, reducing the benchmark rate on deposit facility from 2.75% to 2.5%.

The decision to cut the rate is undebatable, as the Euro area’s weak economic prospects remain a leading cause for concern for ECB policymakers. The old continent’s disinflation path remains intact, allowing the ECB some room to continue its easing trajectory.

Data released by Eurostat on Monday showed that the Eurozone Harmonized Index of Consumer Prices (HICP) rose 2.4% year-over-year (YoY) in February after recording a 2.5% growth in January. The market forecast was for a 2.3% acceleration in the reported period. Meanwhile, the core HICP advanced 2.6% YoY in February, compared with a 2.7% increase in January, meeting the 2.6% expectations.

However, the Bank’s hints on its next move on interest rates will grab the eyeballs amid looming United States (US) President Donald Trump’s reciprocal tariffs on the European Union (EU), which could significantly impact the bloc’s inflation and economic outlooks. Trump threatened to impose 25% tariffs on imports from the EU last week, claiming that the economic and political bloc was formed “to screw” the US.

Therefore, the language in the policy statement and the updated economic forecasts will be closely scrutinized to gauge the timing and the scope of the ECB’s future rate cuts. According to the latest Reuters poll, “the ECB will take another 50 bps off the deposit rate next quarter and then hold steady through at least 2026.” “Markets have fully priced in an end-December rate of 2.00%,” the survey showed.

The markets continue pricing further rate cuts even as top policymakers shared conflicting messages. ECB board member and a vocal policy hawk Isabel Schnabel said in a Financial Times (FT) interview last month: “We are getting closer to the point where we may have to pause or halt our rate cuts.”

“I’m not saying that we’re there yet. But we have to start the discussion,” she added.

On the other hand, her colleague and the head of the Italian central bank, Fabio Panetta, noted: “The available indicators seem to suggest that the predominant risk remains inflation falling below 2% over the medium term.”

Meanwhile, the accounts of the January ECB meeting published on February 27 showed: “Members concurred that the disinflationary process was well on track. But there was some evidence suggesting a shift in the balance of risks to the upside since December.”

The accounts added that some policymakers argued for “greater caution” regarding the size and pace of further rate cuts as policy rates were approaching the neutral level.

Previewing the ECB meeting, TD Securities analysts said: “With just five weeks since their last meeting, there’s little to move the dial, and a 25bps cut is broadly expected. Projections should see minimal changes, and while language around ‘restrictive’ policy may be changed slightly, we doubt there’s a full removal of that statement.”

“April/June will be the far more interesting meetings and highly dependent on tariffs,” the analysts added.

How could the ECB meeting impact EUR/USD?

The EUR/USD pair remains unstoppable in the run-up to the ECB event risk. The pair extends the recovery from two-week lows of 1.0360 as the Euro jumps on Germany’s proposed debt break reforms. Will the major sustain the recovery momentum on the ECB rate-call?

The ECB is expected to stick to its prudence on the policy outlook, reiterating that it is not on any pre-determined path on interest rates. However, if the Bank makes any material change to its “restrictive” policy language, markets could perceive it as a hawkish shift and add to the renewed EUR/USD upside. The pair is set to extend the recovery toward 1.0700 in such a scenario.

However, the main currency pair could come under intense selling pressure if there is no change in the language or tone of the policy statement. The Euro could suffer if ECB President Lagarde explicitly endorses future rate cuts, expressing concerns over a weak economic outlook.

Dhwani Mehta, Asian Session Lead Analyst at FXStreet, offers a brief technical outlook for EUR/USD:

“The EUR/USD recovery remains unabated heading into the ECB showdown. However, The Relative Strength Index (RSI) sits within the overbought region on the daily chart, warranting caution for Euro buyers. If a correction unfolds, the immediate support of the 200-day Simple Moving Average (SMA) at 1.0723 will be tested. Acceptance under that level will put the 1.0600 round level at risk. The last line of defense for EUR/USD buyers is the 100-day SMA at 1.0507.”

“Should Euro buyers defy the bearish technical indicators, the door will likely open for a test of the 1.0900 level. Further up, the November 2024 high of 1.0937 will be on their radars.”

Economic Indicator

ECB Press Conference

Following the European Central Bank’s (ECB) economic policy decision, the ECB President gives a press conference regarding monetary policy. The president’s comments may influence the volatility of the Euro (EUR) and determine a short-term positive or negative trend. If the president adopts a hawkish tone it is considered bullish for the EUR, whereas if the tone is dovish the result is usually bearish for the Euro.

Next release: Thu Mar 06, 2025 13:45

Frequency: Irregular

Consensus: –

Previous: –

Source: European Central Bank

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

-

Blockchain1 week ago

Blockchain1 week agoRobinhood Dealing With Fallout of Tokenized Equities Offering – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhale Sells $407K TRUMP, Loses $1.37M in Exit – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoSatoshi-Era Bitcoin Whale Moves Another $2.42 Billion, What’s Happening? – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoRipple and Ctrl Alt Team to Support Real Estate Tokenization – Crypto News

-

Technology6 days ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCardano’s $1.22 target: Why traders should be aware of THIS ADA setup – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin Breaches $120K, Institutional FOMO Takes and House Debate Propel Gains – Crypto News

-

Technology6 days ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Cryptocurrency1 week ago

Why Is Bitcoin Up Today? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoStrategy Resumes Bitcoin Buys, Boosting Holdings to Over $72 Billion in BTC – Crypto News

-

Business1 week ago

Pepe Coin Rich List June 2025: Who’s Holding Highest PEPE as it Nears Half a Million Holders? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoIt’s a Statement, Says Bitfinex Alpha – Crypto News

-

others6 days ago

others6 days agoEUR/USD recovers with trade talks and Fed independence in focus – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoBitcoin trades near $119K after new all-time high; Coinbase rebrands wallet to ‘Base App’ – Crypto News

-

Business5 days ago

XLM Is More Bullish Than ETH, SOL, And XRP, Peter Brandt Declares – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoUK Banks Should not Issue Stablecoins – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle, Anthropic, OpenAI and xAI join US defence to tackle national security with AI – Crypto News

-

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://dripp.zone/news/wp-content/uploads/2025/07/Stellar-XLM-bulls-exhausted-after-rally-Is-a-pullback.webp-400x240.webp)

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://dripp.zone/news/wp-content/uploads/2025/07/Stellar-XLM-bulls-exhausted-after-rally-Is-a-pullback.webp-80x80.webp) Cryptocurrency1 week ago

Cryptocurrency1 week agoStellar [XLM] bulls exhausted after rally – Is a pullback nearby? – Crypto News

-

others6 days ago

others6 days agoTop Crypto Exchange by Trading Volume Binance Announces Airdrop for New Ethereum (ETH) Ecosystem Altcoin – Crypto News

-

others6 days ago

others6 days agoVanEck Details Key Drivers Boosting Bitcoin Price, Including Corporate Treasury Demand, ETF Flows and More – Crypto News

-

Business6 days ago

XRP Lawsuit Update: Ripple Paid $125M in Cash, Settlement Hinges on Appeal – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoAnarchy, crime and stablecoins – Blockworks – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoZiglu Faces $2.7M Shortfall as Crypto Fintech Enters Special Administration – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoDonald Trump Jr. backs social media startup aiming to become a crypto powerhouse – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoThe Bitcoin Liquidity Supercycle Has Just Begun: Hedge Fund CEO – Crypto News

-

Business1 week ago

CME XRP Futures Hit $1.6B In Total Trading Volume Since Launch – Crypto News

-

Cryptocurrency1 week ago

Fed’s Hammack Raises Inflation Concerns Amid Push For Interest Rate Cut – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoWhy voice is emerging as India’s next frontier for AI interaction – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoNvidia’s Jensen Huang says AI ‘fundamental like electricity’, praises Chinese models as ‘catalyst for global progress’ – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

Business7 days ago

Ethereum Price Prediction- Bulls Target $3,700 As ETH Treasury Accumulation Soars – Crypto News

-

others6 days ago

others6 days agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

others6 days ago

others6 days agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Are So Many Crypto Games Shutting Down? Experts Weigh In – Crypto News

-

De-fi1 week ago

De-fi1 week agoRobinhood Opens Ether and Solana Staking to US Users – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTop 3 altcoins under $1 worth watching: Sei, Ethena, Arbitrum – Crypto News

-

De-fi1 week ago

De-fi1 week agoRipple’s RLUSD Market Cap Passes $515M, Flips TrueUSD – Crypto News

-

others1 week ago

Bitcoin Critic Vanguard Becomes Strategy’s (MSTR) Largest Shareholder – Crypto News

-

De-fi6 days ago

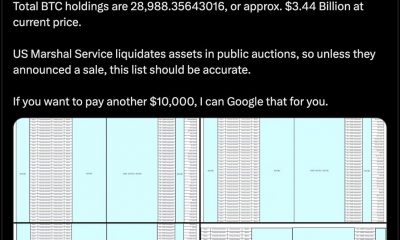

De-fi6 days agoU.S. Marshals Peg Federal Bitcoin Holdings at 28,988 Tokens Worth $3.4 B – Crypto News

-

Cryptocurrency6 days ago

Russia’s $85 Billion Sberbank to Launch Crypto Custody Services – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoNasdaq Exchange Files SEC Form to List Staking Ethereum ETF – Crypto News

-

De-fi5 days ago

De-fi5 days agoU.S. House Passes Clarity, GENIUS, and Anti-CBDC Acts With Historic Bipartisan Support for Crypto – Crypto News

-

Technology4 days ago

“Decentralized Ponzi Scheme”- Gold Bug Peter Schiff Slams Landmark Crypto Bills – Crypto News

-

Blockchain1 week ago

Blockchain1 week ago‘My Fellow Pigs And I Are Feasting’ – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoAltcoins Chase New Highs After Bitcoin Hits $123,000 – Crypto News

-

Technology1 week ago

Technology1 week agoV Guard INSIGHT-G BLDC fan review: Cool performer with a premium look – Crypto News

-

Cryptocurrency1 week ago

Fed’s Hammack Raises Inflation Concerns Amid Push For Interest Rate Cut – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoOmni Network skyrockets 180% as Bitcoin hits $118K: is $10 next? – Crypto News

-

De-fi1 week ago

De-fi1 week agoDeFi TVL Surges Past $126B, Up Over 45% Since April – Crypto News