others

How to play the long term trend accelerating higher – Crypto News

Part 1) Introduction

VolatilityMarkets suggests trend-inspired trades that capitalize on market trends.

In the short term Dow Jones Industrial Average has been decelerating higher. In the long term Dow Jones Industrial Average has been accelerating higher. With the long term trend being the stronger of the two, we propose a long trade idea with a one week time horizon.

Part 2) Trade idea details

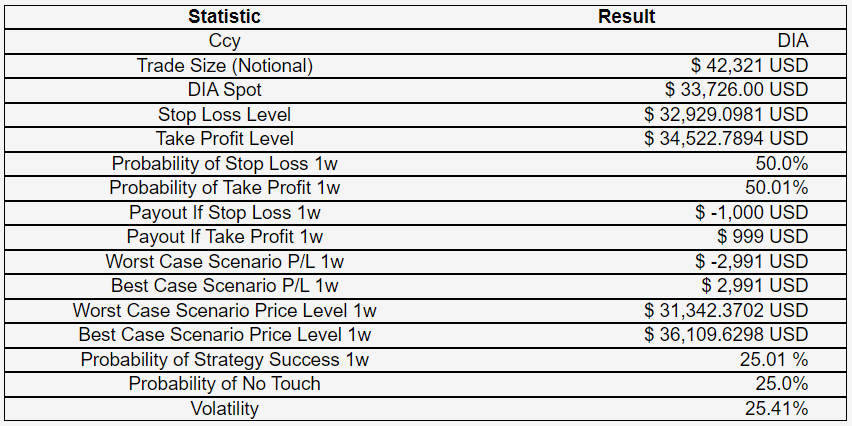

Buy $42,321 USD of Dow Jones Industrial Average, take profit at $34,522.7894 level with 50.01% odds for a $999 USD gain, stop out at $32,929.0981 with 50.0% odds for a $1,000 USD loss through 1w time horizon.

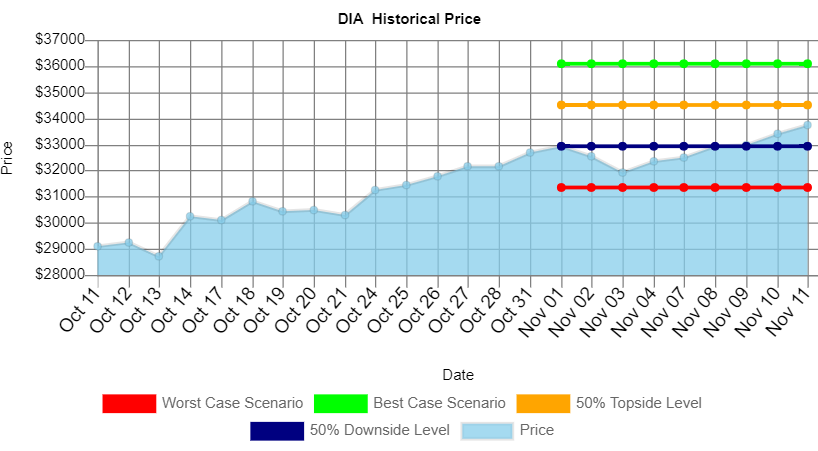

The BoxPlot below outlines the take profit and stop loss level placement of the trade idea, the inter-quartile range of expected traded results, as well as the best and worst case scenario on the whiskers.

Scenario analysis

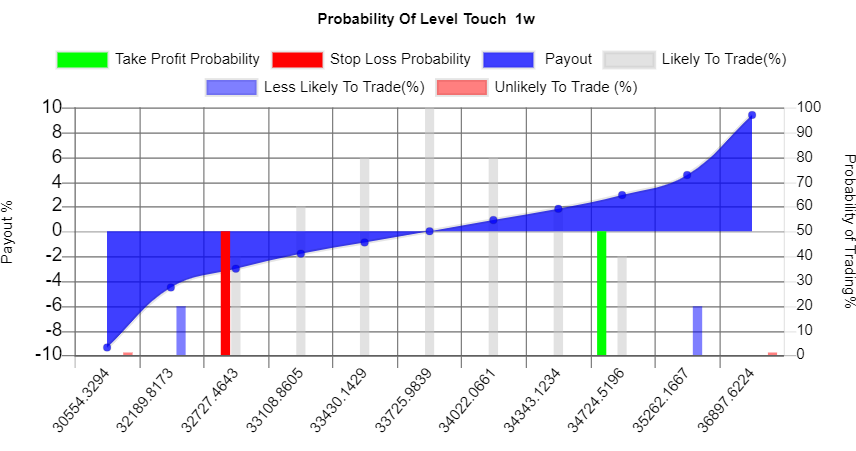

There is a 50.01% probability that the take profit level will independently trade over the 1w timeframe.

There is a 50.0% probability that the stop loss level will independently trade over the 1w timeframe.

There is a 25.0% probability that neither the stop loss level nor take profit level will independently trade over the 1w timeframe.

There is a 25.01% probability that the strategy succeeds by having the take profit level touch and the stop loss level not touch over the 1w timeframe.

Part 3) DIA trend analysis

DIA last price was $ 33,726.00 . The long term trend accelerating higher is stronger than the short term trend decelerating higher. This trade goes long when price has been moving higher and accelerating over the past 23 days.

Price summary

Today’s last mid price was $33,726.00.

Price changes

Over the past 23 Days, the price has increased by 15.83% percent.

Long-term trend analysis

This trade goes long when the price was moving higher but decelerating over the past 23 days.

Over the past 23 days, the price has on average been accelerating $8.00 per day

Short-term trend analysis

This trade goes long when the last change was higher but decelerating.

Over the last session, the price has decelerated $-147.00.

Part 4) DIA value analysis

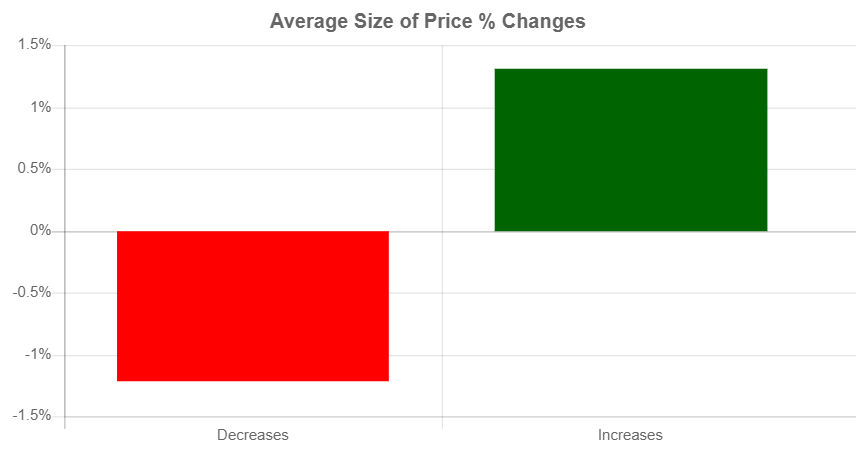

Over the past 23 days, the DIA price increased 17 days and decreased 6 days. For every up day, there were 0.35 down days. The average return on days where the price increased is 1.3117% The average return on days where the price decreased is -1.2124% Over the past 23 Days, the price has increased by 15.83% percent. Over the past 23 days, the average return per day has been 0.6883% percent.

Market skew

Over the past 23 days, the DIA price increased 17 days and decreased 6 Days.

For every up day, there were 0.35 down days.

The average return on days where the price decreased is -1.2124%.

Part 5) DIA worst/best case scenario analysis

Within 1 week, our worst case scenario where we are 95% certain that this level won’t trade for DIA, is $31,342.3702 , and the best case scenario overnight is $36,109.6298 . levels outside of this range are unlikely, but still possible, to trade. We are 50% confident that $32,929.0981 could trade and that $34,522.7894 could trade. These levels are within statistical probability.

Expected range

Within 1 week, our worst case scenario where we are 95% certain that this level won’t trade for DIA, is $31,342.3702 , and the best case scenario overnight is $36,109.6298 . levels outside of this range are unlikely, but still possible, to trade.

We are 50% confident that $32,929.0981 could trade and that $34,522.7894 could trade. These levels are within statistical probability.

Probability vs payout chart

This graph contrasts the percentage payout of holding a position vs the probability that the payout occurs. The red and green columns represent the probability of stopping out and taking profit and their associated payouts.

Key takeaways

-

Price today $ 33,726.00.

-

Over the past 23 days, the DIA price increased 17 days and decreased 6 Days.

-

For every up day, there were 0.35 down days.

-

The average return on days where the price increased is 1.3117%.

-

The average return on days where the price decreased is -1.2124%.

-

Over the past 23 Days, the price has increased by 15.83% percent.

-

Over the past 23 days, the average return per day has been 0.6883% percent.

-

Over the past 23 days, The price has on average been accelerating: $8.00 per day higher.

-

Over the last session, the price increased by $304.00.

-

Over the last session, the price increased by 0.9014 %.

-

Over the last session, the price decelerated by $-147.00.

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoSUI eyes 24% rally as bullish price action gains strength – Crypto News

-

Cryptocurrency4 days ago

Cryptocurrency4 days agoCoinbase scores major win as SEC set to drop lawsuit – Crypto News

-

Business1 week ago

Business1 week agoHow Will It Affect Pi Coin Price? – Crypto News

-

others1 week ago

others1 week agoJapanese Yen remains depressed amid modest USD strength; downside seems limited – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Price Pulls Back From Highs—Are Bulls Still in Control? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP To 3 Digits? The ‘Signs’ That Could Confirm It, Basketball Analyst Says – Crypto News

-

others1 week ago

others1 week agoAustralian Dollar jumps to highs since December on USD weakness – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWho is Satoshi Nakamoto, The Creator of Bitcoin? – Crypto News

-

Business1 week ago

Business1 week agoElon Musk’s DOGE Launches Probe into US SEC, Ripple Lawsuit To End? – Crypto News

-

others1 week ago

others1 week agoForex Today: What if the RBA…? – Crypto News

-

Business1 week ago

Business1 week agoWhales Move From Shiba Inu to FXGuys – Here’s Why – Crypto News

-

Technology4 days ago

Technology4 days agoStellantis Debuts System to Handle ‘Routine Driving Tasks’ – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCrypto narratives as we await next market move – Crypto News

-

Business1 week ago

Business1 week agoWhat Will be KAITO Price At Launch? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Set To Outshine Gold? Analyst Predicts 1,000% Surge – Crypto News

-

Technology1 week ago

Technology1 week agoLuminious inverters for your home to never see darkness again – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoIs BTC Heading For $150K Rally? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoGameStop Stock Price Pumps After Report of Bitcoin Buying Plans – Crypto News

-

Technology1 week ago

Technology1 week agoWhat will it take for India to become a global data centre hub? – Crypto News

-

Technology1 week ago

Technology1 week agoChatGPT vs Perplexity: Sam Altman praises Aravind Srinivas’ Deep Research AI; ‘Proud of you’ – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoNEAR Breaks Below Parallel Channel: Key Levels To Watch – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Price Settles After Gains—Is a Fresh Upside Move Coming? – Crypto News

-

others1 week ago

others1 week agoWTI price bullish, according to FXStreet data – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoHow AI will divide the best from the rest – Crypto News

-

Business1 week ago

Business1 week agoThese 3 Altcoins Will Help You Capitalize on Stellar’s Recent DIp – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHayden Davis crypto scandal deepens as LIBRA memecoin faces fraud allegations – Crypto News

-

Technology1 week ago

Technology1 week agoWeekly Tech Recap: JioHotstar launched, Sam Altman vs Elon Musk feud intensifies, Perplexity takes on ChatGPT and more – Crypto News

-

Technology1 week ago

Technology1 week agoBest gaming mobiles under ₹20,000 in February 2025: Poco X6 Pro, OnePlus Nord CE 4 Lite and more – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoWill BTC Rebound Or Drop To $76,000? – Crypto News

-

Business1 week ago

Business1 week agoWhy Ethereum (ETH) Price Revival Could Start Soon After Solana Mess? – Crypto News

-

Business1 week ago

Business1 week agoMarket Veteran Predicts XRP Price If Ripple Completes Cup and Handle Pattern – Crypto News

-

others1 week ago

others1 week agoUS Dollar struggles to gather traction on quiet Monday – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoRipple Whale Bags 20M Coins Amid Recent Dip, What’s Happening? – Crypto News

-

Technology3 days ago

Technology3 days agoWhy is BTC Down Today? – Crypto News

-

Technology3 days ago

Technology3 days agoWhy is BTC Down Today? – Crypto News

-

Technology3 days ago

Technology3 days agoWhy is BTC Down Today? – Crypto News

-

Technology1 week ago

Technology1 week agoGrok 3 is coming! Elon Musk announces launch date, promises ‘smartest AI on Earth’ – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Bullish Pennant Targets $15-$17 But Confirmation Is Required – Crypto News

-

Technology1 week ago

Technology1 week agoUnion Minister Ashwini Vaishnaw to launch India AI Mission portal soon, 10 companies set to provide 14,000 GPUs – Crypto News

-

Technology1 week ago

Technology1 week agoSouth Korea removes DeepSeek from app stores, existing users advised to ‘service with caution’ – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Price Falls Short Again—Is a Deeper Decline Coming? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin Sees $430M in Outflows as Market Responds to Fed’s Hawkish Stance – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoJudge Assigned to Probe Argentina’s President Milei Over Alleged Crypto Scam – Crypto News

-

Technology1 week ago

Technology1 week agoHYPE Price Shoots 10% As Hyperliquid EVM Goes Live – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoThe Secret Window You Need To Know – Crypto News

-

Cryptocurrency4 days ago

Cryptocurrency4 days agoCanary’s Litecoin ETF listed on DTCC – Will trading begin soon? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoAvalanche Holds Key Demand Zone – Analyst Sets $30 Target If Momentum Holds – Crypto News

-

others1 week ago

Japan CFTC JPY NC Net Positions up to ¥54.6K from previous ¥18.8K – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoThese Factors Could Trigger the Next Altcoin Season, According to Bybit – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy the outlook for Treasury yields remains uncertain – Crypto News

-638037706082957477.png)

-638037705788769404.png)

-638037705459456433.png)

-638037705114967902.png)

-638037704738009794.png)

-638037703821865644.png)

-638037703184033471.png)

-638037702603593899.png)

-638037702001495120.png)

-638037701394299277.png)

-638037701079970590.png)

-638037700699294514.png)

-638037698986928682.png)