Metaverse

Is artificial intelligence making big tech too big? – Crypto News

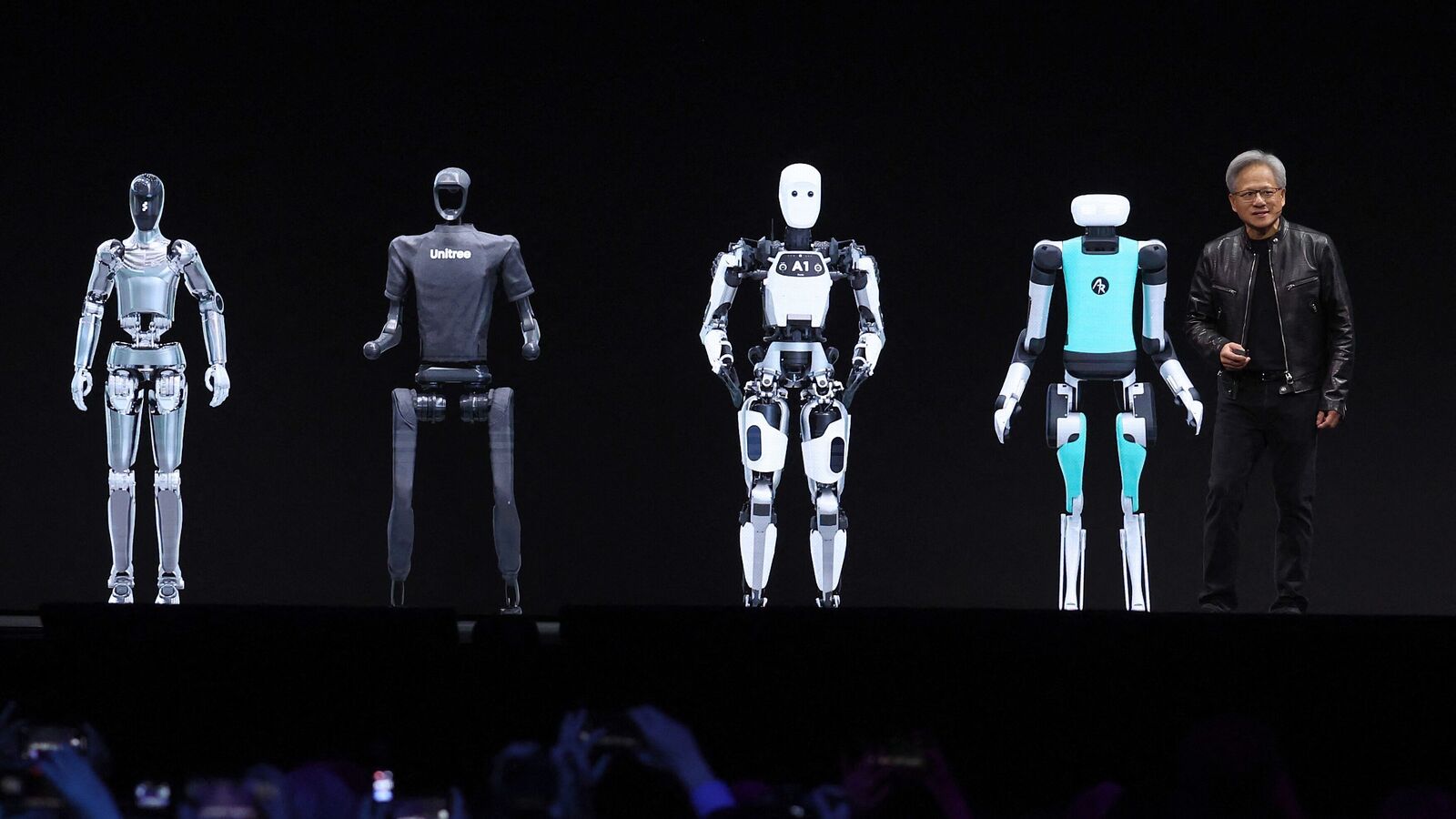

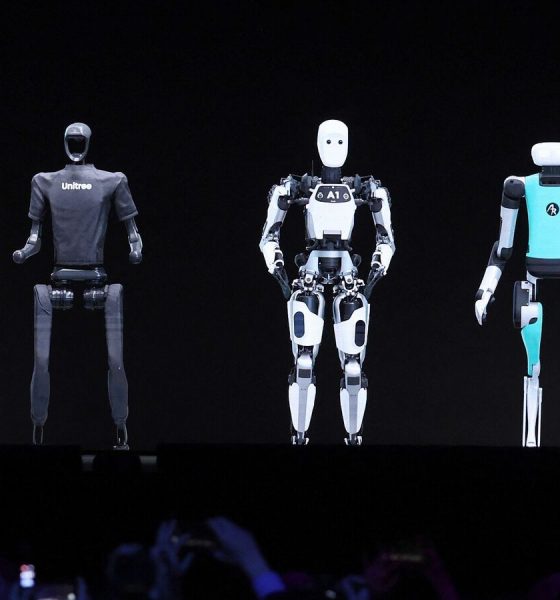

When ChatGPT took everyone by storm in November 2022, it was OpenAI, the startup behind it, that seized the business world’s attention. But, as usual, big tech is back on the front foot. Nvidia, maker of accelerator chips that are at the core of generative artificial intelligence (AI), is now duelling with Microsoft, a tech giant of longer standing, to be the world’s most valuable company. Like Microsoft, it is investing in a diverse ecosystem of startups that it hopes will strengthen its lead. Predictably, given the “techlash” mindset of the regulatory authorities, both firms are high on the watch list of antitrust agencies.

Don’t roll your eyes. The trustbusters may have infamously overreached in recent years in their attempts to cut big firms down to size. Yet for years big-tech incumbents in Silicon Valley and elsewhere have shown just as infamous a tendency to strut imperiously across their digital domains. What is intriguing is the speed at which the antitrust authorities are operating. Historically, such investigations have tended to be labyrinthine. It took 40 years for the Supreme Court to order E.I. Du Pont de Nemours, a large American chemical firm, to divest its anticompetitive stake in General Motors, which it first started to acquire in 1917 when GM was a fledgling carmaker. The Federal Trade Commission (FTC), an American antitrust agency, is still embroiled in a battle with Meta, a social-media giant, to unwind Facebook’s acquisitions of Instagram and WhatsApp, done 12 and ten years ago, respectively.

This time, rather than waiting until deals are done and markets are stitched up, the preference is to be nimble. It is now the trustbusters who are trying to move fast and break things.

Broadly speaking, the authorities have two areas of concern. The first is whether the world’s biggest firms are trying to tie businesses into their products in anticompetitive ways. The second is about control: are some of the biggest generative-AI investments poorly disguised acquisitions intended to sidestep antitrust consideration? Nvidia is under scrutiny on the first count. It has recently fallen under the gaze of America’s Department of Justice, which is understood to be investigating allegations that it locks users of its graphics processing units (GPUs) into its software, and that a scarcity of GPUs is the result of anticompetitive conduct. Nvidia declined to comment.

The attention on Microsoft is more over the second category. The FTC has launched a market inquiry of the software-provider’s $13bn investment in OpenAI, which gives it a 49% share of the profits. It is also investigating Microsoft’s hiring in March of most of the staff of Inflection, a rival to OpenAI (the most significant hire was Mustafa Suleyman, Inflection’s co-founder, who sits on the board of The Economist’s parent company). Microsoft also declined to comment. The FTC has other big-tech firms under the spotlight, too. It is looking at investments by Alphabet and Amazon in Anthropic, another maker of large language models (LLMs).

Inevitably, there is little public information concerning this antitrust scrutiny. Yet Britain’s Competition and Markets Authority, a regulatory agency that is also probing the two Microsoft deals, has recently published a study of LLMs (it refers to them by their alternative name, foundation models) that illustrates the main concerns. The biggest one, it says, is the potential role of a few tech giants to shape the market in anticompetitive ways. It notes that Alphabet, Amazon, Apple, Meta, Microsoft and Nvidia have forged more than 90 partnerships with LLMs since 2019, mostly by taking minority stakes. It expresses concerns that they may exert leverage on the modelmakers through supply of critical inputs, such as computing power and data, as well as controlling access to consumers via their platforms. It also notes that some of the deals may have been structured to avoid merger scrutiny.

In America, the government’s concerns are similar. But the trustbusters are not just looking at LLMs. They have their eyes on the whole caboodle—from the GPUs at the bottom to consumer applications at the top of the generative-AI “stack”. The FTC’s investigation of Microsoft’s Inflection deal is yet another type. The agency is probing whether Microsoft failed to supply the correct merger paperwork when it hired most of Inflection’s employees and paid for a non-exclusive licence to its technology. In other words, it suspects it was an acquisition in disguise aimed at avoiding an antitrust review. For Microsoft, it was not an acquisition at all. What is left of Inflection remains an independent company.

This is all tricky terrain. Building LLMs is capital-intensive, like drilling for oil. The requirements for computing power, digital information and human expertise is such that model-builders justifiably turn to tech giants for support. Big tech has the balance-sheets, data and cloud infrastructure to help, as well as providing a seal of approval. Moreover, it is hard to assert that a tech giant has an exclusive hold over any generative-AI startup when so much polyamory is taking place. Satya Nadella, Microsoft’s boss, once asserted with regard to OpenAI that his firm was “below them, above them, around them”. That sounded suspiciously like monogamy. When OpenAI recently announced a partnership with Apple, a Microsoft rival, Mr Nadella was miffed.

The other type of competition

It is tough political territory as well. If intervention is too heavy-handed, China hawks will accuse the trustbusters of suffocating American innovation in favour of its strategic rival. Yet there is room, at the very least, for a light touch. Generative AI will cause big technological upheaval, though in what ways is still unclear. If the incumbents are left to their own devices, they will surely use their imperial might to try to bend it to their advantage. Regulators have a duty to prevent them quashing competition. So by all means move fast. Just don’t break things too badly.

© 2024, The Economist Newspaper Limited. All rights reserved. From The Economist, published under licence. The original content can be found on www.economist.com

-

Blockchain7 days ago

Blockchain7 days agoThe Quantum Clock Is Ticking on Blockchain Security – Crypto News

-

Technology1 week ago

Technology1 week agoHow Americans are using AI at work, according to a new Gallup poll – Crypto News

-

Technology1 week ago

Technology1 week agoHow Americans are using AI at work, according to a new Gallup poll – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTether Launches Dollar-Backed Stablecoin USAT – Crypto News

-

Metaverse4 days ago

Metaverse4 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRiver Crypto Token Up 1,900% in the Last Month—What’s the Deal? – Crypto News

-

Metaverse3 days ago

Metaverse3 days agoStop panicking about AI. Start preparing – Crypto News

-

others1 week ago

others1 week agoUS Heiress Slaps Billion-Dollar Lawsuit on Banks for Allegedly Aiding the Looting of Her $350,000,000 Trust Fund – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTrump-Backed WLFI Snaps Up 2,868 ETH, Sells $8M WBTC – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTrump-Backed WLFI Snaps Up 2,868 ETH, Sells $8M WBTC – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoUS Storm Smashes Bitcoin Mining Power, Sending Hash Rates Tumbling – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIs AI eating up jobs in UK? New report paints bleak picture – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTrump family-backed American Bitcoin achieves 116% BTC yield – Crypto News

-

Metaverse4 days ago

Metaverse4 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Metaverse4 days ago

Metaverse4 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Gets the Macro Bug as $87,000 Comes Into Play – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoMakinaFi hit by $4.1M Ethereum hack as MEV tactics suspected – Crypto News

-

Technology1 week ago

Technology1 week agoHow Americans are using AI at work, according to a new Gallup poll – Crypto News

-

others1 week ago

others1 week agoPBOC sets USD/CNY reference rate at 6.9843 vs. 6.9929 previous – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoKalshi Expands Political Footprint with DC Office, Democratic Hire – Crypto News

-

Technology1 week ago

Technology1 week agoElon Musk says ‘WhatsApp is not secure’ amid Meta privacy lawsuit; Sridhar Vembu cites ‘conflict of interest’ – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRiver price defies market downturn, explodes 40% to new ATH – Crypto News

-

Technology1 week ago

Fed Rate Cut Odds in January Crash to 99% Ahead of Dollar Yen Intervention- Will BTC React? – Crypto News

-

Cryptocurrency1 week ago

Fed Rate Cut Odds in January Crash to 99% Ahead of Dollar Yen Intervention- Will BTC React? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Gets the Macro Bug as $87,000 Comes Into Play – Crypto News

-

Business1 week ago

Bitcoin and XRP Price At Risk As US Govt. Shutdown Odds Reach 73% – Crypto News

-

Business1 week ago

Bitcoin and XRP Price At Risk As US Govt. Shutdown Odds Reach 73% – Crypto News

-

Business1 week ago

Bitcoin Sentiment Weakens BTC ETFs Lose $103M- Is A Crash Imminent? – Crypto News

-

Business1 week ago

Japan Set to Launch First Crypto ETFs as Early as 2028: Nikkei – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRYO Digital Announces 2025 Year-End Milestones Across Its Ecosystem – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRiver Crypto Token Up 1,900% in the Last Month—What’s the Deal? – Crypto News

-

Business1 week ago

Experts Advise Caution As Crypto Market Heads Into A Bearish Week Ahead – Crypto News

-

Business1 week ago

Experts Advise Caution As Crypto Market Heads Into A Bearish Week Ahead – Crypto News

-

Blockchain1 week ago

Blockchain1 week ago‘Most Reliable’ Bitcoin Price Signal Hints at a 2026 Bull Run – Crypto News

-

Technology1 week ago

Bitcoin And XRP Price Prediction Ahead of FOMC Meeting Tomorrow, Jan 28 – Crypto News

-

Technology1 week ago

Bitcoin And XRP Price Prediction Ahead of FOMC Meeting Tomorrow, Jan 28 – Crypto News

-

Technology1 week ago

Bitcoin And XRP Price Prediction Ahead of FOMC Meeting Tomorrow, Jan 28 – Crypto News

-

Business1 week ago

Bitcoin Faces Renewed Volatility as Investors Explore Options Like Everlight – Crypto News

-

others1 week ago

Jerome Powell Speech Tomorrow: What to Expect From Fed Meeting for Crypto Market? – Crypto News

-

Technology1 week ago

Fed Rate Cut Odds in January Crash to 99% Ahead of Dollar Yen Intervention- Will BTC React? – Crypto News

-

Business1 week ago

Bitcoin and XRP Price At Risk As US Govt. Shutdown Odds Reach 73% – Crypto News

-

others1 week ago

U.S. Shutdown Odds Hit 78% as CLARITY Act Faces Fresh Uncertainty – Crypto News

-

others1 week ago

others1 week ago478,188 Americans Warned After Hackers Strike Government-Related Firm Handling Sensitive Personal Data – Crypto News

-

Technology1 week ago

Crypto Events to Watch This Week: Is the Market Entering a New Recovery Phase? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCZ Won’t Return to Binance, Bullish on Bitcoin Supercycle – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana (SOL) Slips Further As Bears Target Deeper Support Zones – Crypto News

-

Technology1 week ago

Technology1 week agoIs TikTok still down in the United States? Check current status – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoThe productivity bull case for almost everything – Crypto News

-

Business1 week ago

Experts Advise Caution As Crypto Market Heads Into A Bearish Week Ahead – Crypto News

-

Technology1 week ago

Bitcoin And XRP Price Prediction Ahead of FOMC Meeting Tomorrow, Jan 28 – Crypto News