others

Japanese Yen bulls have the upper hand amid BoJ rate hike bets – Crypto News

- The Japanese Yen continues to be underpinned by bets for additional BoJ rate hikes.

- Geopolitical risk and trade war fears also benefit the JPY’s relative safe-haven status.

- Trump’s tariff threats cap gains for the JPY and lend some support to the USD/JPY pair.

The Japanese Yen (JPY) remains on the front foot against its American counterpart during the Asian session on Friday and remains close to over a one-month high touched earlier this week. Data released earlier today showed that consumer prices in Tokyo – Japan’s capital – rose in January. Moreover, Japanese Industrial Production registered unexpected growth in December and Retail Sales surged past consensus estimates. This keeps alive expectations for further interest rate hikes by the Bank of Japan (BoJ), which, in turn, continues to underpin the JPY.

Apart from this, geopolitical risks turn out to be another factor that benefits the safe-haven JPY, which, along with subdued US Dollar (USD) price action, keeps the USD/JPY pair depressed near the 154.00 mark during the Asian session. That said, a positive tone around the equity markets might hold back traders from placing aggressive bullish bets around the JPY. Moreover, the Federal Reserve’s (Fed) hawkish pause on Wednesday and a modest bounce in the US Treasury bond yields act as a tailwind for the USD, lending support to the currency pair.

Japanese Yen bulls turn cautious amid positive risk tone and rebounding US bond yields

- The Statistics Bureau of Japan reported this Friday that the headline Tokyo Consumer Price Index (CPI) accelerated from 3.0% to 3.4% YoY in January – the highest level since April 2023.

- Adding to this, core CPI, which excludes volatile fresh food prices, picked up from the 2.4% seen in December and rose 2.5% YoY during the reported month – representing an 11-month high.

- Meanwhile, a core CPI gauge that excludes both fresh food and energy prices remained close to the Bank of Japan’s 2% annual target and climbed 1.9% YoY in January from the 1.8% previous.

- BoJ Deputy Governor Ryozo Himino reiterated that real rates remain negative and that the central bank would consider more rate increases if economic and price developments align with expectations.

- State-run TASS news agency reported, citing the Russian Defense Ministry, that two Russian Tu-95 strategic bombers conducted a routine flight over the Sea of Okhotsk and the Sea of Japan on Thursday.

- According to the first estimate published by the US Bureau of Economic Analysis (BEA) on Thursday, the US Gross Domestic Product (GDP) grew at an annual rate of 2.3% in the fourth quarter.

- The reading marked a notable slowdown from the 3.1% expansion recorded in the previous quarter and was below the market expectation of 2.6%, though it did little to influence the US Dollar.

- US President Donald Trump reiterated his threat to impose 25% tariffs on Mexico and Canada – the top two US trade partners – and warned of potential 100% tariffs if BRICS attempts to replace the USD.

- Japan’s Prime Minister Shigeru Ishiba said on Friday that the government will continue to invest and create jobs in the US and further stated that he will urge the US to provide a stable energy supply.

- Concerns that Trump’s protectionist policies will boost inflation, along with the Federal Reserve’s hawkish outlook, provide a modest lift to the US Treasury bond yields, which underpin the buck.

- Investors now look forward to the release of the US Personal Consumption Expenditure (PCE) Price Index – the Fed’s preferred inflation gauge – for fresh impetus on the last day of the week.

USD/JPY could acelerate the downward trajectory below monthly swing low, around 153.70

Against the backdrop of the recent breakdown below a short-term ascending trend channel, some follow-through selling below the monthly swing low, around the 153.70 area touched on Monday, will be seen as a key trigger for bearish traders. Moreover, oscillators on the daily chart have been gaining negative traction and are still away from being in the oversold zone. Hence, the subsequent downfall could drag the USD/JPY pair towards the 153.00 round figure en route to the 152.40 area and the 152.00 mark. The latter coincides with the 100-day Simple Moving Average (SMA) and could offer decent support to spot prices.

On the flip side, any attempted recovery above mid-154.00s now seems to confront a stiff barrier near the 155.00 psychological mark. A sustained strength, however, might trigger an intraday short-covering move towards the 155.40-155.45 region en route to the 156.00 round figure and the weekly top, around the 156.25 area. The next relevant hurdle is pegged near the 156.75 region, which if cleared decisively might shift the near-term bias in favor of bullish traders and pave the way for additional gains.

Bank of Japan FAQs

The Bank of Japan (BoJ) is the Japanese central bank, which sets monetary policy in the country. Its mandate is to issue banknotes and carry out currency and monetary control to ensure price stability, which means an inflation target of around 2%.

The Bank of Japan embarked in an ultra-loose monetary policy in 2013 in order to stimulate the economy and fuel inflation amid a low-inflationary environment. The bank’s policy is based on Quantitative and Qualitative Easing (QQE), or printing notes to buy assets such as government or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and further loosened policy by first introducing negative interest rates and then directly controlling the yield of its 10-year government bonds. In March 2024, the BoJ lifted interest rates, effectively retreating from the ultra-loose monetary policy stance.

The Bank’s massive stimulus caused the Yen to depreciate against its main currency peers. This process exacerbated in 2022 and 2023 due to an increasing policy divergence between the Bank of Japan and other main central banks, which opted to increase interest rates sharply to fight decades-high levels of inflation. The BoJ’s policy led to a widening differential with other currencies, dragging down the value of the Yen. This trend partly reversed in 2024, when the BoJ decided to abandon its ultra-loose policy stance.

A weaker Yen and the spike in global energy prices led to an increase in Japanese inflation, which exceeded the BoJ’s 2% target. The prospect of rising salaries in the country – a key element fuelling inflation – also contributed to the move.

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoSatoshi-Era Bitcoin Whale Moves Another $2.42 Billion, What’s Happening? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoRipple and Ctrl Alt Team to Support Real Estate Tokenization – Crypto News

-

Technology1 week ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoIt’s a Statement, Says Bitfinex Alpha – Crypto News

-

others1 week ago

others1 week agoEUR/USD recovers with trade talks and Fed independence in focus – Crypto News

-

Technology1 week ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Business1 week ago

XLM Is More Bullish Than ETH, SOL, And XRP, Peter Brandt Declares – Crypto News

-

others1 week ago

Bitcoin Critic Vanguard Becomes Strategy’s (MSTR) Largest Shareholder – Crypto News

-

Business1 week ago

Pepe Coin Rich List June 2025: Who’s Holding Highest PEPE as it Nears Half a Million Holders? – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoWhy voice is emerging as India’s next frontier for AI interaction – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin trades near $119K after new all-time high; Coinbase rebrands wallet to ‘Base App’ – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoAnarchy, crime and stablecoins – Blockworks – Crypto News

-

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://dripp.zone/news/wp-content/uploads/2025/07/Stellar-XLM-bulls-exhausted-after-rally-Is-a-pullback.webp-400x240.webp)

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://dripp.zone/news/wp-content/uploads/2025/07/Stellar-XLM-bulls-exhausted-after-rally-Is-a-pullback.webp-80x80.webp) Cryptocurrency1 week ago

Cryptocurrency1 week agoStellar [XLM] bulls exhausted after rally – Is a pullback nearby? – Crypto News

-

Technology1 week ago

Technology1 week agoV Guard INSIGHT-G BLDC fan review: Cool performer with a premium look – Crypto News

-

Cryptocurrency1 week ago

Fed’s Hammack Raises Inflation Concerns Amid Push For Interest Rate Cut – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

others1 week ago

others1 week agoTop Crypto Exchange by Trading Volume Binance Announces Airdrop for New Ethereum (ETH) Ecosystem Altcoin – Crypto News

-

others1 week ago

others1 week agoVanEck Details Key Drivers Boosting Bitcoin Price, Including Corporate Treasury Demand, ETF Flows and More – Crypto News

-

Business1 week ago

XRP Lawsuit Update: Ripple Paid $125M in Cash, Settlement Hinges on Appeal – Crypto News

-

Technology6 days ago

“Decentralized Ponzi Scheme”- Gold Bug Peter Schiff Slams Landmark Crypto Bills – Crypto News

-

Business1 week ago

CME XRP Futures Hit $1.6B In Total Trading Volume Since Launch – Crypto News

-

Technology1 week ago

XLM Price Forecast: Why Stellar Lumens May Crash After 80% Rally in Last 7 Days – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitMine Shares Rallied After Peter Thiel Investment. – Crypto News

-

others1 week ago

others1 week agoScammer Drains $10,000,000 From IRS in International Tax Fraud and Identity Theft Scheme: DOJ – Crypto News

-

Business1 week ago

Ethereum Price Prediction- Bulls Target $3,700 As ETH Treasury Accumulation Soars – Crypto News

-

others1 week ago

others1 week agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

others1 week ago

others1 week agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

Cryptocurrency1 week ago

Russia’s $85 Billion Sberbank to Launch Crypto Custody Services – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoUS House passes three key crypto bills; market reaction muted as Bitcoin dips – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoCalifornia Sheriffs Believe 74-Year-Old’s Disappearance Linked to Son’s Crypto Fortune – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoShytoshi Kusama Breaks Silence on New SHIB AI Whitepaper and Transformed Future – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoAltseason heats up, but Bitcoin could face short-term pullback – How? – Crypto News

-

Blockchain3 days ago

Blockchain3 days agoInstitutional Demand Surges As Ethereum Sets New Inflow Records – Crypto News

-

De-fi1 week ago

De-fi1 week agoDeFi TVL Surges Past $126B, Up Over 45% Since April – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHypercharged Exposure to XRP and Solana Now Available With These Two ETFs – Crypto News

-

De-fi1 week ago

De-fi1 week agoSolana RWA Growth Outpaces Ethereum in 2025 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoNothing Burger or Crypto Catalyst? – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoNvidia’s Jensen Huang says AI ‘fundamental like electricity’, praises Chinese models as ‘catalyst for global progress’ – Crypto News

-

Business1 week ago

$800 Billion JPMorgan To Rival Tether, Circle, and Ripple In Stablecoin Race – Crypto News

-

others1 week ago

Crypto Exchange Hack: BigONE Users Lose A Massive $27 Million In Recent Exploit – Crypto News

-

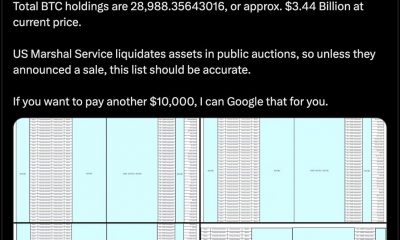

De-fi1 week ago

De-fi1 week agoU.S. Marshals Peg Federal Bitcoin Holdings at 28,988 Tokens Worth $3.4 B – Crypto News

-

De-fi7 days ago

De-fi7 days agoU.S. House Passes Clarity, GENIUS, and Anti-CBDC Acts With Historic Bipartisan Support for Crypto – Crypto News

-

Technology7 days ago

Technology7 days agoMalicious code found in fake coding extensions used to steal crypto – Crypto News

-

De-fi6 days ago

De-fi6 days agoBNB Chain Teases New Blockchain with Privacy Features to Compete With Crypto Exchanges – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoXRP Price Spikes to Record Highs As Momentum Signals Extended Gains – Crypto News

-

Technology6 days ago

Technology6 days agoMeta’s AI Studio: Red flag or red herring? – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoWhy Bitcoin self-custody is declining in the ETF era – Crypto News

-

Technology6 days ago

Breaking: GENIUS Act Becomes First Major Crypto Legislation as Trump Signs Bill – Crypto News

-

De-fi6 days ago

De-fi6 days agoCrypto Market Cap Hits $4 Trillion Milestone as US House Passes Landmark Bills – Crypto News