others

Japanese Yen gets help from easing US data while Yen tries to start its recovery – Crypto News

- The Japanese Yen slightly recovers from its multi-decade low of 160.87 against the US Dollar seen on Wednesday.

- The Yen finds some support after comments from Japanese Finance Minister Shun’ichi Suzuki.

- The US Dollar Index falls back below 106.00 ahead of US Q1 GDP, Durable Goods Orders and weekly Jobless Claims.

The Japanese Yen (JPY) is attempting to starts its recovery after its steep decline Wednesday when markets started playing a chicken game with the Japanese government. The Japanese Yen sank to 160.87 against the US Dollar (USD), even lower than the level of 160.20 seen at the end of April right before the Japanese Ministry of Finance intervened and pushed the USD/JPY back to 151.95. Early comments during the Asian session on Thursday from Japanese Finance Minister Shun’ichi Suzuki seemingly had more impact than the comments from Masato Kanda, Vice Minister for International Affairs, on Wednesday when the actual move occurred.

Meanwhile, the US Dollar Index (DXY) – which gauges the value of the US Dollar against a basket of six foreign currencies – is easing after the chunky US data release on Thursday made markets choke. Certainly the nearly flatlining US Durable Goods orders and the uptick in Wholesale Inventories is another sign on the wall the US consumer is not having it anymore. That could have ripple effect over the summer in employment data and economic performances, no longer support a US Dollar at current levels, but lower.

Daily digest market movers: US data helps out

- At 01:30 GMT, Japanese Finance Minister Shun’ichi Suzuki commented on the recent moves in the Japanese Yen. Suzuki said they are watching currencies closely and will act when needed, though Suzuki declined to comment on specific FX levels.

- Reuters cites severals banks which got consulted by the Bank of Japan during European hours, asked for their expectations over the range and pace of tapering. The survey will certainly be used in the upcoming meeting with the BoJ and bond market participants on July 9th and 10th.

- At 12:30 GMT, nearly all important data points were released for this Thursday:

- US Gross Domestic Product for the third quarter:

- Headline GDP grew at an annualized rate of 1.4%, more than the 1.3% previously estimated.

- GDP Price Index remained stable at 3.1%.

- The Headline Personal Consumption Expenditure Price index went from 3.3% to 3.4%, while the core reading also ticked higher from 3.6% to 3.7%.

- US Durable Goods for May:

- Headline Durable Goods orders fell flat to 0.1%, from a revised 0.6% to only 0.2%.

- Durable Goods without Cars and Transportation missed estimates and fell lower from 0.4% to -0.1%.

- Weekly Jobless Claims for the week ending June 14th:

- Initial Jobless Claims came in stronger, from 238,000 to 233,000..

- Continuing Claims were an issue, as they jumped from 1,821,000 to 1,839,000.

- US Gross Domestic Product for the third quarter:

- Equities are trying to digest the US data release with US equities trying to salvage the situation and erasing earlier losses partially.

- The CME Fedwatch Tool is broadly backing a rate cut in September despite recent comments from Federal Reserve (Fed) officials. The odds now stand at 56.3% for a 25-basis-point cut. A rate pause stands at a 37.7% chance, while a 50-basis-point rate cut has a slim 6.0% possibility.

- The Overnight indexed Swap curve for Japan shows a 64.0% chance of a rate hike on July 31, and a smaller 52.8% chance for a hike on September 20.

- The US 10-year benchmark rate tradesat 4.29%, easing a touch.

- The benchmark 10-year Japan Treasury Note (JGB) trades around 1.07%, nearing highs not seen since 2011.

USD/JPY Technical Analysis: Interventions from both sides?

The USD/JPY is trading off its multi-decade high, freshly printed on Wednesday at 160.81. For now, the words from Japanese Finance Minister Shun’ichi Suzuki are having a bit of an impact, though the question is how long the impact will last as the attention will start to die down. The Japanese government is playing a dangerous game, though, seeming to bet on weak US data on Thursday and Friday, which would trigger a pullback in the DXY and might see Yen strengthen without aid from the Japanese government.

Although the Relative Strength Index (RSI) is overbought in the daily chart, a correction could soon occur. If weaker US data, when that plays out and is undoubtedly not a certainty, will be enough to drive USD/JPY down to 151.91 remains to be seen. Instead, look at the 55-day Simple Moving Average (SMA) at 156.39 and the 100-day SMA at 153.69 for traders to quickly build a pivot on and try to test highs again, testing the Japanese deep pockets again.

USD/JPY: Daily Chart

Central banks FAQs

Central Banks have a key mandate which is making sure that there is price stability in a country or region. Economies are constantly facing inflation or deflation when prices for certain goods and services are fluctuating. Constant rising prices for the same goods means inflation, constant lowered prices for the same goods means deflation. It is the task of the central bank to keep the demand in line by tweaking its policy rate. For the biggest central banks like the US Federal Reserve (Fed), the European Central Bank (ECB) or the Bank of England (BoE), the mandate is to keep inflation close to 2%.

A central bank has one important tool at its disposal to get inflation higher or lower, and that is by tweaking its benchmark policy rate, commonly known as interest rate. On pre-communicated moments, the central bank will issue a statement with its policy rate and provide additional reasoning on why it is either remaining or changing (cutting or hiking) it. Local banks will adjust their savings and lending rates accordingly, which in turn will make it either harder or easier for people to earn on their savings or for companies to take out loans and make investments in their businesses. When the central bank hikes interest rates substantially, this is called monetary tightening. When it is cutting its benchmark rate, it is called monetary easing.

A central bank is often politically independent. Members of the central bank policy board are passing through a series of panels and hearings before being appointed to a policy board seat. Each member in that board often has a certain conviction on how the central bank should control inflation and the subsequent monetary policy. Members that want a very loose monetary policy, with low rates and cheap lending, to boost the economy substantially while being content to see inflation slightly above 2%, are called ‘doves’. Members that rather want to see higher rates to reward savings and want to keep a lit on inflation at all time are called ‘hawks’ and will not rest until inflation is at or just below 2%.

Normally, there is a chairman or president who leads each meeting, needs to create a consensus between the hawks or doves and has his or her final say when it would come down to a vote split to avoid a 50-50 tie on whether the current policy should be adjusted. The chairman will deliver speeches which often can be followed live, where the current monetary stance and outlook is being communicated. A central bank will try to push forward its monetary policy without triggering violent swings in rates, equities, or its currency. All members of the central bank will channel their stance toward the markets in advance of a policy meeting event. A few days before a policy meeting takes place until the new policy has been communicated, members are forbidden to talk publicly. This is called the blackout period.

-

Technology1 week ago

Technology1 week agoSam Altman says OpenAI is developing a ‘legitimate AI researcher’ by 2028 that can discover new science on its own – Crypto News

-

Technology1 week ago

Technology1 week agoBenQ MA270U review: A 4K monitor that actually gets MacBook users right – Crypto News

-

Technology1 week ago

Technology1 week agoGiving Nvidias Blackwell chip to China would slash USs AI advantage, experts say – Crypto News

-

others1 week ago

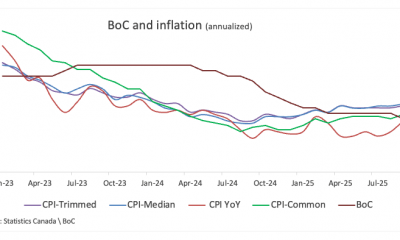

others1 week agoBank of Canada set to cut interest rate for second consecutive meeting – Crypto News

-

De-fi1 week ago

De-fi1 week agoBittensor Rallies Ahead of First TAO Halving – Crypto News

-

Business1 week ago

Business1 week agoStarbucks Says Turnaround Strategy Drives Growth in Global Sales – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana Eyes $210 Before Its Next Major Move—Uptrend Or Fakeout Ahead? – Crypto News

-

De-fi1 week ago

De-fi1 week agoREP Jumps 50% in a Week as Dev Gets Community Support for Augur Fork – Crypto News

-

others7 days ago

others7 days agoMETA stock has lower gaps to fill – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Edges Lower While US Stocks Hit New Highs – Crypto News

-

others1 week ago

Pi Coin Gains Another 15% As Pi Network Joins ISO 20022 For Seamless Banking Integration – Crypto News

-

Cryptocurrency3 days ago

Cryptocurrency3 days agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

Cryptocurrency6 days ago

After 1,993% Burn Spike, Is Shiba Inu Price Set for a Major Trend Reversal? – Crypto News

-

others1 week ago

Crypto Market Tumbles as Jerome Powell Says December Rate Cut ‘Far From Certain’ – Crypto News

-

De-fi1 week ago

De-fi1 week agoBitcoin Dips Under $110,000 After Fed Cuts Rates – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoMany Crypto Treasury Companies Were a Get-Rich-Quick Trap, Warns Columbia Professor – Crypto News

-

De-fi1 week ago

De-fi1 week agoTokenized Nasdaq Futures Enter Top 10 by Volume on Hyperliquid – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCitigroup and Coinbase partner to expand digital-asset payment capabilities – Crypto News

-

De-fi1 week ago

De-fi1 week agoCRO Jumps After Trump’s Truth Social Announces Prediction Market Partnership with Crypto.Com – Crypto News

-

others1 week ago

Can ASTER Price Rebound 50% as Whale Activity and Bullish Pattern Align? – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoSmart Money Buys the Dip – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoZIGChain eyes gains as Nasdaq-Listed SEGG Media backs ZIG – Crypto News

-

Cryptocurrency3 days ago

Cryptocurrency3 days agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

Cryptocurrency3 days ago

Cryptocurrency3 days agoLitecoin: $855K ETF inflow sparks new life – Next target is $105 IF… – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoBitcoin tests $100K support after massive liquidation event rocks market – Crypto News

-

others1 week ago

Pi Network Patterns Point to More Gains Despite Manipulation Claims – Crypto News

-

Technology1 week ago

Breaking: $2.6B Western Union Announces Plans for Solana-Powered Stablecoin by 2026 – Crypto News

-

Business1 week ago

BNB Chain’s Future Growth Won’t Come From DEXs – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoInside Bitwise’s milestone solana ETF launch – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Is Pi Network’s (PI) Price Up by Double Digits Today? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCZ Weighing Lawsuit Against US Senator over Money Laundering Claim: Report – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBasel Reportedly Aims for Friendlier Crypto Bank Guidelines – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoIs the Market Finally Learning to Handle Volatility? – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoAI boom is just beginning – Nvidia CEO Jensen Huang explains what’s driving the virtuous cycle – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoStrategy IPO redefines corporate Bitcoin strategy with euro-denominated offering – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoKERNEL price goes vertical on Upbit listing, hits $0.23 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoVisa To Support Four Stablecoins on Four Blockchains – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoArbitrum beats Ethereum in inflows: Yet ARB price lags – Here’s why – Crypto News

-

Technology1 week ago

Technology1 week agoEthereum Foundation launches institutional portal to boost enterprise adoption – Crypto News

-

Business1 week ago

Bitcoin Price Forecast as Trump Cuts Tariffs After US-China Trade Deal – Crypto News

-

Technology1 week ago

XRP Price Outlook as ETF Nears Possible November 13 Launch – Crypto News

-

Business1 week ago

Not L1s or Wallets – Who Generates the Bulk of Crypto’s $20B in Revenue? – Crypto News

-

others6 days ago

Pi Coin Price Prediction After AI Investment Announcement – Is a Bull Run Ahead? – Crypto News

-

Technology1 week ago

Breaking: $2.6B Western Union Announces Plans for Solana-Powered Stablecoin by 2026 – Crypto News

-

others1 week ago

When liquidity becomes the new frontier – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Cost Basis Map Reveals Key War Zone Between Bulls & Bears – Crypto News

-

others1 week ago

Cardano Price Risks 20% Crash Amid Death Cross and Falling ADA ETF Odds – Crypto News

-

Technology1 week ago

Canary XRP ETF Filing Removes SEC Delay Clause, Targets November Launch – Crypto News

-

others6 days ago

Russia S&P Global Manufacturing PMI dipped from previous 48.2 to 48 in October – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoHBAR under pressure, Descending channel hints at 24% downside move – Crypto News