others

Japanese Yen holds losses as caution prevails following the attack on Trump – Crypto News

- The Japanese Yen declines as the US Dollar improves due to the failed assassination of former US President Donald Trump.

- The JPY may experience volatility amid speculation about potential intervention by Japanese authorities.

- Japanese authorities are estimated to have expended between ¥3.37 trillion to ¥3.57 trillion to curb the rapid depreciation of the JPY.

The Japanese Yen (JPY) edges lower on Monday as the US Dollar (USD) strengthens amid rising risk aversion triggered by the attempted assassination of former US President Donald Trump on Saturday. Analysts speculate that if this event boosts Trump’s chances in the upcoming elections, it may drive ‘Trump-victory trades,’ potentially strengthening the US Dollar and steepening the US Treasury yield curve, as per a Reuters report.

The Japanese Yen (JPY) could face potential volatility amidst speculation of intervention by Japanese authorities. According to data released by the Bank of Japan (BoJ) on Friday, it’s estimated that Japanese authorities may have spent between ¥3.37 trillion to ¥3.57 trillion on Thursday to stem the rapid depreciation of the JPY, as reported by Reuters.

The rally in the Japanese Yen, which had been hovering near 38-year lows, began on Thursday as the US Dollar (USD) weakened following data showing a moderation in US consumer prices for June. This development has increased expectations that the Federal Reserve could cut interest rates as early as September.

According to CME Group’s FedWatch Tool, markets now indicate an 88.1% probability of a 25-basis point rate cut at the September Fed meeting, up from 72.2% a week earlier.

Daily Digest Market Movers: Japanese Yen could experience volatility due to intervention threats

- ING’s FX analyst Francesco Pesole observes that Japan’s Ministry of Finance has adjusted its FX intervention strategy. Following the soft US CPI print on Friday, the USD/JPY pair declined approximately 2%, a larger drop compared to other USD pairs. The increase in JPY futures volumes appears to align with indications of FX intervention.

- UBS FX strategists observe that speculative investors hold near-record short positions on the Yen. They suggest that if US economic data continues to indicate a soft landing, USD/JPY could experience periods of pullbacks.

- BBH FX strategists highlight that recent softness in US data poses challenges to their perspective that the backdrop of sustained inflation and strong growth in the US largely remains intact. They note increasing concern among Federal Reserve officials regarding weaknesses in the labor market.

- Japanese Chief Cabinet Secretary Yoshimasa Hayashi stated his readiness to employ all available measures regarding forex. Hayashi noted that the Bank of Japan (BoJ) would determine the specifics of monetary policy. He expects the BoJ to implement appropriate measures to sustainably and steadily achieve the 2% price target, reported by Reuters on Friday.

- On Friday, Japanese Finance Minister Shunichi Suzuki emphasized that rapid foreign exchange (FX) movements are undesirable. Suzuki refrained from commenting on FX intervention and declined to address media reports regarding Japan’s FX rate checks, as reported by Reuters.

- On Thursday, the data showed that the US Core Consumer Price Index (CPI), which excludes volatile food and energy prices, rose by 3.3% year-over-year in June, compared to May’s increase of 3.4% and the same expectation. Meanwhile, the core CPI increased by 0.1% month-over-month, against the expected and prior reading of 0.2%.

- Federal Reserve Chairman Jerome Powell highlighted the urgent need to monitor the deteriorating labor market on Wednesday. Additionally, Powell expressed confidence in the downward trend of inflation, following his remarks on Tuesday that emphasized the necessity of further data to strengthen confidence in the inflation outlook.

Technical Analysis: USD/JPY holds position around 158.00

USD/JPY trades around 158.00 on Monday. The daily chart analysis indicates a weakening bullish trend as the pair has broken below the lower boundary of an ascending channel pattern. Additionally, the 14-day Relative Strength Index (RSI) is below the 50 level, signaling a decline in the pair’s momentum.

Further downward movement could exert bearish pressure on USD/JPY, potentially testing support near June’s low at 154.55.

On the upside, immediate resistance is observed around the 14-day Exponential Moving Average (EMA) at 159.75, followed by the lower boundary of the ascending channel around 160.20. A return to trading within the ascending channel would likely improve sentiment for the USD/JPY pair, with a potential target toward the upper boundary of the ascending channel near 163.50.

USD/JPY: Daily Chart

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the weakest against the British Pound.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.12% | 0.08% | -0.16% | 0.08% | 0.12% | 0.10% | 0.13% | |

| EUR | -0.12% | -0.00% | -0.09% | 0.15% | 0.04% | 0.17% | 0.20% | |

| GBP | -0.08% | 0.00% | 0.02% | 0.16% | 0.04% | 0.13% | 0.18% | |

| JPY | 0.16% | 0.09% | -0.02% | 0.24% | 0.06% | 0.22% | 0.07% | |

| CAD | -0.08% | -0.15% | -0.16% | -0.24% | -0.03% | 0.02% | 0.01% | |

| AUD | -0.12% | -0.04% | -0.04% | -0.06% | 0.03% | 0.14% | 0.13% | |

| NZD | -0.10% | -0.17% | -0.13% | -0.22% | -0.02% | -0.14% | -0.01% | |

| CHF | -0.13% | -0.20% | -0.18% | -0.07% | -0.01% | -0.13% | 0.00% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

Economic Indicator

Merchandise Trade Balance Total

The Merchandise Trade Balance Total released by the Ministry of Finance is a measure of balance amount between import and export. A positive value shows a trade surplus while a negative value shows a trade deficit. Japan is so much dependant on exports that the Japanese economy heavily relies on a trade surplus. Therefore, any variation in the figures influences the domestic economy. If a steady demand in exchange for Japanese exports is seen, that would turn into a positive.

-

Technology1 week ago

Technology1 week agoSam Altman says OpenAI is developing a ‘legitimate AI researcher’ by 2028 that can discover new science on its own – Crypto News

-

Technology1 week ago

Technology1 week agoBenQ MA270U review: A 4K monitor that actually gets MacBook users right – Crypto News

-

Technology1 week ago

Technology1 week agoGiving Nvidias Blackwell chip to China would slash USs AI advantage, experts say – Crypto News

-

others1 week ago

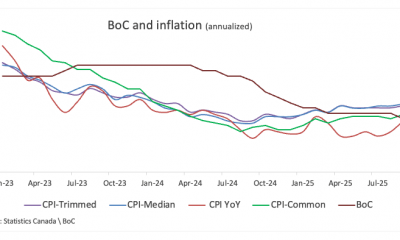

others1 week agoBank of Canada set to cut interest rate for second consecutive meeting – Crypto News

-

De-fi1 week ago

De-fi1 week agoBittensor Rallies Ahead of First TAO Halving – Crypto News

-

Business1 week ago

Business1 week agoStarbucks Says Turnaround Strategy Drives Growth in Global Sales – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana Eyes $210 Before Its Next Major Move—Uptrend Or Fakeout Ahead? – Crypto News

-

De-fi1 week ago

De-fi1 week agoREP Jumps 50% in a Week as Dev Gets Community Support for Augur Fork – Crypto News

-

others7 days ago

others7 days agoMETA stock has lower gaps to fill – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Edges Lower While US Stocks Hit New Highs – Crypto News

-

others1 week ago

Pi Coin Gains Another 15% As Pi Network Joins ISO 20022 For Seamless Banking Integration – Crypto News

-

Cryptocurrency3 days ago

Cryptocurrency3 days agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

Cryptocurrency6 days ago

After 1,993% Burn Spike, Is Shiba Inu Price Set for a Major Trend Reversal? – Crypto News

-

others1 week ago

Crypto Market Tumbles as Jerome Powell Says December Rate Cut ‘Far From Certain’ – Crypto News

-

De-fi1 week ago

De-fi1 week agoBitcoin Dips Under $110,000 After Fed Cuts Rates – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoMany Crypto Treasury Companies Were a Get-Rich-Quick Trap, Warns Columbia Professor – Crypto News

-

De-fi1 week ago

De-fi1 week agoTokenized Nasdaq Futures Enter Top 10 by Volume on Hyperliquid – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCitigroup and Coinbase partner to expand digital-asset payment capabilities – Crypto News

-

De-fi1 week ago

De-fi1 week agoCRO Jumps After Trump’s Truth Social Announces Prediction Market Partnership with Crypto.Com – Crypto News

-

others1 week ago

Can ASTER Price Rebound 50% as Whale Activity and Bullish Pattern Align? – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoSmart Money Buys the Dip – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoZIGChain eyes gains as Nasdaq-Listed SEGG Media backs ZIG – Crypto News

-

Cryptocurrency3 days ago

Cryptocurrency3 days agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

Cryptocurrency3 days ago

Cryptocurrency3 days agoLitecoin: $855K ETF inflow sparks new life – Next target is $105 IF… – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoBitcoin tests $100K support after massive liquidation event rocks market – Crypto News

-

others1 week ago

Pi Network Patterns Point to More Gains Despite Manipulation Claims – Crypto News

-

Technology1 week ago

Breaking: $2.6B Western Union Announces Plans for Solana-Powered Stablecoin by 2026 – Crypto News

-

Business1 week ago

BNB Chain’s Future Growth Won’t Come From DEXs – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoInside Bitwise’s milestone solana ETF launch – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Is Pi Network’s (PI) Price Up by Double Digits Today? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCZ Weighing Lawsuit Against US Senator over Money Laundering Claim: Report – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBasel Reportedly Aims for Friendlier Crypto Bank Guidelines – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoIs the Market Finally Learning to Handle Volatility? – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoAI boom is just beginning – Nvidia CEO Jensen Huang explains what’s driving the virtuous cycle – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoStrategy IPO redefines corporate Bitcoin strategy with euro-denominated offering – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoKERNEL price goes vertical on Upbit listing, hits $0.23 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoVisa To Support Four Stablecoins on Four Blockchains – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoArbitrum beats Ethereum in inflows: Yet ARB price lags – Here’s why – Crypto News

-

Technology1 week ago

Technology1 week agoEthereum Foundation launches institutional portal to boost enterprise adoption – Crypto News

-

Business1 week ago

Bitcoin Price Forecast as Trump Cuts Tariffs After US-China Trade Deal – Crypto News

-

Technology1 week ago

XRP Price Outlook as ETF Nears Possible November 13 Launch – Crypto News

-

Business1 week ago

Not L1s or Wallets – Who Generates the Bulk of Crypto’s $20B in Revenue? – Crypto News

-

others6 days ago

Pi Coin Price Prediction After AI Investment Announcement – Is a Bull Run Ahead? – Crypto News

-

Technology1 week ago

Breaking: $2.6B Western Union Announces Plans for Solana-Powered Stablecoin by 2026 – Crypto News

-

others1 week ago

When liquidity becomes the new frontier – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Cost Basis Map Reveals Key War Zone Between Bulls & Bears – Crypto News

-

others1 week ago

Cardano Price Risks 20% Crash Amid Death Cross and Falling ADA ETF Odds – Crypto News

-

Technology1 week ago

Canary XRP ETF Filing Removes SEC Delay Clause, Targets November Launch – Crypto News

-

others6 days ago

Russia S&P Global Manufacturing PMI dipped from previous 48.2 to 48 in October – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoHBAR under pressure, Descending channel hints at 24% downside move – Crypto News