others

Japanese Yen stands tall near one-month top against USD on hawkish BoJ talks – Crypto News

- The Japanese Yen continues to draw support from expectations for a hawkish BoJ pivot.

- Bets for a June Fed rate cut undermine the USD and further exert pressure on USD/JPY.

- An upward revision of Japan’s Q4 GDP print contributes to the offered tone on Monday.

The Japanese Yen (JPY) rallied to the highest level since early February against its American counterpart on Friday amid bets for an imminent shift in the Bank of Japan’s (BoJ) policy stance. Moreover, investors seem convinced that another substantial pay hike in Japan will fuel demand-driven inflationary pressure and allow the BoJ to end the negative interest rates as early as the March 18-19 meeting. This, along with an upward revision of Japan’s fourth-quarter GDP print, underpins the JPY and keeps the USD/JPY pair depressed through the Asian session on Monday.

Meanwhile, the US employment report for February reaffirmed expectations that the Federal Reserve (Fed) will start cutting interest rates in June and continues to weigh on the US Dollar (USD). This turns out to be another factor that contributes to the offered tone surrounding the USD/JPY pair for the sixth straight day and supports prospects for a further depreciating move. The market focus now shifts to the US consumer inflation figures, due for release on Tuesday. Nevertheless, the fundamental backdrop suggests that the path of least resistance for spot prices is to the downside.

Daily Digest Market Movers: Japanese Yen remains well supported by bets for an imminent shift in the BoJ’s policy stance

- The Japanese Yen remains on the front foot against its American counterpart for the sixth successive day on Monday amid bets that the Bank of Japan (BoJ) will end its negative rate policy in March.

- Jiji News Agency reported over the weekend that the BoJ is considering scrapping its yield curve control program and indicating in advance the amount of government bonds it plans to purchase.

- Furthermore, data released last week showed that wage growth in Japan marked the highest rise since last June and reaffirmed market bets for an imminent shift in the BoJ’s monetary policy stance.

- A revised GDP report showed on Monday that Japan’s economy expanded by 0.1% during the fourth quarter as against a 0.1% contraction reported previously and avoided a technical recession.

- This gives the BoJ more headroom to pivot away from its ultra-loose monetary policy settings, which continue to underpin the JPY and keep the USD/JPY pair depressed near a one-month low.

- A spike in the US unemployment rate to its highest level in two years lifted bets for a June rate cut by the Federal Reserve and dragged the US Dollar to its lowest level since mid-January on Friday.

- The headline NFP showed that the US economy added 275K jobs in February vs. 200K estimated, through was offset by a downward revision of the previous month’s reading to 229K from 353 K.

- Investors now look forward to the release of the latest US consumer inflation figures on Tuesday for a fresh impetus, though the near-term bias seems tilted firmly in favour of the JPY bulls.

Technical Analysis: USD/JPY continues to show hows some resilience below 38.2% Fibo. level, remains vulnerable to sliding further

From a technical perspective, Friday’s breakdown below the 100-day Simple Moving Average (SMA) was seen as a fresh trigger for bearish traders. This comes on top of the recent repeated failures ahead of the 152.00 mark, which constituted the formation of a double-top pattern on the daily chart. Moreover, oscillators on the said chart are holding deep in the negative territory and validate the bearish outlook for the USD/JPY pair. That said, it will still be prudent to wait for acceptance below the 38.2% Fibonacci retracement level of the December-February rally before positioning for further losses. Some follow-through selling below the 200-day SMA, currently pegged near the 146.30-146.25 region, will reaffirm the negative bias and drag spot prices below the 146.00 round figure, towards the 50% Fibo. level, around the 145.60 zone.

On the flip side, any meaningful recovery attempt beyond the 147.00 round figure is more likely to attract fresh sellers and remain capped near the 100-day SMA support breakpoint, now turned resistance near mid-147.00s. A sustained strength beyond, however, could trigger a short-covering rally and lift the USD/JPY pair beyond the 148.00 mark, towards testing the next relevant hurdle near the 148.65-148.70 region. The momentum could extend further towards reclaiming the 149.00 round figure en route to the 149.25 horizontal support-turned-resistance.

Japanese Yen price today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Pound Sterling.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.01% | 0.01% | -0.03% | 0.15% | 0.14% | 0.09% | -0.01% | |

| EUR | -0.01% | -0.02% | -0.05% | 0.14% | 0.12% | 0.06% | -0.02% | |

| GBP | 0.00% | 0.01% | -0.03% | 0.14% | 0.15% | 0.10% | 0.00% | |

| CAD | 0.04% | 0.04% | 0.04% | 0.18% | 0.15% | 0.10% | 0.02% | |

| AUD | -0.15% | -0.14% | -0.14% | -0.19% | -0.01% | -0.06% | -0.16% | |

| JPY | -0.12% | -0.14% | 0.11% | -0.19% | 0.03% | -0.04% | -0.14% | |

| NZD | -0.09% | -0.06% | -0.09% | -0.13% | 0.06% | 0.05% | -0.11% | |

| CHF | 0.03% | 0.04% | 0.02% | -0.01% | 0.18% | 0.13% | 0.09% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

-

others1 week ago

others1 week agoCustomer Who Stole $830,000 From Wells Fargo After Initiating Fraudulent Payments Sentenced to Prison – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoShiba Inu burn surges 2,408%: Can SHIB finally escape bearish pressure? – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoSamsung tapping Perplexity AI for all devices — what does this mean for you? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoAmerican Rapper Cardi B Endorses WAP Token Again—But Is It A Rugpull? – Crypto News

-

others1 week ago

XRP Price Prediction for June: Key Levels to Watch as Technicals Flash 2017 Bull Signs – Crypto News

-

Technology1 week ago

Technology1 week agoBest water purifiers under ₹15000: Explore the top 6 options from Aquaguard, Urban Company and more – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTop crypto predictions: XRP, Monero, Bitcoin Pepe – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago$106,313,218 Solana (SOL) In One Transfer — What Happened? – Crypto News

-

others1 week ago

others1 week agoCanadian Dollar lurches into fresh highs after BoC holds off on rate cuts – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCrypto ATM scams in Australia cause over AUD 3.1 million in losses – Crypto News

-

Technology1 week ago

Technology1 week agoFinal Fantasy Tactics returns once again with remastered edition – The Ivalice Chronicles; all details here – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoJPMorgan to Accept Bitcoin ETFs as Loan Collateral – Crypto News

-

others1 week ago

others1 week ago‘Nothing Stops This Train’ – Macro Guru Lyn Alden Warns Fed Has No Way To Slow Down Debt Growth in US Financial System – Crypto News

-

Cryptocurrency1 week ago

Ethereum’s Pectra Upgrade leaves massive loophole for scammers – Crypto News

-

others1 week ago

Bitcoin Rises As FED Chair Jerome Powell Fails To Speak On Economic Outlook – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoEthereum retests $2,500 as companies bet big on ETH – Crypto News

-

Technology1 week ago

Technology1 week agoWhy are people choosing smart rings over smartwatches in 2025 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agowhat’s fueling the June crypto rally? – Crypto News

-

Technology1 week ago

Technology1 week agoApple WWDC 2025: How to watch the keynote and what all to expect – Crypto News

-

Cryptocurrency5 days ago

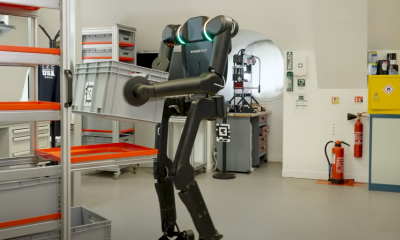

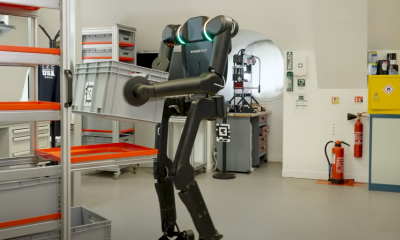

Cryptocurrency5 days agoFrench Exoskeleton Company Wandercraft Pivots to Humanoid Robots – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoFrench Exoskeleton Company Wandercraft Pivots to Humanoid Robots – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoXRP Saved? Bears Not Taking Control – Crypto News

-

Business1 week ago

From Buffett to Zuck: Satoshi Bitcoin Wealth on Path to Surpass Tech and Finance Titans – Crypto News

-

others1 week ago

others1 week agoPound Sterling Price News and Forecast: GBP/USD steadies near 1.3540 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCardano Price Downside Extends As Ethereum Upsurge Adds Pressure – Crypto News

-

others1 week ago

others1 week agoWTI Crude Oil extends gains as Canada wildfires, geopolitical tensions, and a broadly weaker US Dollar support prices – Crypto News

-

Technology1 week ago

Technology1 week agoWi-Fi router buying guide: Speed, range and smart home tips – Crypto News

-

others1 week ago

others1 week agoAustralian Dollar holds ground as Q1 GDP expands 0.2% QoQ – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle Search now shows AI-generated weather snapshots for select users: Report – Crypto News

-

Technology1 week ago

Technology1 week agoTop 5 AI tools in 2025 to boost your productivity, stay ahead and help you save time – Crypto News

-

others5 days ago

others5 days agoGold prices fall as the USD extends gains post NFP – Crypto News

-

Blockchain3 days ago

Blockchain3 days agoEthereum Price Performance Could Hinge On This Binance Metric — Here’s Why – Crypto News

-

others1 week ago

others1 week agoBlackRock Analyst Warns of Overexposure to US Markets, Says One Country On Right Side of Incoming ‘Tectonic Shifts’ – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana Analyst Sets $300 Target – Can Bulls Sustain A Rally? – Crypto News

-

Technology7 days ago

Technology7 days agoWhy Anthropic CEO Dario Amodei thinks a 10-year AI regulation freeze is dangerous – Crypto News

-

Technology6 days ago

Technology6 days agoThe Quiet Voices Questioning China’s AI Hype – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoDonald Trump Ready to Ditch His Tesla Amid Musk Feud? (Report) – Crypto News

-

Technology4 days ago

Technology4 days agoGemini can now schedule tasks, send reminders and keep you on track: Here’s how it works – Crypto News

-

Blockchain2 days ago

Blockchain2 days agoOpenLedger Invests $25 Million to Combat ‘Extractive’ AI Economy – Crypto News

-

Business1 week ago

$3.5B UK Firm Opens XRP Spot Trading In Retail Crypto Push – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoPi Coin slumps amid renewed migration activity on Pi Network – Crypto News

-

Technology1 week ago

Technology1 week agoNintendo Can’t Afford a Slip Up With Switch 2 – Crypto News

-

Technology1 week ago

Technology1 week agoDashcam buying guide: 5 things to know before making a purchase in 2025 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoJPMorgan Plans to Allow Financing Against Crypto ETFs: Report – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBest crypto to buy as Truth Social files for a Spot Bitcoin ETF – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoTrump-Elon feud Erupts, Crypto falls, Coinbase to list Fartcoin – Crypto News

-

Technology6 days ago

Technology6 days agoMicrosoft integrates AI shopping into Copilot app, bringing price tracking and smart comparisons – Crypto News

-

others5 days ago

others5 days agoWidely Followed Analyst Outlines Bullish Path for Bitcoin, Says BTC Will Battle Gold and ‘Never Look Back’ – Crypto News

-

others5 days ago

others5 days agoCanadian Dollar gives back gains despite upbeat jobs data – Crypto News

-

Technology4 days ago

Technology4 days agoBest juicer for home in 2025: Top 10 choices for your family’s good health from brands like Philips, Borosil and more – Crypto News