Technology

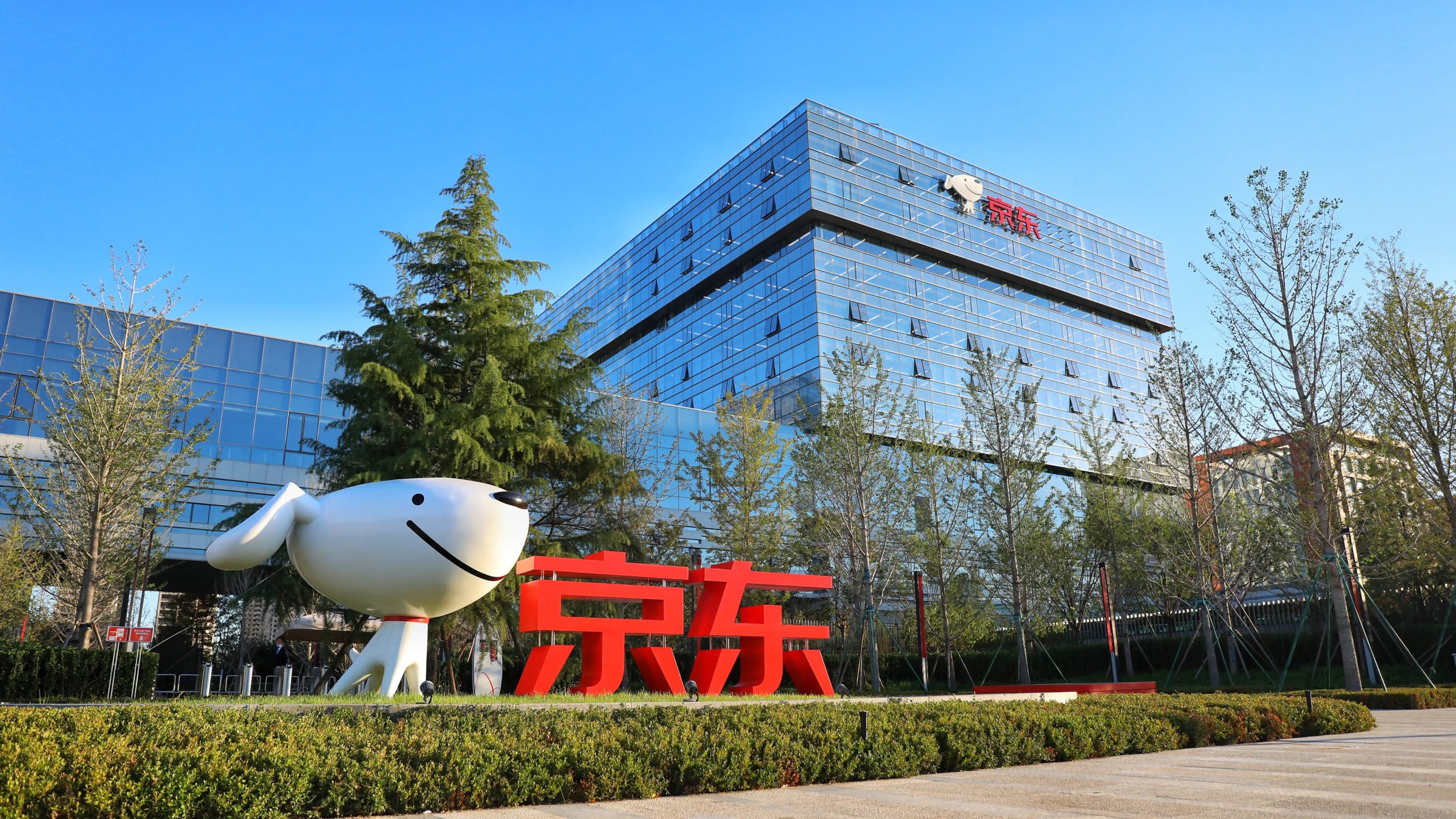

JD.com targets Stablecoin licences to cut cross-border payment costs The Block – Crypto News

Speaking to Observer Network and other media outlets during a 50-minute session on June 17 in Beijing, JD.com founder and chairman Liu Qiangdong revealed the retail giant is actively pursuing regulatory approval for stablecoin operations in “all major sovereign currency countries globally.”

The blockchain-focused announcement represents one of the most significant digital currency initiatives from a major Chinese corporation in recent years.

Targeting a 90% cost reduction in cross-border payments

Liu outlined an ambitious vision where JD.com’s stablecoin infrastructure could transform international commerce.

“We hope to apply for stablecoin licenses in all major sovereign currency countries globally, then through stablecoin licenses achieve global enterprise-to-enterprise currency exchange, reducing global cross-border payment costs by 90% and improving efficiency to in 10 seconds,” Liu said during the session.

The proposed system would represent an improvement on existing international payment rails. Current enterprise-to-enterprise transactions using the SWIFT system typically require “an average of 2-4 days [and come] with high costs,” according to Liu.

The JD.com stablecoin solution promises to complete cross-border payments “in 10 seconds” and cut fees by nine-tenths.

Phased rollout strategy: B2B first, consumer payments later

The company plans a gradual approach to implementations of the stablecoin strategy, beginning with business-to-business transactions before expanding to consumer applications. “After B2B payments, we can penetrate C2C payments,” Liu explained, suggesting the ultimate goal is widespread adoption in JD.com’s ecosystem.

Liu expressed particular optimism about potential in the consumer sector, saying: “We hope one day when consuming worldwide, people use JD local currency for global payments.” However, the timeline for eventual consumer rollout remains unclear.

Regulatory challenges and global expansion

The stablecoin initiative represents a notable regulatory undertaking, requiring compliance with financial regulations in multiple jurisdictions. Liu’s commitment to securing licences in “all major sovereign currency countries” suggests JD.com is prepared for a complex, multi-year regulatory approval process.

The approach aligns with JD.com’s broader international expansion strategy, which Liu described as deliberately methodical. The company has spent three years building logistics infrastructure in Europe and plans to begin full operations on the continent next year, after four years of preparatory work.

“JD’s business model isn’t good in that it’s slow, hard, tiring. You have to work on technology for several years before you can do business,” Liu acknowledged.

Context of JD.com’s innovation push

The stablecoin announcement comes as Liu attempts to revitalise JD.com following what he candidly described as a “lost five years” lacking innovation. Since returning to active leadership in October 2023 after a period of semi-retirement, Liu has pushed multiple new initiatives, including aggressive expansion into food delivery and plans for hotel and tourism services.

“We’ll persist in having innovation every year in the future,” Liu stated, positioning the stablecoin project among “about six innovation projects in the next year and a half.” However, he tempered expectations by noting that “not all these innovation projects can succeed” and some “might fail, losing time and money.”

Supply chain integration strategy

The stablecoin initiative fits in JD.com’s strategy of building supply chain solutions. Liu emphasised that “100% of JD’s businesses revolve around supply chain,” suggesting the payment infrastructure could eventually support the company’s logistics and procurement operations globally.

With JD.com reporting platform transaction volume exceeding 4 trillion yuan (approximately US$550 billion) in 2024 and net revenue of 1.158 trillion yuan, the company has substantial transaction volume that could benefit from reduced payment friction.

Market implications and competitive landscape

JD.com’s stablecoin ambitions come as traditional payment providers face increasing pressure from blockchain-based alternatives. The company’s focus on enterprise payments initially may help avoid some regulatory scrutiny that consumer-focused cryptocurrency projects have faced.

However, the success of JD.com’s stablecoin initiative will depend heavily on regulatory approval across the globe, technological execution, and merchant adoption. Liu’s acknowledgement that some innovation projects “might fail” suggests the company recognises the inherent risks to the acceptance and resilience of blockchain payment infrastructure.

The announcement positions JD.com among a growing number of major corporations exploring stablecoin applications for international commerce, though few have committed to the global licensing approach Liu outlined.

(Photo by JD.com’s corporate blog)

See also: Hong Kong stablecoin regulation: New cryptocurrency law explained

Want to learn more about blockchain from industry leaders? Check out Blockchain Expo taking place in Amsterdam, California and London.

Explore other upcoming enterprise technology events and webinars powered by TechForge here.

-

Technology1 week ago

Technology1 week agoBest 5G phones under ₹10,000 in July 2025: Infinix Hot 60, Samsung M06 and more – Crypto News

-

others1 week ago

Japan CFTC JPY NC Net Positions rose from previous ¥103.6K to ¥106.6K – Crypto News

-

Technology1 week ago

Why is Shiba Inu Price Up Today? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoETH to Lead BTC Over Next 6 Months, Says Galaxy CEO – Crypto News

-

De-fi1 week ago

De-fi1 week agoWindtree Therapeutics Plans $520 Million Raise, 99% for BNB, Secures $500M Equity Line, Uses Kraken Custody – Crypto News

-

others1 week ago

others1 week agoArthur Hayes-Backed Altcoin Outpaces Crypto Market Amid Launch of New Partnership With Anchorage Digital – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTether Gold (XAUt) Market Cap Soars as Gold Hits Record Highs in 2025 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoMarket update: Bitcoin rises after US-EU announce framework trade agreement – Crypto News

-

Cryptocurrency3 days ago

Cryptocurrency3 days agoXRP inflows drop 95% since July spike, while Chaikin data signals possible rally – Crypto News

-

Technology1 week ago

Technology1 week agoWho is Shengjia Zhao? ChatGPT co-creator named Chief Scientist at Meta’s Superintelligence Labs – Crypto News

-

others3 days ago

XRP NIGHT Token Airdrop: Snapshot, Claim Date and What to Expect? – Crypto News

-

Blockchain3 days ago

Blockchain3 days agoBank of America Sees Interest in Tokenization of Real-World Assets – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoETH to Lead BTC Over Next 6 Months, Says Galaxy CEO – Crypto News

-

others1 week ago

others1 week agoUS Dollar finds support amid Fed uncertainty and tariff talks – Crypto News

-

Technology1 week ago

Technology1 week ago‘Screwed up’: Sam Altman warns against using ChatGPT as your lawyer or therapist – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin and Ethereum ETFs Pull in Record-High $11.2 Billion in July – Crypto News

-

Business5 days ago

Business5 days agoChase Launches $4 Million Grant Program as Restaurants Struggle – Crypto News

-

Blockchain4 days ago

Blockchain4 days agoSEC Crypto ETFs Ruling Brings Structural Fix, Not Retail Shakeup – Crypto News

-

Technology3 days ago

Technology3 days agoOppo K13 Turbo series confirmed to launch in India with in-built fan technology: Price, specs and everything expected – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoFriday charts: Crazy train investing – Crypto News

-

Business1 week ago

Buy DexScreener Reactions – Boost Legends: Guide + $5 Bonus – Crypto News

-

others1 week ago

‘Sit Tight With Bitcoin’ Robert Kiyosaki Predicts Great Depression 2.0 – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoOpenAI rolls out ‘Study Mode’ in ChatGPT: What is it? How to use? All your questions answered… – Crypto News

-

others5 days ago

others5 days agoBlockchain Gaming Is Growing Up – What’s Behind the Sector’s Quiet Comeback – Crypto News

-

Business5 days ago

Stablecoins Won’t Boost Treasury Demand, Peter Schiff Warns – Crypto News

-

Technology5 days ago

Technology5 days agoIs AI causing tech worker layoffs? Thats what CEOs suggest, but the reality is complicated – Crypto News

-

Business4 days ago

Breaking: Solana ETFs Near Launch as Issuers Update S-1s With Fund Fees – Crypto News

-

De-fi4 days ago

De-fi4 days agoWhite House Crypto Report Recommends Expanding CFTC’s Role in Crypto Regulation – Crypto News

-

others3 days ago

Breaking: Strategy Files $4.2 Billion STRC Offering To Buy More Bitcoin – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoHow AI can weave a future for Kashmir’s centuries old carpet industry – Crypto News

-

De-fi1 week ago

De-fi1 week agoETH Unstaking Queue Hits Record High, Led by Justin Sun-Linked Addresses – Crypto News

-

Business1 week ago

Ethereum Breaks $3,900 as SharpLink Makes Another $295M ETH Purchase – Crypto News

-

Technology1 week ago

Solayer Launches USDC-Powered Hotel Booking Platform To Give Crypto Travel a Boost – Crypto News

-

Business7 days ago

Breaking: US SEC Delays Launch Of Truth Social’s Bitcoin ETF And Grayscale’s Solana ETF – Crypto News

-

Technology5 days ago

Breaking: BlackRock’s Ethereum ETF Staking Proposal Advances As SEC Acknowledges Filing – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoAltcoins update: Dogecoin and Injective signal recoveries as Ethereum eyes $4,000 – Crypto News

-

Technology5 days ago

Technology5 days agoCoinbase exchange targets alleged cybersquatter in lawsuit – Crypto News

-

others4 days ago

Ripple Swell 2025: Top Speakers and Panelists to Watch this November – Crypto News

-

Technology4 days ago

Coinbase to Offer Tokenized Stocks and Prediction Markets in U.S. – Crypto News

-

others4 days ago

others4 days agoCanadian Dollar under pressure amid weak GDP, Trump tariff threat, and strong US data – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoOpenAI finally rolls out ChatGPT Agent after week-long delay: How it works – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTea App That Claimed to Protect Women Exposes 72,000 IDs in Epic Security Fail – Crypto News

-

Technology1 week ago

Technology1 week agoIndias startup wave merges AI with tradition for smarter daily solutions – Crypto News

-

De-fi1 week ago

De-fi1 week agoBank of America Says U.S. Lenders Ready Stablecoin Launches – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoZK breakthroughs, onchain comebacks and stablecoin shakeups – Crypto News

-

others7 days ago

others7 days agoEUR/USD dives as the US Dollar outperforms with all eyes on the Fed decision – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoSEC Gives Green Light to In-Kind Transactions for Crypto ETPs – Crypto News

-

Technology6 days ago

Technology6 days agoSpotify hits 276M subscribers and strong user growth in Q2, but revenue and profit fall short of targets – Crypto News

-

Technology5 days ago

Ethereum Price Prediction- Bulls Target $5,400 Amid DeFi Revival and Soaring TVL – Crypto News

-

Technology4 days ago

Technology4 days agoSolana DEX volume dips 20% after co-founder slams meme coins – Crypto News