Business

KuCoin Hit by $200M Withdrawal Surge After DOJ Charges – Crypto News

Since the recent indictment of the cryptocurrency exchange KuCoin and its founders by the Department of Justice (DOJ), there has been a significant increase in the number of withdrawal activities. Nansen, an onchain analytics firm, observed a major exodus of funds from the platform in which more than $200 million were pulled from the Ethereum-based assets and other EVM-compatible chains in a short period.

DOJ Legal Action Triggers Withdrawal Surge

According to Damian Williams, the U.S. Attorney for the Southern District of New York, the indictment charges KuCoin and its owners with breaches of anti-money laundering and Bank Secrecy Act regulations.

Mass Stablecoin Withdrawals on KuCoin Exchange

“The exchange’s reserves, in stablecoins, have decreased by more than US$100 million in the last 3 hours.” – By @caueconomy

Full post 👇https://t.co/3CeAAq45AJ

— CryptoQuant.com (@cryptoquant_com) March 26, 2024

In the wake of this announcement, Nansen noted a quick reaction from the exchange’s users, with approximately $99 million withdrawn from the Ethereum chain and an additional $109 million from the other EVM-compatible chains. This migration is a reflection of the community’s response to the possible legal and operational risks related to the indictment.

KuCoin’s Response and Asset Security

In reply to the charges brought forward by the DOJ, KuCoin released a statement that its users should not worry about the platform as it is “operating well.” Additionally, it was assured that the users’ assets were “absolutely safe.” The exchange stressed its commitment to law compliance and transparency, promising a thorough investigation through legal channels.

However, the large outflows attest to some degree of users’ worry about the stability and future of their holdings on the exchange.

Analysis of Withdrawals and Exchange Reserves

Meanwhile, after the announcement by the DOJ, the valuation of KuCoin’s cryptocurrency holdings was at about $5.92 billion, with a huge chunk of such holdings in key cryptocurrencies like USDT, BTC, ETH, and its own token, KCS.

The KCS token itself lost 14% of its value after the legal action, trading at $12.51 at press time. Particularly, the fast withdrawals of stablecoins indicate that the users are just trying to protect their assets from the uncertainty of the exchange’s legibility and operational integrity in the US.

The KuCoin case illustrates problems that exist within the cryptocurrency industry with regard to regulatory compliance and the security of assets on exchanges. DOJ’s crackdown on KuCoin is only a part of growing tendencies to impose stricter discipline on the cryptocurrency platforms as well as the necessity of compliance with anti-money laundering standards and financial regulations.

Read Also: Blackrock CEO Raises Alarm on US Debt; What’s Next for Crypto Markets?

<!–

–>

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

<!–

–>

-

Blockchain1 week ago

Blockchain1 week agoRipple and Ctrl Alt Team to Support Real Estate Tokenization – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoSatoshi-Era Bitcoin Whale Moves Another $2.42 Billion, What’s Happening? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin Breaches $120K, Institutional FOMO Takes and House Debate Propel Gains – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoIt’s a Statement, Says Bitfinex Alpha – Crypto News

-

others1 week ago

others1 week agoEUR/USD recovers with trade talks and Fed independence in focus – Crypto News

-

Technology1 week ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Technology1 week ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Business7 days ago

XLM Is More Bullish Than ETH, SOL, And XRP, Peter Brandt Declares – Crypto News

-

others1 week ago

Bitcoin Critic Vanguard Becomes Strategy’s (MSTR) Largest Shareholder – Crypto News

-

Business1 week ago

Pepe Coin Rich List June 2025: Who’s Holding Highest PEPE as it Nears Half a Million Holders? – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoWhy voice is emerging as India’s next frontier for AI interaction – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoAnarchy, crime and stablecoins – Blockworks – Crypto News

-

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://dripp.zone/news/wp-content/uploads/2025/07/Stellar-XLM-bulls-exhausted-after-rally-Is-a-pullback.webp-400x240.webp)

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://dripp.zone/news/wp-content/uploads/2025/07/Stellar-XLM-bulls-exhausted-after-rally-Is-a-pullback.webp-80x80.webp) Cryptocurrency1 week ago

Cryptocurrency1 week agoStellar [XLM] bulls exhausted after rally – Is a pullback nearby? – Crypto News

-

Technology1 week ago

Technology1 week agoV Guard INSIGHT-G BLDC fan review: Cool performer with a premium look – Crypto News

-

Cryptocurrency1 week ago

Fed’s Hammack Raises Inflation Concerns Amid Push For Interest Rate Cut – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

others1 week ago

others1 week agoTop Crypto Exchange by Trading Volume Binance Announces Airdrop for New Ethereum (ETH) Ecosystem Altcoin – Crypto News

-

others1 week ago

others1 week agoVanEck Details Key Drivers Boosting Bitcoin Price, Including Corporate Treasury Demand, ETF Flows and More – Crypto News

-

Business1 week ago

XRP Lawsuit Update: Ripple Paid $125M in Cash, Settlement Hinges on Appeal – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin trades near $119K after new all-time high; Coinbase rebrands wallet to ‘Base App’ – Crypto News

-

Technology5 days ago

“Decentralized Ponzi Scheme”- Gold Bug Peter Schiff Slams Landmark Crypto Bills – Crypto News

-

Business1 week ago

CME XRP Futures Hit $1.6B In Total Trading Volume Since Launch – Crypto News

-

Technology1 week ago

XLM Price Forecast: Why Stellar Lumens May Crash After 80% Rally in Last 7 Days – Crypto News

-

others1 week ago

others1 week agoScammer Drains $10,000,000 From IRS in International Tax Fraud and Identity Theft Scheme: DOJ – Crypto News

-

Business1 week ago

Ethereum Price Prediction- Bulls Target $3,700 As ETH Treasury Accumulation Soars – Crypto News

-

others1 week ago

others1 week agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

others1 week ago

others1 week agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

Cryptocurrency1 week ago

Russia’s $85 Billion Sberbank to Launch Crypto Custody Services – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoCalifornia Sheriffs Believe 74-Year-Old’s Disappearance Linked to Son’s Crypto Fortune – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoShytoshi Kusama Breaks Silence on New SHIB AI Whitepaper and Transformed Future – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoAltseason heats up, but Bitcoin could face short-term pullback – How? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHypercharged Exposure to XRP and Solana Now Available With These Two ETFs – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoNothing Burger or Crypto Catalyst? – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoNvidia’s Jensen Huang says AI ‘fundamental like electricity’, praises Chinese models as ‘catalyst for global progress’ – Crypto News

-

Business1 week ago

$800 Billion JPMorgan To Rival Tether, Circle, and Ripple In Stablecoin Race – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitMine Shares Rallied After Peter Thiel Investment. – Crypto News

-

De-fi1 week ago

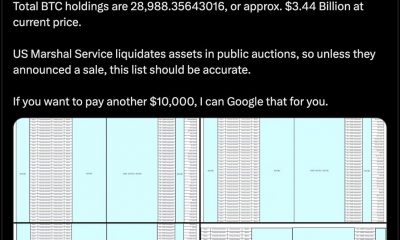

De-fi1 week agoU.S. Marshals Peg Federal Bitcoin Holdings at 28,988 Tokens Worth $3.4 B – Crypto News

-

De-fi7 days ago

De-fi7 days agoU.S. House Passes Clarity, GENIUS, and Anti-CBDC Acts With Historic Bipartisan Support for Crypto – Crypto News

-

De-fi6 days ago

De-fi6 days agoBNB Chain Teases New Blockchain with Privacy Features to Compete With Crypto Exchanges – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoXRP Price Spikes to Record Highs As Momentum Signals Extended Gains – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoWhy Bitcoin self-custody is declining in the ETF era – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoUS House passes three key crypto bills; market reaction muted as Bitcoin dips – Crypto News

-

Technology6 days ago

Breaking: GENIUS Act Becomes First Major Crypto Legislation as Trump Signs Bill – Crypto News

-

De-fi6 days ago

De-fi6 days agoCrypto Market Cap Hits $4 Trillion Milestone as US House Passes Landmark Bills – Crypto News

-

De-fi6 days ago

De-fi6 days agoCrypto Market Cap Hits $4 Trillion Milestone as US House Passes Landmark Bills – Crypto News

-

others4 days ago

Why Is The Crypto Market Rising Today? – Crypto News

-

Blockchain3 days ago

Blockchain3 days agoInstitutional Demand Surges As Ethereum Sets New Inflow Records – Crypto News

-

Technology1 week ago

Technology1 week agoV Guard INSIGHT-G BLDC fan review: Cool performer with a premium look – Crypto News

-

Cryptocurrency1 week ago

Fed’s Hammack Raises Inflation Concerns Amid Push For Interest Rate Cut – Crypto News

✓ Share: