De-fi

Lyra Finance Offers Leveraged Exposure to ETH Through Ethena – Crypto News

The platform has launched its sUSDeBULL vault, providing depositors with leveraged upside to ETH’s price increasing.

Lyra Finance, a DeFi platform offering tokenized derivatives and yield, is offering an extra 2.5x on sUSDe yields when ETH rises via a partnership with Ethena.

Users who deposit into Lyra’s new sUSDeBULL vault will be earning LDX Points from Lyra and Ethena Sats, while maintaining exposure to Lyra’s automated options strategy that is meant to increase yields as ETH goes up, and preserve yield when the ETH price chops.

Lyra’s automated options strategy buys bull call spreads with yield generated by sUSDe in the previous week, providing users a leveraged exposure to ETH upside via yield. If ETH trends downwards, users risk earning zero yield on their capital during that time.

Lyra’s total-value locked (TVL) has expanded by over 10 times since the beginning of the year, and is now back at levels it has not seen since Q1 2022, according to DeFiLlama.

The product’s deposits began to take off at the end of May, when Lyra introduced liquid restaking token (LRT) deposits.

Notably, the sUSDeBULL vault is launching ahead of the Ethereum ETF. However, Ethereum’s price has been on a steady decline since June, and is down 15.9% on the month, contradicting expectations that the upcoming ETFs would be expected to bode well for ETH holders.

-

Technology5 days ago

Technology5 days agoMeet Matt Deitke: 24-year-old AI whiz lured by Mark Zuckerberg with whopping $250 million offer – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoXRP inflows drop 95% since July spike, while Chaikin data signals possible rally – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoBank of America Sees Interest in Tokenization of Real-World Assets – Crypto News

-

Technology1 week ago

Technology1 week agoIs AI causing tech worker layoffs? Thats what CEOs suggest, but the reality is complicated – Crypto News

-

others7 days ago

Breaking: Strategy Files $4.2 Billion STRC Offering To Buy More Bitcoin – Crypto News

-

others7 days ago

XRP NIGHT Token Airdrop: Snapshot, Claim Date and What to Expect? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSEC Crypto ETFs Ruling Brings Structural Fix, Not Retail Shakeup – Crypto News

-

Business1 week ago

Breaking: Solana ETFs Near Launch as Issuers Update S-1s With Fund Fees – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoAltcoin Rally To Commence When These 2 Signals Activate – Details – Crypto News

-

Cryptocurrency5 days ago

Cardano’s NIGHT Airdrop to Hit 2.2M XRP Wallets — Find Out How Much You Can Get – Crypto News

-

Business1 week ago

Business1 week agoChase Launches $4 Million Grant Program as Restaurants Struggle – Crypto News

-

others1 week ago

Ripple Swell 2025: Top Speakers and Panelists to Watch this November – Crypto News

-

Technology7 days ago

Technology7 days agoOppo K13 Turbo series confirmed to launch in India with in-built fan technology: Price, specs and everything expected – Crypto News

-

others1 week ago

others1 week agoBlockchain Gaming Is Growing Up – What’s Behind the Sector’s Quiet Comeback – Crypto News

-

Business1 week ago

Stablecoins Won’t Boost Treasury Demand, Peter Schiff Warns – Crypto News

-

Technology7 days ago

Coinbase to Offer Tokenized Stocks and Prediction Markets in U.S. – Crypto News

-

others7 days ago

others7 days agoCanadian Dollar under pressure amid weak GDP, Trump tariff threat, and strong US data – Crypto News

-

Business6 days ago

Bitpanda Co-Founder & Co-CEO Paul Klanschek Steps Down as Firm Eyes Frankfurt IPO – Crypto News

-

others1 week ago

others1 week agoEUR/USD dives as the US Dollar outperforms with all eyes on the Fed decision – Crypto News

-

others1 week ago

Breaking: PayPal to Let Merchants Accept Payments in Over 100 Cryptocurrencies – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSEC Gives Green Light to In-Kind Transactions for Crypto ETPs – Crypto News

-

Metaverse1 week ago

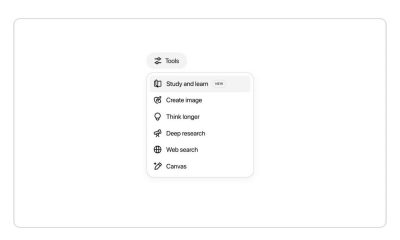

Metaverse1 week agoOpenAI rolls out ‘Study Mode’ in ChatGPT: What is it? How to use? All your questions answered… – Crypto News

-

Technology1 week ago

Breaking: BlackRock’s Ethereum ETF Staking Proposal Advances As SEC Acknowledges Filing – Crypto News

-

Technology1 week ago

Ethereum Price Prediction- Bulls Target $5,400 Amid DeFi Revival and Soaring TVL – Crypto News

-

Technology1 week ago

Technology1 week agoCoinbase exchange targets alleged cybersquatter in lawsuit – Crypto News

-

De-fi1 week ago

De-fi1 week agoWhite House Crypto Report Recommends Expanding CFTC’s Role in Crypto Regulation – Crypto News

-

Technology6 days ago

Technology6 days agoBig Tech’s Big Bet on AI Driving $344 Billion in Spend This Year – Crypto News

-

Cryptocurrency6 days ago

CME XRP Futures Hit Record Highs in July Amid ETF Approval Optimism – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoStablecoins Are Finally Legal—Now Comes the Hard Part – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoTron Eyes 40% Surge as Whales Pile In – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoEthereum Hits Major 2025 Year Peak Despite Price Dropping to $3,500 – Crypto News

-

Technology4 days ago

Beyond Billboards: Why Crypto’s Future Depends on Smarter Sports Sponsorships – Crypto News

-

Technology1 week ago

Technology1 week agoSpotify hits 276M subscribers and strong user growth in Q2, but revenue and profit fall short of targets – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoAltcoins update: Dogecoin and Injective signal recoveries as Ethereum eyes $4,000 – Crypto News

-

Business1 week ago

Breaking: CBOE Files For Rule Change To List Crypto ETFs Without SEC Approval – Crypto News

-

Technology1 week ago

Technology1 week agoSolana DEX volume dips 20% after co-founder slams meme coins – Crypto News

-

Technology7 days ago

Technology7 days agoTim Cook confirms Apple will ramp up AI spending, ‘open’ to acquisitions – Crypto News

-

Technology7 days ago

Technology7 days agoOppo K13 Turbo series confirmed to launch in India with in-built fan technology: Price, specs and everything expected – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoStrategy Expands STRC Offering Twice in One Week – Crypto News

-

Technology5 days ago

Will The First Spot XRP ETF Launch This Month? SEC Provides Update On Grayscale’s Fund – Crypto News

-

Technology5 days ago

Technology5 days agoAmazon Great Freedom Sale deals on smartwatches: Up to 70% off on Samsung, Apple and more – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoXRP Must Hold $2.65 Support Or Risk Major Breakdown – Analyst – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoXRP Must Hold $2.65 Support Or Risk Major Breakdown – Analyst – Crypto News

-

Business4 days ago

Is Quantum Computing A Threat for Bitcoin- Elon Musk Asks Grok – Crypto News

-

Technology4 days ago

Technology4 days agoElon Musk reveals why AI won’t replace consultants anytime soon—and it’s not what you think – Crypto News

-

Technology4 days ago

Technology4 days agoGoogle DeepMind CEO Demis Hassabis explains why AI could replace doctors but not nurses – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCoinbase and JPMorgan Chase partner for crypto integration – Crypto News

-

others1 week ago

others1 week agoGold slides below $3,300 as traders await Fed policy decision – Crypto News

-

others1 week ago

others1 week agoGold slides below $3,300 as traders await Fed policy decision – Crypto News

-

Technology1 week ago

Technology1 week agoNintendo Direct Partner showcase highlights third-party titles coming to Switch and Switch 2 – Crypto News