others

Mexican Peso depreciates on expectation of Banxico’s rate cut – Crypto News

- Mexican Peso declines as USD/MXN climbs over 1.40%, driven by expectations of further Banxico rate cuts.

- Cooling inflation in early September bolsters the case for a Banxico rate reduction at the September 26 meeting.

- Bloomberg survey: 20 of 25 analysts expect Banxico to cut 25 bps to 10.50%, with some predicting a 50 bps reduction.

The Mexican Peso tumbles against the Greenback on Wednesday as the latter appreciates sharply against most emerging market currencies. There are expectations for further easing by the Bank of Mexico (Banxico) at its September 26 meeting. This environment has sponsored a leg-up in the exotic pair. At the time of writing, the USD/MXN trades at 19.58, a gain of over 1.40%.

Mexico’s economic docket remained absent on Wednesday, but data revealed on Monday and Tuesday paint a mixed economic picture. In annual data, Economic Activity improved in July, but Retail Sales extended its agony to three consecutive months of registering negative readings.

On Tuesday, the Instituto Nacional de Estadistica Geografía e Informatica (INEG) announced that monthly and yearly inflation figures for September’s first half cooled.

The latest data set should allow Banxico to cut its interest rate by at least 25 basis points (bps) on Thursday. According to Bloomberg, 20 out of 25 analysts estimate that the central bank will lower borrowing costs to 10.50%. One expects rates to remain unchanged, and four estimate a 50 bps rate cut, following the Fed’s footsteps.

If Banxico eases its policy, that would be negative for the Peso. Hence, the USD/MXN could extend its uptrend, with traders setting their sights on the psychological 20.00 figure.

Christian Lawrence, senior cross-asset strategist at Rabobank, noted, “We see room for bouts of downside on the back of tactical carry trade flows during periods of vol suppression. Still, our base is for further MXN weakness over the coming months as reforms and US elections add to MXN risk premia.”

Meanwhile, data in the United States (US) show that although the economy is slowing down, most market participants estimate a soft-landing scenario. On Tuesday, the Conference Board (CB) revealed that Consumer Sentiment in September deteriorated and hit its lowest level since August 2021 at 98.7, down from 105.6.

Daily digest market movers: Mexican Peso dips amid scarce economic docket

- USD/MXN extended its rally on Banxico rate cut expectations, alongside the Greenback’s recovery.

- US Dollar Index (DXY), which tracks the buck’s performance against a basket of six peers, climbs 0.56% and exchanges hands at 100.91.

- Banxico is expected to lower borrowing costs by 175 bps toward the end of 2025, according to the swaps markets.

- Market participants had fully priced in a 100% chance of a 25 bps rate cut by the Fed. However, the odds for 50 bps of easing are 60.8%, according to the CME FedWatch Tool.

USD/MXN technical analysis: Mexican Peso slumps as USD/MXN surpasses 19.50

The USD/MXN resumed its uptrend on Wednesday and hit a daily high of 19.64 before stabilizing at current levels. Momentum favors further upside as the Relative Strength Index (RSI) is bullish.

The first key resistance level that buyers need to clear is the August 6 high at 19.61. Once surpassed, the next stop is 20.00, followed by the year-to-date (YTD) peak at 20.22.

On the flip side, if sellers drive USD/MXN below the September 23 low of 19.29, it will expose the confluence of the 50-day Simple Moving Average (SMA) and the September 18 low between 19.08 and 19.06.

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.

-

Technology1 week ago

Technology1 week agoSam Altman says OpenAI is developing a ‘legitimate AI researcher’ by 2028 that can discover new science on its own – Crypto News

-

Technology1 week ago

Technology1 week agoGiving Nvidias Blackwell chip to China would slash USs AI advantage, experts say – Crypto News

-

Technology1 week ago

Technology1 week agoBenQ MA270U review: A 4K monitor that actually gets MacBook users right – Crypto News

-

others1 week ago

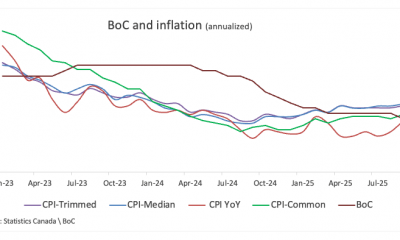

others1 week agoBank of Canada set to cut interest rate for second consecutive meeting – Crypto News

-

De-fi1 week ago

De-fi1 week agoBittensor Rallies Ahead of First TAO Halving – Crypto News

-

De-fi1 week ago

De-fi1 week agoAI Sector Rebounds as Agent Payment Systems Gain Traction – Crypto News

-

Business1 week ago

Business1 week agoStarbucks Says Turnaround Strategy Drives Growth in Global Sales – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoIBM Set to Launch Platform for Managing Digital Assets – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana Eyes $210 Before Its Next Major Move—Uptrend Or Fakeout Ahead? – Crypto News

-

De-fi1 week ago

De-fi1 week agoREP Jumps 50% in a Week as Dev Gets Community Support for Augur Fork – Crypto News

-

Technology1 week ago

Pi Coin Price Jumps 24% as 10M Tokens Exit Exchanges – Can Bulls Sustain the Momentum? – Crypto News

-

others1 week ago

others1 week agoGBP/USD floats around 1.3320 as softer US CPI reinforces Fed cut bets – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Edges Lower While US Stocks Hit New Highs – Crypto News

-

others6 days ago

others6 days agoMETA stock has lower gaps to fill – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Phones Struggle as Solana Quietly Pulls Plug on Saga – Crypto News

-

Business1 week ago

Crypto ETFs Attract $1B in Fresh Capital Ahead of Expected Fed Rate Cut This Week – Crypto News

-

others1 week ago

Pi Coin Gains Another 15% As Pi Network Joins ISO 20022 For Seamless Banking Integration – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

others1 week ago

Crypto Market Tumbles as Jerome Powell Says December Rate Cut ‘Far From Certain’ – Crypto News

-

De-fi1 week ago

De-fi1 week agoBitcoin Dips Under $110,000 After Fed Cuts Rates – Crypto News

-

De-fi1 week ago

De-fi1 week agoTokenized Nasdaq Futures Enter Top 10 by Volume on Hyperliquid – Crypto News

-

Cryptocurrency17 hours ago

Cryptocurrency17 hours agoMany Crypto Treasury Companies Were a Get-Rich-Quick Trap, Warns Columbia Professor – Crypto News

-

De-fi1 week ago

De-fi1 week agoMetaMask Fuels Airdrop Buzz With Token Claim Domain Registration – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCitigroup and Coinbase partner to expand digital-asset payment capabilities – Crypto News

-

others1 week ago

Can ASTER Price Rebound 50% as Whale Activity and Bullish Pattern Align? – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

De-fi1 week ago

De-fi1 week agoCRO Jumps After Trump’s Truth Social Announces Prediction Market Partnership with Crypto.Com – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoInside Bitwise’s milestone solana ETF launch – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Is Pi Network’s (PI) Price Up by Double Digits Today? – Crypto News

-

Cryptocurrency5 days ago

After 1,993% Burn Spike, Is Shiba Inu Price Set for a Major Trend Reversal? – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoGold Price Forecast 2025, 2030, 2040 & Investment Outlook – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoKERNEL price goes vertical on Upbit listing, hits $0.23 – Crypto News

-

Technology1 week ago

Breaking: $2.6B Western Union Announces Plans for Solana-Powered Stablecoin by 2026 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoVisa To Support Four Stablecoins on Four Blockchains – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCrypto Analyst Shows The Possibility Of The Ethereum Price Reaching $16,000 – Crypto News

-

Business1 week ago

$2.5T Citigroup Partners With Coinbase to Enable Stablecoin Payments – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoArgentine Stablecoin Use Surged Ahead of President Milei’s Midterm Election Win – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

others1 week ago

Gold and Silver continue to correct – Commerzbank – Crypto News

-

Cryptocurrency1 week ago

Is Stock Tokenization Really Exploding? Not Even 0.01% – Crypto News

-

Business1 week ago

BNB Chain’s Future Growth Won’t Come From DEXs – Crypto News

-

others1 week ago

When liquidity becomes the new frontier – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoZIGChain eyes gains as Nasdaq-Listed SEGG Media backs ZIG – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoLitecoin: $855K ETF inflow sparks new life – Next target is $105 IF… – Crypto News

-

Cryptocurrency1 day ago

Cryptocurrency1 day agoBitcoin tests $100K support after massive liquidation event rocks market – Crypto News

-

Cryptocurrency1 day ago

Cryptocurrency1 day agoStrategy IPO redefines corporate Bitcoin strategy with euro-denominated offering – Crypto News

-

Business1 week ago

Cardano Price Eyes 80% Rally as x402 Upgrade Sparks Hope for AI Payment Expansion – Crypto News

-

others1 week ago

Litecoin Price Jumps, What’s Behind the Sudden Rally? (28 oct) – Crypto News

-

Business1 week ago

Trump Media Launches Polymarket Rival, Eyes $9B Prediction Market with Crypto.com – Crypto News