others

Mexican Peso erases its earlier gains ahead of next week Mexico’s inflation data – Crypto News

- Mexican Peso’s advance against the US Dollar halts, with USD/MXN bouncing from recent lows despite broad-based USD weakness.

- Banxico officials hint at a less restrictive monetary policy yet suggest gradual rate cuts.

- Upbeat US economic data and Federal Reserve officials’ resistance to early rate cuts propelled the USD/MXN up move.

Mexican Peso (MXN) trims some of its weekly gains against the US Dollar (USD) even though the stock market in the United States (US) portrays a risk-on mood. Investors are pricing the Federal Reserve (Fed) to cut rates for the first half of 2024, though it failed to weigh on the Greenback (USD), as the USD/MXN jumps late in the New York session, gained some 0.08%, trades at 17.23, after hitting a two-month low at 17.18.

Mexico’s economic docket remained scarce, though comments from Bank of Mexico (Banxico) officials suggest monetary policy would be less restrictive next year. Banxico Deputy Governor Jonathan said that despite cutting rates “gradually,” policy would continue to be restrictive. Governor Victoria Rodriguez Ceja said that monetary policy would be adjusted based on “macroeconomic conditions,” disregarding a cut through the remainder of 2023.

Next week, the Mexican economic docket will feature Retail Sales mid-month Inflation alongside Gross Domestic Product (GDP) data for the third quarter. On the US front, the releases of the latest Fed meeting minutes, Durable Goods Orders, unemployment claims, and Flash PMIs would offer fresh impetus for USD/MXN traders.

Daily digest movers: Mexican Peso advancement halts after printing five straight days of gains

- US Building Permits in October came at 1.487 million, a jump of 1.1%, beating estimates of 1.45 million.

- US Housing Starts for October increased 1.9% to 1.37 million, the highest in three months, above forecasts of 1.35 million.

- On Friday, San Francisco Fed President Mary Daly said the Fed is uncertain if inflation is on track to 2%, and it’s too soon to declare victory on inflation. Fed Governor Michael Barr said the Fed is likely at or near the peak needed to be on interest rates.

- Thursday’s economic data in the US suggests the economy is decelerating as expected by the Federal Reserve, after Industrial Production plunged in October, while unemployment claims have risen the most since August.

- The US Producer Price Index and Consumer Price Index reports in October suggest prices are cooling down, increasing the odds of ending the US Federal Reserve tightening cycle.

- Interest rates swap traders expect 100 basis points of rate cuts by the Fed in 2024.

- Banxico’s Deputy Governor Jonathan Heath said the Government Board continues to monitor real rates, which currently lie at around 7%.

- Heath said Banxico wouldn’t rely on other countries – usually, Banxico reacts to the US Federal Reserve’s decisions – and said they would depend on incoming data and how inflation expectations evolve.

- On Monday, Banxico’s Governor Victoria Rodriguez Ceja commented that the easing inflationary outlook could pave the way for discussing possible rate cuts. She said that monetary policy loosening could be gradual but not necessarily imply continuous rate cuts, adding that the board would consider macroeconomic conditions, adopting a data-dependent approach.

- The latest inflation report in Mexico, published on November 9, showed prices grew by 4.26% YoY in October, below forecasts of 4.28% and prior rate of 4.45%. On a monthly basis, inflation came at 0.39%, slightly above the 0.38% consensus and September’s 0.44%.

- Mexico’s economy remains resilient after October’s S&P Global Manufacturing PMI improved to 52.1 from 49.8, and the Gross Domestic Product (GDP) expanded by 3.3% YoY in the third quarter.

- Banxico revised its inflation projections from 3.50% to 3.87% for 2024, which remains above the central bnk’s 3.00% target (plus or minus 1%).

Technical Analysis: Mexican Peso is on a mission to strengthen further as USD/MXN sellers’ eye 17.00

The USD/MXN daily chart depicts the downtrend remains intact, though a break above the 100-day Simple Moving Average (SMA) at 17.34 could pave the way to 17.50. However, the breach of the latest cycle low printed on November 3 at 17.28 opened the door for further losses, with the next demand area at 17.20, ahead of the 17.00 figure.

On the flip side, in case of a clear break of key resistance levels at 17.34 and 17.50, the USD/MXN could challenge the 200-day SMA at 17.63, ahead of the 50-day SMA at 17.69. Once cleared, the next resistance emerges at the 20-day SMA at 17.87 before buyers could lift the spot price towards the 18.00 figure.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it.

Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

-

Technology1 week ago

Technology1 week agoSam Altman says OpenAI is developing a ‘legitimate AI researcher’ by 2028 that can discover new science on its own – Crypto News

-

Technology1 week ago

Technology1 week agoGiving Nvidias Blackwell chip to China would slash USs AI advantage, experts say – Crypto News

-

Technology1 week ago

Technology1 week agoBenQ MA270U review: A 4K monitor that actually gets MacBook users right – Crypto News

-

others1 week ago

others1 week agoBank of Canada set to cut interest rate for second consecutive meeting – Crypto News

-

De-fi1 week ago

De-fi1 week agoBittensor Rallies Ahead of First TAO Halving – Crypto News

-

De-fi1 week ago

De-fi1 week agoAI Sector Rebounds as Agent Payment Systems Gain Traction – Crypto News

-

Business1 week ago

Crypto Market Rally: BTC, ETH, SOL, DOGE Jump 3-7% as US China Trade Talks Progress – Crypto News

-

Business1 week ago

Business1 week agoStarbucks Says Turnaround Strategy Drives Growth in Global Sales – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoIBM Set to Launch Platform for Managing Digital Assets – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoWhat Happens When You Don’t Report Your Crypto Taxes to the IRS – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana Eyes $210 Before Its Next Major Move—Uptrend Or Fakeout Ahead? – Crypto News

-

De-fi1 week ago

De-fi1 week agoREP Jumps 50% in a Week as Dev Gets Community Support for Augur Fork – Crypto News

-

Technology1 week ago

Technology1 week agoDonald Trump as Halo Master Chief? White House joins GameStop’s ‘End of Console Wars’ celebration – Crypto News

-

Technology1 week ago

Pi Coin Price Jumps 24% as 10M Tokens Exit Exchanges – Can Bulls Sustain the Momentum? – Crypto News

-

others1 week ago

others1 week agoGBP/USD floats around 1.3320 as softer US CPI reinforces Fed cut bets – Crypto News

-

others5 days ago

others5 days agoMETA stock has lower gaps to fill – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Phones Struggle as Solana Quietly Pulls Plug on Saga – Crypto News

-

Business1 week ago

Crypto ETFs Attract $1B in Fresh Capital Ahead of Expected Fed Rate Cut This Week – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Edges Lower While US Stocks Hit New Highs – Crypto News

-

others1 week ago

Pi Coin Gains Another 15% As Pi Network Joins ISO 20022 For Seamless Banking Integration – Crypto News

-

Cryptocurrency1 day ago

Cryptocurrency1 day agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

others1 week ago

Crypto Market Tumbles as Jerome Powell Says December Rate Cut ‘Far From Certain’ – Crypto News

-

De-fi1 week ago

De-fi1 week agoBitcoin Dips Under $110,000 After Fed Cuts Rates – Crypto News

-

De-fi1 week ago

De-fi1 week agoMetaMask Fuels Airdrop Buzz With Token Claim Domain Registration – Crypto News

-

De-fi1 week ago

De-fi1 week agoTokenized Nasdaq Futures Enter Top 10 by Volume on Hyperliquid – Crypto News

-

Cryptocurrency11 hours ago

Cryptocurrency11 hours agoMany Crypto Treasury Companies Were a Get-Rich-Quick Trap, Warns Columbia Professor – Crypto News

-

others1 week ago

Is Changpeng “CZ” Zhao Returning To Binance? Probably Not – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCitigroup and Coinbase partner to expand digital-asset payment capabilities – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoInside Bitwise’s milestone solana ETF launch – Crypto News

-

others1 week ago

Can ASTER Price Rebound 50% as Whale Activity and Bullish Pattern Align? – Crypto News

-

Cryptocurrency5 days ago

After 1,993% Burn Spike, Is Shiba Inu Price Set for a Major Trend Reversal? – Crypto News

-

Cryptocurrency1 day ago

Cryptocurrency1 day agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

others1 week ago

others1 week agoGold weakens as US-China trade optimism lifts risk sentiment, focus turns to Fed – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoGold Price Forecast 2025, 2030, 2040 & Investment Outlook – Crypto News

-

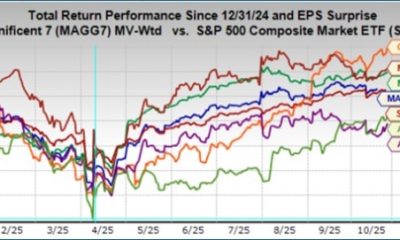

Metaverse1 week ago

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

De-fi1 week ago

De-fi1 week agoCRO Jumps After Trump’s Truth Social Announces Prediction Market Partnership with Crypto.Com – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoKERNEL price goes vertical on Upbit listing, hits $0.23 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Is Pi Network’s (PI) Price Up by Double Digits Today? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCrypto Analyst Shows The Possibility Of The Ethereum Price Reaching $16,000 – Crypto News

-

Business1 week ago

$2.5T Citigroup Partners With Coinbase to Enable Stablecoin Payments – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoArgentine Stablecoin Use Surged Ahead of President Milei’s Midterm Election Win – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

Cryptocurrency1 week ago

Is Stock Tokenization Really Exploding? Not Even 0.01% – Crypto News

-

Technology1 week ago

Breaking: $2.6B Western Union Announces Plans for Solana-Powered Stablecoin by 2026 – Crypto News

-

Business1 week ago

BNB Chain’s Future Growth Won’t Come From DEXs – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoVisa To Support Four Stablecoins on Four Blockchains – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoZIGChain eyes gains as Nasdaq-Listed SEGG Media backs ZIG – Crypto News

-

others1 week ago

others1 week agoPreviewing Mag 7 earnings: What investors should know – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoHayes’ Zcash ‘Vibe Check’ Sparks 30% Moonshot – Crypto News

-

others1 week ago

Gold and Silver continue to correct – Commerzbank – Crypto News