others

Mexican Peso rebound falters as investors shrug off Banxico’s intervention warning – Crypto News

- The Mexican Peso briefly recovered on Thursday after the President of the Banxico warned she will prop up the Peso if volatility persists.

- The recovery falters on Friday, however, as traders continue beating MXN lower following the outcome of the June elections.

- USD/MXN appears to end its correction and resume its bullish trend.

The Mexican Peso (MXN) trades between half a percent and over one percent lower in its most traded pairs on Friday as markets continue to fret about the proposed policies of Mexico’s newly elected left-wing government. The Peso is additionally pressured by a squeeze on overweight long positions that have built up after a multi-year period of appreciation for the Mexican currency.

At the time of writing, a single US Dollar (USD) buys 18.62 Mexican Pesos, EUR/MXN is trading at 19.92 and GBP/MXN at 23.67.

Mexican Peso temporarily recovers after intervention, then sinks

The Mexican Peso backs and fills on Friday after the previous day’s steep rally, which came on the back of verbal intervention by the President of the Banco de Mexico (Banxico), Victoria Rodriguez Ceja, who said Banxico would step in to prop up the Peso if volatility became too “extreme”.

On Friday, however, traders continue to apply pressure in line with the downturn since the results of the Mexican elections on June 2. These led to a victory for President-elect Claudia Sheinbaum and her left-wing coalition Sigamos Haciendo Historia (SHH). SHH won a supermajority in the Mexican house of deputies and came two seats away in the senate. This will make it easier for incumbent President Andres Manuel Lopez Obrador (AMLO) to push through radical amendments to the constitution that have set markets on edge.

The raft of 20 proposed amendments and reforms range from rights to higher minimum wages and an increase in state-sector pensions, to the abolition of independent regulators and reforms to the judiciary – particularly the controversial idea of replacing the current system of appointing judges with one that would see them elected by popular vote.

“The main concerns around these amendments is that (i) there will be an erosion of checks and balances and (ii) they would start to take Mexico down the path of wage indexation, which would clearly undermine Banxico’s efforts to get inflation under control,” Jason Tuvey, Deputy Chief Emerging Markets Economist at Capital Economics told FXStreet.

On Wednesday during his daily broadcast to the masses, AMLO hit back at critics of his reforms, saying the current depreciation of the Peso, which has lost 10% of its value since the election, has been driven by “speculators” not “investors” and is part of a conspiracy of the right to “blackmail” the government into ditching the proposed reforms.

He further argued that the current system of appointing judges was too open to corruption by elites, politicians and organized crime, resulting in a judiciary that was compromised. In comparison his reforms “would make the appointment of judges more democratic, improving the rule of law and actually attracting more not less foreign investment,” he said. AMLO also pointed to the fact that under his administration the Peso had appreciated whereas under all five previous Presidents it had depreciated, sometimes considerably. Critics of AMLO say he is punishing the Supreme court for obstructing some of his reforms.

The large decline in the Mexican Peso since the June 2 elections could be seen as an overdue correction from overvalued extremes. The Peso has been in a long-term uptrend since April 2020, partly due to the extraordinarily high interest rates set by the Bank of Mexico (Banxico), which have made the currency attractive to carry traders. Carry traders borrow in currencies with low interest rates like the Japanese Yen (Apr circa 0.0% -0.1%) and invest in currencies like the Mexican Peso that offer higher returns (Apr circa 11.00%), pocketing the difference.

It seems unlikely that the prospect of judicial reforms are primarily to blame for the sudden steep correction in MXN. Rather the elections may have acted as a kind of tinder stick to a bonfire of long positions that had built up in the Peso.

“Before the election, we’d been arguing for some time that the Peso appeared increasingly overvalued and was vulnerable to a sharp fall – the declines over the past couple of weeks have taken it within touching distance of our long-standing year-end forecast of 19.00 (USD/MXN),” said Tuvey.

Technical Analysis: USD/MXN probably resumes short-term uptrend

USD/MXN rebounds after its recent correction on Friday, resuming its short and intermediate term uptrend.

USD/MXN Daily Chart

Given “the trend is your friend,” the odds favor a continuation of the uptrend, with the next target potentially situated at 19.22 (March 2023 high).

The Relative Strength Index (RSI) has just exited the overbought zone. However, the correction could still go deeper – although the established uptrend is likely to eventually resume.

The direction of the long-term trend is in doubt after the break above the October 2023 high. Previous to that, it was down.

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.

-

Metaverse6 days ago

Metaverse6 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoThe Quantum Clock Is Ticking on Blockchain Security – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoStop panicking about AI. Start preparing – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTether Launches Dollar-Backed Stablecoin USAT – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoKalshi Expands Political Footprint with DC Office, Democratic Hire – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTrump family-backed American Bitcoin achieves 116% BTC yield – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRiver price defies market downturn, explodes 40% to new ATH – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCourt Crushes Lawsuit Against Ripple – Crypto News

-

Blockchain22 hours ago

Blockchain22 hours agoPolymarket Taps Circle to Support Dollar-Denominated Settlements – Crypto News

-

Business1 week ago

XRP Payments Utility Expands as Ripple Launches Treasury Platform – Crypto News

-

Technology1 week ago

Technology1 week agoElon Musk says ‘WhatsApp is not secure’ amid Meta privacy lawsuit; Sridhar Vembu cites ‘conflict of interest’ – Crypto News

-

others1 week ago

others1 week agoUS Dollar hits 2022 lows as ‘Sell America’ trade intensifies ahead of Fed’s decision – Crypto News

-

Technology1 week ago

Technology1 week agoWhatsApp launches ‘Strict Account Settings’: How to enable the new lockdown-style mode? – Crypto News

-

others1 week ago

others1 week agoMichael Saylor’s Strategy Buys Another $264,100,000 in Bitcoin (BTC) Amid Crypto Market Downturn – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCrypto Laundering On Centralized Exchanges Declines: Report – Crypto News

-

others1 week ago

others1 week agoFundstrat’s Tom Lee Says Earnings Growth, Dollar Weakness Primed To Drive Stocks Higher – Here’s His Target – Crypto News

-

others1 week ago

others1 week agoQXMP Labs Announces Activation of RWA Liquidity Architecture and $1.1 Trillion On-Chain Asset Registration – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoHow to avoid common AI pitfalls in the workplace – Crypto News

-

others1 week ago

Jerome Powell Speech Tomorrow: What to Expect From Fed Meeting for Crypto Market? – Crypto News

-

Business1 week ago

Strategic Bitcoin Reserve: South Dakota Introduces Bill to Invest in BTC as U.S. States Explore Crypto – Crypto News

-

Business1 week ago

Trump’s Crypto Adviser Confirms Probe Into Alleged Theft From U.S. Crypto Reserve – Crypto News

-

Technology1 week ago

Technology1 week agoWhatsApp launches ‘Strict Account Settings’: How to enable the new lockdown-style mode? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHyperliquid: The frontend wars – Blockworks – Crypto News

-

Technology1 week ago

Solana Price Targets $200 as $152B WisdomTree Joins the Ecosystem – Crypto News

-

others1 week ago

others1 week agoCrypto Exchange Kraken Announces DeFi-Level Yields for Users in US, EU and Canada – Crypto News

-

Technology4 days ago

Fed Rate Cut Uncertainty Mounts as BLS Delays Jobs Report Amid Shutdown – Crypto News

-

others2 days ago

Crypto Market Bill Set to Progress as Senate Democrats Resume Talks After Markup Delay – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBNB Chain’s Prediction Markets Soar As Volume Crosses $20B – Crypto News

-

Technology1 week ago

Trump Speech in Iowa Today: Possible Impact on Stocks and Crypto Market – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin, Ethereum, Crypto News & Price Indexes – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEthereum Price Breaks Back To $3K As Traders Question Follow-Through – Crypto News

-

others1 week ago

Shiba Inu Price Outlook As SHIB Burn Rate Explodes 2800% in 24 Hours – Crypto News

-

Blockchain1 week ago

Blockchain1 week ago4 In 10 US Merchants Now Accept Crypto – Crypto News

-

Business1 week ago

XRP Price Prediction After Ripple Treasury launch – Crypto News

-

Technology1 week ago

Technology1 week agoMicrosoft shares slide as AI spending surges – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoMetaplanet boosts forecasts despite Bitcoin write-down clouding annual results – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoETH price prediction as Ethereum prepares for ERC-8004 mainnet rollout – Crypto News

-

Technology1 week ago

Technology1 week agoEconomic Survey calls for age-based limits on social media access, urges curbs to tackle digital addiction – Crypto News

-

Technology1 week ago

Technology1 week agoSAP Stock Sees Biggest Drop Since 2020 Over Cloud Concerns – Crypto News

-

Technology1 week ago

Technology1 week agoSAP Stock Sees Biggest Drop Since 2020 Over Cloud Concerns – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoAI Tool of the Week: When translation understands context – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoETH Staking Skyrockets as 30% of Total Supply Now Staked in Historic Move – Crypto News

-

Metaverse5 days ago

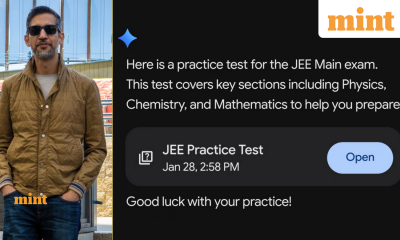

Metaverse5 days agoGoogle Gemini launches JEE Main mock test papers: IIT Kharagpur alumnus Sundar Pichai goes nostalgic, ‘If I could…’ – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoChiliz price drops 15% amid sharp altcoin pullback – Crypto News

-

Business4 days ago

Fed Rate Cut Uncertainty Mounts as BLS Delays Jobs Report Amid Shutdown – Crypto News

-

Technology3 days ago

GLXY Stock Price Falls as Mike Novogratz’s Galaxy Digital Reports $482 Million Q4 Loss – Crypto News

-

Blockchain3 days ago

Blockchain3 days agoBitcoin Unrealized Losses Reach 22% – Still No Capitulation Phase – Crypto News

-

Technology2 days ago

Technology2 days agoEmbedded Payments Help SaaS as AI Reshapes Workflows – Crypto News