others

Mexican Peso sticks around key support at around 17.10 ahead of US economic data – Crypto News

- Mexican Peso erases its earlier losses as traders await a crucial US inflation report.

- Mexico’s trade balance, unemployment and manufacturing PMI to spotlight economic trends amid high Banxico rates.

- Banxico meeting minutes fuel speculation of a March rate cut, influencing the Peso’s trajectory.

The Mexican Peso (MXN) pared its losses against the US Dollar on Monday, though it stayed near familiar levels, with market participants awaiting a busy weekly economic schedule in the United States. Traders are eyeing the release of the Personal Consumption Expenditures (PCE) report, the Federal Reserve’s (Fed) preferred inflation gauge, along with Q4 2023 Gross Domestic Product (GDP) figures on its second estimate. The USD/MXN trades at 17.09, almost flat.

Mexico’s economic docket on Monday is absent, though it gathers pace on Tuesday with the release of the Balance of Trade expected to print a deficit in January. On Thursday, the National Statistics Agency (INEGI) will reveal the Unemployment Rate for January, estimated to increase compared to December’s data, followed by Friday’s Business Confidence and S&P Global Manufacturing PMI.

The economic data in Mexico is expected to show an economic slowdown due to higher interest rates set by the Bank of Mexico (Banxico) at 11.25%. That, along with the latest report of the Consumer Price Index (CPI) dipping sharply for the first half of February, justifies the posture of three members of Banxico. The latest meeting minutes suggested that three policymakers are eyeing the first rate cut at the March meeting, which could put pressure on the Mexican Peso, opening the door for further upside on the USD/MXN exchange rate.

Across the border, housing data was positive, while the Dallas Fed Manufacturing Index in February improved slightly compared to January’s figures.

Daily digest market movers: Mexican Peso hovers near last week’s lows

- The language of the Banxico minutes was less “hawkish,” indicating a more flexible approach, according to analysts cited by El Economista. Analysts at Goldman Sachs commented that the Banxico Governing Council is tilting toward easing monetary policy unless exogenous shocks impact the USD/MXN exchange rate.

- The latest inflation report in Mexico showed that headline and underlying inflation continued to dip toward Banxico’s goal of 3% plus or minus 1%, while economic growth exceeded estimates but finished below Q3’s 3.3%. Those factors added to the plunge in Retail Sales:I.

- Mexico’s Consumer Price Index (CPI) in the first half of February was 4.45%, down from 4.9% YoY.

- Mexico’s Core CPI slowed from 4.78% to 4.63% in the yearly data.

- Mexico’s GDP for Q4 2023 exceeded estimates of 2.4% YoY and hit 2.5%, less than Q3 2023 print of 3.3%.

- Economic trade issues between Mexico and the US could depreciate the Mexican currency if the Mexican government fails to resolve its steel and aluminum dispute with the United States. US Trade Representative Katherine Tai warned the US could reimpose tariffs on the commodities.

- US New Home Sales rose by 1.5% from 0.651M to 0.661M, less than the 0.68 M expected.

- The last meeting minutes of the US Federal Reserve (Fed) showed that policymakers remain hesitant to cut rates amid fears of a second round of inflation. They have expressed willingness to adjust policy when necessary but remain cautious, indicating no urgency to act. This stance is supported by current economic data suggesting strength in the economy, which could potentially revive inflationary pressure.

- Market players had trimmed the odds for a first 25 basis point (bps) rate cut in June, with odds lying at 49.4%, while 40% of investors expected the Fed to keep rates unchanged at the current level of 5.25%-5.50%.

Technical analysis: Mexican Peso slide pushes USD/MXN above 50-day SMA

The USD/MXN continues to consolidate for the third straight day above the 50-day Simple Moving Average (SMA) at 17.07, which could open the door for further gains. If buyers reclaim the psychological 17.20 figure, that could open the door to threaten the 200-day SMA at 17.27. If they cleared those two levels, up next would be the 100-day SMA at 17.38, ahead of the 17.50 figure.

On the other hand, if sellers step in and cap USD/MXN’s upside, they need to push prices below the 50-day SMA, before challenging the 17.00 figure. Once cleared, the next support would be the current year-to-date (YTD) low of 16.78, followed by the 2023 low of 16.62.

USD/MXN Price Action – Daily Chart

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

-

Technology1 week ago

Technology1 week agoSam Altman says OpenAI is developing a ‘legitimate AI researcher’ by 2028 that can discover new science on its own – Crypto News

-

Technology1 week ago

Technology1 week agoGiving Nvidias Blackwell chip to China would slash USs AI advantage, experts say – Crypto News

-

Technology1 week ago

Technology1 week agoBenQ MA270U review: A 4K monitor that actually gets MacBook users right – Crypto News

-

others1 week ago

others1 week agoBank of Canada set to cut interest rate for second consecutive meeting – Crypto News

-

De-fi1 week ago

De-fi1 week agoBittensor Rallies Ahead of First TAO Halving – Crypto News

-

De-fi1 week ago

De-fi1 week agoAI Sector Rebounds as Agent Payment Systems Gain Traction – Crypto News

-

Business1 week ago

Crypto Market Rally: BTC, ETH, SOL, DOGE Jump 3-7% as US China Trade Talks Progress – Crypto News

-

Business1 week ago

Business1 week agoStarbucks Says Turnaround Strategy Drives Growth in Global Sales – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoIBM Set to Launch Platform for Managing Digital Assets – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoWhat Happens When You Don’t Report Your Crypto Taxes to the IRS – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana Eyes $210 Before Its Next Major Move—Uptrend Or Fakeout Ahead? – Crypto News

-

De-fi1 week ago

De-fi1 week agoREP Jumps 50% in a Week as Dev Gets Community Support for Augur Fork – Crypto News

-

Technology1 week ago

Technology1 week agoDonald Trump as Halo Master Chief? White House joins GameStop’s ‘End of Console Wars’ celebration – Crypto News

-

Technology1 week ago

Pi Coin Price Jumps 24% as 10M Tokens Exit Exchanges – Can Bulls Sustain the Momentum? – Crypto News

-

others1 week ago

others1 week agoGBP/USD floats around 1.3320 as softer US CPI reinforces Fed cut bets – Crypto News

-

others5 days ago

others5 days agoMETA stock has lower gaps to fill – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Phones Struggle as Solana Quietly Pulls Plug on Saga – Crypto News

-

Business1 week ago

Crypto ETFs Attract $1B in Fresh Capital Ahead of Expected Fed Rate Cut This Week – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Edges Lower While US Stocks Hit New Highs – Crypto News

-

others1 week ago

Pi Coin Gains Another 15% As Pi Network Joins ISO 20022 For Seamless Banking Integration – Crypto News

-

Cryptocurrency1 day ago

Cryptocurrency1 day agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

others1 week ago

Crypto Market Tumbles as Jerome Powell Says December Rate Cut ‘Far From Certain’ – Crypto News

-

De-fi1 week ago

De-fi1 week agoBitcoin Dips Under $110,000 After Fed Cuts Rates – Crypto News

-

De-fi1 week ago

De-fi1 week agoMetaMask Fuels Airdrop Buzz With Token Claim Domain Registration – Crypto News

-

De-fi1 week ago

De-fi1 week agoTokenized Nasdaq Futures Enter Top 10 by Volume on Hyperliquid – Crypto News

-

Cryptocurrency11 hours ago

Cryptocurrency11 hours agoMany Crypto Treasury Companies Were a Get-Rich-Quick Trap, Warns Columbia Professor – Crypto News

-

others1 week ago

Is Changpeng “CZ” Zhao Returning To Binance? Probably Not – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCitigroup and Coinbase partner to expand digital-asset payment capabilities – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoInside Bitwise’s milestone solana ETF launch – Crypto News

-

others1 week ago

Can ASTER Price Rebound 50% as Whale Activity and Bullish Pattern Align? – Crypto News

-

Cryptocurrency5 days ago

After 1,993% Burn Spike, Is Shiba Inu Price Set for a Major Trend Reversal? – Crypto News

-

Cryptocurrency1 day ago

Cryptocurrency1 day agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

others1 week ago

others1 week agoGold weakens as US-China trade optimism lifts risk sentiment, focus turns to Fed – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoGold Price Forecast 2025, 2030, 2040 & Investment Outlook – Crypto News

-

Metaverse1 week ago

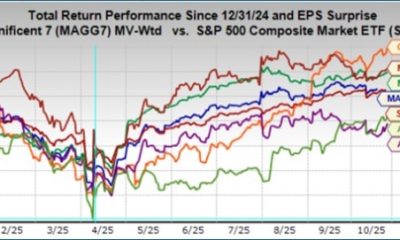

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

De-fi1 week ago

De-fi1 week agoCRO Jumps After Trump’s Truth Social Announces Prediction Market Partnership with Crypto.Com – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoKERNEL price goes vertical on Upbit listing, hits $0.23 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Is Pi Network’s (PI) Price Up by Double Digits Today? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCrypto Analyst Shows The Possibility Of The Ethereum Price Reaching $16,000 – Crypto News

-

Business1 week ago

$2.5T Citigroup Partners With Coinbase to Enable Stablecoin Payments – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoArgentine Stablecoin Use Surged Ahead of President Milei’s Midterm Election Win – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

Cryptocurrency1 week ago

Is Stock Tokenization Really Exploding? Not Even 0.01% – Crypto News

-

Technology1 week ago

Breaking: $2.6B Western Union Announces Plans for Solana-Powered Stablecoin by 2026 – Crypto News

-

Business1 week ago

BNB Chain’s Future Growth Won’t Come From DEXs – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoVisa To Support Four Stablecoins on Four Blockchains – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoZIGChain eyes gains as Nasdaq-Listed SEGG Media backs ZIG – Crypto News

-

others1 week ago

others1 week agoPreviewing Mag 7 earnings: What investors should know – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoHayes’ Zcash ‘Vibe Check’ Sparks 30% Moonshot – Crypto News

-

others1 week ago

Gold and Silver continue to correct – Commerzbank – Crypto News