others

Natural Gas sees summer futures shoot higher with traders looking for profit – Crypto News

- Natural Gas marches higher in a bounce off the $2.10 barrier.

- Traders are focussing on summer futures contracts to salvage the lost first quarter.

- The US Dollar Index is steady ahead of ECB, US GDP, Durable Goods and Jobless Claims.

Natural Gas (XNG/USD) has sunk to a substantial low earlier this week near $2.10. Meanwhile the course has reversed within the futures markets, with summer expiries trading over $1 higher against the more near-term expiries. This means that for Europe it is cheaper to buy Gas now than in four to six months, when it would normally refill up its gas storages. This is making Gas traders scramble to still make a buck after the lacklustre to negative performance in the first weeks of 2024.

The US Dollar (USD) is holding ground in the US Dollar Index near 103, ahead of a big batch of data releases later this Thursday. In just a time span of around 30 minutes, the European Central Bank (ECB) will release its first rate decision for 2024, together with the release of US GDP, US Durable Goods and weekly Jobless Claims. While the Greenback is caught between two important technical elements (cap and floor), a breakout could be seen on the back of the above-mentioned catalysts.

Natural Gas is trading at $2.30 per MMBtu at the time of writing.

Natural Gas market movers: Traders looking forward for profit

- Benchmark futures for February and March are currently trading $1 lower against the June and July contracts. This comes with traders seeing Europe heading back into the Gas markets by the summer, in order to refill Gas storages.

- The Prime Minister of Slovakia Robert Fico said that Ukraine is open to still let Russian Gas flow beyond 2024, which would mean inflow into Austria and Italy is still guaranteed.

- Temperatures in Europe are soaring with very mild temperatures at hand for the weekend and next week. In London even 12.5 degrees Celsius is projected, with near 20 degrees in Barcelona, which is very mild for this time of year.

- Near 15:30 GMT, the Energy Information Administration (EIA) is due to release the weekly Gas Storage Changes. Previous was a drawdown of 154 billion cubic feet of Gas.

Natural Gas Technical Analysis: Recovery makes sense

Natural Gas got oversold earlier this week, with the commodity rebounding now in a natural move. The Relative Strength Index (RSI) is heading back to more normal levels while Gas prices are off the lows. More upside looks granted, though do not expect any exaggerated moves seeing the overall tepid outlook for 2024 in terms of global growth and economic strength.

On the upside, Natural Gas is facing quite some pivotal levels to get back to. First is the low of December 13th at $2.20 which broke on Wednesday. Next is the intermediary level near $2.48. Once that area gets hit, expect to see a test near $2.57 at the purple line.

A break below the yellow line at $2.10 means big issues for Natural Gas, with a fresh multi-year low. First level to look for on the downside is near $1.51, the low of June 2021. Further pre-Ukraine levels would come in sight as well with $1.00 up for grabs in the longer-term

XNG/USD (Daily Chart)

Natural Gas FAQs

Supply and demand dynamics are a key factor influencing Natural Gas prices, and are themselves influenced by global economic growth, industrial activity, population growth, production levels, and inventories. The weather impacts Natural Gas prices because more Gas is used during cold winters and hot summers for heating and cooling. Competition from other energy sources impacts prices as consumers may switch to cheaper sources. Geopolitical events are factors as exemplified by the war in Ukraine. Government policies relating to extraction, transportation, and environmental issues also impact prices.

The main economic release influencing Natural Gas prices is the weekly inventory bulletin from the Energy Information Administration (EIA), a US government agency that produces US gas market data. The EIA Gas bulletin usually comes out on Thursday at 14:30 GMT, a day after the EIA publishes its weekly Oil bulletin. Economic data from large consumers of Natural Gas can impact supply and demand, the largest of which include China, Germany and Japan. Natural Gas is primarily priced and traded in US Dollars, thus economic releases impacting the US Dollar are also factors.

The US Dollar is the world’s reserve currency and most commodities, including Natural Gas are priced and traded on international markets in US Dollars. As such, the value of the US Dollar is a factor in the price of Natural Gas, because if the Dollar strengthens it means less Dollars are required to buy the same volume of Gas (the price falls), and vice versa if USD strengthens.

-

Technology1 week ago

Technology1 week agoSam Altman says OpenAI is developing a ‘legitimate AI researcher’ by 2028 that can discover new science on its own – Crypto News

-

Technology1 week ago

Technology1 week agoGiving Nvidias Blackwell chip to China would slash USs AI advantage, experts say – Crypto News

-

Technology1 week ago

Technology1 week agoBenQ MA270U review: A 4K monitor that actually gets MacBook users right – Crypto News

-

others1 week ago

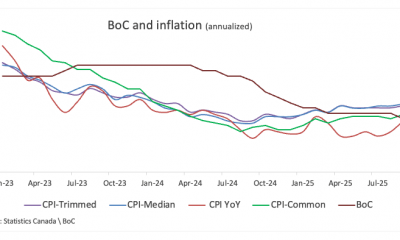

others1 week agoBank of Canada set to cut interest rate for second consecutive meeting – Crypto News

-

De-fi1 week ago

De-fi1 week agoBittensor Rallies Ahead of First TAO Halving – Crypto News

-

De-fi1 week ago

De-fi1 week agoAI Sector Rebounds as Agent Payment Systems Gain Traction – Crypto News

-

Business1 week ago

Business1 week agoStarbucks Says Turnaround Strategy Drives Growth in Global Sales – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoIBM Set to Launch Platform for Managing Digital Assets – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana Eyes $210 Before Its Next Major Move—Uptrend Or Fakeout Ahead? – Crypto News

-

De-fi1 week ago

De-fi1 week agoREP Jumps 50% in a Week as Dev Gets Community Support for Augur Fork – Crypto News

-

Technology1 week ago

Pi Coin Price Jumps 24% as 10M Tokens Exit Exchanges – Can Bulls Sustain the Momentum? – Crypto News

-

others1 week ago

others1 week agoGBP/USD floats around 1.3320 as softer US CPI reinforces Fed cut bets – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Edges Lower While US Stocks Hit New Highs – Crypto News

-

others6 days ago

others6 days agoMETA stock has lower gaps to fill – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Phones Struggle as Solana Quietly Pulls Plug on Saga – Crypto News

-

Business1 week ago

Crypto ETFs Attract $1B in Fresh Capital Ahead of Expected Fed Rate Cut This Week – Crypto News

-

others1 week ago

Pi Coin Gains Another 15% As Pi Network Joins ISO 20022 For Seamless Banking Integration – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

others1 week ago

Crypto Market Tumbles as Jerome Powell Says December Rate Cut ‘Far From Certain’ – Crypto News

-

De-fi1 week ago

De-fi1 week agoBitcoin Dips Under $110,000 After Fed Cuts Rates – Crypto News

-

De-fi1 week ago

De-fi1 week agoTokenized Nasdaq Futures Enter Top 10 by Volume on Hyperliquid – Crypto News

-

Cryptocurrency18 hours ago

Cryptocurrency18 hours agoMany Crypto Treasury Companies Were a Get-Rich-Quick Trap, Warns Columbia Professor – Crypto News

-

De-fi1 week ago

De-fi1 week agoMetaMask Fuels Airdrop Buzz With Token Claim Domain Registration – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCitigroup and Coinbase partner to expand digital-asset payment capabilities – Crypto News

-

others1 week ago

Can ASTER Price Rebound 50% as Whale Activity and Bullish Pattern Align? – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

De-fi1 week ago

De-fi1 week agoCRO Jumps After Trump’s Truth Social Announces Prediction Market Partnership with Crypto.Com – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoInside Bitwise’s milestone solana ETF launch – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Is Pi Network’s (PI) Price Up by Double Digits Today? – Crypto News

-

Cryptocurrency5 days ago

After 1,993% Burn Spike, Is Shiba Inu Price Set for a Major Trend Reversal? – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoGold Price Forecast 2025, 2030, 2040 & Investment Outlook – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoKERNEL price goes vertical on Upbit listing, hits $0.23 – Crypto News

-

Technology1 week ago

Breaking: $2.6B Western Union Announces Plans for Solana-Powered Stablecoin by 2026 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoVisa To Support Four Stablecoins on Four Blockchains – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCrypto Analyst Shows The Possibility Of The Ethereum Price Reaching $16,000 – Crypto News

-

Business1 week ago

$2.5T Citigroup Partners With Coinbase to Enable Stablecoin Payments – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoArgentine Stablecoin Use Surged Ahead of President Milei’s Midterm Election Win – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

others1 week ago

Gold and Silver continue to correct – Commerzbank – Crypto News

-

Cryptocurrency1 week ago

Is Stock Tokenization Really Exploding? Not Even 0.01% – Crypto News

-

Business1 week ago

BNB Chain’s Future Growth Won’t Come From DEXs – Crypto News

-

others1 week ago

When liquidity becomes the new frontier – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoZIGChain eyes gains as Nasdaq-Listed SEGG Media backs ZIG – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoLitecoin: $855K ETF inflow sparks new life – Next target is $105 IF… – Crypto News

-

Cryptocurrency1 day ago

Cryptocurrency1 day agoBitcoin tests $100K support after massive liquidation event rocks market – Crypto News

-

Cryptocurrency1 day ago

Cryptocurrency1 day agoStrategy IPO redefines corporate Bitcoin strategy with euro-denominated offering – Crypto News

-

Business1 week ago

Cardano Price Eyes 80% Rally as x402 Upgrade Sparks Hope for AI Payment Expansion – Crypto News

-

others1 week ago

Litecoin Price Jumps, What’s Behind the Sudden Rally? (28 oct) – Crypto News

-

Business1 week ago

Trump Media Launches Polymarket Rival, Eyes $9B Prediction Market with Crypto.com – Crypto News