Blockchain

No More Bitcoin Bear Markets? Fund CIO Explores New Reality – Crypto News

In a new investor note published on January 29, 2025, Matt Hougan, Chief Investment Officer at Bitwise, questioned whether the historical four-year market cycle of Bitcoin could finally be coming to an end. His reasoning is rooted in seismic shifts in US policy toward crypto, highlighted by a recent executive order from President Trump aimed at solidifying the nation’s leadership in digital assets.

Could 2026 Buck The Bitcoin Bear Trend?

Hougan’s note begins with an explanation of the so-called “four-year cycle,” where Bitcoin has typically seen three years of substantial gains followed by a pullback. This cycle, he explains, mirrors broader boom-bust patterns in traditional markets:“The four-year cycle in crypto is driven by the same forces that drive broader cycles of growth and recession in the general economy,” he wrote.

Related Reading

These expansions, fueled by technological breakthroughs or increased investor interest, often lead to over-leverage, occasionally resulting in fraud or industry-wide strain. Eventually, something “breaks” and triggers a market correction—such as the 2014 Mt. Gox collapse or the 2018 SEC crackdown on ICOs.

Hougan describes the current crypto upswing as the “Mainstream Cycle,” emerging out of 2022’s “massive deleveraging” caused by failures like FTX, Three Arrows Capital, and others. According to him, the latest bull phase took off in March 2023, when Grayscale convincingly “won the opening argument” in its legal challenge against the SEC over a spot Bitcoin ETF.

“Bitcoin was trading at $22,218 when Grayscale mounted its argument. It’s trading at $102,674 today. The mainstream era has arrived.” Once a spot Bitcoin ETF was approved and launched in January 2024, investor inflows surged, further cementing Bitcoin’s acceptance among both retail and institutional players.

The most striking component of Hougan’s analysis is his examination of last week’s executive order issued by President Trump. The order not only deemed the development of the US digital asset ecosystem a “national priority,” but it also set in motion a clearer regulatory framework for crypto.

Related Reading

“Last week, President Trump issued an executive order that was so overwhelmingly bullish for the space that it’s making me wonder,” Hougan wrote, noting how the document outlines plans for a potential “national crypto stockpile” and encourages banks and financial institutions to accelerate their adoption of digital assets.

Combined with a now more welcoming stance from the SEC, Hougan believes these measures could unleash trillions in new investment over the coming years, far surpassing the hundreds of billions that an ETF-driven market was already expected to generate.

Hougan’s analysis acknowledges that Bitcoin has historically followed its pattern of eventual pullbacks after surging bull runs. But with Wall Street behemoths and major banks preparing to integrate crypto at every level, there’s a growing possibility that the market may not face the traditional plunge in 2026: “If it’s not until next year that we feel those impacts, will we really have a new ‘crypto winter’ in 2026?” he posited. “If BlackRock CEO Larry Fink is calling for $700k Bitcoin, are we really going to see a 70% pullback?”

While he concedes that leverage continues to build in the system—citing an uptick in Bitcoin-backed lending programs, derivatives, and levered exchange-traded products—he also highlights an increasingly diverse pool of crypto investors. This diversity, he argues, could dampen severe drawdowns. “My guess is that we haven’t fully overcome the four-year cycle. Leverage will build up as the bull market builds. Excess will appear. Bad actors will emerge. And at some point, there could be a sharp pullback when the market gets over its skis,” Hougan argued.

However, Hougan expects that any future market correction will be “shorter and shallower” than previous cycles. With the industry’s infrastructure now significantly more robust and mainstream participants treating crypto as a legitimate asset class, a dramatic bear market akin to those of 2014 or 2018 may be less likely. “As for now, it’s full steam ahead,” he concluded. “The crypto train is leaving the station.”

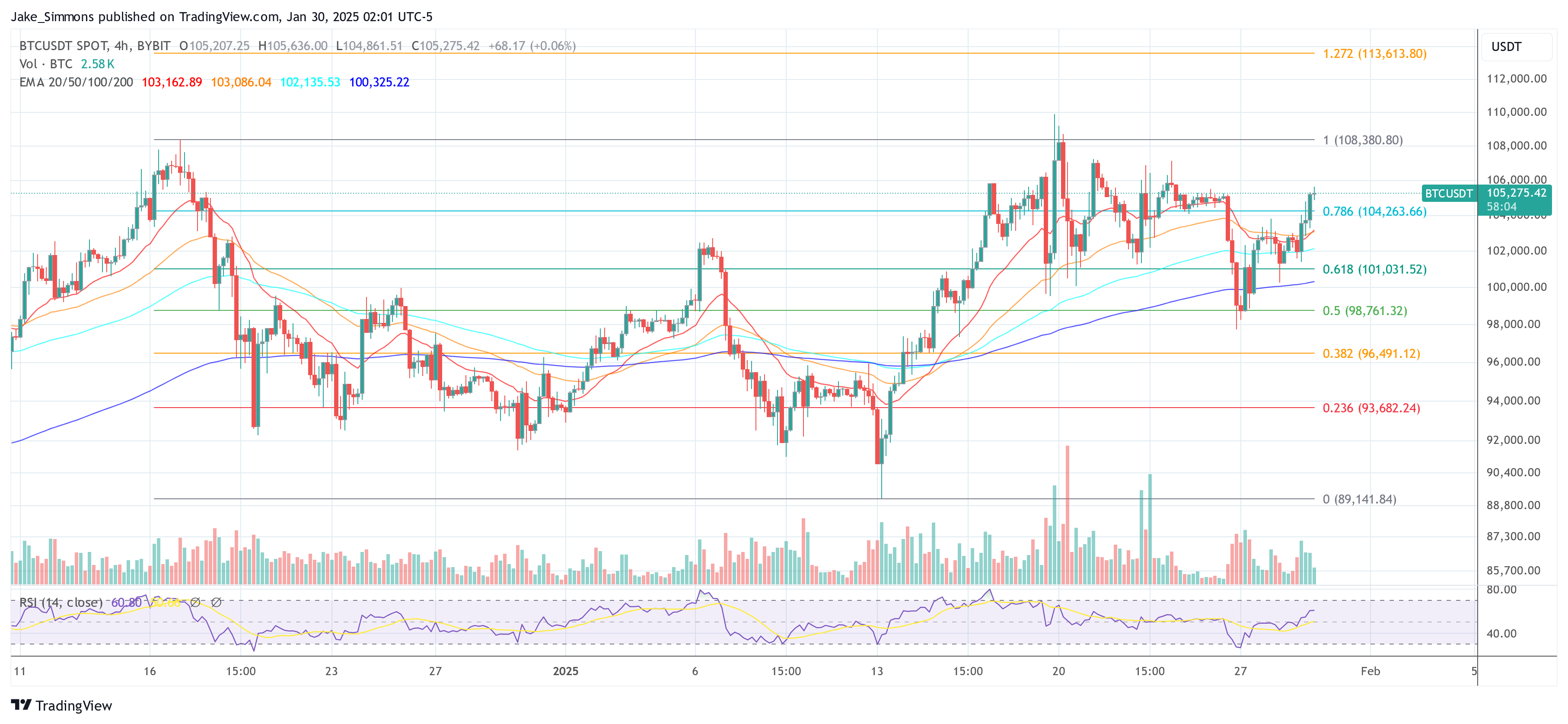

At press time, BTC traded at $105,275.

Featured image created with DALL.E, chart from TradingView.com

-

Blockchain1 week ago

Blockchain1 week agoPolymarket Taps Circle to Support Dollar-Denominated Settlements – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhat’s Next for XRP? Ripple Teases Big Updates at This Key Event – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoY Combinator Offers Startups Stablecoins Instead of Cash – Crypto News

-

Business1 week ago

Gold vs BTC: Why JPMorgan Suggests Buying Bitcoin Despite Price Crash? – Crypto News

-

Business1 week ago

Japan’s Metaplanet Pledges to Buy More Bitcoin Even as BTC Price Crashes to $60k – Crypto News

-

Blockchain1 day ago

Blockchain1 day agoThe Market Starts to Splinter – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana Eyes Deeper Correction As Bearish Pattern Targets $40 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoFigure Expands Access to Its On-Chain Public Equity Network – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoWhiteboard your 30-page strategy with Gemini’s nanobanana – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoWhiteboard your 30-page strategy with Gemini’s nanobanana – Crypto News

-

Business1 week ago

XRP News: Ripple’s RLUSD Gets Boost as CFTC Expands Approved Tokenized Collateral – Crypto News

-

De-fi1 week ago

De-fi1 week agoBithumb Mistakenly Airdrops $30 Billion of Bitcoin – Crypto News

-

Technology1 week ago

Technology1 week agoIndias digital transformation rooted in open, secure, inclusive Internet: IT Secy Krishnan – Crypto News

-

De-fi1 week ago

De-fi1 week agoZcash Down Over 50% Since Winklevoss-Backed DAT’s Last Purchase – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWeb 2-Web3 GameFi Platform Playnance Makes First Official Announcement, Reveals Growth Plans – Crypto News

-

De-fi1 week ago

De-fi1 week agoETHZilla to Tokenize $4.7 Million in Manufactured Home Loans on Ethereum Layer 2 – Crypto News

-

Business1 week ago

Bitcoin Price Prediction as Funding Rate Tumbles Ahead of $2.1B Options Expiry – Crypto News

-

Business1 week ago

Bitcoin Crashes to $67K as Crypto Market Erases $2T in Market Cap Since October Record High – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoOpenAI unveils new service, Frontier – How does it work? All you need to know – Crypto News

-

Business1 week ago

Is Bhutan Selling Bitcoin? Government Sparks Sell-Off Concerns as BTC Crashes – Crypto News

-

Business1 week ago

Is the Sell-Off Just Starting? BlackRock Bitcoin ETF Sees Records $10B in Notional Volume – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoIREN & CleanSpark Signal Evolution: $SUBBD Solves New Needs – Crypto News

-

Business1 week ago

BlackRock Signals More Selling as $291M in BTC, ETH Hit Coinbase Amid $2.5B Crypto Options Expiry – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana Crashes Hard — And Big Money Isn’t In A Hurry To Save It – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHow Low Can Pi Network’s PI Go? Shocking Bear-Market AI Scenarios After the Latest ATLs – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBinance SAFU Fund Adds 3,600 Bitcoin ($233M) As Market Faces Pressure – Crypto News

-

others1 week ago

United Kingdom CFTC GBP NC Net Positions up to £-13.9K from previous £-16.2K – Crypto News

-

Cryptocurrency1 week ago

Crypto Markets Brace as Another Partial U.S. Government Shutdown Looms Next Week – Crypto News

-

Technology1 week ago

Cardano Price Prediction as Midnight Token Soars 15% – Crypto News

-

Business7 days ago

Experts Predict COIN Stock Rally Above $200 as Coinbase CEO Warns of U.S. Falling Behind – Crypto News

-

De-fi6 days ago

De-fi6 days agoPolymarket Partners with Circle to Integrate Native USDC – Crypto News

-

Technology5 days ago

Technology5 days agoDeutsche Bank Warns Software Debt Faces AI Threat – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEU Tokenization Companies Urge Fixes to DLT Pilot Rules – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Reclaims $71K, But How Long Will It Hold? – Crypto News

-

Business1 week ago

Arthur Hayes Blames BlackRock’s IBIT Hedging for Bitcoin Crash as BTC Price Rebounds 7% – Crypto News

-

Business1 week ago

Arthur Hayes Blames BlackRock’s IBIT Hedging for Bitcoin Crash as BTC Price Rebounds 7% – Crypto News

-

others1 week ago

others1 week agoVolatility to stay high on flows – MUFG – Crypto News

-

Business1 week ago

ETH Price Fears Major Crash As Trend Research Deposits $1.8B Ethereum to Binance – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBTC Shows Signs of Recovery After Brutal November Sell-Off – Crypto News

-

others1 week ago

$40B Bitcoin Airdrop Error: Bithumb to Reimburse Customer Losses After BTC Crash To $55k – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoDogecoin shows accumulation signs – Will DOGE still fall to $0.080? – Crypto News

-

De-fi7 days ago

De-fi7 days agoEthereum Falls Below $2,000 as Crypto Sell-Off Deepens – Crypto News

-

others7 days ago

others7 days agoBank of America Employee Fuels $10,000,000,000 Fraud Scheme, Uses Position To Launder Millions in Medicare Proceeds: DOJ – Crypto News

-

De-fi7 days ago

De-fi7 days agoAptos-Based Perp DEX Merkle Trade Shutters Business – Crypto News

-

Technology6 days ago

Crypto Market Bill Nears Key Phase as White House Sets Feb 10 Meeting to Reach Deal – Crypto News

-

De-fi5 days ago

De-fi5 days agoCME Group to Launch Futures for Cardano, Chainlink, and Stellar – Crypto News

-

De-fi5 days ago

De-fi5 days agoCME Group to Launch Futures for Cardano, Chainlink, and Stellar – Crypto News

-

Business1 week ago

Trump’s World Liberty Faces House Probe Amid Claims of Major UAE Investment – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin prices fall: Will 2026 mirror BTC’s 2022 bear market? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin prices fall: Will 2026 mirror BTC’s 2022 bear market? – Crypto News