others

NZD/USD flirts with daily low around mid-0.6100s, softer USD helps limit losses – Crypto News

- NZD/USD drifts lower during the Asian session, although the downside seems limited.

- The worsening US-China relations turn out to be a key factor weighing on the Kiwi.

- The upbeat market mood keeps the USD bulls on the defensive and lends support.

The USD/NZD The pair extended the overnight rejection slide from the 0.6200 mark and remained under some selling pressure through the Asian session on Wednesday. Spot prices dropped to a fresh daily low in the last hour and currently trade around the mid-0.6100s, down 0.15% for the day.

Reports that the Biden administration is considering new restrictions on exports of artificial intelligence chips to China fuel worries about the worsening relations between the world’s two largest economies. This, in turn, is seen as a key factor driving flows away from antipodean currencies, including the Kiwi. The US Dollar (USD), on the other hand, remains on the defensive for the third straight day and might limit the downside for the NZD/USD pair, at least for the time being.

China’s Premier Li Qiang told delegates at the World Economic Forum in Tianjin on Tuesday that economic growth in the second quarter will be higher than the first and is expected to reach the annual projected target of around 5%. Apart from this, the upbeat US macro data helps ease fears of a global economic downturn and boosts investors’ confidence. This led to an overnight positive move in the US equity markets and exerted some downward pressure on the safe-haven Greenback.

That said, the Federal Reserve’s (Fed) hawkish outlook might continue to act as a tailwind for the USD and supports prospects for a further intraday depreciating move for the NZD/USD pair. In fact, the Fed signaled earlier this month that borrowing costs may still need to rise as much as 50 bps by the end of this year. Furthermore, the markets have fully priced in another 25 bps lift-off at the July FOMC meeting, which continues to lend support to the US Treasury bond yields and the USD.

Hence, the focus will remain glued to fed Chair Jerome Powell’s comments during a panel discussion at the ECB Forum on Central Banking in Sintra on Wednesday and Thursday. Investors will look for clues about the Fed’s future rate-hike move, which, in turn, will drive the USD demand and provide some meaningful impetus to the NZD/USD pair. The market attention will then shift to the release of the Fed’s preferred inflation gauge – the US Core PCE Price Index on Friday.

Technical levels to watch

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhale Sells $407K TRUMP, Loses $1.37M in Exit – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoRobinhood Dealing With Fallout of Tokenized Equities Offering – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoSatoshi-Era Bitcoin Whale Moves Another $2.42 Billion, What’s Happening? – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoRipple and Ctrl Alt Team to Support Real Estate Tokenization – Crypto News

-

Technology6 days ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin Breaches $120K, Institutional FOMO Takes and House Debate Propel Gains – Crypto News

-

Technology6 days ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCardano’s $1.22 target: Why traders should be aware of THIS ADA setup – Crypto News

-

Cryptocurrency1 week ago

Why Is Bitcoin Up Today? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoStrategy Resumes Bitcoin Buys, Boosting Holdings to Over $72 Billion in BTC – Crypto News

-

Business1 week ago

Pepe Coin Rich List June 2025: Who’s Holding Highest PEPE as it Nears Half a Million Holders? – Crypto News

-

others6 days ago

others6 days agoEUR/USD recovers with trade talks and Fed independence in focus – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoBitcoin trades near $119K after new all-time high; Coinbase rebrands wallet to ‘Base App’ – Crypto News

-

Business5 days ago

XLM Is More Bullish Than ETH, SOL, And XRP, Peter Brandt Declares – Crypto News

-

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://dripp.zone/news/wp-content/uploads/2025/07/Stellar-XLM-bulls-exhausted-after-rally-Is-a-pullback.webp-400x240.webp)

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://dripp.zone/news/wp-content/uploads/2025/07/Stellar-XLM-bulls-exhausted-after-rally-Is-a-pullback.webp-80x80.webp) Cryptocurrency1 week ago

Cryptocurrency1 week agoStellar [XLM] bulls exhausted after rally – Is a pullback nearby? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoIt’s a Statement, Says Bitfinex Alpha – Crypto News

-

others6 days ago

others6 days agoTop Crypto Exchange by Trading Volume Binance Announces Airdrop for New Ethereum (ETH) Ecosystem Altcoin – Crypto News

-

others6 days ago

others6 days agoVanEck Details Key Drivers Boosting Bitcoin Price, Including Corporate Treasury Demand, ETF Flows and More – Crypto News

-

Business6 days ago

XRP Lawsuit Update: Ripple Paid $125M in Cash, Settlement Hinges on Appeal – Crypto News

-

others1 week ago

others1 week agoJPMorgan Chase CEO Says Traders May Be Seriously Mistaken on Fed Rate Cuts: Report – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoZiglu Faces $2.7M Shortfall as Crypto Fintech Enters Special Administration – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoUK Banks Should not Issue Stablecoins – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoDonald Trump Jr. backs social media startup aiming to become a crypto powerhouse – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoThe Bitcoin Liquidity Supercycle Has Just Begun: Hedge Fund CEO – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle, Anthropic, OpenAI and xAI join US defence to tackle national security with AI – Crypto News

-

Business1 week ago

CME XRP Futures Hit $1.6B In Total Trading Volume Since Launch – Crypto News

-

Cryptocurrency1 week ago

Fed’s Hammack Raises Inflation Concerns Amid Push For Interest Rate Cut – Crypto News

-

Metaverse7 days ago

Metaverse7 days agoWhy voice is emerging as India’s next frontier for AI interaction – Crypto News

-

Metaverse7 days ago

Metaverse7 days agoNvidia’s Jensen Huang says AI ‘fundamental like electricity’, praises Chinese models as ‘catalyst for global progress’ – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

Business6 days ago

Ethereum Price Prediction- Bulls Target $3,700 As ETH Treasury Accumulation Soars – Crypto News

-

others5 days ago

others5 days agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

others5 days ago

others5 days agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoAnarchy, crime and stablecoins – Blockworks – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoFriday charts: The rise of zero-sum thinking – Crypto News

-

others1 week ago

others1 week agoCrypto Hacker Who Drained $42,000,000 From GMX Goes White Hat, Returns Funds in Exchange for $5,000,000 Bounty – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoPump.fun Concludes $500M ICO in 12 Minutes — But Something Doesn’t Add Up – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Are So Many Crypto Games Shutting Down? Experts Weigh In – Crypto News

-

De-fi1 week ago

De-fi1 week agoRobinhood Opens Ether and Solana Staking to US Users – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTop 3 altcoins under $1 worth watching: Sei, Ethena, Arbitrum – Crypto News

-

De-fi1 week ago

De-fi1 week agoRipple’s RLUSD Market Cap Passes $515M, Flips TrueUSD – Crypto News

-

others1 week ago

Bitcoin Critic Vanguard Becomes Strategy’s (MSTR) Largest Shareholder – Crypto News

-

De-fi5 days ago

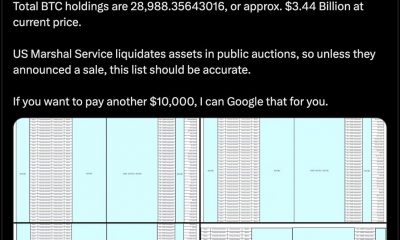

De-fi5 days agoU.S. Marshals Peg Federal Bitcoin Holdings at 28,988 Tokens Worth $3.4 B – Crypto News

-

Cryptocurrency5 days ago

Russia’s $85 Billion Sberbank to Launch Crypto Custody Services – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoNasdaq Exchange Files SEC Form to List Staking Ethereum ETF – Crypto News

-

Business1 week ago

Pump Token Surges Premarket Following Pump.fun $600M Raise – Crypto News

-

Technology1 week ago

Technology1 week agoV Guard INSIGHT-G BLDC fan review: Cool performer with a premium look – Crypto News

-

Cryptocurrency1 week ago

Fed’s Hammack Raises Inflation Concerns Amid Push For Interest Rate Cut – Crypto News

-

De-fi1 week ago

De-fi1 week agoDeFi TVL Surges Past $126B, Up Over 45% Since April – Crypto News