others

Pair remains near YTD high, hovers below 147.50 – Crypto News

- USD/JPY extends losses on the chatter surrounding stimulus measures by the Japanese government.

- Momentum indicators suggest a favorable trend in the pair’s price movement over the short-term period.

- The 147.50 psychological level acts as the immediate resistance, lined up with the weekly high.

USD/JPY extends its losses on the second day, trading around 147.40 below the Year-To-Date (YTD) high during the European session on Thursday. The pair experienced downward pressure after the moderate economic data from the United States (US).

Additionally, Kyodo News citing anonymous sources, the Japanese government is reportedly planning to introduce new economic stimulus measures in October. The primary objectives of these stimulus measures, as mentioned in the news, are to provide support for companies to increase wages and reduce energy costs.

The Moving Average Convergence Divergence (MACD) line stays above the centerline and lies above the signal line. This suggests that the recent momentum is relatively stronger.

The 147.50 psychological level acts as the immediate barrier, followed by the weekly high at 147.87. A break above the latter could support the USD/JPY pair to explore the region around the 148.00 level.

On the downside, the 14-day Exponential Moving Average (EMA) at 146.37 emerges as the key support, following the 21-day EMA at 145.81 aligned to the 23.6% Fibonacci retracement at 145.37 level.

In the short term, the USD/JPY pair remains to be bullish as long as the 14-day Relative Strength Index (RSI) stays above 50.

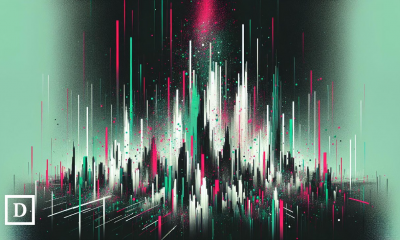

USD/JPY: Daily Chart

-

Blockchain5 days ago

Blockchain5 days agoThe Market Starts to Splinter – Crypto News

-

Technology1 week ago

Technology1 week agoDeutsche Bank Warns Software Debt Faces AI Threat – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoHow to hedge a bubble, AI edition – Crypto News

-

others1 week ago

others1 week agoMarket focus returns to rate path – MUFG – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin price outlook: buy signals appear amid deep BTC correction – Crypto News

-

De-fi1 week ago

De-fi1 week agoCME Group to Launch Futures for Cardano, Chainlink, and Stellar – Crypto News

-

De-fi1 week ago

De-fi1 week agoCME Group to Launch Futures for Cardano, Chainlink, and Stellar – Crypto News

-

Business1 week ago

Godex Review: No-KYC exchange for private crypto conversions – Crypto News

-

De-fi1 week ago

De-fi1 week agoBitcoin Recovers $70,000 Levels After Multi-Billion Dollar Crash – Crypto News

-

Technology1 week ago

US Jobs Data: Bitcoin Falls to $66K as Wall Street Sees Rise in Nonfarm Payrolls – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoFake ‘XRP’ Issued Token Causes Confusion on XRPL – Crypto News

-

Technology1 week ago

Technology1 week agoBattlefield 6 Season 2 drops new map, modes and major fixes: Launch date and all you need to know – Crypto News

-

De-fi1 week ago

De-fi1 week agoTether Invests $100 Million in US ‘Crypto Bank’ Anchorage Digital – Crypto News

-

Technology1 week ago

Technology1 week agoWill X get a native AI video editor? Product head Nikita Bier responds – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoHow to hedge a bubble, AI edition – Crypto News

-

others1 week ago

others1 week agoDiversifier role challenged by volatility – HSBC – Crypto News

-

Blockchain1 week ago

XRP Ledger Clears The Threshold For Institutional Settlement – Here’s How – Crypto News

-

De-fi1 week ago

De-fi1 week agoRobinhood Launches Public Testnet for Ethereum Layer 2 Blockchain – Crypto News

-

Technology1 week ago

Technology1 week agoChile launches open-source AI model designed for Latin America – Crypto News

-

others1 week ago

others1 week agoFraudster Who Drained $73,000,000 From Americans in Crypto Scheme Gets Two Decades in Prison – Despite Being on the Run – Crypto News

-

others7 days ago

U.S. Jobs Report: January Nonfarm Payrolls Rise To 130k, Bitcoin Climbs – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoStrongest quarter in three years – Yet, Canaan’s CAN stays below $1! – Crypto News

-

Business7 days ago

U.S. Government Shutdown Odds Hit 84%, Will Bitcoin Crash Again? – Crypto News

-

others7 days ago

U.S. Government Shutdown Odds Hit 84%, Will Bitcoin Crash Again? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoPompliano: Bitcoin Will Do ‘Very Well’ Over Long Run – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoAI is sneaking up on the Fed. Will Warsh be ready? – Crypto News

-

Business7 days ago

Breaking: $14T BlackRock To Venture Into DeFi On Uniswap, UNI Token Surges 28% – Crypto News

-

others7 days ago

U.S. Government Shutdown Odds Hit 84%, Will Bitcoin Crash Again? – Crypto News

-

Business7 days ago

U.S. Government Shutdown Odds Hit 84%, Will Bitcoin Crash Again? – Crypto News

-

Business6 days ago

Why Galaxy CEO Mike Novogratz Signals End of Crypto’s Speculative Era – Crypto News

-

others1 week ago

others1 week agoINVESTING YACHTS Launches RWA Yacht Charter Model – Crypto News

-

others1 week ago

others1 week agoConstructive view with CNY support – MUFG – Crypto News

-

Technology1 week ago

Technology1 week agoEU warns Meta WhatsApp policy could cause serious harm to rival AI chatbots: All you need to know – Crypto News

-

Business1 week ago

Bernstein Downplays Bitcoin Bear Market Jitters, Predicts Rally To $150k This Year – Crypto News

-

Business1 week ago

Bernstein Downplays Bitcoin Bear Market Jitters, Predicts Rally To $150k This Year – Crypto News

-

Business1 week ago

Bernstein Downplays Bitcoin Bear Market Jitters, Predicts Rally To $150k This Year – Crypto News

-

De-fi1 week ago

De-fi1 week agoWhy Bitcoin Crashed Over 10% in One Week – Crypto News

-

Business1 week ago

XRP News: Ripple Expands Custody Services to Ethereum and Solana Staking – Crypto News

-

Business1 week ago

BitMine Keeps Buying Ethereum With New $84M Purchase Despite $8B Paper Losses – Crypto News

-

Technology1 week ago

Technology1 week agoOppo K14x with 6.75-inch 120Hz display, 6,500mAh battery launched in India: Check price, full specs, and more – Crypto News

-

others1 week ago

others1 week agoDownside bias with policy drivers – MUFG – Crypto News

-

Technology1 week ago

Why is XRP Price Dropping Today? – Crypto News

-

Business1 week ago

Business1 week agoQVC Weighs Bankruptcy as $6.6 Billion Debt Looms – Crypto News

-

De-fi1 week ago

De-fi1 week agoSpark Launches Institutional Lending Products in Off-Chain Expansion – Crypto News

-

Business1 week ago

Ripple Price Prediction As Goldman Sachs Discloses Crypto Exposure Including XRP – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoArgentum AI Unveils Nuno Pereira As Managing Partner, Eying Faster Global Expansion – Crypto News

-

De-fi7 days ago

De-fi7 days agoFranklin Templeton and Binance Launch Tokenized Collateral Program – Crypto News

-

others7 days ago

others7 days agoBTCC Exchange Launches BTCC Earn with Flexible 20% APY and Exclusive New User Offer – Crypto News

-

Cryptocurrency7 days ago

Wall Street Giant Citi Shifts Fed Rate Cut Forecast To April After Strong U.S. Jobs Report – Crypto News

-

Cryptocurrency7 days ago

Wall Street Giant Citi Shifts Fed Rate Cut Forecast To April After Strong U.S. Jobs Report – Crypto News