De-fi

Pendle Attracts Over $125M In TVL With ‘Discounted Assets’ – Crypto News

Equilibria and Penpie Kick Off ‘Pendle Wars’ For Governance Control Of Yield Trading Protocol

Total value locked (TVL) in Pendle, a DeFi protocol that splits yield-bearing tokens into their principal and yield components, hit an all-time high of $127M on July 4.

Inflows accelerated after Ethereum’s Shanghai upgrade went live in April, enabling withdrawals of staked ETH for the first time. Data from DeFiLlama shows that over $40M worth of stETH has since been tokenized on the platform.

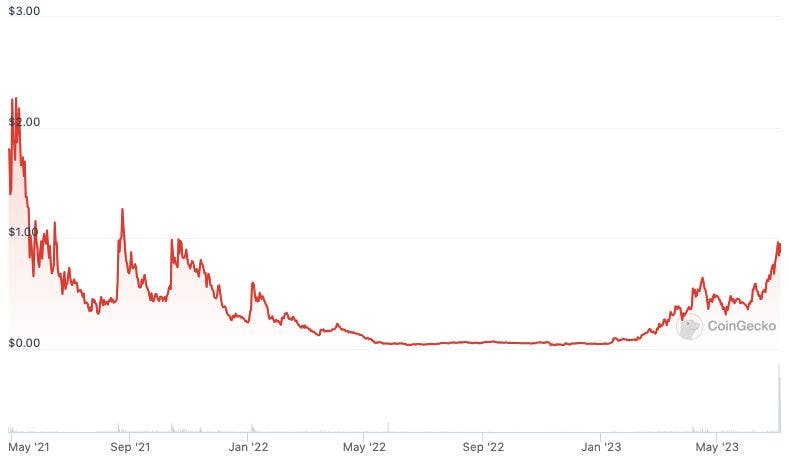

The project’s PENDLE token, which accrues protocol fees when locked, is up over 1,700% this year, trading at levels last seen two years ago during the height of the bull market.

In addition to yield-splitting, Pendle also features an automated market maker (AMM), where traders can buy and sell either the principal token or its associated yield separately. At over 5,000 transactions, the AMM saw a major spike in activity on July 3.

Increased Efficiency With V2

dan, growth lead at Pendle, told The Defiant that the trading volume on the AMM has been growing even faster than the value locked in the protocol. He cited Pendle’s V2 deployment, which went live in November, as a key driver for the momentum.

Pendle V2 increased the capital efficiency of the AMM by combining the principal and yield tokens into one pool, according to a posts on the release. It also increased capital efficiency by taking into account the relatively small fluctuations in yield. “We know that yields are predictable, [so] we can concentrate our liquidity into a specific range,” Dan said.

Cornerstone Of Traditional Finance

By enabling yield-splitting, Pendle represents what could be a major new DeFi primitive.

Splitting bonds into their principal and yield-bearing components is common practice in traditional finance, allowing more conservative investors to lock in fixed yields while enabling traders to speculate on variable rates.

Projects like Voltz, an interest rate swap protocol, are also looking to make yield trading a new pillar of the DeFi market.

The broader trend ofLSTfi,” the proliferation of applications built around liquid staking tokens (LSTs) like Lido Finance’s stETH, is also buoying Pendle — the protocol’s deepest pool has nearly $20M of stETH locked up until December 2025.

Traders can lock up yield-bearing tokens for a set period in exchange for principal (PT) and yield (YT) tokens, which can be traded separately.

Principal tokens trade at a discount since the yield component has been removed, and purchasers can lock in a fixed yield until their chosen maturity. Meanwhile, yield tokens offer traders a leveraged bet on future yields.

Nick Forda DeFi investor and content creator, told The Defiant he started paying attention to Pendle when it launched on Arbitrum, a scaling solution for Ethereum, earlier this year. “I appreciated it because it was actually serving a need by creating a marketplace to trade yields,” he said.

Building For Retail And Institutions

Dan said that the project split its efforts to expand on retail and institutional fronts. To that end, Pendle’s user interface features a toggle to switch between “simple” and “pro” versions.

The retail side has mostly focused on education — yield trading isn’t as intuitive as spot trading, so Pendle developed educational materials To help users.

On the institutional side, Dan said Pendle has reached out to institutions to understand their pain points in order to make the product more useful. “I would say the hype comes from retail, but the utility at the moment comes mostly from the bigger players,” he said.

PENDLE WARS

Behind the scenes, projects are sprouting up to build atop the yield-trading protocol — Pendle features a locking mechanism for its PENDLE token, which has created a dynamic reminiscent of the Curve Wars,

Like Curve’s CRV, users can lock up PENDLE in order to earn trading fees and vote on where to direct token incentives emitted by the Pendle. protocols,

Two projects, Equilibria and Penpie, are at the center of the “Pendle Wars.” Both offer higher yields on PENDLE than Pendle offers directly.

Because of this, Equilibria controls over 26% of the vePENDLE supply, while Penpie has over 24%, according to a Dune. data dashboard,

The projects are fighting over PENDLE because the locked tokens’ voting rights are valuable.

Other projects will pay Equilibria and PenPie to use their locked PENDLE to vote to incentivize liquidity for specific pools on the Pendle protocol. Colloquially, these incentives are called “bribes.”

Speaking to the momentum behind the burgeoning Pendle ecosystem, Equilibria and Penpie both launched just last month and have nearly $70M in TVL. between them,

Quiet Expansion

Pendle has been relatively quiet in terms of raising money — the project raised $3.7M in April 2021 in a seed round led by Mechanism Capital and hasn’t raised money since.

That doesn’t appear to have dampened the project’s momentum of late – Pendle recently received a major boost from Binance, the world’s largest centralized exchange by volume, which listed PENDLE on July 3.

The protocol seemingly returned the favor on July 5, when it launched on BNB Chain, the Ethereum-compatible blockchain developed by Binance.

-

others6 days ago

Japan Foreign Investment in Japan Stocks up to ¥528.3B in December 12 from previous ¥96.8B – Crypto News

-

Technology1 week ago

Technology1 week agoApple iPhone 16 Pro price slashed by up to ₹40,000 on Flipkart? Here’s how to grab the deal – Crypto News

-

Technology6 days ago

Technology6 days agoOnePlus 15R vs Pixel 9a: Which phone is the best buy under ₹50,000? Display, camera, processor and more compared – Crypto News

-

Blockchain4 days ago

Blockchain4 days agoThis Week in Stablecoins: Winning the Back Office – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoJPMorgan Prepares to Launch First Tokenized Money Market Fund – Crypto News

-

Technology1 week ago

Technology1 week agoHow to create your own Chibi-style 3D selfie diorama in minutes. Here’s the prompt for Nano Banana Pro – Crypto News

-

others4 days ago

others4 days agoAustralian Dollar loses as US Dollar advances before Michigan Sentiment Index – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Macro Retracement Meets Mid-Range Battle – Crypto News

-

others1 week ago

others1 week agoGBP/USD drops as UK GDP shrinks for second straight month – Crypto News

-

Technology1 week ago

Technology1 week agoMicrosoft AI boss Suleyman calls Elon Musk a ‘bulldozer’, labels Sam Altman ‘courageous’ – Crypto News

-

Technology1 week ago

Technology1 week agoElon Musk’s X rolls out home and lock screen widgets for iPhone and iPad users – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBlockworks launches investor relations platform with Solana – Crypto News

-

Business3 days ago

XRP Holders Eye ‘Institutional Grade Yield’ as Ripple Engineer Details Upcoming XRPL Lending Protocol – Crypto News

-

others1 week ago

others1 week agoAUD/USD steadies as focus shifts to PMIs, US Nonfarm Payrolls and CPI – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoWhy Twenty One’s First-Day Slide Shows Waning Appetite for BTC Firms – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoAave DAO Community Clashes With Aave Labs Over CoW Swap Fees – Crypto News

-

Technology1 week ago

Technology1 week agoElon Musk’s X rolls out home and lock screen widgets for iPhone and iPad users – Crypto News

-

Business1 week ago

Bitcoin Faces Slide Towards $70K as Japan Rate Hike Odds Spike – Crypto News

-

Technology7 days ago

Technology7 days agoUS Puts Tech Deal With UK on Hold – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoCiti Says Identity Is the New Gatekeeper for Financial Blockchains – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoBitcoin on Track For 4th Annual Decline Despite Crypto Adoption – Crypto News

-

Business4 days ago

DOGEBALL Presale: A Boost to Bring P2E Games Back into the Spotlight – Crypto News

-

Business3 days ago

125 Crypto Firms Mount Unified Defense as Banks Push to Block Stablecoin Rewards – Crypto News

-

Blockchain3 days ago

Blockchain3 days agoLitecoin Follows Bitcoin’s Momentum, But Resistance Looms At $79.60 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBTC is up and L1s are down as flows turn messy again – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago$350B in crypto losses – But big Bitcoin buyers are moving in – Crypto News

-

others1 week ago

others1 week agoCopper hits record near $12,000 – Commerzbank – Crypto News

-

others1 week ago

Will Bittensor Price Break Above $400 After First TAO Halving Tomorrow? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoDollar dominance can’t be manufactured – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Holders Labeled ‘Uneducated Perma Bulls’ By Veteran Trader – Crypto News

-

Business1 week ago

Bitcoin Faces Slide Towards $70K as Japan Rate Hike Odds Spike – Crypto News

-

Technology1 week ago

Technology1 week agoSamsung tipped to raise Galaxy A series price in India starting Monday: here’s what to expect – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTranshumanism Branded a ‘Death Cult’ as Thinkers Clash Over Humanity’s Future – Crypto News

-

others1 week ago

Metaplanet CEO Teases “Crucial” Bitcoin Buy Decision at Upcoming EGM, Stock Wavers – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoXRP Price Analysis for December 14 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCapital gets selective – Blockworks – Crypto News

-

others1 week ago

Low-Fee vs. High-Leverage – How to Choose the Optimal Exchange for Your Trading Strategy? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin and Ethereum Wobble as US Reports Highest Unemployment Rate Since 2021 – Crypto News

-

others7 days ago

others7 days agoJapanese Yen strengthens as BoJ rate hike speculation grows – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoBlockchain’s Institutional Future Is Private and Permissioned – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoWhy quantum computing is becoming a real concern for Bitcoin – Crypto News

-

Business4 days ago

Bitcoin Price Alarming Pattern Points to a Dip to $80k as $2.7b Options Expires Today – Crypto News

-

Business3 days ago

Ethereum Faces Selling Pressure as BitMEX Co-Founder Rotates $2M Into DeFi Tokens – Crypto News

-

others3 days ago

XRP Holders Eye ‘Institutional Grade Yield’ as Ripple Engineer Details Upcoming XRPL Lending Protocol – Crypto News

-

Technology3 days ago

Technology3 days agoApple iPhone 16 price drops to ₹40,990 in Croma’s Cromtastic December Sale: How the deal works – Crypto News

-

Blockchain3 days ago

Blockchain3 days agoCrypto Market Sentiment Not Fearful Enough For Bottom: Santiment – Crypto News

-

Blockchain3 days ago

Blockchain3 days agoCrypto Market Sentiment Not Fearful Enough For Bottom: Santiment – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSEC Publishes Crypto Custody and Wallet Primer for Investing Public – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoThese Bleak Victim Letters Helped Seal Terra Founder Do Kwon’s Fate – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCrypto Use in Venezuela Likely to Rise as Economic Pressures Intensify – Crypto News