De-fi

Polygon leads in EVM efficiency as DeFi users favor low transaction costs – Crypto News

Layer-1 blockchains are foundational networks supporting various applications directly on their protocol, while Layer-2 blockchains operate atop these foundational layers, enhancing scalability and efficiency. Comparing the usage and efficiency of EVM-compatible L1 and L2 blockchains and side chains helps us better understand the market values and where most of the DeFi activity comes from.

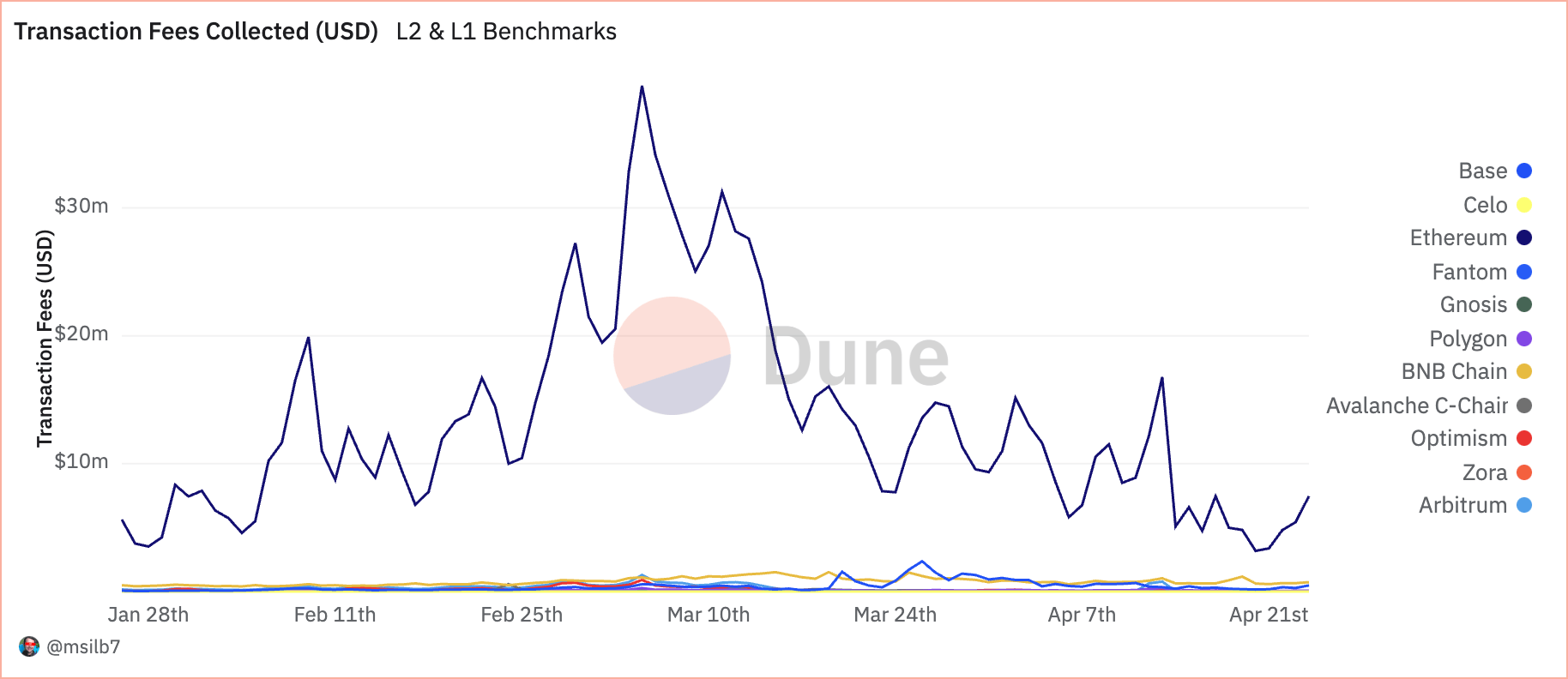

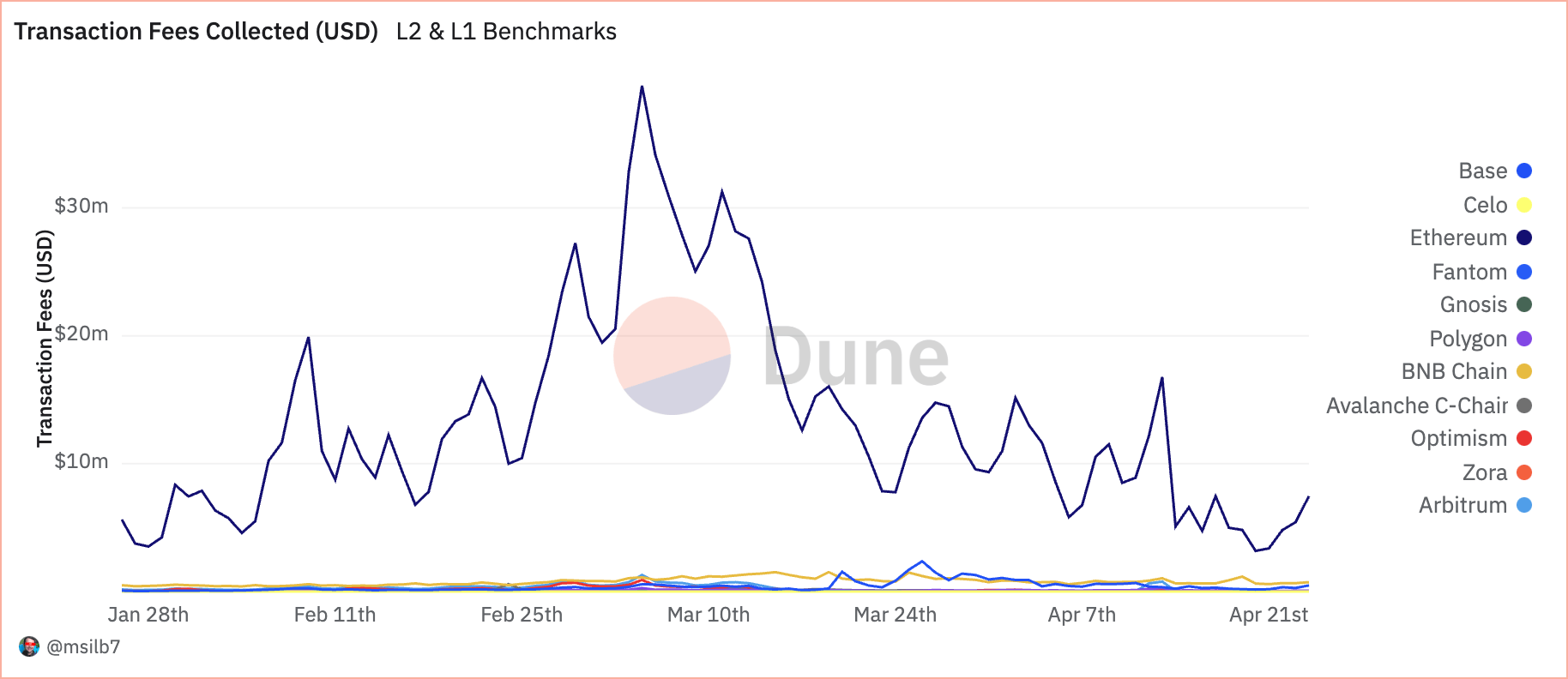

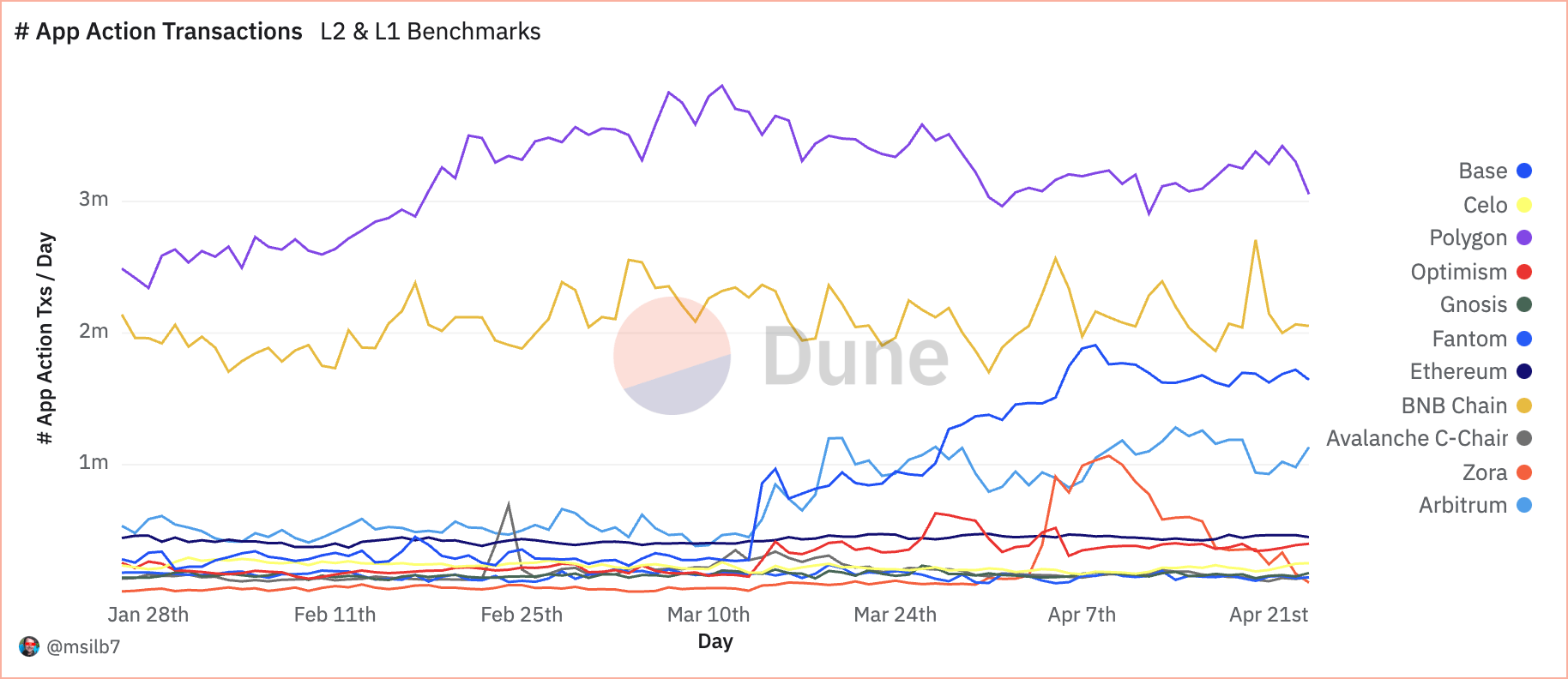

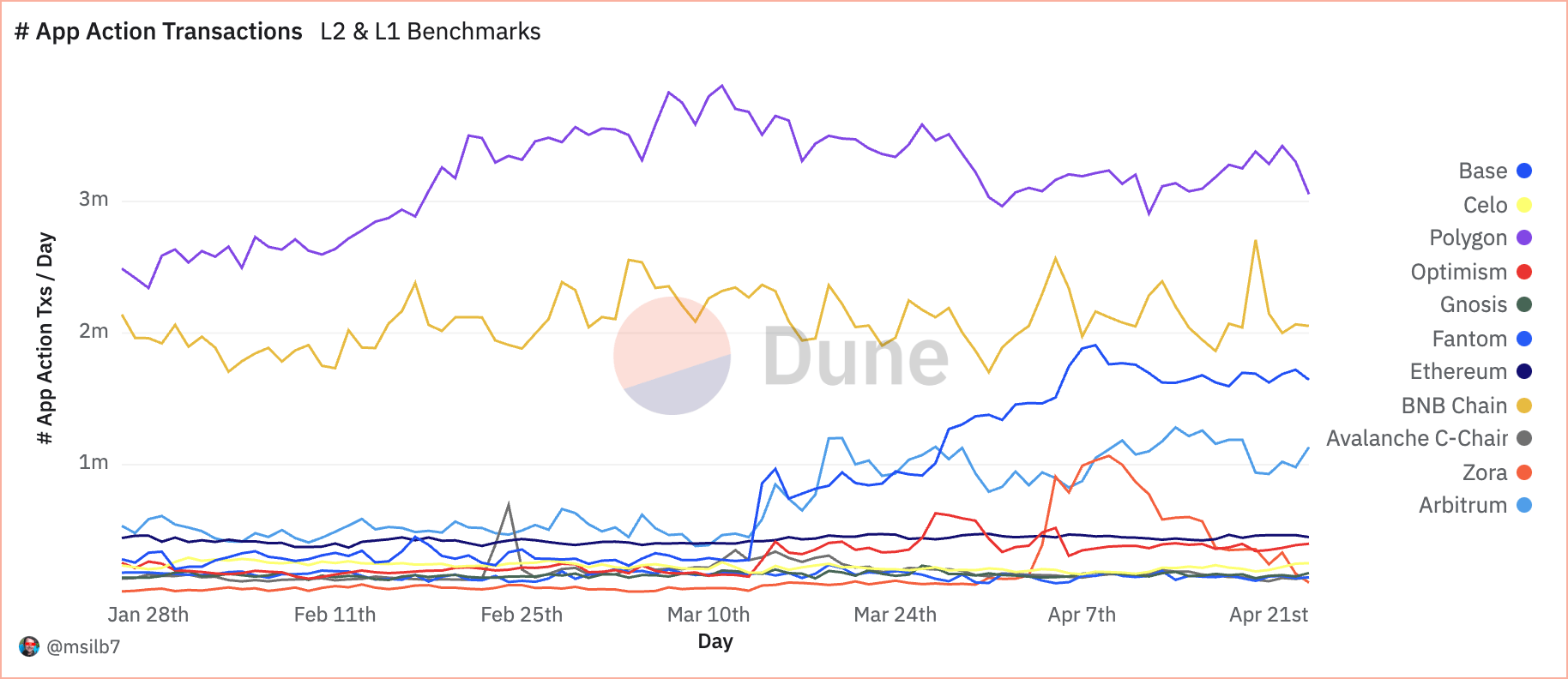

Dune Analytics data analyzed by CryptoSlate showed Polygon, a Layer-2 sidechain, was the leading figure in the DeFi ecosystem, closely followed by BNB Chain, an EVM-compatible Layer-1 blockchain.

One of the most important metrics when analyzing L1s and L2s is the daily gas usage—the computational effort required to execute operations on the blockchain. Gas fees are paid in native blockchain currencies, and high gas usage typically indicates robust network activity. Notably, when L2 solutions maintain high gas usage at low USD costs, it reflects an efficient scaling solution that makes transactions affordable without sacrificing blockchain activity.

Polygon utilizes an average of 579.97 billion units of native gas daily, with associated costs amounting to just $65.48k. This translates to a meager average of $0.76 in USD per second despite processing a high volume of 48.37 transactions per second. Each transaction on Polygon costs about 138,782 gas units. BNB Mainnet, while also high in transaction volume, shows a different cost structure with 454.89 billion units of native gas used daily and $1.02 million in daily USD fees; the cost per second soars to $11.81, far surpassing Polygon’s. The higher cost per transaction, which averages 108,513 gas units, reflects BNB’s heavier computational demand per transaction, suggesting a more resource-intensive operation than Polygon.

| Chain | Avg Native Gas Used / Day | Avg USD Gas Fees / Day | Avg # Txs / Day | Avg Native Gas per Tx | Avg Native Gas Used / Second | Avg USD Gas Fees / Second | Avg # Txs / Second |

|---|---|---|---|---|---|---|---|

| Polygon Mainnet | 579.97b | $65.48k | 4.18m | 138,782 | 6.71m | $0.76 | 48.37 |

| BNB Mainnet | 454.89b | $1.02m | 4.06m | 108,513 | 5.26m | $11.81 | 47.03 |

| Arbitrum One | 273.96b | $250.05k | 1.14m | 241,207 | 3.17m | $2.89 | 13.15 |

| Base Mainnet | 222.37b | $378.72k | 1.26m | 174,229 | 2.57m | $4.38 | 14.59 |

| OP Mainnet | 213.30b | $160.26k | 490.83k | 429,129 | 2.47m | $1.85 | 5.68 |

| Gnosis Mainnet | 109.77b | $1.05k | 182.58k | 601,244 | 1.27m | $0.01 | 2.11 |

| Ethereum Mainnet | 108.14b | $12.63m | 1.19m | 90,758 | 1.25m | $146.20 | 13.79 |

| Fantom Mainnet | 94.86b | $4.89k | 248.93k | 372,521 | 1.10m | $0.06 | 2.88 |

Arbitrum uses 273.96 billion units of gas daily, costing users $250.05k, which breaks down to $2.89 per second and 241,207 gas units per transaction, indicating a higher cost efficiency than BNB but less so than Polygon. Base Mainnet records similar trends with 222.37 billion units and daily fees of $378.72k, resulting in a slightly higher per-second cost of $4.38 and 174,229 units per transaction.

Ethereum operates with the highest cost impact, using 108.14 billion gas units daily, translating into a hefty $12.63 million in fees. With costs skyrocketing to $146.20 per second, despite having an average of 90,758 gas units per transaction, it illustrates Ethereum’s robust security and computational breadth and highlights its scalability challenges that L2 networks aim to address.

Looking at transaction metrics, data from April 23 shows that Polygon led with 4.02 million transactions, followed by BNB Chain with 3.9 million. These figures show strong user engagement and network utility, representing a respective 25.8% and 25.1% share of total transactions (excluding known system transactions).

However, when examining transaction fees, a different narrative emerges. Despite a lower transaction count, Ethereum amassed $7.46 million in fees, representing a staggering 83.9% of total fees collected. This discrepancy suggests that while Ethereum processes fewer transactions, its higher transaction costs reflect its primary layer status and the intensive computational resources required for operations.

When it comes to DeFi apps, Polygon again leads the transaction numbers, with 3.3 million app transactions, showing it’s a go-to platform for DeFi activities.

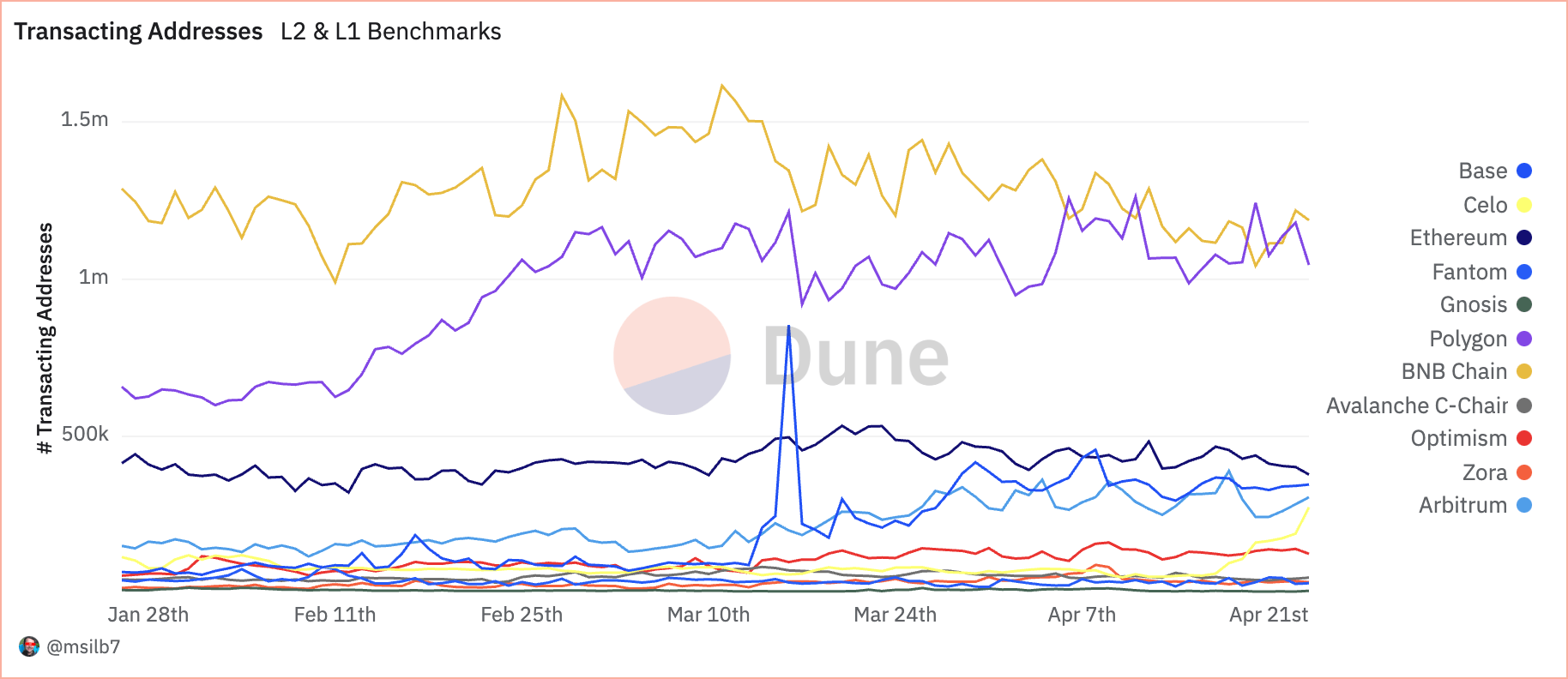

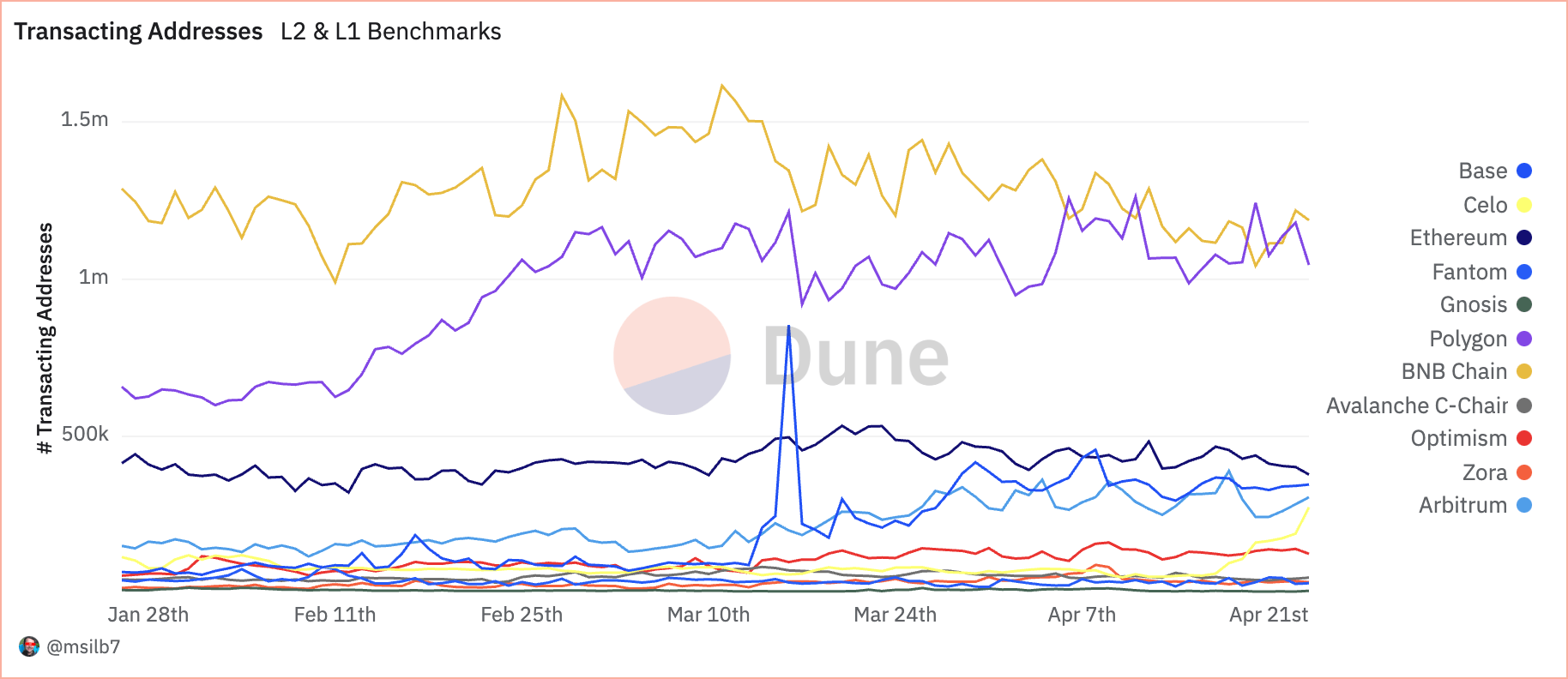

BNB Chain saw 1.22 million transacting addresses, with Polygon slightly behind at 1.18 million. These figures, contrasted with Ethereum’s 402.77k, suggest that other EVM-compatible networks are becoming preferred platforms for regular DeFi users due to their lower cost structures.

Analyzing the performance of these blockchains side-by-side shows a battle between foundational security and enhanced scalability. While L1 blockchains like Ethereum continue to secure high-value transactions with substantial fees, scaling solutions like Polygon capture the bulk of daily transactions and application interactions, signifying a shift towards more efficient and user-friendly blockchain infrastructures in DeFi.

It’s important to note that despite being labeled as a Layer-2 blockchain by many, Polygon operates as an L2 sidechain for Ethereum, as it relies on its own set of validators and doesn’t depend on Ethereum for security. This allows Polygon to support more experimental activity than “true” L2 blockchains without impacting Ethereum. Another fact worth mentioning is that BNB Chain is an EVM-compatible Layer-1 blockchain but has positioned itself on the market not as a competitor to Ethereum, another L1, but to other L2s.

Mentioned in this article

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoVanEck’s Solana ETF nears launch after SEC 8-A filing – Details – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoVanEck’s Solana ETF nears launch after SEC 8-A filing – Details – Crypto News

-

De-fi1 week ago

De-fi1 week agoZEC Jumps as Winklevoss‑Backed Cypherpunk Reveals $100M Zcash Treasury – Crypto News

-

Business7 days ago

December Fed Meeting 2025: Rate Cut or Hold? Key levels to Watch – Crypto News

-

Metaverse7 days ago

Metaverse7 days agoClaude Desktop is your new best friend for an organized PC – Crypto News

-

De-fi1 week ago

De-fi1 week agoKraken’s xStocks Hit $10B in Total Trading Volume – Crypto News

-

others7 days ago

December Fed Meeting 2025: Rate Cut or Hold? Key levels to Watch – Crypto News

-

Metaverse7 days ago

Metaverse7 days agoClaude Desktop is your new best friend for an organized PC – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin faces quantum risk: why SegWit wallets may offer limited protection – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoYour deep research tool may save you time, but can it save you embarrassment? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoUAE makes Bitcoin wallets a crime risk in global tech crackdown – Crypto News

-

Technology5 days ago

Technology5 days agoPerplexity faces harsh crowd verdict at major San Francisco AI conference: ‘Most likely to flop’ – Crypto News

-

De-fi1 week ago

De-fi1 week agoEthereum Sees First Sustained Validator Exit Since Proof-of-Stake Shift – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoXRP’s Big Moment? Why Nov. 13 Could Be the Day Ripple Investors Have Waited For – Crypto News

-

De-fi1 week ago

De-fi1 week agoXPL Rallies After Plasma Reveals Collaboration with Daylight Energy – Crypto News

-

De-fi1 week ago

De-fi1 week agoSKY Surges 14% as Savings TVL Passes $4 Billion – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin (BTC) battles macro headwinds despite improved ETF inflows – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoAI-driven phishing scams and hidden crypto exploits shake Web3 security – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoWhy the Future of Blockchain Payments Could Stay Narrow – Crypto News

-

Technology5 days ago

Japan’s ¥17 Trillion Stimulus Plan: A Turning Point for Global Liquidity Shifts – Crypto News

-

Cryptocurrency4 days ago

Cryptocurrency4 days agoTLC Coin Price Prediction 2026, 2030, &2040: Trillioner Forecast » InvestingCube – Crypto News

-

Cryptocurrency1 week ago

Can Dogecoin Price Hold Above $0.17 Amid Weekly Surge? – Crypto News

-

De-fi1 week ago

De-fi1 week agoTrump Tokens Outperform After US President Teases ‘Tariff Dividends’ – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoFoxconn reports strong Q3 profit driven by AI server boom, teases OpenAI announcement – Crypto News

-

others1 week ago

Hyperliquid Halts Deposits and Withdrawals Amid POPCAT Liquidation Saga – Crypto News

-

Business1 week ago

Hyperliquid Halts Deposits and Withdrawals Amid POPCAT Liquidation Saga – Crypto News

-

De-fi6 days ago

De-fi6 days agoBitcoin Drops to $94,000 Following Second-Largest Daily ETF Outflows – Crypto News

-

De-fi6 days ago

De-fi6 days agoBitcoin Drops to $94,000 Following Second-Largest Daily ETF Outflows – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoCrypto market’s weekly winners and losers – TEL, STRK, ICP, CC – Crypto News

-

Technology5 days ago

Technology5 days agoAI chatbots like ChatGPT and Gemini may be ‘bullshitting’ to keep you happy, new study finds – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoBitcoin Indicator Sounds Buy Alarm For The First Time Since March — Return To $110K Soon? – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoCrypto update: Bitcoin ETFs see $300M inflow as investors ‘buy the dip’ – Crypto News

-

Blockchain4 days ago

Blockchain4 days agoA16z’s Sees Arcade Tokens As Key To Crypto Evolution – Crypto News

-

Blockchain4 days ago

Blockchain4 days agoBlackRock XRP ETF Speculation Hit New Highs As XRPC Performance Shocks Markets – Crypto News

-

Technology1 week ago

Technology1 week agoChinas cryptoqueen jailed in UK over $6.6 billion Bitcoin scam – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Path To $1 Million Clears With OG Sellers Fading: Weisberger – Crypto News

-

Technology1 week ago

Breaking: USDC Issuer Circle Explores Native Token for Arc Network – Crypto News

-

De-fi1 week ago

De-fi1 week agoFlare TVL Nears Record High as Firelight Teases XRP Liquid Staking – Crypto News

-

De-fi1 week ago

De-fi1 week agoXRP Surges as First US Spot ETF Debuts on Nasdaq – Crypto News

-

Business1 week ago

Ethereum Price Sheds 10% but Lands on the $3,150 Accumulation Base — Is a Buy-the-Dip Bounce Ahead? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoZcash Revival Sparks Debate on Bringing Privacy Back to Bitcoin – Crypto News

-

Blockchain4 days ago

Blockchain4 days agoAnt International and UBS Team on Blockchain-Based Deposits – Crypto News

-

Business1 week ago

Arthur Hayes Buys UNI as CryptoQuant CEO Says Supply Shock ‘Inevitable’ for Uniswap – Crypto News

-

Business1 week ago

Cardano News: Wirex Partners EMURGO To Launch First Ever ADA Card – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoUniswap finally turns the fee switch – Crypto News

-

Business1 week ago

U.S. Government Shutdown Set to End as House Panel Approves Senate Funding Deal – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoMatthew McConaughey, Michael Caine Team Up With ElevenLabs to Recreate Their Voices Using AI – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoMajor Ethereum Upgrade Scheduled for December – Crypto News

-

Business1 week ago

Death Cross Triggers Sell Signals for Cardano Price— Will ADA Retest $0.50? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCanary XRP ETF gets green light for Nasdaq launch tomorrow – Crypto News