others

Pound Sterling aims sustainable break above 1.2900 as domestic wage pressures remain resilient – Crypto News

- pound sterling has attracted significant bets as chances of more fat rate hikes from the Bank of England solidify.

- United Kingdom firms are offering higher payroll charges to offset labor shortages.

- Britain’s jobless rate has jumped to 4% and the Claimant Count Change has added a fresh 25.7K job seekers.

The Pound Sterling (GBP) has delivered a north-side vertical move marginally above the round-level resistance of 1.2900 as labor cost data has turned out more resilient than expected. The GBP/USD pair has picked immense strength as chances of a bulky interest rate hike from the Bank of England (BoE) have escalated, knowing the fact, that higher disposable income available to households will result in higher purchasing power, and eventually the overall demand will elevate further.

United Kingdom firms are offering higher wages to attract fresh talent amid labor shortages. Scrutiny of the Employment data indicates that the jobless rate has increased as firms have started avoiding credit due to higher interest rate attachment. It seems that the chances of a fat rate hike by the BoE will remain elevated as higher wage pressures are sufficient to offset the impact of a rise in the unemployment rate,

Daily Digest Market Movers: Pound Sterling capitalizes on upbeat labor data

- Pound Sterling attempts a break above 1.2900 United Kingdom labor cost has turned out hotter than expected.

- Three-month average earnings excluding bonuses have remained steady at 7.3% while investors were anticipating a decline to 7.1%.

- Claimant Count Change has jumped to 25.7K while there was a decline of 22.5K claims last month. Three-month Unemployment Rate has increased to 4.0% vs. the expectations and the earlier release of 3.8%.

- Higher wage pressures are sufficient to offset a significant rise in the jobless rate.

- Market participants are expecting that the interest rates by the Bank of England would peak at 6.25-6.50%.

- BoE Governor Andrew Bailey conveyed on Monday that the central bank will keep the job market under observation in an attempt to bring down inflation.

- Andrew Bailey reiterated that the central bank is making efforts to provide an environment of price stability.

- United Kingdom FM Jeremy Hunt cited on Monday that the government and the central bank “will do what is necessary, for as long as necessary” to return inflation to its 2% target.

- Inflation in Britain’s economy has softened from its peak of 11.1%, however, the promise made by UK PM Rishi Sunak that inflationary pressures would halve by year-end would be missed.

- A survey from the British Retail Consortium (BRC) showed that higher food prices have squeezed the budgets of households, which has eased demand for big-ticket items.

- Households are facing the burden of high price pressures as the pace of inflation is higher than the velocity of labor costs.

- Last week, Andrew Bailey urged industry regulators to stop overcharging customers for fuel.

- This week, the UK’s economic calendar is full of events as the labor market data will be followed by Wednesday’s Financial Policy Committee (FPC) minutes, and Thursday’s Industrial and Manufacturing data (May).

- Monthly Industrial Production and Gross Domestic Product (GDP) are expected to contract by 0.4%. And Manufacturing Production is seen contracting by 0.5%.

- Market sentiment is quite bullish amid an upbeat appeal for risk-sensitive currencies.

- The US Dollar Index (DXY) has extended its three-day losing spell as investors are hoping only one interest rate hike has left in the toolkit of the Federal Reserve (Fed).

- Cleveland Fed President Loretta Mester, in a speech at the University of San Diego, cited that “The economy has shown more underlying strength than anticipated earlier this year, and inflation has remained stubbornly high, with progress on core inflation stalling,” as reported by Reuters.

- This week, the United States Consumer Price Index (CPI) will be keenly watched. As per the preliminary report, monthly headline CPI delivered a higher pace of 0.3% vs. the former pace of 0.1%. Also, core inflation that excludes oil and food prices is expected to match the headline CPI pace.

Technical Analysis: Pound Sterling aims to sustain above 1.2900

Pound Sterling has continued its three-day winning streak after overstepping Monday’s high at 1.2868. The Cable is approaching the Rising Channel chart pattern formed on a daily period in which each pullback is considered a buying opportunity for investors. Upward-sloping 50- and 200-period daily Exponential Moving Averages (DEMAs) indicate that the overall trend is extremely bullish. Bounded oscillators are demonstrating strength in the upside momentum.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data.

Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%) . The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates.

When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money.

When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP.

A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net trade balance strengthens a currency and vice versa for a negative balance.

-

Technology1 week ago

Technology1 week agoSam Altman says OpenAI is developing a ‘legitimate AI researcher’ by 2028 that can discover new science on its own – Crypto News

-

Technology1 week ago

Technology1 week agoGiving Nvidias Blackwell chip to China would slash USs AI advantage, experts say – Crypto News

-

Technology1 week ago

Technology1 week agoBenQ MA270U review: A 4K monitor that actually gets MacBook users right – Crypto News

-

others1 week ago

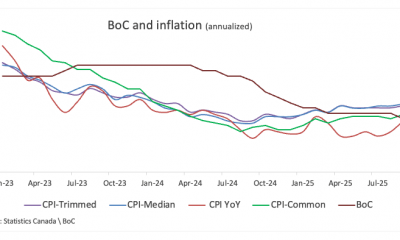

others1 week agoBank of Canada set to cut interest rate for second consecutive meeting – Crypto News

-

De-fi1 week ago

De-fi1 week agoBittensor Rallies Ahead of First TAO Halving – Crypto News

-

De-fi1 week ago

De-fi1 week agoAI Sector Rebounds as Agent Payment Systems Gain Traction – Crypto News

-

Business1 week ago

Crypto Market Rally: BTC, ETH, SOL, DOGE Jump 3-7% as US China Trade Talks Progress – Crypto News

-

Business1 week ago

Business1 week agoStarbucks Says Turnaround Strategy Drives Growth in Global Sales – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoIBM Set to Launch Platform for Managing Digital Assets – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoWhat Happens When You Don’t Report Your Crypto Taxes to the IRS – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana Eyes $210 Before Its Next Major Move—Uptrend Or Fakeout Ahead? – Crypto News

-

De-fi1 week ago

De-fi1 week agoREP Jumps 50% in a Week as Dev Gets Community Support for Augur Fork – Crypto News

-

Technology1 week ago

Technology1 week agoDonald Trump as Halo Master Chief? White House joins GameStop’s ‘End of Console Wars’ celebration – Crypto News

-

Technology1 week ago

Pi Coin Price Jumps 24% as 10M Tokens Exit Exchanges – Can Bulls Sustain the Momentum? – Crypto News

-

others1 week ago

others1 week agoGBP/USD floats around 1.3320 as softer US CPI reinforces Fed cut bets – Crypto News

-

others5 days ago

others5 days agoMETA stock has lower gaps to fill – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Phones Struggle as Solana Quietly Pulls Plug on Saga – Crypto News

-

Business1 week ago

Crypto ETFs Attract $1B in Fresh Capital Ahead of Expected Fed Rate Cut This Week – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Edges Lower While US Stocks Hit New Highs – Crypto News

-

others1 week ago

Pi Coin Gains Another 15% As Pi Network Joins ISO 20022 For Seamless Banking Integration – Crypto News

-

others1 week ago

Crypto Market Tumbles as Jerome Powell Says December Rate Cut ‘Far From Certain’ – Crypto News

-

Cryptocurrency1 day ago

Cryptocurrency1 day agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

De-fi1 week ago

De-fi1 week agoBitcoin Dips Under $110,000 After Fed Cuts Rates – Crypto News

-

De-fi1 week ago

De-fi1 week agoMetaMask Fuels Airdrop Buzz With Token Claim Domain Registration – Crypto News

-

De-fi1 week ago

De-fi1 week agoTokenized Nasdaq Futures Enter Top 10 by Volume on Hyperliquid – Crypto News

-

others1 week ago

Is Changpeng “CZ” Zhao Returning To Binance? Probably Not – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCitigroup and Coinbase partner to expand digital-asset payment capabilities – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoInside Bitwise’s milestone solana ETF launch – Crypto News

-

others1 week ago

Can ASTER Price Rebound 50% as Whale Activity and Bullish Pattern Align? – Crypto News

-

Cryptocurrency10 hours ago

Cryptocurrency10 hours agoMany Crypto Treasury Companies Were a Get-Rich-Quick Trap, Warns Columbia Professor – Crypto News

-

others1 week ago

others1 week agoGold weakens as US-China trade optimism lifts risk sentiment, focus turns to Fed – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoGold Price Forecast 2025, 2030, 2040 & Investment Outlook – Crypto News

-

Metaverse1 week ago

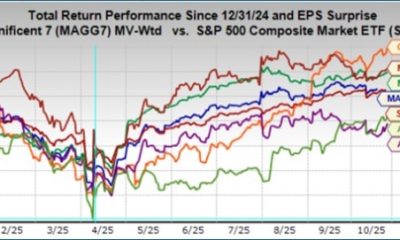

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

De-fi1 week ago

De-fi1 week agoCRO Jumps After Trump’s Truth Social Announces Prediction Market Partnership with Crypto.Com – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoKERNEL price goes vertical on Upbit listing, hits $0.23 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Is Pi Network’s (PI) Price Up by Double Digits Today? – Crypto News

-

Cryptocurrency5 days ago

After 1,993% Burn Spike, Is Shiba Inu Price Set for a Major Trend Reversal? – Crypto News

-

Cryptocurrency1 day ago

Cryptocurrency1 day agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCrypto Analyst Shows The Possibility Of The Ethereum Price Reaching $16,000 – Crypto News

-

Business1 week ago

$2.5T Citigroup Partners With Coinbase to Enable Stablecoin Payments – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoArgentine Stablecoin Use Surged Ahead of President Milei’s Midterm Election Win – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

Cryptocurrency1 week ago

Is Stock Tokenization Really Exploding? Not Even 0.01% – Crypto News

-

Technology1 week ago

Breaking: $2.6B Western Union Announces Plans for Solana-Powered Stablecoin by 2026 – Crypto News

-

Business1 week ago

BNB Chain’s Future Growth Won’t Come From DEXs – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoVisa To Support Four Stablecoins on Four Blockchains – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoZIGChain eyes gains as Nasdaq-Listed SEGG Media backs ZIG – Crypto News

-

Cryptocurrency1 week ago

XRP News: Ripple-Backed Evernorth Amasses Over $1B in XRP Ahead of Nasdaq Listing – Crypto News

-

others1 week ago

others1 week agoPreviewing Mag 7 earnings: What investors should know – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoHayes’ Zcash ‘Vibe Check’ Sparks 30% Moonshot – Crypto News