others

Pound Sterling rallies as market mood strengthens after soft US Core PCE Inflation data – Crypto News

- Pound Sterling rebounds as market mood improves on soft US core PCE price index data.

- High UK inflation would allow BoE policymakers to maintain a hawkish tone on interest rates.

- The US Dollar falls sharpy on softer inflation outlook.

The Pound Sterling (GBP) bounces back strongly as the US Core Personal Consumption Expenditure (PCE) Price Index data softened in December. Monthly core PCE grew by 0.2%, which was in-line with estimates. The annual core PCE data decelerated to 2.9% against expectations of 3% and the former reading of 3.2%.

Going forward, investors will focus on the interest rate decisions by the Bank of England (BoE) and the Federal Reserve (Fed) next week. Both central banks are widely anticipated to keep the monetary policy unchanged for the fourth straight time but guidance on interest rates for the entirety of 2024 will be keenly watched.

BoE policymakers are expected to refrain from rate-cut discussions as the United Kingdom economy is still experiencing significantly higher inflationary pressures than the US. There, however, policymakers could provide some cues about future interest rate-cuts. The Summary of Economic Projections (SEP) published after the last Fed meeting showed members on average predicting three rate cuts in 2024. Before the Fed’s interest rate decision, softer core PCE data is expected to elevate the odds favoring a rate-cut in March.

Daily Digest Market Movers: Pound Sterling recovery further while US Dollar cracks

- Pound Sterling finds significant bids as investors shift focus towards the interest rate decision by the Bank of England, which will be announced next week.

- The BoE is widely anticipated to maintain interest rates steady at 5.25% for the fourth time in a row.

- Investors will keenly watch whether BoE policymakers will follow the Fed or the European Central Bank (ECB) and start discussing making costs to interest rates.

- Unlike the ECB and the Fed, BoE policymakers have not offered any timeframe or projections for rate cuts amid high inflationary pressures.

- The core inflation in the United Kingdom economy is at 5.1%, significantly far from the desired rate of 2%, and higher than the US and Eurozone (3.9% and 3.4% respectively).

- This could mean the BoE to be the laggard among Group of Seven central banks in commencing a “rate-cut campaign”.

- Meanwhile, improving business confidence in the economic outlook amid hopes of rate cuts could make price pressures more persistent.

- PMI numbers, reported by the S&P Global for January, were significantly up and marked a promising start for 2024. Also, Oil supply disruptions in the Red Sea could escalate inflationary pressures in the manufacturing sector.

- This could allow BoE policymakers to stretch the restrictive interest rate stance.

- The United States Q4 Gross Domestic Product (GDP) data, released on Thursday, indicated that the economy is growing at a robust pace, allowing Federal Reserve (Fed) policymakers to hold back interest rate-cuts in the first-half of 2024.

- The US Dollar Index (DXY) falls sharply to near 103.23 as soft US core PCE report has indicated a subsiding outlook on inflation.

Technical Analysis: Pound Sterling climbs to near 1.2750

Pound Sterling jumps to near 1.2750 against the US Dollar after soft US core PCE data . The broader price action in the GBP/USD pair demonstrates a steep contraction in volatility. The near-term demand for the Cable is stable as it is aiming to sustain above the 20-period Exponential Moving Average (EMA), which trades around 1.2700. An inventory adjustment auction after a sharp rally is visible on the daily timeframe, which signifies an absence of a potential economic trigger for fresh guidance.

The 14-period Relative Strength Index (RSI) oscillates in the 40.00-60.00, indicating absence of fresh impetus.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it.

Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

-

Blockchain5 days ago

Blockchain5 days agoInstitutional Demand Surges As Ethereum Sets New Inflow Records – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoDeFi Development Nears 1 Million Solana In Treasury – Crypto News

-

Business1 week ago

XLM Is More Bullish Than ETH, SOL, And XRP, Peter Brandt Declares – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoAnarchy, crime and stablecoins – Blockworks – Crypto News

-

Business1 week ago

XRP Lawsuit Update: Ripple Paid $125M in Cash, Settlement Hinges on Appeal – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin trades near $119K after new all-time high; Coinbase rebrands wallet to ‘Base App’ – Crypto News

-

Technology1 week ago

“Decentralized Ponzi Scheme”- Gold Bug Peter Schiff Slams Landmark Crypto Bills – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCalifornia Sheriffs Believe 74-Year-Old’s Disappearance Linked to Son’s Crypto Fortune – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoAltseason heats up, but Bitcoin could face short-term pullback – How? – Crypto News

-

others1 week ago

others1 week agoVanEck Details Key Drivers Boosting Bitcoin Price, Including Corporate Treasury Demand, ETF Flows and More – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoZoho Zia LLM launched with speech-to-text models and AI agent marketplace: All you need to know – Crypto News

-

De-fi1 week ago

De-fi1 week agoBNB Chain Teases New Blockchain with Privacy Features to Compete With Crypto Exchanges – Crypto News

-

Technology1 week ago

Breaking: GENIUS Act Becomes First Major Crypto Legislation as Trump Signs Bill – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Cap Hits $4 Trillion Milestone as US House Passes Landmark Bills – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoShytoshi Kusama Breaks Silence on New SHIB AI Whitepaper and Transformed Future – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoSanctum acquires Ironforge, plots transaction infrastructure vertical – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoXRP Price Hits All-Time High at $3.66 — Can It Smash Through $4 After Trump Win & SEC Shake-Up? – Crypto News

-

Business6 days ago

Vitalik Buterin Approves Gas Limit Hike, Warns Against Risky Ethereum Scaling – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoStrategy to keep STRC Fund Pegged to $100 – Crypto News

-

others1 week ago

others1 week agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

others1 week ago

others1 week agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

Cryptocurrency1 week ago

Russia’s $85 Billion Sberbank to Launch Crypto Custody Services – Crypto News

-

Technology1 week ago

Technology1 week agoEurope’s answer to ChatGPT? Mistral adds voice and research features to Le Chat AI – Crypto News

-

De-fi1 week ago

De-fi1 week agoU.S. House Passes Clarity, GENIUS, and Anti-CBDC Acts With Historic Bipartisan Support for Crypto – Crypto News

-

Technology1 week ago

Technology1 week agoMalicious code found in fake coding extensions used to steal crypto – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoXRP Price Spikes to Record Highs As Momentum Signals Extended Gains – Crypto News

-

Technology1 week ago

Technology1 week agoMeta’s AI Studio: Red flag or red herring? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoWhy Bitcoin self-custody is declining in the ETF era – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoUS House passes three key crypto bills; market reaction muted as Bitcoin dips – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Cap Hits $4 Trillion Milestone as US House Passes Landmark Bills – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoArthur Hayes-linked wallet bags $2M worth of AAVE and LDO in an OTC deal – Crypto News

-

others6 days ago

Why Is The Crypto Market Rising Today? – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoHow to Use Google Gemini to Turn Crypto News Into Trade Signals – Crypto News

-

others6 days ago

Breaking: Polymarket Reenters US Market With Exchange Acquisition As Probe Ends – Crypto News

-

others5 days ago

others5 days agoEUR/CHF rises on speculation of SNB intervention, but EU–US trade risks cap gains – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoSolana Clinches 5-Month High, Where to From Here? – Crypto News

-

Technology5 days ago

Technology5 days agoGrab up to 43% off on best selling premium laptops from Apple, Asus and more – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoXRP Could Skyrocket 500% Against Bitcoin, Analyst Warns – Crypto News

-

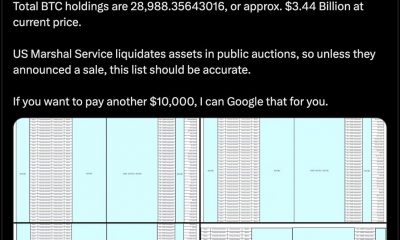

De-fi1 week ago

De-fi1 week agoU.S. Marshals Peg Federal Bitcoin Holdings at 28,988 Tokens Worth $3.4 B – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoNasdaq Exchange Files SEC Form to List Staking Ethereum ETF – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoEthereum price surges 6% to $2,800 as shorts suffer amid $500M crypto liquidation – Crypto News

-

Technology1 week ago

Technology1 week agoOnePlus Pad 3 with Snapdragon 8 Elite SoC makes its India debut, set to go on first sale in September – Crypto News

-

others1 week ago

others1 week agoStreaming Service Handing $3,400,000 To Current and Former Customers To Settle Illegal Data Harvesting Allegations – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoFriday charts: Fiscal dominance and super intelligence – Crypto News

-

De-fi1 week ago

De-fi1 week agoTrump’s Crypto Assets Now Comprise a Key Part of Family Fortune Worth Billions – Crypto News

-

Business1 week ago

Pi Coin Price Technical Analysis Confirms Buy Signal Despite 2M Exchange Inflows – Crypto News

-

Technology1 week ago

Technology1 week agoNot Google or Bing! This search engine lets you block AI images in search results – Crypto News

-

Cryptocurrency7 days ago

GENIUS Act Is The Catalyst For XRP And RLUSD’s Dominance, Expert Declares – Crypto News

-

De-fi6 days ago

De-fi6 days agoNasdaq Files to Add Staking to BlackRock’s ETH ETF – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoTo The Moon? Justin Sun To Be Launched Into Space After $28M Bid – Crypto News

![Nifty 50 Index Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/05/Nifty-50-Index-Elliott-Wave-technical-analysis-Video-Crypto-400x240.jpg)

![Nifty 50 Index Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/05/Nifty-50-Index-Elliott-Wave-technical-analysis-Video-Crypto-80x80.jpg)