others

Pound Sterling rallies on robust UK Employment data, US Inflation eyed – Crypto News

- Pound Sterling jumps strongly on upbeat UK labor market data, higher wage growth.

- The growth in average earnings was higher than expected, allowing BoE to maintain a hawkish narrative.

- The US inflation data will guide further action in the GBP/USD pair.

The Pound Sterling (GBP) discovers a stellar buying interest in Tuesday’s early European session as the United Kingdom Office for National Statistics (ONS) has reported upbeat employment data for the three months ending December. The labor demand remains upbeat, and Average Earnings rose at a higher pace than the expectations of market participants.

Hiring from UK employers remained strong as business owners are optimistic about the economic outlook due to receding recession fears, easing price pressures, and hopes of rate cuts by the Bank of England (BoE).

While wage growth momentum was higher than market expectations, the pace was slower than readings in the three months ending December. This indicates that progress in the labor cost declining towards the required 2% target level has slowed. It suggests the BoE will be able to maintain an argument in favor of keeping interest rates at their current level for a more extended period. This has boosted the Pound Sterling as higher interest rates tend to attract more foreign inflows.

Investors brace for higher volatility in the GBP/USD pair as the United States Bureau of Labor Statistics (BLS) will report January’s Consumer Price Index (CPI) data on Tuesday. The appeal for the GBP/USD will strengthen if the inflation data remains softer than expected. The US Dollar would face a sell-off as soft inflation data would allow the Fed to adopt a dovish interest rate stance sooner, which will increase foreign outflows

Daily Digest Market Movers: Pound Sterling jumps on upbeat labor demand

- Pound Sterling witnesses strong buying interest as the United Kingdom ONS has reported upbeat Employment data for three months ending December.

- The Unemployment Rate falls significantly to 3.8% against expectations of 4.0% and the prior reading of 4.2%.

- UK employers recruited 72K workers in December, similar to 73K labor additions in November.

- In January, Claimant Count Change were higher at 14.1K against 5.5K reading in December.

- The reduction in Average Earnings (both with and without bonuses) for three months ending December was slower than expected, which is expected to allow Bank of England policymakers to push back expectations of early rate cuts.

- Average Earnings Excluding Bonus’ grew by 6.2% against expectations of 6.0% and the former release of 6.7% (revised from 6.6%). The economic data including bonuses rose at a higher pace of 5.8% against the consensus of 5.6% but remained slower than the prior reading of 6.7% (revised from 6.5%).

- The outlook for the Pound Sterling remains upbeat as investors hope the BoE will start reducing its benchmark rates after the Federal Reserve (Fed).

- The CME FedWatch tool shows that the Fed will start unwinding its restrictive monetary policy stance in May.

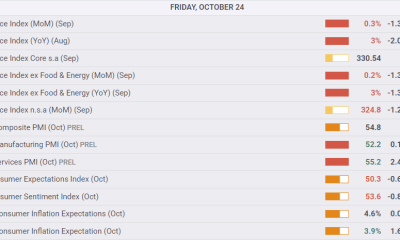

- The current outlook on interest rates by the Fed will be impacted after the release of the United States inflation data for January, which will be published at 13:30 GMT.

- According to the estimates, the headline inflation grew at a slower pace of 3.0% against 3.4% in December. In the same period, core inflation that excludes volatile food and oil prices decelerated slightly to 3.8% from 3.9%.

- Investors anticipate the monthly headline rose steadily by 0.2% and core inflation fell by 0.3%.

- A soft inflation report would raise expectations of an early rate cut by the Fed in January.

Technical Analysis: Pound Sterling sets to refresh weekly high above 1.2660

Pound Sterling advances vertically to 1.2640 on upbeat labor market data. The GBP/USD pair aims to print a fresh weekly high above 1.2655. The asset aims to sustain above the 50-day Exponential Moving Average (EMA), which trades around 1.2636. The outlook for the Pound Sterling would strengthen if it climbs above the 20-day EMA, which trades near 1.2660.

The 14-period Relative Strength Index (RSI) rebounds from 40.00, which indicates that market participants have utilized the correction as a buying opportunity. A bullish momentum would emerge if the RSI (14) climbs above 60.00.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data.

Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates.

When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money.

When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP.

A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoStripe’s stablecoin biz seeks national bank trust charter – Crypto News

-

Technology1 week ago

Technology1 week agoApple launches MacBook Pro 14-inch with M5 chip in India, price starts at ₹1,69,900 – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoTech is valued as if AI is the next smartphone. It isn’t. – Crypto News

-

Technology6 days ago

Technology6 days agoChatGPT remains the most popular chatbot globally but Google’s Gemini is catching up fast – Crypto News

-

Business1 week ago

Dogecoin Gets Major Utility Boost as Trump-Linked Thumzup Prepares DOGE Payments – Crypto News

-

others5 days ago

‘Floki Is The CEO’: FLOKI Surges Over 20% After Elon Musk’s Name Drop – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Are These Ripple (XRP) ETF Filings the Worst Idea Ever? Analyst Explains – Crypto News

-

Business1 week ago

Fed’s Stephen Miran Calls for Rapid Rate Cuts Amid U.S.-China Trade Tensions – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoIs Wave 5 Still Coming or a New Bull Trend Emerging? – Crypto News

-

Technology1 week ago

XRP News: Ripple Strikes Deal with Absa, Expanding Custody Footprint To Africa – Crypto News

-

Business1 week ago

Pi Coin Price Gears for Recovery as DEX and AMM Launch Revives Utility Hopes – Crypto News

-

others1 week ago

Cardano’s Charles Hoskinson Addresses Allegations of Diverting Treasury Funds – Crypto News

-

others5 days ago

others5 days agoRisk-off sentiment drives selective equity positioning – BNY – Crypto News

-

others5 days ago

others5 days agoAUD/USD rises on US-China trade hopes, Fed rate cut outlook – Crypto News

-

Technology5 days ago

Technology5 days agoAmazon Web Services outage: Here’s how many users are impacted and the downtime costs – Crypto News

-

others5 days ago

Ethereum Price Targets $8K Amid John Bollinger’s ‘W’ Bottom Signal and VanEck Staked ETF Filing – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoChatGPT ‘adult model’ plan: OpenAI’s Sam Altman reacts to criticism, says ‘not elected moral police’ – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoVisa Says Stablecoins Are Powering ‘a New Lending Space’ – Crypto News

-

Business1 week ago

Building Through the Downturn – Why Smart Money Is Watching XYZVerse – Crypto News

-

Business1 week ago

Gold vs Bitcoin – Peter Schiff Declares BTC Has Failed as Digital Gold, CZ Reacts – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoGhana Moves Toward Crypto Regulation Amid Rising User Adoption – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoAll About AI Tech4Good Awards are back for the second edition. Apply Now! – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCrypto markets turn red after Trump threatens to halt cooking oil imports from China – Crypto News

-

others1 week ago

others1 week agoUSD/JPY strengthens as Trump’s softer stance on China boosts US Dollar demand – Crypto News

-

De-fi1 week ago

De-fi1 week agoStripe-Backed Tempo Blockchain Raises $500 Million in Series A – Crypto News

-

others7 days ago

Shiba Inu Price Eyes Recovery as Burn Rate Jumps 10,785% – Can SHIB Hit $0.000016? – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoTrump Confirms Meeting With Xi Jinping on Oct 31, Markets Rally in Response – Crypto News

-

Business5 days ago

How Will “Unusual” US CPI Inflation Data Release Could Impact Fed Rate Cut, Crypto Market? – Crypto News

-

Technology5 days ago

Technology5 days agoAWS says it has fixed the problem that crippled half the internet but many popular apps are still down – Crypto News

-

Business5 days ago

Binance Founder CZ Predicts Bitcoin Will Flip Gold’s $30 Trillion Market – Crypto News

-

Business4 days ago

Solana Price Eyes $240 Recovery as Gemini Launches SOL-Reward Credit Card – Crypto News

-

Blockchain4 days ago

Blockchain4 days agoXRP Whales Flood Binance With Massive Deposits – Selling Pressure Mounts – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCoinbase Plans to List Surging BNB After Previously Delisting Binance Stablecoin – Crypto News

-

![Nifty 50 Index Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/05/Nifty-50-Index-Elliott-Wave-technical-analysis-Video-Crypto-400x240.jpg)

![Nifty 50 Index Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/05/Nifty-50-Index-Elliott-Wave-technical-analysis-Video-Crypto-80x80.jpg) others1 week ago

others1 week agoDow Jones holds onto recovery levels as investors focus on earnings – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Slides for Second Day as Bitcoin Dips Amid Geopolitical Tensions – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHow to Create A Meme Coin For Free On Solana – Crypto News

-

others1 week ago

others1 week agoEUR/USD rests 50-DMA after holding 1.1540 support – Société Générale – Crypto News

-

De-fi1 week ago

De-fi1 week agoLighter Distributes Points to Users Affected by Platform Outage – Crypto News

-

De-fi1 week ago

De-fi1 week agoSony Enters U.S. Crypto Banking Race Amid Growing Institutional Interest – Crypto News

-

Business1 week ago

BlackRock Dumps Bitcoin and Adds Ethereum Amid Crypto Market Crash – Crypto News

-

others1 week ago

others1 week agoEUR/USD slips as Trump softens China tariff stance, US Dollar recovers – Crypto News

-

others1 week ago

others1 week agoDow Jones takes one last bullish swing for the week – Crypto News

-

others1 week ago

Stripe-backed Tempo Hires Ethereum Researcher Dankrad Feist After $500M Funding – Crypto News

-

others7 days ago

others7 days agoGold crashes 2% from record high as Trump tempers threats on China – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoEthena (ENA) Price Outperforming: Only Reason – Crypto News

-

Technology7 days ago

Technology7 days agoPerplexity AI tops app charts on Google Play Store and Apple App Store, outpaces ChatGPT and Gemini – Crypto News

-

others7 days ago

others7 days agoWe should not cut rates every quarter, but rate-cutting cycle not over – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoAI is making jobs, not taking them – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoAster price tanks 20% as sell-off pressure hits altcoins – Crypto News

-

others5 days ago

Data Shows Bitcoin Short Squeeze Likely With Speculation of “Bullish” US CPI – Crypto News