Cryptocurrency

Prediction markets surge to new highs as Neutrl unlocks hidden yield – Crypto News

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

Happy Thanksgiving, everyone! Prediction markets are exploding with record volumes, billion dollar raises and new players shaking up the landscape. At the same time, Neutrl is opening up one of the strongest and least talked about yield opportunities in crypto, and early numbers are already turning heads. Plenty to be thankful for in the middle of this market chop.

Market Update

Since my last update on prediction markets, the space has only gotten more competitive. New entrants want a slice of the rapidly growing pie, and the race for dominance now feels like a full-blown fundraising arms race. Kalshi’s valuation jumped to $11 billion after announcing a $1 billion round, following the NYSE’s $2 billion investment in Polymarket at a $9 billion valuation. Polymarket is already in early conversations to raise at a $12 billion to $15 billion valuation, suggesting that the market is heating up faster than expected.

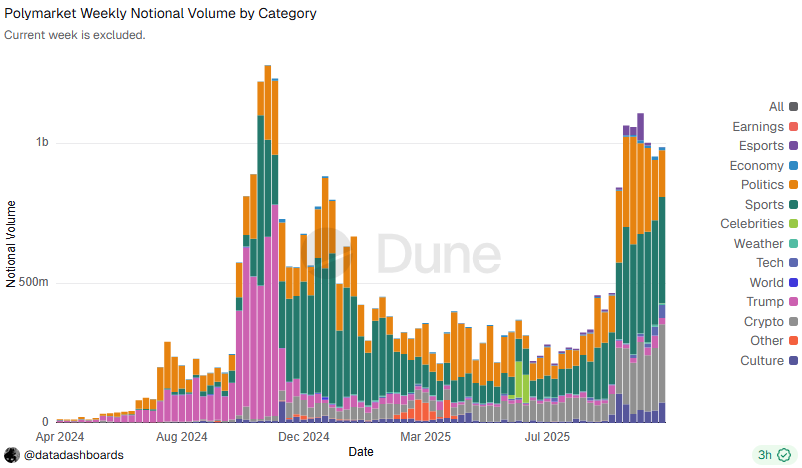

On the activity side, weekly volumes have broken past previous all-time highs, hitting $3.68 billion two weeks ago, which is 2.4x above last year’s election peak. A major reason for this surge is a new entrant called Opinion Labs. Backed by investors like YZi Labs, the platform is already doing close to one third of total volumes across prediction markets.

However, most of this growth appears to be farming-driven. Opinion Labs is running a points program, and the data quickly shows it. One market alone, titled Will Satoshi move any Bitcoin in 2025, has done $1.28 billion in volume, which accounts for 32% of its total notional volume. It is not the type of market one would expect to generate that level of activity organically. Despite the volume surge, Opinion Labs only represents 14% of total open interest, another sign of inorganic participation.

Looking across categories, Polymarket has a more balanced distribution with Sports, Crypto, and Politics making up 38%, 28%, and 17%, respectively, of last week’s volumes.

On Kalshi, Sports is the clear story, with 85.5% of weekly volumes coming from that category. Regardless of platform, it is now undeniable that Sports is becoming the primary driver of prediction market growth.

One protocol well positioned to benefit from this trend is Sire, which we covered in a research piece recently. Sire functions as an onchain sports betting hedge fund that captures inefficiencies in sports odds. It does this by using Score Subnet’s AI models that extract alpha directly from gameplay footage. In the last 32 days, the agent has executed $267,700 in volume on an initial vault size of $500,000, with an average win rate of 58% and weekly returns on traded volume near 10%.

What is clear is that this market is just getting started. With FanDuel preparing to launch its own prediction product, the next phase will reveal whether this becomes a winner-take-all environment or whether different platforms carve out their own niches in Sports, Crypto and beyond.

How Neutrl is cracking open the OTC market

Amid the ups and downs of the market, innovative protocols continue to emerge, and one that has stood out to me recently is Neutrl. It introduced NUSD, a synthetic dollar built on top of OTC arbitrage, funding rate inefficiencies and market neutral strategies. These sources of yield usually sit behind OTC desks or require constant hands-on management, but Neutrl wraps them into a product that everyday users can access.

Around 20% of deposits are deployed into hedged OTC positions. Neutrl acquires discounted locked tokens from early investors, foundations or teams, then hedges them in perps markets to capture the spread. Discounts vary depending on the lockup period, and can reach well above 50%.

This strategy benefits from the supply overhang in crypto markets and performs best in bearish periods when locked token holders under pressure are willing to accept deeper discounts just to access liquidity.

Source: https://app.stix.co/listings

Source: https://app.stix.co/listings

60% of the portfolio runs delta neutral strategies similar to the ones popularized by Ethena. These strategies hold spot exposure while shorting perpetuals to collect funding payments and basis spreads. The remaining share of the portfolio is held in liquid reserves such as USDC, USDT and USDe, which supports redemptions and cushions volatility.

The strategy seems to be working. Based on Neutrl’s first epoch results, the effective APY sits at 16.58%, compared with 5.12% on sUSDe. The difference comes from the OTC component, where the unrealized APR on deployed capital currently sits at 42%. OTC yield is proving to be a powerful source of return, especially in an environment where buyers can negotiate steep discounts.

The protocol launched on Plasma in October and the initial deposit cap of $50 million was filled in 20 minutes, which prompted the team to raise the cap by $25 million a few days after. Since removing the caps on Nov. 10, total deposits now sit at $125 million. Beyond yield, depositors accumulate XPL incentives, Neutrl Points and UpShift points. With NUSD set to integrate with Pendle, speculation around point values could increase TVL further.

Neutrl benefits from a team with experience across both TradFi and DeFi, and it is backed by STIX, one of the largest OTC desks in the industry. That relationship likely gives Neutrl preferred access to locked token flow. Still, no strategy comes without risk. The main concern is the management of the short legs of these trades, especially in the event of auto deleveraging on perp platforms, which could leave the protocol with a naked long position. There is also the question of how scalable returns will remain as TVL grows.

Even with these uncertainties, Neutrl is one of the more compelling protocols I’ve come across in the last six months, and one worth keeping an eye on as it scales.

Get the news in your inbox. Explore Blockworks newsletters:

-

Blockchain7 days ago

Blockchain7 days agoThe Quantum Clock Is Ticking on Blockchain Security – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoWould you raise an AI pet? India’s new digital companions are here – Crypto News

-

Technology1 week ago

Technology1 week agoHow Americans are using AI at work, according to a new Gallup poll – Crypto News

-

Technology1 week ago

Technology1 week agoHow Americans are using AI at work, according to a new Gallup poll – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTether Launches Dollar-Backed Stablecoin USAT – Crypto News

-

Metaverse4 days ago

Metaverse4 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoWould you raise an AI pet? India’s new digital companions are here – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRiver Crypto Token Up 1,900% in the Last Month—What’s the Deal? – Crypto News

-

Metaverse3 days ago

Metaverse3 days agoStop panicking about AI. Start preparing – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoWould you raise an AI pet? India’s new digital companions are here – Crypto News

-

others1 week ago

others1 week agoUS Heiress Slaps Billion-Dollar Lawsuit on Banks for Allegedly Aiding the Looting of Her $350,000,000 Trust Fund – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTrump-Backed WLFI Snaps Up 2,868 ETH, Sells $8M WBTC – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTrump-Backed WLFI Snaps Up 2,868 ETH, Sells $8M WBTC – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoUS Storm Smashes Bitcoin Mining Power, Sending Hash Rates Tumbling – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIs AI eating up jobs in UK? New report paints bleak picture – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTrump family-backed American Bitcoin achieves 116% BTC yield – Crypto News

-

Metaverse4 days ago

Metaverse4 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Business1 week ago

New $2M Funding Reveals Ethereum Foundation’s New Threat – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Gets the Macro Bug as $87,000 Comes Into Play – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoMakinaFi hit by $4.1M Ethereum hack as MEV tactics suspected – Crypto News

-

Technology1 week ago

Technology1 week agoHow Americans are using AI at work, according to a new Gallup poll – Crypto News

-

others1 week ago

others1 week agoPBOC sets USD/CNY reference rate at 6.9843 vs. 6.9929 previous – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoKalshi Expands Political Footprint with DC Office, Democratic Hire – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRiver price defies market downturn, explodes 40% to new ATH – Crypto News

-

Metaverse4 days ago

Metaverse4 days agoContext engineering and the Future of AI-powered business – Crypto News

-

others1 week ago

New $2M Funding Reveals Ethereum Foundation’s New Threat – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoAAVE drops 10% – Assessing if $1 trillion in loans can spark rebound – Crypto News

-

Technology1 week ago

Fed Rate Cut Odds in January Crash to 99% Ahead of Dollar Yen Intervention- Will BTC React? – Crypto News

-

Cryptocurrency1 week ago

Fed Rate Cut Odds in January Crash to 99% Ahead of Dollar Yen Intervention- Will BTC React? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Gets the Macro Bug as $87,000 Comes Into Play – Crypto News

-

Business1 week ago

Bitcoin and XRP Price At Risk As US Govt. Shutdown Odds Reach 73% – Crypto News

-

Business1 week ago

Bitcoin and XRP Price At Risk As US Govt. Shutdown Odds Reach 73% – Crypto News

-

Business1 week ago

Bitcoin Sentiment Weakens BTC ETFs Lose $103M- Is A Crash Imminent? – Crypto News

-

Business1 week ago

Japan Set to Launch First Crypto ETFs as Early as 2028: Nikkei – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRYO Digital Announces 2025 Year-End Milestones Across Its Ecosystem – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRiver Crypto Token Up 1,900% in the Last Month—What’s the Deal? – Crypto News

-

Business1 week ago

Experts Advise Caution As Crypto Market Heads Into A Bearish Week Ahead – Crypto News

-

Business1 week ago

Experts Advise Caution As Crypto Market Heads Into A Bearish Week Ahead – Crypto News

-

Blockchain1 week ago

Blockchain1 week ago‘Most Reliable’ Bitcoin Price Signal Hints at a 2026 Bull Run – Crypto News

-

Technology1 week ago

Bitcoin And XRP Price Prediction Ahead of FOMC Meeting Tomorrow, Jan 28 – Crypto News

-

Technology1 week ago

Bitcoin And XRP Price Prediction Ahead of FOMC Meeting Tomorrow, Jan 28 – Crypto News

-

Technology1 week ago

Bitcoin And XRP Price Prediction Ahead of FOMC Meeting Tomorrow, Jan 28 – Crypto News

-

Business1 week ago

Bitcoin Faces Renewed Volatility as Investors Explore Options Like Everlight – Crypto News

-

Technology1 week ago

Technology1 week agoElon Musk says ‘WhatsApp is not secure’ amid Meta privacy lawsuit; Sridhar Vembu cites ‘conflict of interest’ – Crypto News

-

Technology1 week ago

Fed Rate Cut Odds in January Crash to 99% Ahead of Dollar Yen Intervention- Will BTC React? – Crypto News

-

Business1 week ago

Bitcoin and XRP Price At Risk As US Govt. Shutdown Odds Reach 73% – Crypto News

-

others1 week ago

U.S. Shutdown Odds Hit 78% as CLARITY Act Faces Fresh Uncertainty – Crypto News

-

others1 week ago

others1 week ago478,188 Americans Warned After Hackers Strike Government-Related Firm Handling Sensitive Personal Data – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCZ Won’t Return to Binance, Bullish on Bitcoin Supercycle – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana (SOL) Slips Further As Bears Target Deeper Support Zones – Crypto News