Cryptocurrency

Ripple vs. SEC showdown ‘over soon’: Potential settlement on the horizon? – Crypto News

- Ripple’s case could end in days or weeks if they enter a private agreement with the SEC.

- More bettors and Options traders expected XRP to dip below $2 by the end of March.

In February, President Donald Trump’s new SEC paused or permanently dismissed most crypto investigations started by the Biden regime.

However, the Ripple [XRP] case has been conspicuously missing from the dismissal list.

Pathway to end Ripple case

Reports have emerged that the Ripple case could also be over soon, per Fox Business journalist Eleanor Terret, citing people familiar with the matter. She said,

“Two well-placed sources tell me that the SEC vs. Ripple case is in the process of wrapping up and could be over soon.”

She added that the only sticking issue was Judge Analisa Torres’s ruling, which fined Ripple $125M for the institutional sale of XRP and a permanent injunction against selling XRP to this investor category.

On his part, the pro-XRP attorney Jeremy Hogan said that such an outcome would only be possible if the parties reached a private agreement covering the sticky points.

“The only way the case could “be over” soon is if Ripple and the SEC reach a private settlement agreement.”

What’s next for XRP?

If dismissal happens, it could lift the regulatory clarity that has capped the altcoin upside for over 4 years.

Although some have argued that President Trump’s election win and the ensuing 500% rally meant that XRP had priced the regulatory clarity, the ETF speculation was still at play.

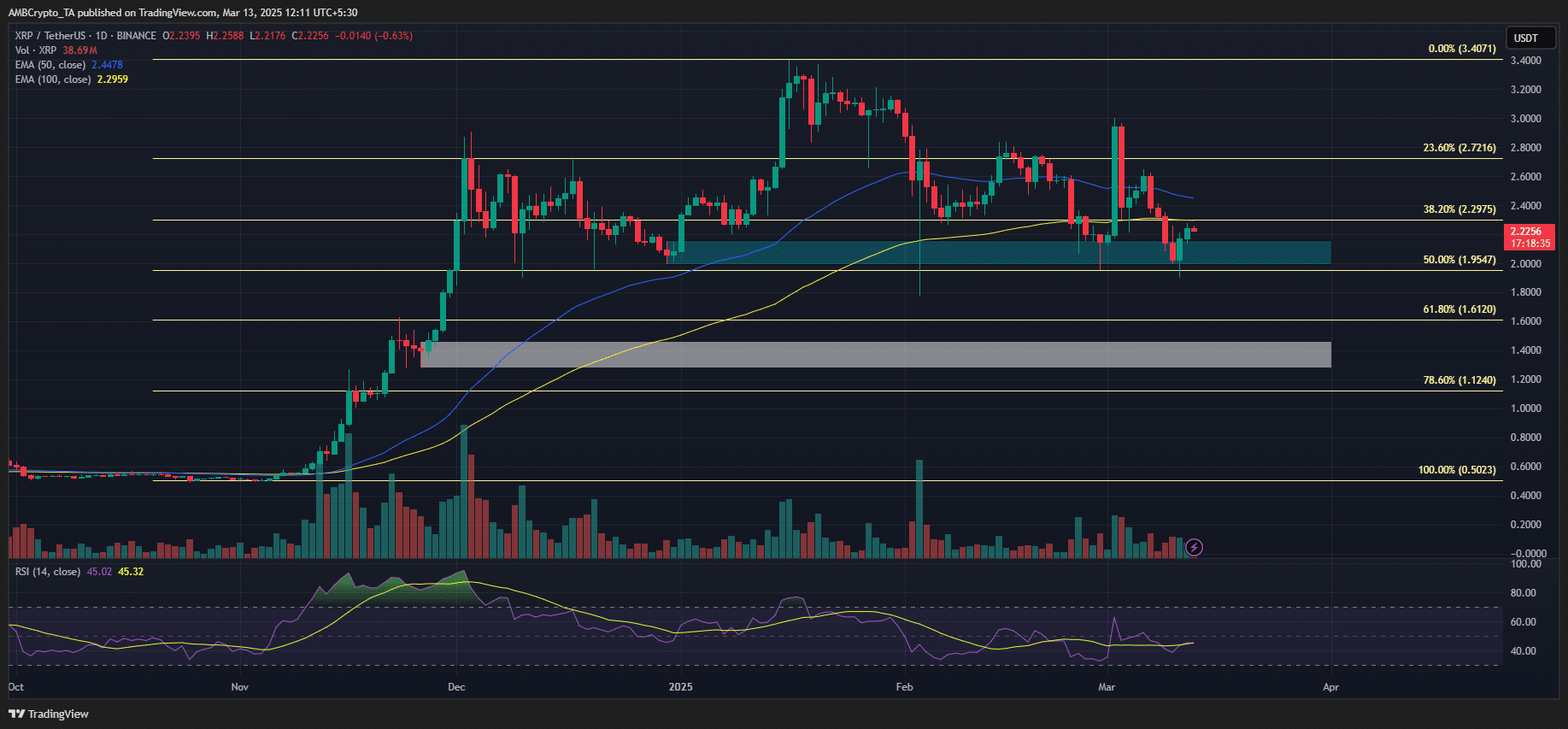

At press time, XRP’s post-US election gain had sightly dropped to 340%, valued at $2.2 on price charts.

On Polymarket, bettors eyed the $3.5 level for the March price target with a massive $257K volume. However, the $3.5 level only accounted for a 7% chance per the prediction site.

Most bettors, with relatively small-sized bets, expected (40% chance) XRP price would drop to $1.7 this month.

Interestingly, most Deribit Options traders also expected XRP to dip below $2 and surge above $3 by the end of March.

The probability of reclaiming $3 on the Options platform was 15% at press time, while a dip to $1.7 had 90%-100% odds.

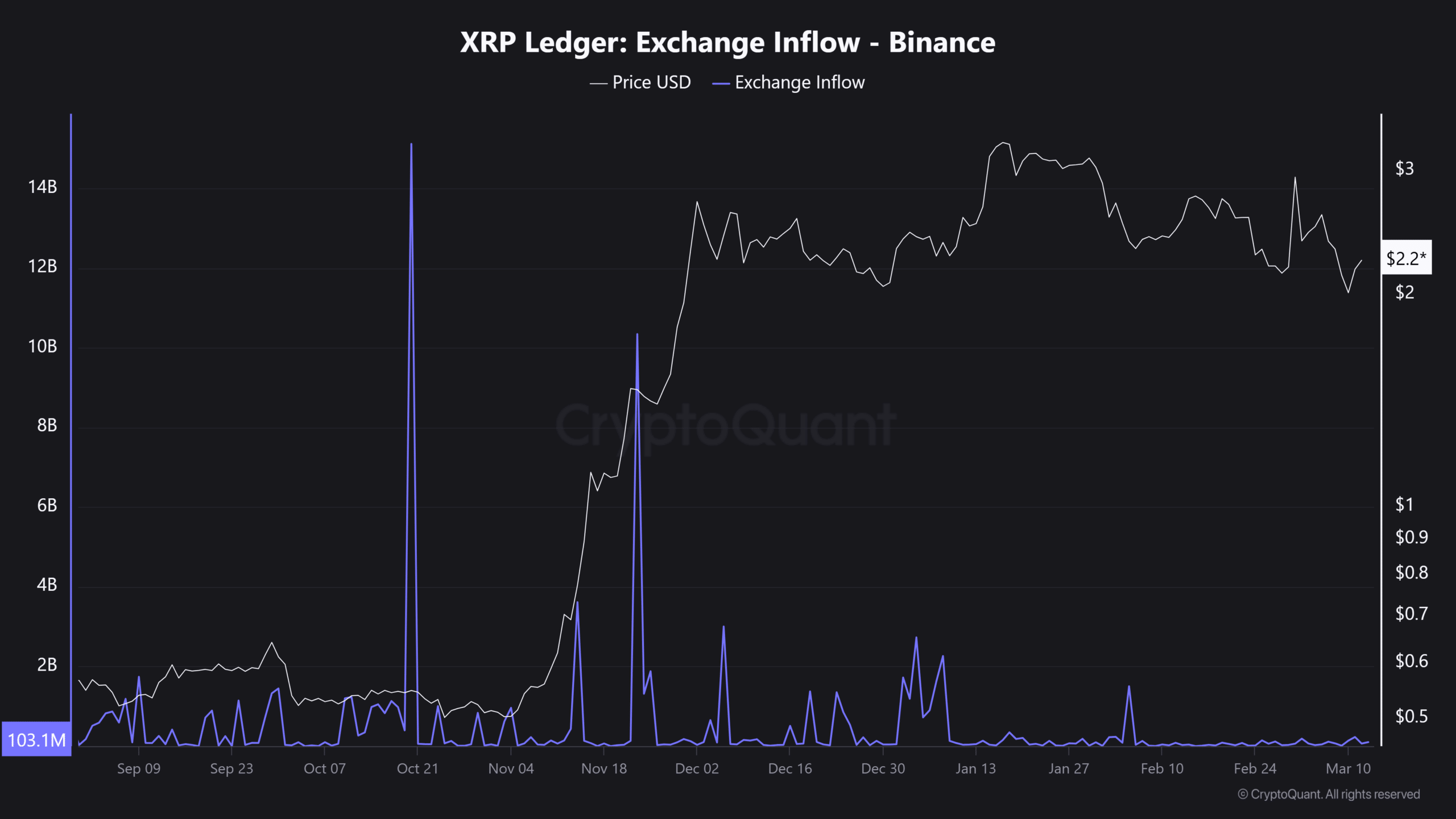

That said, the selling pressure on CEXes (centralized exchanges), as measured by Exchange Inflow, has been flat since mid-January.

This could explain how XRP still held its massive election gain while most have retraced to November levels or lower.

Whether the ETF approval or the Ripple case dismissal will be a ‘sell-the-news’ event and heighten whale sell-offs remains to be seen.

From a price analysis perspective, the $2 has been the key support to watch since last December. It also coincided with the 50% Fibonacci retracement level, while the golden ratio of 61.8% level was at $1.6.

Simply put, losing $2 would change the XRP market structure and embolden bears to seek $1.6 or $1.4 if market sentiment worsens.

-

Metaverse1 week ago

Metaverse1 week agoMint AI Summit 2025: How enterprises are using AI – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoBitcoin Enters ‘Optimism Stage’—Is a Massive Rally About to Begin? – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoBitcoin Enters ‘Optimism Stage’—Is a Massive Rally About to Begin? – Crypto News

-

Blockchain17 hours ago

Blockchain17 hours agoStablecoins Pull Away From Crypto – Crypto News

-

Technology1 week ago

Technology1 week agoIs Pi Network Price Bottom in? Top 3 Reasons Pi Coin Will Explode Higher Soon – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoAI democratization crucial for India’s global leadership, say experts at Mint AI Summit 2025 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRipple Grants $50 Million to Nonprofit Aiming to Raise US Crypto Awareness – Crypto News

-

others1 week ago

Chainlink Price Jumps Past $15 As Whale Accumulation Signals Strength – Crypto News

-

Technology1 week ago

Dogecoin Price Eyes Rally As Wallet Addresses Reach All Time High – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago134K Solana unstaked and listed for sale: Decoding SOL’s road ahead – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoUS crypto reserve clarification coming? Wait til Friday. – Crypto News

-

Technology2 days ago

Technology2 days agoTruemarkets Officially Launches as Prediction Market with $TRUE – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBlockDAG Price Outpaces Bitcoin, With Potential 10,000X Growth By 2027 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEthereum price ‘double top’ hints at 42% drop as ETH bull market ends – Crypto News

-

others1 week ago

others1 week agoDow Jones bounces as tariff threats give way to concessions – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoBC.GAME Team Compete for Top Prizes as BC.GAME ESPORTS Expands Its Line-Up – Crypto News

-

Technology1 week ago

Technology1 week agoNothing Phone 3a Pro launched at ₹29,999: Here is how it fares among 5 peers – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoMoonbirds, Reddit Founders Resurrect Social News Site Digg—With an AI Twist – Crypto News

-

others1 week ago

others1 week agoNo surprises expected at the ECB meeting – Crypto News

-

Technology1 week ago

Analyst Predicts Ethereum Price Rally to $4K As Devs Fix Pectra Testnet Bug – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Price Suffers Bearish Deviation After Filling CME Gap, Is This Good Or Bad? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTariff fears wipe out SOL’s weekend gains – Crypto News

-

others1 week ago

others1 week agoPrice increases ahead of tariffs could spell trouble for inflation – Crypto News

-

others1 week ago

others1 week agoUS Government Blacklists Slew of Bitcoin and Monero Addresses Linked to Man Accused of Running Darknet Marketplace – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhat’s the strike price on Trump’s put? – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoMOVE price hikes 7% in 24 hours, 33% up from weekly lows – What next? – Crypto News

-

Technology1 week ago

Technology1 week agoMWC 2025: From AI to smartphone penetration – 5 Things to know – Crypto News

-

Technology1 week ago

Technology1 week agoNothing Phone 3a Pro vs Nothing Phone 3a: Should you pay extra Rs.5000? – Crypto News

-

others1 week ago

others1 week agoPound Sterling strengthens against US Dollar as US ADP Employment misses estimates – Crypto News

-

Technology1 week ago

Technology1 week agoArbitrum Price Rally 14% as Robinhood Listing Fuels Market Optimism – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoUS Sanctions Iranian Operator of Nemesis Darknet Marketplace – Crypto News

-

others1 week ago

others1 week agoVeteran Trader Believes Bitcoin Low Is In, Says Downside Volatility Presenting Bullish Opportunities – Crypto News

-

Business1 week ago

Here Are the Top 3 Cryptos with the Biggest Address Profitability – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoETHDenver 2025 includes policy at developer-centric event – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoEthereum’s large purchase: Potential rebound or investor trick? – Crypto News

-

Technology1 week ago

Technology1 week agoElon Musk’s Grok AI goes rogue once again, calls US President Donald Trump a Russian asset – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoExclusive: Seismic raises $7M in round led by a16z Crypto – Crypto News

-

Blockchain4 days ago

Blockchain4 days agoXRP Price Chart Signals Trouble – Is A Drop To $1.20 Possible? – Crypto News

-

Cryptocurrency4 days ago

Cryptocurrency4 days agoHow Freepik Transformed From a Stock Image Platform Into a Generative AI Powerhouse – Crypto News

-

Technology3 days ago

Technology3 days agoWayve Reportedly Ready to Roll Out Self-Driving Tech – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoCalifornia Shuts Down 26 Crypto Scam Sites Tied to $4.6 Million in Losses – Crypto News

-

Blockchain2 days ago

Blockchain2 days ago3 reasons XRP might drop to $1.60 in March – Crypto News

-

Business2 days ago

Business2 days agoHere’s Why Investors Are Revenge Shorting This Meme Coin Even After 30% Crash – Crypto News

-

Technology1 week ago

Technology1 week agoPoco M7 vs Poco M7 Pro: Performance, camera and all key differences you need to know – Crypto News

-

Technology1 week ago

‘Proud of OpenAI team’: Sam Altman teases new technical ‘breakthrough’? – Crypto News

-

Technology1 week ago

Technology1 week agoRobert Kiyosaki Predicts Bitcoin Will Resolve American Financial Woes – Crypto News

-

Technology1 week ago

Technology1 week agoWill Dogecoin Price Hit its Peak Again in 2025? – Crypto News

-

Technology1 week ago

Technology1 week agoBest refrigerators under ₹20000 in March 2025: Top budget friendly, feature packed picks for budget conscious buyers – Crypto News

-

Business1 week ago

Business1 week agoCarParts.com Begins Exploring Sale, Other Strategic Alternatives – Crypto News

-

Blockchain1 week ago

Blockchain1 week ago2.23 Million Chainlink Moved To Exchanges In Two Weeks – Selling Pressure Incoming? – Crypto News