Cryptocurrency

RVNL Share Price Target 2025, 2030, 2040- Good Investment? – Crypto News

Rail Vikas Nigam Limited (NSE: RVNL) is a major stakeholder in India’s railway infrastructure industry. Investors have a strong interest the company because if the Indian government’s move to invest significant resources to modernize the country’s train system. RVNL is a public sector company that works for the Ministry of Railways. Its main job is to implement projects including electrification, signaling, and high-speed lines.

As a financial market analyst closely following India’s public sector companies, I believe the RVNL Share Price Target deserves serious attention. In this analysis, I will share my outlook for 2025, 2030, and 2040, highlighting the key factors that could drive or limit its growth. By the end, you’ll have a clear view of my professional opinion on whether RVNL is a good long-term investment.

As India’s rail budget grows, RVNL’s will likely stays on the growth path. However, the market still faces relative instability and there are still risks associated with its ability to execute in good time. This article discusses RVNL share prices as of October 2025 and looks at its current performance, historical trends, expert predictions, and factors that could influence investment.

RVNL Stock Live Today

RVNL stock has been on an unexciting ride over the last two weeks, creating jitters among investors. The stock trades at ₹325 as of this writing. In the last ten trading sessions, the shares stayed in a small range between lows of ₹326 and highs of ₹337. However, the broader market was also troubled, with benchmark Nifty and Sensex indices both declining in late October because of uncertainties around US-China and US-India trade relations. .

On the positive side, the company got a few major contracts that improved the near-term sentiment. An example was the ₹165 crore project from North Eastern Railway, announced on October 27. In the near-term, the RVNL share price trajectory depends on a number of events that could impact sentiment. In particular, the Q2 FY26 earnings figures coming out on November 11 are getting a lot of attention. The results could either cause a rebound or make the market even more volatile.

If earnings rise more than expected and railway budget allocations go up, we may see a push toward ₹340 soon. On the other hand, if the results are weak, the market could become choppy because investors will still be uneasy. Economic Times and ET Now report that RVNL is still resilient overall. However, investors will need to keep a close eye on the earnings results that are coming up next to be better informed to decide what to do.

The 52-week range demonstrates significant swings, with RVNL share price going as low as ₹301.60 and as high as ₹501.80. The market cap is around ₹68,628 crore, and the price-to-earnings ratio is around 46, which is above the industry average. This also means that the valuations are stretched. In addition, the stock is trading below its 50-day moving average, which is a sign of negative pressure in the short term.

RVNL Share Price History

Government-funded rail infrastructure projects are the backbone of RVNL’s business. In fact, the government’s strong investment in the railway sector is what has caused RVNL stock to rise so quickly in recent years.

With its massive order book, RVNL is able to significantly reduce risk. According to a recent stock summary from Tickertape, the company’s total order book was over ₹1,01,000 crores (about $11.5 billion) as of the first quarter of FY’26.

Meanwhile, StockAnalysis.com’s daily records show that prices have been between ₹303 and ₹369 from January to October 2025. New orders have helped push prices up, but global economic constraints and rising costs have subdued gains. A notable driver was an early-2025 MoU with a Dubai-based company, which momentarily boosted optimism.

Smart-Investing, on the other hand, points out that the company faces the inherent problems of government projects. These include possible delays in execution and growing costs, which can put pressure on profit margins.

RVNL 2025 Forecast

According to Investing.com’s technical assessment, analysts are still cautious about the short-term outlook, with resistance levels set at ₹340–350. Meanwhile, an analysis by The Economic Times says that RVNL could see its net profit margins rise from their present levels to roughly 6.43% if it keeps up its high execution rate. Some models suggest the price could reach the ₹500-550 range.

RVNL stock price daily chart as of November 4, 2025 showing a recent break below the Volume Weighted Moving Average (VWMA). Source: TradingView

RVNL Share Price Target 2030

With India’s rail infrastructure development having gathered a strong momentum, RVNL share price forecasts 2030 paint a bright picture. For instance, Investing.com’s analysis projects ₹1,612, driven by a steady growth in profit at an average rate of 15.89% and favourable government policy boosts like increased budgetary allocations and rail electrification. Some analysts targets are more bullish and range between ₹1,800-₹2,000. Based on these forecasts, a target of ₹1,500-₹2,000 seems more realistic for 2030.

RVNL Share Price Target 2040

Projecting RVNL Share Price Target 2040 means seeing the company at the centre of India’s developed economy. However, in order to maintain its current level of success over the next fifteen years, the corporation will need to evolve into something more than just an executor of government projects.

Much of its success will depend on its ability to win more high-margin engineering, procurement, and construction projects. That will also involve growing its business internationally, and becoming a leader in integrating railway technology.

If it realizes these requirements, RVNL Share Price Target could go well above ₹3,000. However, this figure is only possible if GDP growth stays high and infrastructure spending gets ongoing governmental support.

On the other hand, structural developments like privatization, new technologies, and strong competition could lower value.

RVNL Stock Investment Strategy

According to IDBI Capital’s report, RVNL’s strong order book through projects like Dedicated Freight Corridors, gives it a strong stake in India’s rail development. The key advantages include government backing and dividend yields of 1-2%. On the other hand, the disadvantages include a reliance on railways for more than 90% of revenue, delays in execution and high PE ratios.

Despite its recent slowdown, RVNL stock is still a great long-term investment for people who want to be part of India’s long-term growth in infrastructure. The company’s strong balance sheet, substantial promoter holding, and the government’s promise to modernize the train system all make for a strong base. A smart move right now would be to buy on dips to lower the cost, rather than making a big, one-time investment.

In Summary

In summary, the long-term outlook for RVNL stock looks good, and the company stands to gain multiple times its initial investment if its infrastructure plans come to fruition. However, because of near-term challenges and concerns about the stock’s value, it is only a moderate hold for patient investors.

Why is RVNL share price falling?

RVNL share price has fallen by about 2% in the last five sessions, reflecting a broader market weakness in the railway sector amid profit booking and concerns about high valuation.

What is the future of RVNL share price?

RVNL offers promising long-term growth, assuming policy stability. Backed by government contracts and a strong order book from Dedicated Freight Corridors (IDBI capital), it’s a moderate hold despite valuation concerns.

What is RVNL’s main competitive advantage?

RVNL’s primary edge is its status as a public corporation and its role as the dedicated project execution arm for the Ministry of Railways. This ensures a strong pipeline of mega-projects, giving it significant long-term revenue inflow.

-

Blockchain1 week ago

Blockchain1 week agoXRP Price Gains Traction — Buyers Pile In Ahead Of Key Technical Breakout – Crypto News

-

Technology1 week ago

Technology1 week agoSam Altman says OpenAI is developing a ‘legitimate AI researcher’ by 2028 that can discover new science on its own – Crypto News

-

Technology1 week ago

Technology1 week agoBenQ MA270U review: A 4K monitor that actually gets MacBook users right – Crypto News

-

De-fi1 week ago

De-fi1 week agoBittensor Rallies Ahead of First TAO Halving – Crypto News

-

Technology1 week ago

Technology1 week agoGiving Nvidias Blackwell chip to China would slash USs AI advantage, experts say – Crypto News

-

Technology1 week ago

Technology1 week agoMicrosoft ‘tricked users into pricier AI-linked 365 plans,’ says Australian watchdog; files lawsuit – Crypto News

-

De-fi1 week ago

De-fi1 week agoAI Sector Rebounds as Agent Payment Systems Gain Traction – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBig Iran Bank Goes Bankrupt, Affecting 42 Million Customers – Crypto News

-

Business1 week ago

Crypto Market Rally: BTC, ETH, SOL, DOGE Jump 3-7% as US China Trade Talks Progress – Crypto News

-

others1 week ago

others1 week agoBank of Canada set to cut interest rate for second consecutive meeting – Crypto News

-

Business1 week ago

Business1 week agoStarbucks Says Turnaround Strategy Drives Growth in Global Sales – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoIBM Set to Launch Platform for Managing Digital Assets – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana Eyes $210 Before Its Next Major Move—Uptrend Or Fakeout Ahead? – Crypto News

-

De-fi1 week ago

De-fi1 week agoREP Jumps 50% in a Week as Dev Gets Community Support for Augur Fork – Crypto News

-

Technology1 week ago

Technology1 week agoDonald Trump as Halo Master Chief? White House joins GameStop’s ‘End of Console Wars’ celebration – Crypto News

-

others1 week ago

others1 week agoGBP/USD floats around 1.3320 as softer US CPI reinforces Fed cut bets – Crypto News

-

others5 days ago

others5 days agoMETA stock has lower gaps to fill – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoWhat Happens When You Don’t Report Your Crypto Taxes to the IRS – Crypto News

-

Business1 week ago

Crypto ETFs Attract $1B in Fresh Capital Ahead of Expected Fed Rate Cut This Week – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Edges Lower While US Stocks Hit New Highs – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Phones Struggle as Solana Quietly Pulls Plug on Saga – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWestern Union eyes stablecoin rails in pursuit of a ‘super app’ vision – Crypto News

-

Technology1 week ago

Pi Coin Price Jumps 24% as 10M Tokens Exit Exchanges – Can Bulls Sustain the Momentum? – Crypto News

-

others1 week ago

Pi Coin Gains Another 15% As Pi Network Joins ISO 20022 For Seamless Banking Integration – Crypto News

-

others1 week ago

Crypto Market Tumbles as Jerome Powell Says December Rate Cut ‘Far From Certain’ – Crypto News

-

De-fi1 week ago

De-fi1 week agoBitcoin Dips Under $110,000 After Fed Cuts Rates – Crypto News

-

De-fi1 week ago

De-fi1 week agoMetaMask Fuels Airdrop Buzz With Token Claim Domain Registration – Crypto News

-

De-fi1 week ago

De-fi1 week agoTokenized Nasdaq Futures Enter Top 10 by Volume on Hyperliquid – Crypto News

-

others1 week ago

Is Changpeng “CZ” Zhao Returning To Binance? Probably Not – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCitigroup and Coinbase partner to expand digital-asset payment capabilities – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoInside Bitwise’s milestone solana ETF launch – Crypto News

-

others1 week ago

Can ASTER Price Rebound 50% as Whale Activity and Bullish Pattern Align? – Crypto News

-

others1 week ago

others1 week agoGold weakens as US-China trade optimism lifts risk sentiment, focus turns to Fed – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoGold Price Forecast 2025, 2030, 2040 & Investment Outlook – Crypto News

-

Metaverse1 week ago

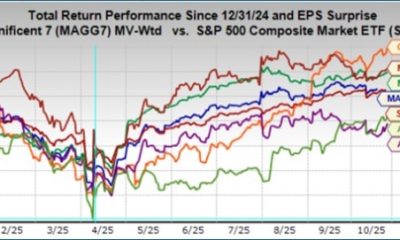

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

De-fi1 week ago

De-fi1 week agoCRO Jumps After Trump’s Truth Social Announces Prediction Market Partnership with Crypto.Com – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoKERNEL price goes vertical on Upbit listing, hits $0.23 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Is Pi Network’s (PI) Price Up by Double Digits Today? – Crypto News

-

Cryptocurrency1 day ago

Cryptocurrency1 day agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCrypto Analyst Shows The Possibility Of The Ethereum Price Reaching $16,000 – Crypto News

-

Business1 week ago

$2.5T Citigroup Partners With Coinbase to Enable Stablecoin Payments – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoArgentine Stablecoin Use Surged Ahead of President Milei’s Midterm Election Win – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

Cryptocurrency1 week ago

Is Stock Tokenization Really Exploding? Not Even 0.01% – Crypto News

-

Technology1 week ago

Breaking: $2.6B Western Union Announces Plans for Solana-Powered Stablecoin by 2026 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoVisa To Support Four Stablecoins on Four Blockchains – Crypto News

-

Cryptocurrency5 days ago

After 1,993% Burn Spike, Is Shiba Inu Price Set for a Major Trend Reversal? – Crypto News

-

Cryptocurrency1 week ago

XRP News: Ripple-Backed Evernorth Amasses Over $1B in XRP Ahead of Nasdaq Listing – Crypto News

-

others1 week ago

others1 week agoPreviewing Mag 7 earnings: What investors should know – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoHayes’ Zcash ‘Vibe Check’ Sparks 30% Moonshot – Crypto News