Cryptocurrency

SEC: Gemini, Genesis Blended Deposits, Ran Afoul of Securities Law – Crypto News

Mark Genesis and Gemini down as the latest crypto companies accused — and charged — by the SEC of improperly handling customer funds shuffled between the two firms.

In a Thursday complaintsthe US securities regulator alleged that Genesis “pooled” digital assets from investors in Gemini’s yield-bearing investment suite, Gemini Earn, with funds from other customers in a somewhat complex and allegedly improper lending arrangement.

Both companies are accused of violating federal financial law, in part, because of that setup, which the SEC claimed involved billions of dollars of digital assets, “primarily from US retail investors.” The mechanism, per the regulator, resulted in a number of unregistered crypto securities.

Though the SEC’s charges are unique to Genesis and Gemini, the allegations appear to bear at least one key resemblance to those against Sam Bankman-Fried’s Alameda Research and FTX: Customer funds were improperly mixed and mingled, resulting in “significant harm.” And the charges, in one more commonality, claim that harm was intensified by Genesis’ November 2022 move to freeze withdrawals.

Purported retail harm center stage

Much of the regulator’s complaint is centered around allegations that both companies caused significant damage to retail customers — with Genesis “otherwise engaged in crypto asset transactions with large institutional and other accredited investors.” Social media pushes undertaken by Genesis and Gemini fueled retail exposure and amplified investor pitfalls, the SEC said.

Genesis is then said to have deployed the assets, primarily by lending them out to those same institutional borrowers — in a bid to drum up revenue. It was not immediately clear if those alleged efforts deepened in tandem with crypto’s ongoing bear market.

The measures also included revenue that became requisite to divest out interest to Gemini investors, the original source of the funding, according to the complaint.

SEC says billions of dollars in balance

As a requirement to participate in the exchange’s Earn program, Genesis and Gemini allegedly enforced a requirement for customers: to enter into a tri-party “Master Digital Asset Loan Agreement.”

The arrangement, in the SEC’s estimation, boils down to Earn customers coughing up crypto to Genesis with Gemini purportedly stepping in as an “issuing agent.” Gemini “received, pooled, deployed, and paid interest on investors’ assets,” the regulator said.

Through the first quarter of 2022 alone, Gemini reportedly raked in about $2.7 million in fees accordingly. Through October of last year, effective interest rates for Gemini’s yield-bearing customers clocked in as high as 8.1%, per the regulator, adding that Gemini’s fee on assets “tendered to Genesis” ranged from .06% to 4.3%, varying with the type of cryptocurrency in question.

Hundreds of thousands of investors were affected, according to an SEC statements,

The regulator claims that Genesis, a subsidiary of crypto conglomerate Digital Currency Group (DCG), from December 2020 onwards struck a deal with Gemini to offer the exchange’s customers an option to earn interest on their deposits.

By February 2021, Genesis and Gemini had allegedly begun offering Gemini yield-bearing digital assets products to retail investors, namely in the US, Hong Kong and later Singapore, with customers tendering digital assets to the lender. Gemini facilitated those transactions, per the US financial watchdog.

As of November 2022, roughly 340,000 retail investors, mostly residing in the US, had digital assets invested with Genesis through Earn.

latest gemini wrinkle

Gemini co-founder Cameron Winklevoss levied accusations against DCG CEO Barry Silbert and Genesis for “false statements and misrepresentations” last week revolving around Genesis’s solvency and financial health. Winklevoss blames DCG and its subsidiary for harming those hundreds of thousands of retail investors.

The SEC says that the main investment play in question — Gemini Earn — constitutes an offer and sale of securities under US law and should have been registered with the regulator.

“Crypto intermediaries need to comply with our securities laws,” SEC head Gary Gensler tweeted on thursday. “This protects investors. It promotes trust in markets. It’s not optional. It’s the law.

Gemini, the centralized cryptocurrency exchange founded by the Winklevoss twins, terminated its interest-bearing program on Wednesday after Genesis allegedly failed to return $900 million of outstanding assets.

“While the Gemini Earn program has been terminated, both Genesis and Gemini continue to do business in the crypto asset industry,” the SEC said. Genesis had intended to dive back into related lending, the regulator added.

Gemini, meanwhile, “continues to hold billions of dollars’ worth of crypto assets on behalf of retail investors in connection with its trading platform and other activity in this industry.”

Both Gemini and Genesis remained in a position — and planned to — to violate the same SEC requirements if they were not “restrained” from doing so again, the regulator said.

The SEC is after permanent injunctive relief and disgorgement of ill-gotten gains, plus prejudgment interest and civil penalties. Representatives for both firms did not immediately return a request for comment.

Michael Bodley contributed reporting.

Updated Jan. 12, 7:03 pm ET: Adds additional context to allegations relating to Genesis and Gemini’s lending to institutional borrowers and provides additional details of accusations of retail investor harm.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.

Interested in working at Blockworks? We’re hiring journalists, a VP of Sales, and engineers! Check our open positions,

Can’t wait? Get our news the fastest way possible. Join us on Telegram,

-

![DIS Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/06/DIS-Elliott-Wave-technical-analysis-Video-Crypto-News-400x240.jpg)

![DIS Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/06/DIS-Elliott-Wave-technical-analysis-Video-Crypto-News-80x80.jpg) others1 week ago

others1 week agoSkies are clearing for Delta as stock soars 13% on earnings beat – Crypto News

-

![DIS Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/06/DIS-Elliott-Wave-technical-analysis-Video-Crypto-News-400x240.jpg)

![DIS Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/06/DIS-Elliott-Wave-technical-analysis-Video-Crypto-News-80x80.jpg) others1 week ago

others1 week agoSkies are clearing for Delta as stock soars 13% on earnings beat – Crypto News

-

others1 week ago

Will Ethereum Price Rally to $3,200 as Wall Street Pivots from BTC to ETH – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoInsomnia Labs Debuts Stablecoin Credit Platform for Creators – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoAnt Group Eyes USDC Integration Circle’s: Report – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTornado Cash Judge Won’t Let One Case Be Mentioned in Roman Storm’s Trial: Here’s Why – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Rally Possible If Senate Web3 Crypto Summit Goes Well – Crypto News

-

others1 week ago

others1 week agoUSD/CAD trades with positive bias below 1.3700; looks to FOMC minutes for fresh impetus – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoKraken and Backed Expand Tokenized Equities to BNB Chain – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin Breaks New Record at $111K, What’s Fueling the $120K Price Target? – Crypto News

-

Technology1 week ago

XRP Eyes $3 Breakout Amid Rising BlackRock ETF Speculation – Crypto News

-

Business6 days ago

PENGU Rallies Over 20% Amid Coinbase’s Pudgy Penguins PFP Frenzy – Crypto News

-

Technology1 week ago

Solana Meme Coin PNUT Rallies 10% Amid Elon Musk’s Statement – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoIs ETH Finally Ready to Shoot For $3K? (Ethereum Price Analysis) – Crypto News

-

Blockchain1 week ago

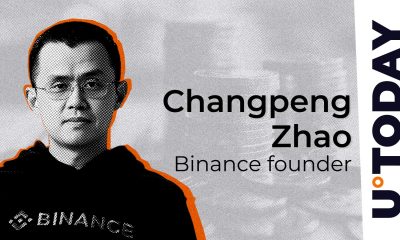

Blockchain1 week agoBinance Founder Backs BNB Treasury Company Aiming For US IPO – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEthereum Bulls Roar — $3K Beckons After 5% Spike – Crypto News

-

Business1 week ago

Did Ripple Really Win XRP Lawsuit Despite $125M Fine? Lawyer Fires Back at CEO – Crypto News

-

others1 week ago

others1 week agoEUR/GBP posts modest gain above 0.8600 ahead of German inflation data – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoXRP price forecast as coins surges 2.19% to $2.33 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSUI Chart Pattern Confirmation Sets $3.89 Price Target – Crypto News

-

Technology7 days ago

Breaking: SharpLink Purchases 10,000 ETH from Ethereum Foundation, SBET Stock Up 7% – Crypto News

-

others7 days ago

others7 days agoEUR/GBP climbs as weak UK data fuels BoE rate cut speculation – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoBitcoin Hits All-Time High as Crypto Legislation Votes Near – Crypto News

-

Blockchain4 days ago

Blockchain4 days agoRobinhood Dealing With Fallout of Tokenized Equities Offering – Crypto News

-

Cryptocurrency4 days ago

Cryptocurrency4 days agoWhale Sells $407K TRUMP, Loses $1.37M in Exit – Crypto News

-

Business1 week ago

Metaplanet Trading Volume Hits $12.8B Amid Digital Bank Acquisition Plans – Crypto News

-

others1 week ago

others1 week agoRBA Governor Bullock discusses policy outlook after the surprise interest rate-hold – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBulls In Control But Resistance Persists at $2.30. What Next? – Crypto News

-

Technology1 week ago

GameSquare Stock Shoots 58% After Revealing $100 Million Ethereum Treasury Strategy – Crypto News

-

others1 week ago

others1 week agoAustralian Dollar remains stronger due to persistent inflation risks, FOMC Minutes eyed – Crypto News

-

others1 week ago

others1 week agoUS Dollar Resurgence May Be Around the Corner, According to Barclays Currency Strategist – Here’s Why: Report – Crypto News

-

others1 week ago

Trump Jr. Backed Thumzup Media To Invest In ETH, XRP, SOL, DOGE And LTC – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin Hits Record Peak. How High Can It Surge in 2025? – Crypto News

-

Technology1 week ago

VC Firm Ego Death Capital Closes $100M Funding to Back Bitcoin-Based Projects – Crypto News

-

Cryptocurrency1 week ago

Tokenized Securities Are Still Securities, US SEC Warns Robinhood, Kraken – Crypto News

-

others1 week ago

others1 week agoNovaEx Launches with a Security-First Crypto Trading Platform Offering Deep Liquidity and Institutional-Grade Infrastructure – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoAustralia Banks Join Digital Currency Trial for Tokenized Assets – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoHow Brands Can Deepen Customer Connections in the Metaverse – Crypto News

-

others1 week ago

others1 week agoAnthony Scaramucci Says $180,000 Bitcoin Price Explosion Possible As BTC ‘Supremacy’ Creeps Up – Here’s His Timeline – Crypto News

-

Technology1 week ago

Technology1 week agoPerplexity launches Comet, an AI-powered browser to challenge Google Chrome; OpenAI expected to enter the space soon – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin Breaks New Record at $111K, What’s Fueling the $120K Price Target? – Crypto News

-

Business1 week ago

US Senate To Release CLARITY Act Draft Next Week – Crypto News

-

others1 week ago

others1 week ago$687,220,000 in Bitcoin Shorts Liquidated in Just One Hour As BTC Explodes To $116,000 – Crypto News

-

Business6 days ago

Business6 days agoS&P Global Downgrades Saks Global’s Credit Rating – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle’s worst nightmare? OpenAI’s new AI web browser is coming soon to challenge Chrome – Crypto News

-

Technology1 week ago

Technology1 week ago10 Smartchoice tablets from top brands, curated for everyday use, up to 45% off before Amazon Prime Day Sale – Crypto News

-

others1 week ago

China’s Ant Group With 1.4B Users Taps Circle to Integrate USDC – Crypto News

-

Business1 week ago

XRP Ledger (XRPL) EVM Sidechain Sees 1,400 Smart Contracts Deployed in First Week Of Launch – Crypto News

-

Business1 week ago

Just In: DeFi Development Corp. Adds 47,272 SOL, Now Holds $103M In Solana – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin crash narrative returns as geopolitical tensions mount – Crypto News