De-fi

Sui DEX Momentum Teases Expansion Plans After Hitting $100 Million in Daily Volume – Crypto News

Momentum has surpassed $150 million in TVL, and now plans to bring over EVM and Solana projects to Sui using the Wormhole bridge.

Daily trading volume on Momentum Finance, a decentralized exchange (DEX) on the Sui blockchain, has surpassed $100 million.

As of press time, Momentum’s total value locked stands at $156.4 million, ranking it as the sixth-largest protocol and the largest DEX on the Sui network, according to data from DefiLlama. Sui’s decentralized finance (DeFi) ecosystem has also continued to expand, with total TVL reaching $2.26 billion and the stablecoin market cap surpassing $1 billion.

In a press release shared with The Defiant, Momentum noted that its TVL first crossed the $100 million mark on June 26, and its daily swap volume reached the same milestone less than a month later.

Momentum’s team told The Defiant that the rebound reflects the resilience of the Sui network and the ability of infrastructure players to respond quickly.

Founder Wendy Fu said the exchange experienced sharp growth following its March 31 launch, adding that trading volume jumped by more than 1.2 million percent — from about $7,000 in late March to over $90 million by late April — as new users entered the Sui ecosystem. Fu pointed out that Momentum focused on “attracting fresh liquidity from outside the Sui ecosystem – rather than cannibalizing what was already circulating within it.”

Cetus Exploit

The growth follows a major security breach in May that targeted Cetus Protocol, a competing DEX on Sui. The attackers exploited a mathematical error in the project’s smart contract code, resulting in a loss of approximately $260 million in cryptocurrency.

The team later froze around $160 million of the stolen funds and promised to return the money to liquidity providers once a forensic investigation is complete.

Commenting on that incident, Fu said the exploit was a “pivotal moment for the entire Sui ecosystem. We dropped from $67M TVL to $42M overnight after reopening our DEX.”

To address user concerns, Momentum coordinated with the Sui Foundation and Mysten Labs to “reinforce security across the board, initiated additional audits, and implemented new protocol-level safeguards.” Following the upgrade, Fu claims the exchange’s TVL recovered “in just five days.”

Expanding Beyond Sui

Momentum uses the ve(3,3) model, which aims to balance incentives for liquidity providers and future MMT governance token holders. The team says this mechanism helps ensure consistent liquidity by aligning incentives around active price ranges.

Fu told The Defiant that the DEX “absolutely” has plans to expand beyond Sui, though a specific timeline wasn’t revealed.

“As for expansion beyond Sui: absolutely. From day one, we’ve envisioned Momentum as a multichain ve(3,3) DEX, taking cues from what Velodrome built on Optimism,” Fu said.

The team is now collaborating with the Wormhole cross-chain bridge to facilitate the integration of EVM and Solana-based protocols onto Sui using the upcoming NTT bridge. Despite those plans, Fu emphasized that Momentum is “fully committed to making Sui the best entry point for sustainable on-chain liquidity.”

-

Blockchain1 week ago

Blockchain1 week agoXRP Price Gains Traction — Buyers Pile In Ahead Of Key Technical Breakout – Crypto News

-

Technology1 week ago

Technology1 week agoSam Altman says OpenAI is developing a ‘legitimate AI researcher’ by 2028 that can discover new science on its own – Crypto News

-

Technology1 week ago

Technology1 week agoGiving Nvidias Blackwell chip to China would slash USs AI advantage, experts say – Crypto News

-

Technology1 week ago

Technology1 week agoBenQ MA270U review: A 4K monitor that actually gets MacBook users right – Crypto News

-

others1 week ago

others1 week agoBank of Canada set to cut interest rate for second consecutive meeting – Crypto News

-

De-fi1 week ago

De-fi1 week agoBittensor Rallies Ahead of First TAO Halving – Crypto News

-

De-fi1 week ago

De-fi1 week agoAI Sector Rebounds as Agent Payment Systems Gain Traction – Crypto News

-

Business1 week ago

Crypto Market Rally: BTC, ETH, SOL, DOGE Jump 3-7% as US China Trade Talks Progress – Crypto News

-

Business1 week ago

Business1 week agoStarbucks Says Turnaround Strategy Drives Growth in Global Sales – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoIBM Set to Launch Platform for Managing Digital Assets – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoWhat Happens When You Don’t Report Your Crypto Taxes to the IRS – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana Eyes $210 Before Its Next Major Move—Uptrend Or Fakeout Ahead? – Crypto News

-

De-fi1 week ago

De-fi1 week agoREP Jumps 50% in a Week as Dev Gets Community Support for Augur Fork – Crypto News

-

Technology1 week ago

Technology1 week agoDonald Trump as Halo Master Chief? White House joins GameStop’s ‘End of Console Wars’ celebration – Crypto News

-

Technology1 week ago

Pi Coin Price Jumps 24% as 10M Tokens Exit Exchanges – Can Bulls Sustain the Momentum? – Crypto News

-

others1 week ago

others1 week agoGBP/USD floats around 1.3320 as softer US CPI reinforces Fed cut bets – Crypto News

-

others5 days ago

others5 days agoMETA stock has lower gaps to fill – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Phones Struggle as Solana Quietly Pulls Plug on Saga – Crypto News

-

Business1 week ago

Crypto ETFs Attract $1B in Fresh Capital Ahead of Expected Fed Rate Cut This Week – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Edges Lower While US Stocks Hit New Highs – Crypto News

-

others1 week ago

Pi Coin Gains Another 15% As Pi Network Joins ISO 20022 For Seamless Banking Integration – Crypto News

-

others1 week ago

Crypto Market Tumbles as Jerome Powell Says December Rate Cut ‘Far From Certain’ – Crypto News

-

Cryptocurrency1 day ago

Cryptocurrency1 day agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

De-fi1 week ago

De-fi1 week agoBitcoin Dips Under $110,000 After Fed Cuts Rates – Crypto News

-

De-fi1 week ago

De-fi1 week agoMetaMask Fuels Airdrop Buzz With Token Claim Domain Registration – Crypto News

-

De-fi1 week ago

De-fi1 week agoTokenized Nasdaq Futures Enter Top 10 by Volume on Hyperliquid – Crypto News

-

others1 week ago

Is Changpeng “CZ” Zhao Returning To Binance? Probably Not – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCitigroup and Coinbase partner to expand digital-asset payment capabilities – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoInside Bitwise’s milestone solana ETF launch – Crypto News

-

others1 week ago

Can ASTER Price Rebound 50% as Whale Activity and Bullish Pattern Align? – Crypto News

-

Cryptocurrency9 hours ago

Cryptocurrency9 hours agoMany Crypto Treasury Companies Were a Get-Rich-Quick Trap, Warns Columbia Professor – Crypto News

-

others1 week ago

others1 week agoGold weakens as US-China trade optimism lifts risk sentiment, focus turns to Fed – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoGold Price Forecast 2025, 2030, 2040 & Investment Outlook – Crypto News

-

Metaverse1 week ago

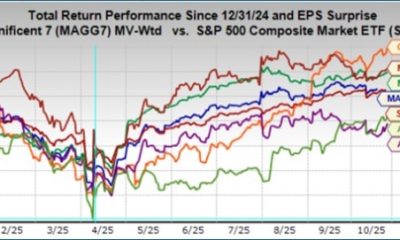

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

De-fi1 week ago

De-fi1 week agoCRO Jumps After Trump’s Truth Social Announces Prediction Market Partnership with Crypto.Com – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoKERNEL price goes vertical on Upbit listing, hits $0.23 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Is Pi Network’s (PI) Price Up by Double Digits Today? – Crypto News

-

Cryptocurrency5 days ago

After 1,993% Burn Spike, Is Shiba Inu Price Set for a Major Trend Reversal? – Crypto News

-

Cryptocurrency1 day ago

Cryptocurrency1 day agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCrypto Analyst Shows The Possibility Of The Ethereum Price Reaching $16,000 – Crypto News

-

Business1 week ago

$2.5T Citigroup Partners With Coinbase to Enable Stablecoin Payments – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoArgentine Stablecoin Use Surged Ahead of President Milei’s Midterm Election Win – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

Cryptocurrency1 week ago

Is Stock Tokenization Really Exploding? Not Even 0.01% – Crypto News

-

Technology1 week ago

Breaking: $2.6B Western Union Announces Plans for Solana-Powered Stablecoin by 2026 – Crypto News

-

Business1 week ago

BNB Chain’s Future Growth Won’t Come From DEXs – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoVisa To Support Four Stablecoins on Four Blockchains – Crypto News

-

Cryptocurrency1 week ago

XRP News: Ripple-Backed Evernorth Amasses Over $1B in XRP Ahead of Nasdaq Listing – Crypto News

-

others1 week ago

others1 week agoPreviewing Mag 7 earnings: What investors should know – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoHayes’ Zcash ‘Vibe Check’ Sparks 30% Moonshot – Crypto News