Business

Tether Excluded as MiCA Clears 10 Stablecoin Issuers In Europe – Crypto News

The European Union (EU) has approved ten stablecoin issuers under the Markets in Crypto-Assets (MiCA) regulations. This marks a key step in the bloc’s approach to cryptocurrency regulation. However, the absence of Tether (USDT), the largest stablecoin by market capitalization, has raised concerns about regulatory priorities and the potential consequences for the digital asset market.

Tether Misses Out as EU Grants MiCA Approval to 10 Stablecoin Providers

The largest stablecoin issuer, Tether, was noticeably absent from the list of ten firms authorized under MiCA regulations to issue stablecoins in the EU. The approved entities include Banking Circle, Circle, Crypto.Com, Fiat Republic, Membrane Finance, Quantoz Payments, Schuman Financial, Societe Generale, StabIR, and Stable Mint. These firms have issued ten euro-pegged stablecoins and five US dollar-pegged stablecoins.

Despite Tether’s $141 billion market capitalization, the company did not receive approval, which means crypto platforms have begun delisting USDT for EU-based users.

Alongside stablecoin issuers, 11 MiCA-authorized Crypto-Asset Service Providers (CASPs) were approved across Germany, the Netherlands, and Malta. These providers offer services in trading, exchange, execution, custody, and transfers within the EU regulatory framework.

Expanding Operations Beyond the EU

With growing regulatory restrictions in the EU, Tether has continued to expand its operations in other regions. The stablecoin issuer recently proposed to acquire a 51% stake in a South African energy company, signaling a shift in focus toward investments outside of digital assets.

Tether’s exclusion from MiCA-approved stablecoin issuers raises questions about the EU’s regulatory approach. The company expressed disappointment over the decision, stating that the delistings were “hasty and unwarranted.” However, MiCA’s rules require stablecoin issuers to meet specific compliance standards.

Similarly, Tether has expanded into the sports industry, recently investing in Juventus to strengthen its presence in mainstream sectors. This move aligns with its broader strategy of integrating digital assets, AI, and biotech into traditional industries.

MiCA Rules To Isolate the EU Crypto?

Industry experts caution that the strict regulations under MiCA could isolate the EU’s digital asset market. Natalia Łątka, Director of Public Policy and Regulatory Affairs at Merkle Science, suggested that the EU’s regulatory stance may discourage foreign firms from operating in the region. She also noted that local crypto companies could consider relocating outside the EU to avoid restrictions associated with MiCA compliance.

Additionally, some analysts argue that the EU’s regulatory focus on compliance over innovation could reduce market competitiveness. While MiCA aims to provide clarity and stability, critics believe it may lead to fewer options for European crypto users. This pushes firms toward jurisdictions with more flexible regulations.

<!–

–>

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

<!–

–>

-

Technology1 week ago

Technology1 week agoChip Designer Arm Plans to Become Chip Manufacturer – Crypto News

-

Cryptocurrency3 days ago

Cryptocurrency3 days agoSUI eyes 24% rally as bullish price action gains strength – Crypto News

-

others6 days ago

others6 days agoJapanese Yen remains depressed amid modest USD strength; downside seems limited – Crypto News

-

Technology1 week ago

Technology1 week agoMacBook Air M3 15-inch model gets a ₹12,000 price drop on Amazon: Deal explained – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoCoinbase scores major win as SEC set to drop lawsuit – Crypto News

-

others1 week ago

Japan Foreign Investment in Japan Stocks declined to ¥-384.4B in February 7 from previous ¥-315.2B – Crypto News

-

Technology1 week ago

Technology1 week agoPerplexity takes on ChatGPT and Gemini with new Deep Research AI that completes most tasks in under 3 minutes – Crypto News

-

Technology1 week ago

Technology1 week agoLava Pro Watch X with 1.44-inch AMOLED display, in-built GPS launched in India at ₹4,499 – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoXRP Set To Outshine Gold? Analyst Predicts 1,000% Surge – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoAdvisers on crypto: Takeaways from another survey – Crypto News

-

others1 week ago

others1 week agoRemains subdued below 1.4200 near falling wedge’s lower threshold – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago0xLoky Introduces AI-powered Intel for Crypto Data & On-chain Insights – Crypto News

-

Technology1 week ago

Technology1 week agoFactbox-China’s AI firms take spotlight with deals, low-cost models – Crypto News

-

Technology1 week ago

Technology1 week agoMassive price drops on Samsung Galaxy devices: Up to ₹10000 discount on Watch Ultra, Tab S10 Plus, and more – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTether Acquires a Minority Stake in Italian Football Giant Juventus – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP To 3 Digits? The ‘Signs’ That Could Confirm It, Basketball Analyst Says – Crypto News

-

others1 week ago

others1 week agoAustralian Dollar jumps to highs since December on USD weakness – Crypto News

-

Technology1 week ago

Technology1 week agoWeekly Tech Recap: JioHotstar launched, Sam Altman vs Elon Musk feud intensifies, Perplexity takes on ChatGPT and more – Crypto News

-

Technology1 week ago

Technology1 week agoWhat will it take for India to become a global data centre hub? – Crypto News

-

Technology1 week ago

Technology1 week agoChatGPT vs Perplexity: Sam Altman praises Aravind Srinivas’ Deep Research AI; ‘Proud of you’ – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoNEAR Breaks Below Parallel Channel: Key Levels To Watch – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoWill BTC Rebound Or Drop To $76,000? – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoXRP Price Settles After Gains—Is a Fresh Upside Move Coming? – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoHow AI will divide the best from the rest – Crypto News

-

Business6 days ago

Business6 days agoWhat Will be KAITO Price At Launch? – Crypto News

-

Business6 days ago

Business6 days agoElon Musk’s DOGE Launches Probe into US SEC, Ripple Lawsuit To End? – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoXRP Price Pulls Back From Highs—Are Bulls Still in Control? – Crypto News

-

Business5 days ago

Business5 days agoWhales Move From Shiba Inu to FXGuys – Here’s Why – Crypto News

-

Technology1 week ago

Technology1 week agoBest phones under ₹20,000 in February 2025: Poco X7, Motorola Edge 50 Neo and more – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoPopular Investor Says Memecoin More Superior With ‘World’s Best Chart’ – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWho is Satoshi Nakamoto, The Creator of Bitcoin? – Crypto News

-

Technology1 week ago

Technology1 week agoGrok 3 is coming! Elon Musk announces launch date, promises ‘smartest AI on Earth’ – Crypto News

-

Technology7 days ago

Technology7 days agoUnion Minister Ashwini Vaishnaw to launch India AI Mission portal soon, 10 companies set to provide 14,000 GPUs – Crypto News

-

Business6 days ago

Business6 days agoThese 3 Altcoins Will Help You Capitalize on Stellar’s Recent DIp – Crypto News

-

others6 days ago

others6 days agoForex Today: What if the RBA…? – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoHayden Davis crypto scandal deepens as LIBRA memecoin faces fraud allegations – Crypto News

-

Technology5 days ago

Technology5 days agoLuminious inverters for your home to never see darkness again – Crypto News

-

Technology3 days ago

Technology3 days agoStellantis Debuts System to Handle ‘Routine Driving Tasks’ – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoStrange Love: why people are falling for their AI companions – Crypto News

-

Technology1 week ago

Technology1 week agoFormer Google CEO warns of ‘Bin Laden scenario’ for AI: ‘They could misuse it and do real harm’ – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoYap-to-earn takes over Twitter – Blockworks – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoSomeone Just Won $100K in Bitcoin From a $50 Pack of Trading Cards – Crypto News

-

Technology1 week ago

Technology1 week agoCyber fraud alert: Doctor duped of ₹15.50 lakh via fake trading app; here’s what happened – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCrypto narratives as we await next market move – Crypto News

-

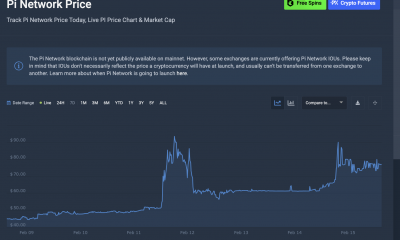

Business1 week ago

Business1 week agoHow Will It Affect Pi Coin Price? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoGameStop Stock Price Pumps After Report of Bitcoin Buying Plans – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Bullish Pennant Targets $15-$17 But Confirmation Is Required – Crypto News

-

Business6 days ago

Business6 days agoWhy Ethereum (ETH) Price Revival Could Start Soon After Solana Mess? – Crypto News

-

Business6 days ago

Business6 days agoMarket Veteran Predicts XRP Price If Ripple Completes Cup and Handle Pattern – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoBitcoin Sees $430M in Outflows as Market Responds to Fed’s Hawkish Stance – Crypto News

✓ Share: