Cryptocurrency

Uniswap finally turns the fee switch – Crypto News

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

Crypto markets were green on Monday as the longest-ever government shutdown in US history appears to be coming to an end. The headline news yesterday was Uniswap’s proposal to turn on the fee switch and unify ecosystem incentives. We also dive into Ore’s comeback, another clear case of sticky demand for -EV games in crypto.

Indices

Markets rallied on Monday as the Senate passed a bill to end the longest government shutdown in US history. The House of Representatives could pass the bill as soon as tomorrow, enabling President Trump to sign it into effect. If passed, the deal would extend funding through Jan. 30, 2026, with the federal government continuing to run at an $1.8 trillion-per-year deficit.

As seen above, Gold (+2.51%) outperformed the major US equity indices and BTC (+1.24%), gaining back momentum after three weeks of consolidation.

Despite underperforming gold, bitcoin saw needed relief on Monday after two weeks of consecutive ETF net outflows totaling $2 billion. Nearly half of this figure came from BlackRock’s IBIT. It will be interesting to monitor whether ETF flows can regain momentum this week.

Regarding cross-index performance, the clear outliers on Monday were the Ethereum and Solana Ecosystem indices, which rose by 7.9% and 5.2%, respectively. The best-performing asset in the Ethereum index was UNI, which rallied 40% on the day following a joint governance proposal by Uniswap Labs and the Uniswap Foundation to activate protocol fees.

PUMP drove the majority of returns in the Solana index, up 9.3% on the day. Pump’s daily buybacks have remained steadily above $1 million, with nearly 11% of the circulating supply offset since July.

A win for token holder rights

Uniswap has turned into the prime example of the conflicting equity-token structure, an issue that unfortunately permeates the industry. For years, Uniswap Labs has accrued all revenue generated by the protocol at the expense of UNI token holders. Yesterday, Uniswap founder Hayden Adams published a governance proposal on behalf of Uniswap Labs and the Uniswap Foundation to turn on Uniswap protocol fees and unify the ecosystem’s incentives, an unexpected win for token holders.

The Uniswap protocol includes a fee switch that can only be turned on by a UNI governance vote. The proposal would flip the fee switch and introduce a programmatic mechanism that burns UNI, with a retroactive burn of 100 million UNI tokens from the treasury to compensate for all the years token holders missed out on value accrual. Simultaneously, the proposal directs all Unichain sequencer fees, after L1 data costs and the 15% to Optimism, into the burn mechanism. In terms of aligning incentives, the proposal also folds most foundation functions into labs and creates a 20 million UNI per year growth budget, so labs can focus on protocol adoption while dropping its takerate on the frontend interface, wallet and API to zero.

Now that Uniswap will establish a clear value-accrual mechanism between the token and the protocol’s success, what is the fair value for UNI? Over the past two years, Uniswap has lost its dominant position in the DEX landscape, with volume market share dropping from over 60% in October 2023 to less than 15% last month. The shift in DEX market share reflects Solana’s growing dominance in onchain activity over the same period, as well as the rise of protocols like Aerodrome, which has managed to maintain a leading position over Uniswap on Base.

If we look at Unichain, network activity remains relatively depressed, with weekly DEX trading volumes decreasing since July. The $925 million in volume registered last week represents the lowest figure since mid-April.

Unichain’s network revenue presents a more optimistic view, though we also see decreasing revenues in recent weeks. Over the past 30 days, Unichain’s network revenue has amounted to $460,000, translating to an annualized run rate of $5.52 million. With an 84% margin, that would translate to $4.64 million in revenue for Uniswap Labs with the current structure, and into the burn mechanism after the proposal passes. That said, Unichain is just a small part of the protocol’s total revenue, as most revenue still comes from the v2 and v3 implementations.

Fellow Blockworks Research analyst Kunal built a fantastic dashboard showcasing Uniswap’s burn estimates, based on the UNIfication proposal. Had the mechanism been live, the protocol would have burned almost $26 million worth of UNI over the past 30 days, and almost $150 million year to date. The table below compares UNI against other decentralized exchanges (note that we included Pump because of its AMM).

Despite the UNIfication proposal being a step in the right direction, UNI still seems expensive relative to the median and average price-to-sale ratios among the cohort, even if we take into account the 100 million UNI retroactive burn.

Yearning for the mines

Ore is running it back, and in a big way. First launched on April 2nd of 2024, the v1 of Ore functioned as a proof-of-work protocol on Solana, where mining and the “work” were decoupled from consensus. Seeing early traction, mining transactions grew to account for 10-16% of all transactions on Solana. The mining game quickly devolved into a Sybil problem, leading to significant spam and degradation in Solana’s network performance. Mining on v1 was eventually paused just two weeks after launch on April 16, 2024, while the founder, Hardhat Chad, worked on an iteration to address the shortcomings of v1.

Ore v2 shipped at the start of August 2024. The iteration introduced a difficulty multiplier, where mining rewards skewed exponentially toward the miners that produced the most difficult hashes. With this, Sybil was reduced, as miners were incentivized to concentrate all of their available hashpower from a single address, rather than multiple. Additionally, v2 introduced a staking multiplier, where miners would receive a bonus in linear proportion to their share of ORE staked.

The launch of v2 was met with much anticipation and fervor. Preceding the launch, ORE’s price rose from $200 to a high of $1,400. At the launch of v2, mining transactions again accounted for over 10% of all transactions on Solana. But, with a max supply of 21 million, the FDV sat in the tens of billions, and the inflation curve was steep. Additionally, as mining rewards skewed exponentially toward difficulty over the stake balance, there was little incentive to hold. Subsequently, the price collapsed over the past year — from $800 at the start of v2, toward a low of $10 in October. During this time, Hardhat Chad and the development team kept tinkering, seeking to iterate and improve to a mining product with market fit. This included seven governance proposals traded on MetaDAO’s futarchy platform, including LP mining boosts to incentivize liquidity.

At the start of October 2025, ORE opened up its new version of mining. The protocol involves a 5×5 grid of tiles, whereby miners stake a balance of SOL on select or across all tiles. At the end of a round, set to one minute, a winning tile is selected through a random number generator. All SOL deployed across the losing tiles is split and distributed among the miners of the winning tile, pro-rata to their share of the SOL staked on the winning tile.

In addition, 1 ORE is distributed in alternating fashion to the winning miners pro-rata or in its entirety to one winning miner selected by weighted random chance. Coupled with this, 0.2 ORE is minted and added to a “Motherlode” pool, where each round offers miners a 1/625 chance of winning the motherlode. If the motherlode is not hit, the balance continues to accrue for distribution in a further round. Miners pay a 10% “refining fee” for withdrawing ORE proceeds, with the fee distributed to other miners in proportion to their unclaimed balance, incentivizing miners to hold their winnings.

Ore charges a 10% takerate on SOL mining rewards before distributing this to the winning miners. 90% of this revenue is used to buyback and bury ORE, while the remaining 10% is allocated to ORE stakers.

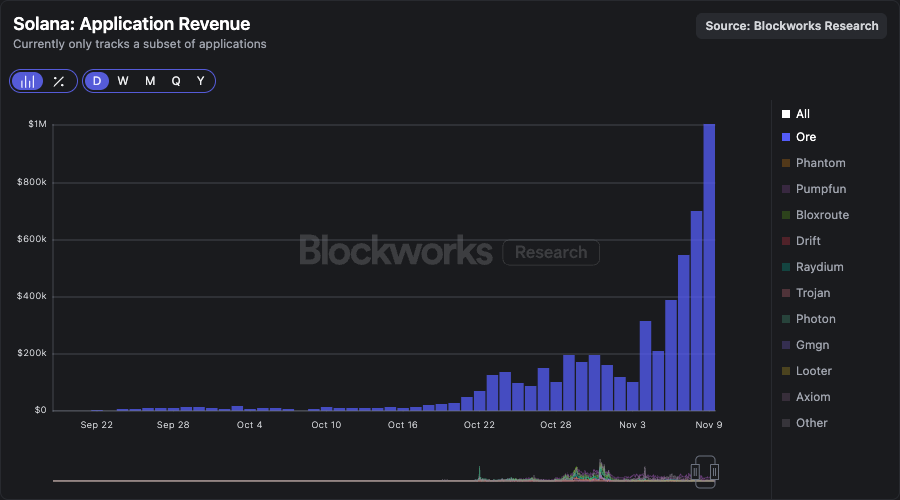

In the past month since public launch, this new “mining” mechanism, which looks quite similar to a gambling game, has seen remarkable success. Key metrics like active miners, staking ratio, unclaimed balance, winnings and daily revenue have all skyrocketed, along with the ORE price.

Ore generated over $1 million in revenue over the past 24 hours, placing it as the second-highest revenue generating application on Solana over that timeframe — eclipsed only by pump.fun.

After many iterations and much tinkering, Ore appears to have caught lighting in a bottle. Despite negative profitability, miners want to play this game, generating substantial revenue which translates into ORE buybacks and deflation. And while mining may be negative EV on a per-step basis, as the production cost is well above the token price, this cost is papered over in time, through the staking yield of 22% or the yield on unrefined ORE of 150%. Be it memecoins or perps, we’ve frequently observed durable demand to continue to play -EV games in the crypto casino.

Get the news in your inbox. Explore Blockworks newsletters:

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin tests $100K support after massive liquidation event rocks market – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoMany Crypto Treasury Companies Were a Get-Rich-Quick Trap, Warns Columbia Professor – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoLitecoin: $855K ETF inflow sparks new life – Next target is $105 IF… – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoStrategy IPO redefines corporate Bitcoin strategy with euro-denominated offering – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoStablecoin Orchestration Becomes FinTech Battleground – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBittensor (TAO) plunges 16% amid broader crypto sell-off – Crypto News

-

others1 week ago

“Never Had Plans to Sue Binance,” Wintermute CEO Evgeny Gaevoy Confirms – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRipple Just Made XRP and RLUSD Tradeable Like Stocks: Here’s How – Crypto News

-

Cryptocurrency1 week ago

Crypto Market Crash as $595.8M in Longs is Liquidated, Bitcoin Slides to $105,000 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoGold declined but still outperformed BTC last week – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoChainalysis Warns of ‘Concerning’ Vulnerabilities in DeFi Platforms – Crypto News

-

Cryptocurrency1 week ago

Dogecoin Price Risks 20% Crash as Death Cross Aligns With Falling DOGE ETF Inflows – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTokenized Treasuries cross $8.6B as banks and exchanges push collateral use – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoPi Network (PI) News Today: November 4th – Crypto News

-

others1 week ago

AI Bubble: Big Short Legend Michael Burry Bets Against AI Giants As NVIDIA And Palantir Stocks Dip – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoPaytm is getting AI! Vijay Shekhar Sharma drops cryptic teaser ahead of launch – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEthereum Price Needs To Reclaim This Key Level To Prevent Drop To $1,700 – Crypto News

-

Cryptocurrency5 days ago

Kalshi Sees Nearly 50-Day Shutdown As Bitcoin Now Mirrors Nasdaq – Crypto News

-

Business4 days ago

Michael Saylor Says ‘₿uy Now’ as Bitcoin Faces $111,000 Resistance – Crypto News

-

others1 week ago

Will Hyperliquid Price Hit $50 After OKX Listing? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Hyper Next to Soar? – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle Maps integrates Gemini for hands-free routing, real-world landmark navigation and more – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoLitecoin 2M Bollinger Band Width Hits New Lows, CMT-Certified Analyst Reveals What It Means – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana Price Drops Below $180 Despite $199M ETF Inflows, What’s Behind the Decline? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoSui ($SUI) Down 13.1%, Solana ($SOL) Down 7.1%: Digitap ($TAP) is the Only Altcoin Thriving – Crypto News

-

others1 week ago

Mastercard’s $2Bn Stablecoin Startup Bet ZeroHash is Now MiCA Licensed – Acquisition Next? – Crypto News

-

Technology1 week ago

Technology1 week agoChatGPT Go now free in India: How it stacks up against Plus, Pro, and other plans – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana (SOL) Decline Intensifies — Bears Tighten Grip, Recovery Looks Unlikely – Crypto News

-

others1 week ago

others1 week agoTakaichi vs Katayama – OCBC – Crypto News

-

Business1 week ago

Business1 week agoSantander Unveils Tool to Help Businesses Navigate Global Expansion – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCoinbase Exec Criticizes Banks’ Pushback to Crypto Charter Application – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoYou Could’ve Made a 100x Prediction Market Bet on Last Night’s Elections – Crypto News

-

Business7 days ago

Ripple Secures $500M Funding Led by Fortress and Citadel Securities After Record Growth – Crypto News

-

Technology4 days ago

Technology4 days agoFlipkart deal alert: Samsung Galaxy S24 Ultra 5G available with up to ₹50,000 savings – here’s how the deal works – Crypto News

-

Technology3 days ago

Filecoin Price Rockets 51% as Grayscale’s FIL Holdings Hit Record High — What’s Next for FIL? – Crypto News

-

Business3 days ago

Trump Tariffs: Crypto Market Surges After $400B Dividend Announcement for Americans – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEU Mulls SEC-Like Supervision For Stock, Crypto Exchanges – Crypto News

-

Business1 week ago

Expert Warns XRP Investors of “ Extremely Mediocre” Growth Next to Solana’s 100x Activity Surge – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTrump Downplays Knowledge of Binance Chief After Pardon Linked to Family’s Crypto Dealings – Crypto News

-

others1 week ago

others1 week agoDow Jones grapples with missing out on AI investment train – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBalancer Audits under Scrutiny after $100M+ Exploit – Crypto News

-

others1 week ago

Top 3 Developments That Could Impact Bitcoin Price This Week – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoAster Explodes After CZ Drops Bombshell: He Owns $2.5M Worth – Crypto News

-

others1 week ago

Japan Jibun Bank Manufacturing PMI came in at 48.2, below expectations (48.3) in October – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Community Divided on DeFi Trust Implications After $128M Balancer Exploit – Crypto News

-

others1 week ago

others1 week agoWhy Lattice Semi (LSCC) plunged despite a double beat – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoWhat’s at Stake for Sam Bankman-Fried’s Long-awaited Appeal? – Crypto News

-

Technology1 week ago

Technology1 week agoAltcoins today: Perpetual tokens shed over $2B as ETH slips under $3.5K – Crypto News