others

US Dollar bears move in as markets turn on a dime during Fed event – Crypto News

- The US Dollar is back on its backside following a mixed reaction to the Fed event.

- Two-way price action was the outcome in financial asset classes as the Fed and US Dollar prints fresh bear cycle lows.

The US Dollar is tailing off from the highs that were made on the knee-jerk in what was perceived to be a hawkish rate hike of 50 basis points by the United States Federal Reserve. At the time of writing, DXY, an index that measures the US Dollar vs. A basket of currencies, is correcting all of the post-Fed announcement rally from the high of 104.163 to the current level of 103.448.

While the Fed has signaled its plans to keep lifting rates next year to combat high inflation Fed’s chair Jerome Powell is currently speaking and his comments have given mixed messages to the market. Consequently, we are seeing two-way price action across asset classes, including the US Dollar and bonds, More on Powell below.

US Treasury yields have spun around in the 10-year from a high of 3.5610% to print 3.47% currently, well on course towards the day’s low of 3.46%.

Fed key takeaways

- The Federal Reserve hikes 50 basis points, as expected

- Target Range stands at 4.25% – 4.50%.

- The vote was unanimous.

- The guidance in the statement repeats that: “The Committee anticipates that ongoing increases in the target range will be appropriate.”

Powell’s comments

Opening remarks:

We still have “some ways to go”.

We expect ongoing hikes are appropriate to get sufficiently restrictive.

The US economy slowed ‘significantly’ from last year.

Without price stability, no sustained strong labor market.

Strongly committed to inflation target.

Yet to feel full effects of tightening, have more work to do.

Not at restrictive policy stance yet.

Recent Comments:

Getting close to sufficiently restrictive rates level.

No rate cuts until confident inflation moving towards 2%.

By middle of 2023 should begin to see slower inflation from housing services sector.

Size of February rate hike will depend on incoming data.

dxy technical analysis

The M-formation is a reversal pattern that has shown up on the daily charts above. While on the front side of the trendline, a move into the neckline could be the next phase of the bearish cycle prior to a downside continuation to test 102.00 and below.

-

Blockchain6 days ago

Blockchain6 days agoEthereum Price Performance Could Hinge On This Binance Metric — Here’s Why – Crypto News

-

Technology1 week ago

Technology1 week agoBest water purifiers under ₹15000: Explore the top 6 options from Aquaguard, Urban Company and more – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoFrench Exoskeleton Company Wandercraft Pivots to Humanoid Robots – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoFrench Exoskeleton Company Wandercraft Pivots to Humanoid Robots – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoDonald Trump Ready to Ditch His Tesla Amid Musk Feud? (Report) – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTrump-Elon feud Erupts, Crypto falls, Coinbase to list Fartcoin – Crypto News

-

others1 week ago

others1 week agoCanadian Dollar gives back gains despite upbeat jobs data – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoOpenLedger Invests $25 Million to Combat ‘Extractive’ AI Economy – Crypto News

-

others5 days ago

others5 days agoGold price in India: Rates on June 10 – Crypto News

-

Technology1 week ago

Technology1 week agoWhy Anthropic CEO Dario Amodei thinks a 10-year AI regulation freeze is dangerous – Crypto News

-

Technology1 week ago

Technology1 week agoGemini can now schedule tasks, send reminders and keep you on track: Here’s how it works – Crypto News

-

Technology1 week ago

Technology1 week agoBest juicer for home in 2025: Top 10 choices for your family’s good health from brands like Philips, Borosil and more – Crypto News

-

Technology4 days ago

Technology4 days agoCircle IPO shows strong crypto market investor demand – Crypto News

-

Technology1 week ago

Technology1 week agoMicrosoft integrates AI shopping into Copilot app, bringing price tracking and smart comparisons – Crypto News

-

others1 week ago

others1 week agoGold prices fall as the USD extends gains post NFP – Crypto News

-

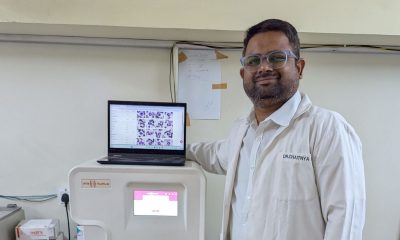

Technology7 days ago

Technology7 days agoHow artificial intelligence caught leukaemia in Maharashtra’s Parbhani – Crypto News

-

Technology6 days ago

Technology6 days agoOpenAI CEO Sam Altman says AI is like an intern today, but it will soon match experienced software engineers – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoTRON: Who’s fueling TRX’s breakout? It’s not whales, here’s the answer! – Crypto News

-

Technology1 week ago

Technology1 week agoThe Quiet Voices Questioning China’s AI Hype – Crypto News

-

others1 week ago

others1 week agoEUR/USD retreats from multi-week highs ahead of Eurozone GDP and consumption data – Crypto News

-

Technology7 days ago

Technology7 days agoWeekly Tech Recap: Resident Evil Requiem release date revealed, OnePlus 13s makes India debut and more – Crypto News

-

Technology6 days ago

Technology6 days agoOnePlus 13s review: A near-perfect compact phone, minus a few flagship perks – Crypto News

-

Technology5 days ago

Technology5 days agoiOS 26’s Liquid Glass redesign met with backlash from Apple users: ‘Please tone it down’ – Crypto News

-

others1 week ago

others1 week agoXAG/USD remains positive, supported above $34.00 – Crypto News

-

others1 week ago

others1 week agoBitcoin Could Crash by Double-Digit Percentage Points in a ‘Quick Move’ if This Support Level Fails, Warns Crypto Trader – Crypto News

-

others1 week ago

others1 week agoWidely Followed Analyst Outlines Bullish Path for Bitcoin, Says BTC Will Battle Gold and ‘Never Look Back’ – Crypto News

-

Technology1 week ago

Technology1 week agoBest juicer for home in 2025: Top 10 choices for your family’s good health from brands like Philips, Borosil and more – Crypto News

-

![Stacks [STX] down 31% after Alex Protocol exploit - Details](https://dripp.zone/news/wp-content/uploads/2025/06/Stacks-STX-down-31-after-Alex-Protocol-exploit-Details.webp-400x240.webp)

![Stacks [STX] down 31% after Alex Protocol exploit - Details](https://dripp.zone/news/wp-content/uploads/2025/06/Stacks-STX-down-31-after-Alex-Protocol-exploit-Details.webp-80x80.webp) Cryptocurrency1 week ago

Cryptocurrency1 week agoStacks [STX] down 31% after Alex Protocol exploit – Details – Crypto News

-

others6 days ago

others6 days agoNew Yorkers Warned of Fake QR Codes Being Placed on Parking Meters That Steal Victims’ Payment Information – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoUnion completes trusted setup to pave the way for trustless cross-chain DeFi – Crypto News

-

Technology5 days ago

Technology5 days agoFather’s Day 2025 gift ideas: Smartwatch, Bluetooth speaker and more – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoSolo Miner Defies Odds After Mining Bitcoin Block Earning Over $330K – Crypto News

-

others1 week ago

Russia Central Bank Reserves $ climbed from previous $678.5B to $678.7B – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoMaple Expands to Solana, Brings Yield-Bearing Stablecoin – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoThe transformer birthed GenAI. Meet the man who built it – Crypto News

-

others1 week ago

others1 week agoGBP/USD slips as strong US jobs data cools Fed rate cut bets – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoDeutsche Bank Considers Digital Asset Projects – Crypto News

-

Business1 week ago

Business1 week agoBusinesses Limit Pass-Through of Tariff Costs – Crypto News

-

others1 week ago

others1 week agoS&P 500 reaches 6,000 for first time since February on NFP print – Crypto News

-

Technology6 days ago

Technology6 days agoIndia targets indigenous 2nm, Nvidia-level GPU by 2030 – Crypto News

-

others6 days ago

others6 days agoAnalyst Says Bitcoin Has ‘Pretty Good’ Chance of Hitting Massive Price Target in 2026, Citing Three Technical Signals – Crypto News

-

Technology6 days ago

Technology6 days agoBP Puts AI at the Heart of Its Efforts to Boost Performance – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoResistance Persists at $2,700 But Buyer Appetite Grows – Crypto News

-

Technology5 days ago

Technology5 days agoiOS 26’s Liquid Glass redesign met with backlash from Apple users: ‘Please tone it down’ – Crypto News

-

Technology5 days ago

Technology5 days agoiOS 26’s Liquid Glass redesign met with backlash from Apple users: ‘Please tone it down’ – Crypto News

-

others5 days ago

others5 days agoStock Market Pullback in Sight As Several of America’s Problems Still Remain, Warns Former JPMorgan Strategist – Crypto News

-

others5 days ago

others5 days agoARK Invest’s Cathie Wood Unveils Massive Price Target for Tesla (TSLA) in Five Years Fueled by Robotaxi Platform – Crypto News

-

Technology4 days ago

Technology4 days agoOne Tech Tip: How to protect your 23andMe genetic data – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEthereum Eyes 15% Move Amid $2,680 Retest – Breakout Next? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolo Bitcoin Miner Wins $330K Block as Difficulty Hits Record 126.98T – Crypto News