others

US Dollar enters calm waters after rollercoaster Wednesday – Crypto News

- The US Dollar trades broadly sideways after Wednesday’s wild ride following the Fed decision to hold interest rates.

- Traders took the Fed’s rate decision and rhetoric as less hawkish than feared.

- The US Dollar Index holds ground above 105.50 despite several attempts from bears to break lower.

The US Dollar (USD) enters some calm waters on Thursday after a rollercoaster ride on Wednesday following the Federal Reserve’s (Fed) monetary policy decision. The big batch of economic data on Wednesday together with the Fed’s policy meeting and Chairman Jerome Powell’s speech was the dream scenario for an uptick in the US Dollar Index (DXY), but this scenario failed to materialize and the index fell to 105.43, near the low of this week. Although it looked for a moment that the US Dollar could weaken further, it still holds ground and is likely to stay there until the US Nonfarm Payrolls data on Friday as the next catalyst.

On the economic data front, some appetisers ahead of the Nonfarm Payrolls print and the broader employment report on Friday. Traders can feast on the weekly Jobless Claims numbers and the Challenger Job Cuts number to look for clues if those announced layoffs during the recent earnings season are starting to weigh on the labor market. However, expectations are for traders to keep their powder dry for Friday.

Daily digest market movers: Here come the layoffs

- A substantial move on the charts in USD/JPY and EUR/JPY on Wednesday, pointing to a possible intervention again from either the Bank of Japan (BoJ) or the Ministry of Finance, though no official confirmations were issued.

- Kickoff this Thursday at 11:30 GMT with the April Challenger Job Cuts report. the previous number was at 90,309.

- At 12:30 GMT, the bigger part of the data for Thursday is to be released:

- Weekly Initial Jobless Claims expected to head to 212,000 from 207,000.

- Continuing Claims were at 1.781 million last week, with no forecast available.

- The US Goods and Trade balance from March is to be released:

- The Goods Trade Balance deficit was previously at $91.8 billion.

- Goods and Services Trade Balance expected to head from a deficit of $68.9 billion to a deficit of $69.1 billion.

- Nonfarm Productivity growth for the first quarter of 2024 should slow down from 3.2% to 0.8%.

- Unit Labor Costs are expected to accelerate substantially, from 0.4% to 3.2%.

- Near 14:00 GMT, the monthly factory orders for March are expected to increase by 1.6%, higher than the 1.4% advance seen a month earlier.

- Equities trade mixed on Thursday morning, with European equities mildly in the red while US Futures are mildly in the green.

- The CME Fedwatch Tool suggests a 91.1% probability that June will still see no change to the Federal Reserve’s fed fund rate. Odds of a rate cut in July are also out of the cards, while for September the tool shows a 56% chance that rates will be lower than current levels.

- The benchmark 10-year US Treasury Note trades around 4.61% and keeps lingering around this level.

US Dollar Index Technical Analysis: Burning through cash

The US Dollar Index (DXY) had a roller coaster ride on Wednesday while European markets were closed for Labor Day. Despite the moves and selling pressure in the DXY, the floor at 105.50 still holds despite three failed breaks in the past two weeks. Dollar bulls are buying at these levels clearly, as support is still there. This could result in a breakout soon, with either bulls stepping away and letting the DXY drop or sellers giving up, seeing DXY shooting higher.

On the upside, 105.88 (a pivotal level since March 2023) needs to be recovered again with a daily close above it, before targeting the April 16 high at 106.52 for a third time. Further up and above the 107.00 round level, the DXY index could meet resistance at 107.35, the October 3 high.

On the downside, 105.12 and 104.60 should act as support ahead of the 55-day and the 200-day Simple Moving Averages (SMAs) at 104.40 and 104.10, respectively. If those levels are unable to hold, the 100-day SMA near 103.75 is the next best candidate.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

-

Blockchain1 week ago

Blockchain1 week agoRobinhood Dealing With Fallout of Tokenized Equities Offering – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhale Sells $407K TRUMP, Loses $1.37M in Exit – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoSatoshi-Era Bitcoin Whale Moves Another $2.42 Billion, What’s Happening? – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoRipple and Ctrl Alt Team to Support Real Estate Tokenization – Crypto News

-

Technology6 days ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCardano’s $1.22 target: Why traders should be aware of THIS ADA setup – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin Breaches $120K, Institutional FOMO Takes and House Debate Propel Gains – Crypto News

-

Technology6 days ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Cryptocurrency1 week ago

Why Is Bitcoin Up Today? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoStrategy Resumes Bitcoin Buys, Boosting Holdings to Over $72 Billion in BTC – Crypto News

-

Business1 week ago

Pepe Coin Rich List June 2025: Who’s Holding Highest PEPE as it Nears Half a Million Holders? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoIt’s a Statement, Says Bitfinex Alpha – Crypto News

-

others6 days ago

others6 days agoEUR/USD recovers with trade talks and Fed independence in focus – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoBitcoin trades near $119K after new all-time high; Coinbase rebrands wallet to ‘Base App’ – Crypto News

-

Business5 days ago

XLM Is More Bullish Than ETH, SOL, And XRP, Peter Brandt Declares – Crypto News

-

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://dripp.zone/news/wp-content/uploads/2025/07/Stellar-XLM-bulls-exhausted-after-rally-Is-a-pullback.webp-400x240.webp)

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://dripp.zone/news/wp-content/uploads/2025/07/Stellar-XLM-bulls-exhausted-after-rally-Is-a-pullback.webp-80x80.webp) Cryptocurrency1 week ago

Cryptocurrency1 week agoStellar [XLM] bulls exhausted after rally – Is a pullback nearby? – Crypto News

-

others6 days ago

others6 days agoTop Crypto Exchange by Trading Volume Binance Announces Airdrop for New Ethereum (ETH) Ecosystem Altcoin – Crypto News

-

others6 days ago

others6 days agoVanEck Details Key Drivers Boosting Bitcoin Price, Including Corporate Treasury Demand, ETF Flows and More – Crypto News

-

Business6 days ago

XRP Lawsuit Update: Ripple Paid $125M in Cash, Settlement Hinges on Appeal – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoAnarchy, crime and stablecoins – Blockworks – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoZiglu Faces $2.7M Shortfall as Crypto Fintech Enters Special Administration – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoUK Banks Should not Issue Stablecoins – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoDonald Trump Jr. backs social media startup aiming to become a crypto powerhouse – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoThe Bitcoin Liquidity Supercycle Has Just Begun: Hedge Fund CEO – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle, Anthropic, OpenAI and xAI join US defence to tackle national security with AI – Crypto News

-

Business1 week ago

CME XRP Futures Hit $1.6B In Total Trading Volume Since Launch – Crypto News

-

Cryptocurrency1 week ago

Fed’s Hammack Raises Inflation Concerns Amid Push For Interest Rate Cut – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoWhy voice is emerging as India’s next frontier for AI interaction – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoNvidia’s Jensen Huang says AI ‘fundamental like electricity’, praises Chinese models as ‘catalyst for global progress’ – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

Business6 days ago

Ethereum Price Prediction- Bulls Target $3,700 As ETH Treasury Accumulation Soars – Crypto News

-

others6 days ago

others6 days agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

others6 days ago

others6 days agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoFriday charts: The rise of zero-sum thinking – Crypto News

-

others1 week ago

others1 week agoCrypto Hacker Who Drained $42,000,000 From GMX Goes White Hat, Returns Funds in Exchange for $5,000,000 Bounty – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoPump.fun Concludes $500M ICO in 12 Minutes — But Something Doesn’t Add Up – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Are So Many Crypto Games Shutting Down? Experts Weigh In – Crypto News

-

De-fi1 week ago

De-fi1 week agoRobinhood Opens Ether and Solana Staking to US Users – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTop 3 altcoins under $1 worth watching: Sei, Ethena, Arbitrum – Crypto News

-

De-fi1 week ago

De-fi1 week agoRipple’s RLUSD Market Cap Passes $515M, Flips TrueUSD – Crypto News

-

others1 week ago

Bitcoin Critic Vanguard Becomes Strategy’s (MSTR) Largest Shareholder – Crypto News

-

De-fi6 days ago

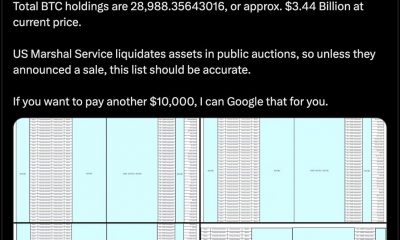

De-fi6 days agoU.S. Marshals Peg Federal Bitcoin Holdings at 28,988 Tokens Worth $3.4 B – Crypto News

-

Cryptocurrency5 days ago

Russia’s $85 Billion Sberbank to Launch Crypto Custody Services – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoNasdaq Exchange Files SEC Form to List Staking Ethereum ETF – Crypto News

-

De-fi5 days ago

De-fi5 days agoU.S. House Passes Clarity, GENIUS, and Anti-CBDC Acts With Historic Bipartisan Support for Crypto – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCardano Price Explodes 30% In Past Week — Analyst Calls $5 Next Market Top – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoAltcoins Chase New Highs After Bitcoin Hits $123,000 – Crypto News

-

Technology1 week ago

Technology1 week agoV Guard INSIGHT-G BLDC fan review: Cool performer with a premium look – Crypto News

-

Cryptocurrency1 week ago

Fed’s Hammack Raises Inflation Concerns Amid Push For Interest Rate Cut – Crypto News