others

US Dollar gets little tailwind from bullish Fed speak and US session – Crypto News

- The US Dollar is off the lows as the US session is taking over for the final trading hours of this Friday.

- Traders are fishing behind the net when it comes to any hawkish elements from Fed speakers today that could support the US Dollar and try to salvage any losses.

- The US Dollar Index sinks to a new monthly low and flirts with a break below 102 for this week.

The US Dollar (USD) is set to close the week with several one month lows against Euro, Pound Sterling and a few other peers after the European Central Bank (ECB) and its chairman Christine Lagarde out-hawked the US Federal Reserve (Fed). The ECB delivered a 25 basis points rate hike and committed to a hike for July, while the Fed Chairman Jerome Powell reiterated that the US central bank remains data dependent and that it will hike when it deems necessary. This split in stance on monetary policies gave the Euro wings and saw the US Dollar losing ground against some of its peers.

On Friday, traders are assessing the Bank of Japan (BoJ) policy meeting which already took place early this morning in the ASIA PAC session and saw BoJ chairman Kazuo Ueda repeating an unchanged stance as long as price forecasts is above 2%, maintaining its policy rate at -0.1% and its 10-year JGB yield target around 0%. On the speakers front, fed members Jim Bullard and Chris Waller have been unable to trigger a turnaround with their comments, while Tom Barkin is the only one today to mention more hikes are around the corner. Look for clues or any change in statements in order to further clarify what Jerome Powell communicated in case the Fed is not happy with the current stance of the markets, as Michigan Consumer Sentiment and Inflation expectations are to close off this trading week at 14:00 GMT in terms of economic data.

Daily digest: US Dollar sees Fed’s barking to the rescue

- University of Michigan Sentiment jumps from 59.2 to 63.9, a strong beat. Meanwhile, the 1-year inflation expectation slides to 3.3% from 4.2% earlier. Current Conditions jump from 64.9 to 68. This could be interpreted as the Fed not being done yet as economic conditions are still to strong while inflation is not yet at its target target of 2%.

- Comments from Fed’s Barkin that the Fed can do more comfortable to slow resilient US economy. Stubborn inflation may require more rate hikes. His comments trigger a jump on the 2-year Treasury yield to 4.75% and the US Dollar to get off the lows.

- US Defense Secretary mentioning the door is open for military dialogue with China.

- Comments from Fed’s Chris Waller that the Fed will use its policy tools to stem financial systems risk build-up, and that the Fed is not going to change its policy due to worry over a few banks. The US economy is still ripping along for the most part.

- China says its studying policies to expand demand and prevent risk, trying to roll out economic policy controls.

- The US futures markets Chicago Mercantile Exchange (CME), Intercontinental Exchange (ICE), and the Chicago Board Options Exchange (CBOE) and several other institutions are facing exceptionally large volumes today as ‘Quadruple Witching’ is set to take place today. ‘Quadruple Witching’ is the moment when a large bulk of options and futures contracts in several asset classes are set to expire at the same moment and will either be liquidated or rolled over. Traded volumes could be multiple times higher than normal.

- The US session will be key to see where the US Dollar closes against several of its peers. At the moment, mostly sideways price action is noted, which could result in either a recovery of more follow-through in recent moves. Seeing the fact that this is the last trading day of the week, some profit taking in certain positions could materialise.

- Speaker of Russia’s Upper House of Parliament commented that an extension to the Black Sea Grain Deal is off the table.

- Belarus is officially taking delivery of Russian nuclear weapons. Meanwhile NATO Secretary-General Jens Stoltenberg said it’s too early to decide on delivering the F-16 to Ukraine.

- Bank of Japan held its rate decision early this Friday morning with BoJ chairman Ueda keeping the central bank’s measures unchanged at -0.1% for the policy rate and the 10-year JGB yield target at 0%. Special remarks for the recent FX developments in Japanese Yen, which was a topic of concern for the central bank and requires additional attention.

- The China Hang Seng stock market added another 1% gain to its winning streak and nearly closed at a one-month high, while Japan’s Topix index closed just below its 33-year high. Meanwhile the tailwind is picking up speed in Europe as well with the German DAX printing a new all-time high and US equity futures entering the green and on track for their best week since 2021.

- The CME Group FedWatch Tool shows that markets are pricing in a 71.9% chance of a 25 basis point (bp) hike on July 26th. Overall, the point of view here seems to be just one more hike and done as all other futures for 2023 are pointing to an unchanged rate level. Nevertheless, with the data dependency of the Fed, there could be a dislocation between the Fed policy and market expectations, possibly undervaluing the Greenback currently, which could trigger US Dollar strength later this year.

- The benchmark 10-year US Treasury bond yield trades at 3.77%, a nudge higher after hawkish comments from Fed’s Barkin. The 10-year yield was trading around 3.83% before dropping substantially toward 3.70% as the ECB outpaced the Fed with its forward guidance.

US Dollar Index technical analysis: US session underpins 102

The US Dollar has taken a firm step back against a few of its peers, while it tries to cling on to gains against some Asian currencies. After a mild recovery in the European session, sentiment is turning South again for the US Dollar Index (DXY) with the US trading session just around the corner. After the substantial slide lower on Thursday from 103 to nearly 102 it looks to try and hold above 102 before the weekly close.

On the upside, a whole other ball park now as the 55-day Simple Moving Average (SMA) at 102.55 has turned from support into resistance. Should the DXY recover further today, look for the 103 psychological level as the next big challenge to the upside. The May high at 104.70 remains the ultimate target longer term.

On the downside, the psychological level near 102 is the only element upholding DXY for now. Once price action should start to reside below it, expect to see another nosedive move for the US Dollar Index towards100.82. That means a challenge for this year’s low and means a substantial devaluation for the Greenback to come.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to date from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the unemployment rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it affect the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is generally positive for the US Dollar.

-

Blockchain1 week ago

Blockchain1 week agoEthereum Price Performance Could Hinge On This Binance Metric — Here’s Why – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoFrench Exoskeleton Company Wandercraft Pivots to Humanoid Robots – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoFrench Exoskeleton Company Wandercraft Pivots to Humanoid Robots – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTrump-Elon feud Erupts, Crypto falls, Coinbase to list Fartcoin – Crypto News

-

others1 week ago

others1 week agoCanadian Dollar gives back gains despite upbeat jobs data – Crypto News

-

Technology1 week ago

Technology1 week agoBest juicer for home in 2025: Top 10 choices for your family’s good health from brands like Philips, Borosil and more – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoOpenLedger Invests $25 Million to Combat ‘Extractive’ AI Economy – Crypto News

-

others6 days ago

others6 days agoGold price in India: Rates on June 10 – Crypto News

-

Technology5 days ago

Technology5 days agoCircle IPO shows strong crypto market investor demand – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoDonald Trump Ready to Ditch His Tesla Amid Musk Feud? (Report) – Crypto News

-

Technology1 week ago

Technology1 week agoMicrosoft integrates AI shopping into Copilot app, bringing price tracking and smart comparisons – Crypto News

-

Technology1 week ago

Technology1 week agoGemini can now schedule tasks, send reminders and keep you on track: Here’s how it works – Crypto News

-

others1 week ago

others1 week agoGold prices fall as the USD extends gains post NFP – Crypto News

-

Technology1 week ago

Technology1 week agoWeekly Tech Recap: Resident Evil Requiem release date revealed, OnePlus 13s makes India debut and more – Crypto News

-

Technology1 week ago

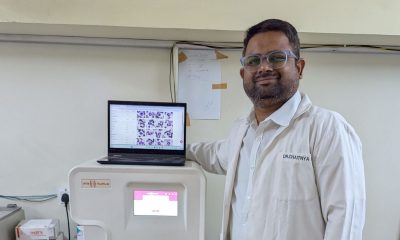

Technology1 week agoHow artificial intelligence caught leukaemia in Maharashtra’s Parbhani – Crypto News

-

Technology1 week ago

Technology1 week agoIndia targets indigenous 2nm, Nvidia-level GPU by 2030 – Crypto News

-

Technology1 week ago

Technology1 week agoOpenAI CEO Sam Altman says AI is like an intern today, but it will soon match experienced software engineers – Crypto News

-

others1 week ago

others1 week agoWidely Followed Analyst Outlines Bullish Path for Bitcoin, Says BTC Will Battle Gold and ‘Never Look Back’ – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTRON: Who’s fueling TRX’s breakout? It’s not whales, here’s the answer! – Crypto News

-

others1 week ago

others1 week agoEUR/USD retreats from multi-week highs ahead of Eurozone GDP and consumption data – Crypto News

-

Technology1 week ago

Technology1 week agoBest juicer for home in 2025: Top 10 choices for your family’s good health from brands like Philips, Borosil and more – Crypto News

-

others1 week ago

others1 week agoNew Yorkers Warned of Fake QR Codes Being Placed on Parking Meters That Steal Victims’ Payment Information – Crypto News

-

Technology1 week ago

Technology1 week agoOnePlus 13s review: A near-perfect compact phone, minus a few flagship perks – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoUnion completes trusted setup to pave the way for trustless cross-chain DeFi – Crypto News

-

Technology6 days ago

Technology6 days agoiOS 26’s Liquid Glass redesign met with backlash from Apple users: ‘Please tone it down’ – Crypto News

-

Technology6 days ago

Technology6 days agoiOS 26’s Liquid Glass redesign met with backlash from Apple users: ‘Please tone it down’ – Crypto News

-

Technology6 days ago

Technology6 days agoiOS 26’s Liquid Glass redesign met with backlash from Apple users: ‘Please tone it down’ – Crypto News

-

others6 days ago

others6 days agoStock Market Pullback in Sight As Several of America’s Problems Still Remain, Warns Former JPMorgan Strategist – Crypto News

-

Technology6 days ago

Technology6 days agoFather’s Day 2025 gift ideas: Smartwatch, Bluetooth speaker and more – Crypto News

-

others1 week ago

others1 week agoBitcoin Could Crash by Double-Digit Percentage Points in a ‘Quick Move’ if This Support Level Fails, Warns Crypto Trader – Crypto News

-

others1 week ago

others1 week agoGBP/USD slips as strong US jobs data cools Fed rate cut bets – Crypto News

-

![Stacks [STX] down 31% after Alex Protocol exploit - Details](https://dripp.zone/news/wp-content/uploads/2025/06/Stacks-STX-down-31-after-Alex-Protocol-exploit-Details.webp-400x240.webp)

![Stacks [STX] down 31% after Alex Protocol exploit - Details](https://dripp.zone/news/wp-content/uploads/2025/06/Stacks-STX-down-31-after-Alex-Protocol-exploit-Details.webp-80x80.webp) Cryptocurrency1 week ago

Cryptocurrency1 week agoStacks [STX] down 31% after Alex Protocol exploit – Details – Crypto News

-

others1 week ago

others1 week agoAnalyst Says Bitcoin Has ‘Pretty Good’ Chance of Hitting Massive Price Target in 2026, Citing Three Technical Signals – Crypto News

-

Technology7 days ago

Technology7 days agoBP Puts AI at the Heart of Its Efforts to Boost Performance – Crypto News

-

De-fi5 days ago

De-fi5 days agoResolv Stablecoin Protocol’s Token Debuts at $300 Million Valuation – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoDeutsche Bank Considers Digital Asset Projects – Crypto News

-

others1 week ago

others1 week agoS&P 500 reaches 6,000 for first time since February on NFP print – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin trades near $107K despite national guard deployment in Los Angeles – Crypto News

-

others6 days ago

Japan Money Supply M2+CD (YoY) increased to 0.6% in May from previous 0.5% – Crypto News

-

others6 days ago

others6 days agoARK Invest’s Cathie Wood Unveils Massive Price Target for Tesla (TSLA) in Five Years Fueled by Robotaxi Platform – Crypto News

-

Technology6 days ago

Technology6 days agoSwiss Military Retro 2.0 review: This speaker looks like a classic radio—and almost sounds like one too – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoFranklin Templeton Debuts ‘Intraday Yield’ Feature for Benji – Crypto News

-

Technology5 days ago

Technology5 days agoCloud Giants Hit Slow Lane as Legacy Systems Stall Upgrades – Crypto News

-

Technology1 week ago

Technology1 week agoUK watchdog pushes Amazon to rein in misleading product ratings: Know what happened – Crypto News

-

others1 week ago

others1 week agoUS Trade Deficit Plummets by $76,700,000,000 in April Following the Rollout of Trump’s Tariffs – Crypto News

-

others1 week ago

others1 week agoMichael Saylor Doubling Down on Bitcoin Price Prediction As BTC Holds $100,000 Level – Crypto News

-

Technology6 days ago

Technology6 days agoApple Expands ChatGPT Deal and Mimics Google in AI Comeback Attempt – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoResistance Persists at $2,700 But Buyer Appetite Grows – Crypto News

-

Technology5 days ago

Technology5 days agoOne Tech Tip: How to protect your 23andMe genetic data – Crypto News

-

Technology5 days ago

Technology5 days agoOnePlus Nord 5 and Nord CE 5 tipped to launch on 8 July with big battery upgrades and MediaTek chipsets – Crypto News