others

US Dollar sees ISM setting the record straight with a jaw breaking Services report – Crypto News

- The US Dollar near session high after ISM beat.

- Markets are supporting the Greenback for a second day despite another softer-than-expected JOLTS data on Tuesday.

- The US Dollar Index holds above 104.00 and looks to test nearby upside resistance.

The US Dollar (USD) edges higher for a second day on Wednesday, with the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, still negative in the week after Monday’s meltdown. Although the JOLTS Job Openings report for April published on Tuesday showed another decline, even falling below consensus, the fact that the wages element in the report still pointed to a willingness to pay higher salaries is an issue and main driver for the US inflation outlook.

On the economic front, all eyes are on Automatic Data Processing (ADP) and the Institute for Supply Management (ISM). ADP has already released its monthly Employment Change ahead of the official US Employment report on Friday, while the ISM confirms upbeat Services sentiment. It is worth noting that the lacklustre performance of the ISM release about the Manufacturing sector was a main driver for the meltdown in the Greenback on Monday, where services this Wednesday is telling a tail of two stories.

Daily digest market movers: ISM kicks back

- Earlier in the day, the Mortgage Bankers Association (MBA) released its Mortgage Applications number for the last week of May. Data showed a -5.2% concerning the previous week against -5.7% already from the week before.

- The ADP Employment Change data for May came in substantially lower than the consensus call for a 173,000 increase against the previous reading of 192,000 in April. The actual number came in at 152,000 while the 192,000 from April got revised down to 188,000. Thus a softer actual print and a softer revision.

- At 13:45 GMT, S&P Global will release its final reading for the Services and Composite Purchasing Managers Index (PMI) for May. Services are expected to remain unchanged at 54.8. The Composite should come in at 54.4, in line with preliminary readings.

- At 14:00 GMT, the ISM releases the Services sector PMI for May:

- Services Employment component jumps from 45.9 in April to 47.1 in May.

- New Orders index jumps from 52.2 to 54.1.

- Headline Services PMI jumps back into growth from 49.4 to 53.8.

- Prices Paid index was 59.2 in April, and eases to 58.1.

- Equities are in the green across the board in both the European and US session.

- According to the CME Fedwatch Tool, Fed Fund futures pricing data suggests a 35.1% chance for keeping rates unchanged in September, against a 55.3% chance for a 25 basis points (bps) rate cut and a 9.6% chance for an even 50 bps rate cut. An interest rate hike is no longer considered an option since this week. For the upcoming meeting on June 12, futures are fully pricing in an unchanged result.

- The benchmark 10-year US Treasury Note trades around 4.33%, near its monthly low at 4.32%.

US Dollar Index Technical Analysis: ISM kicks back against Monday’s performance

The US Dollar Index (DXY)tries to recover for a second day all its losses that got booked on Monday. Although the US Dollar weakness looks to be trickling through more and more in the price action, the decline in the JOLTS report held another element that markets did not pick up on immediately. That is, employers, even with fewer job openings than in previous months and weeks, are still willing to pay higher salaries for the right people in the right job, which means that one of the main drivers in US inflation is still alive.

On the upside, the DXY first faces double resistance in the form of the 200-day Simple Moving Average (SMA) at 104.43 and the 100-day SMA at 104.42. Next up, the pivotal level near 104.60 comes into play. For now, the topside is forming around 105.00, with the 55-day SMA coinciding with this round number and the peak from recent weeks at 105.12.

On the downside, the Greenback is trading in that air pocket area in which the 104.00 big figure looks to be holding. Once through there, another decline to 103.50 and even 103.00 are the levels to watch. With the Relative Strength Index (RSI) still not oversold, more downsides are still under consideration.

Employment FAQs

Labor market conditions are a key element in assessing the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels because low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given their significance as a gauge of the health of the economy and their direct relationship to inflation.

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhale Sells $407K TRUMP, Loses $1.37M in Exit – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoRobinhood Dealing With Fallout of Tokenized Equities Offering – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoSatoshi-Era Bitcoin Whale Moves Another $2.42 Billion, What’s Happening? – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoRipple and Ctrl Alt Team to Support Real Estate Tokenization – Crypto News

-

Technology6 days ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoStrategy Resumes Bitcoin Buys, Boosting Holdings to Over $72 Billion in BTC – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin Breaches $120K, Institutional FOMO Takes and House Debate Propel Gains – Crypto News

-

Technology6 days ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Business5 days ago

XLM Is More Bullish Than ETH, SOL, And XRP, Peter Brandt Declares – Crypto News

-

Cryptocurrency1 week ago

Why Is Bitcoin Up Today? – Crypto News

-

Business1 week ago

Pepe Coin Rich List June 2025: Who’s Holding Highest PEPE as it Nears Half a Million Holders? – Crypto News

-

others6 days ago

others6 days agoEUR/USD recovers with trade talks and Fed independence in focus – Crypto News

-

Business5 days ago

XRP Lawsuit Update: Ripple Paid $125M in Cash, Settlement Hinges on Appeal – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoBitcoin trades near $119K after new all-time high; Coinbase rebrands wallet to ‘Base App’ – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoZiglu Faces $2.7M Shortfall as Crypto Fintech Enters Special Administration – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCardano’s $1.22 target: Why traders should be aware of THIS ADA setup – Crypto News

-

Metaverse7 days ago

Metaverse7 days agoWhy voice is emerging as India’s next frontier for AI interaction – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoNvidia’s Jensen Huang says AI ‘fundamental like electricity’, praises Chinese models as ‘catalyst for global progress’ – Crypto News

-

others5 days ago

others5 days agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

others5 days ago

others5 days agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin and Ethereum ETFs record $3.6B inflows this week – Crypto News

-

Technology1 week ago

Technology1 week agoAmazon Prime Day Sale 2025: Best earphones and headphone deals with up to 70% off – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoUK Banks Should not Issue Stablecoins – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoDonald Trump Jr. backs social media startup aiming to become a crypto powerhouse – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle, Anthropic, OpenAI and xAI join US defence to tackle national security with AI – Crypto News

-

Business1 week ago

CME XRP Futures Hit $1.6B In Total Trading Volume Since Launch – Crypto News

-

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://dripp.zone/news/wp-content/uploads/2025/07/Stellar-XLM-bulls-exhausted-after-rally-Is-a-pullback.webp-400x240.webp)

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://dripp.zone/news/wp-content/uploads/2025/07/Stellar-XLM-bulls-exhausted-after-rally-Is-a-pullback.webp-80x80.webp) Cryptocurrency1 week ago

Cryptocurrency1 week agoStellar [XLM] bulls exhausted after rally – Is a pullback nearby? – Crypto News

-

Cryptocurrency1 week ago

Fed’s Hammack Raises Inflation Concerns Amid Push For Interest Rate Cut – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoIt’s a Statement, Says Bitfinex Alpha – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

Business6 days ago

Ethereum Price Prediction- Bulls Target $3,700 As ETH Treasury Accumulation Soars – Crypto News

-

others6 days ago

others6 days agoTop Crypto Exchange by Trading Volume Binance Announces Airdrop for New Ethereum (ETH) Ecosystem Altcoin – Crypto News

-

others5 days ago

others5 days agoVanEck Details Key Drivers Boosting Bitcoin Price, Including Corporate Treasury Demand, ETF Flows and More – Crypto News

-

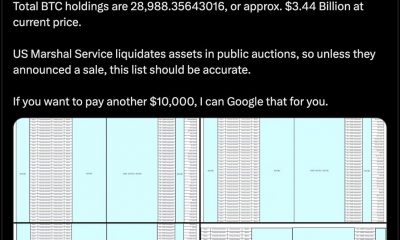

De-fi5 days ago

De-fi5 days agoU.S. Marshals Peg Federal Bitcoin Holdings at 28,988 Tokens Worth $3.4 B – Crypto News

-

Cryptocurrency5 days ago

Russia’s $85 Billion Sberbank to Launch Crypto Custody Services – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoNasdaq Exchange Files SEC Form to List Staking Ethereum ETF – Crypto News

-

Cryptocurrency4 days ago

Cryptocurrency4 days agoAnarchy, crime and stablecoins – Blockworks – Crypto News

-

Technology1 week ago

Peter Schiff Reignites Bitcoin Criticism, Calls 21M Supply Arbitrary – Crypto News

-

Business1 week ago

Ethereum ETFs Record Best Week Since Launch With $900M Inflows – Crypto News

-

De-fi1 week ago

De-fi1 week agoOG Large-Cap Altcoins Lead Market Rally – Crypto News

-

others1 week ago

others1 week agoJPMorgan Chase CEO Says Traders May Be Seriously Mistaken on Fed Rate Cuts: Report – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoFriday charts: The rise of zero-sum thinking – Crypto News

-

others1 week ago

others1 week agoCrypto Hacker Who Drained $42,000,000 From GMX Goes White Hat, Returns Funds in Exchange for $5,000,000 Bounty – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoPump.fun Concludes $500M ICO in 12 Minutes — But Something Doesn’t Add Up – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Are So Many Crypto Games Shutting Down? Experts Weigh In – Crypto News

-

De-fi1 week ago

De-fi1 week agoRobinhood Opens Ether and Solana Staking to US Users – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTop 3 altcoins under $1 worth watching: Sei, Ethena, Arbitrum – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoThe Bitcoin Liquidity Supercycle Has Just Begun: Hedge Fund CEO – Crypto News

-

De-fi1 week ago

De-fi1 week agoRipple’s RLUSD Market Cap Passes $515M, Flips TrueUSD – Crypto News