others

US Dollar sees traders puzzled what do to next after strong NFP print with lower wage increases – Crypto News

- US Dollar price action fairly contained in the aftermath of the US Jobs report.

- ISM Manufacturing up next to try and move the needle or paint a clearer picture.

- The US Dollar Index is off its weekly low, though any headwind could snap the summer rally in the Greenback.

The US Dollar (USD) is trading pretty much sideways, not making any big moves, except for the Japanese Yen. The Greenback there loses nearly 0.70% after the US Jobs report print and is at a one-week low level around 144.90 USD/JPY. But overall the losses are fairly contained and are starting to be paired back in the aftermatch of the Nonfarm Payrolls change.

Traders got a perfect summary of the earlier datapoints seen this week, represented in the Jobs report: Nonfarm Payrolls change went up 187k, and even beated last month’s print as it was revised down from 187k to 157k. So jobs were added in the month of August. It looks like the job market is thus still holding out very nicely against these elevate drates. Another hike by the Fed though starts to look doubtfull as the Average Hourly Earnings have dropped from 0.4% to 0.2% month-over-month, pointing to employers having to pay less in order to get staff hired and thus might abate any inflationary pressures.

Daily digest: US Dollar reluctant to move

- In the background commodities are soaring with Crude Oil on a tear. Crude is jumping higher after Kuwait and Saudi crude export numbers point to a multi-year low in exports.

- Senate Leader Chuck Schumer said that the focus net week will be on funding, preventing a shutdown.

- In Asian trading the Chinese Yuan strenghtend against the Greenback after the People’s Bank of China (PBoC) had cut the Forex Reserve Ratio by 0.02%.

- The US jobs report from 12:30 GMT had a few key takeaways: the Nonfarm Payrolls change was a beat of expectations and a beat of July with a revised 157k for July been beaten by 187k for August. Average Hourly Eernings against July have declined from 0.4% to 0.2%. To summarize: people are still finding a job fairly easily, though are not starting to see those higher pays or have less room to get more wage in negotiations, which means less room for spending and less inflationary pressures around the corner.

- Around 13:45 GMT, the S&P Global Manufacturing Purchasing Managers Index (PMI) wil be released for the month of August. Expectations are for an unchanged print at 47, which means a contractionary posture remains.

- Final confirmation from the earlier move on the back of the US Nonfarm Payrolls will come from the ISM Manufacturing PMI for August, which is expected to head from 46.4 to 47. This amounts to a continuation within contraction territory. The Employment Index is expected to stay steady from 44.4 to 44.2 for the next month. The New Orders Index is forecast to head from 47.3 to 46.3; and, the Prices Paid Index from 42.6 to 43.9.

- A similar picture to Thursday unfolds in the equity markets with the Japanese Topix index closes at +0.76%. The Hong Kong Hang Seng heads lower by 0.55%. European and US equities are mildy higher but looking for direction.

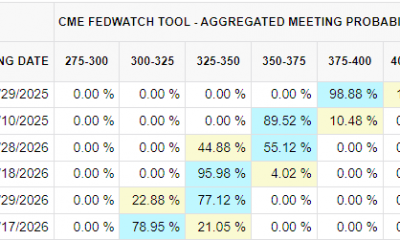

- The CME Group’s FedWatch Tool shows that markets are pricing in an 89% chance that the Federal Reserve will keep interest rates unchanged at its meeting in September. The prior 78% probability was quickly reassessed after the downbeat data from the JOLTS report.

- The benchmark 10-year US Treasury bond yield trades at 4.09% and has halted its decline from earlier this week.

US Dollar Index technical analysis: nor left, nor right… sideways

The US Dollar was not expected to make any moves until the main event this Friday – the August NFP – and did not make any big ones after it neither. This Friday is not over yet as the ISM PMI numbers are still due to come out later and might still trigger some follow through on the mild decline in the US Dollarindex that markets are seeing currently. No real support levels are being tested or are under pressure, so a rebound and a move higher could still be possible.

On the upside, 103.74, the high of August 31, comes into play as the level to beat in order to halt this downturn. Once that level is broken and consolidated, look for a surge to 104.00, where 104.35 (the peak of August 29) is an ideal candidate for a double top. Should the Greenback go on a tear, expect a test at 104.47 – the six-month high.

On the downside, the summer rally of the DXY is set to be broken as only one element now supports the US Dollar. That is the 200-day SMA, and it could mean substantially more weakness to come once the DXY starts trading further below it. The double belt of support at 102.38 with both the 100-day and the 55-day SMA are the last lines of defence before the US Dollar sees substantial and longer-term devaluation.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money.

When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions.

The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoStripe’s stablecoin biz seeks national bank trust charter – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoTech is valued as if AI is the next smartphone. It isn’t. – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin, Ethereum rebound following ‘largest single-day wipeout in crypto history’ – Crypto News

-

Technology1 week ago

Technology1 week agoApple launches MacBook Pro 14-inch with M5 chip in India, price starts at ₹1,69,900 – Crypto News

-

others1 week ago

Four Meme and BNB Partner on $45M ‘Rebirth Support’ Airdrop, First Batch Set to Begin – Crypto News

-

Technology1 week ago

Technology1 week agoCrypto investors brace for more swings after $19 billion liquidation – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoWalmart teams with OpenAI for ChatGPT purchases. The retailer is ‘ahead of the curve’. – Crypto News

-

Business1 week ago

Nasdaq-Listed Webus Adopts XRP in New Tokenized Reward Platform, Eyes $20B Loyalty Market – Crypto News

-

Business1 week ago

Dogecoin Gets Major Utility Boost as Trump-Linked Thumzup Prepares DOGE Payments – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoPowell speech steadies crypto market: Fed hints at slower balance-sheet runoff – Crypto News

-

Business1 week ago

Pro Says Ethereum Price is a Buy Despite Rising Liquidations and BlackRock Selling – Crypto News

-

Business1 week ago

Pro Says Ethereum Price is a Buy Despite Rising Liquidations and BlackRock Selling – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Are These Ripple (XRP) ETF Filings the Worst Idea Ever? Analyst Explains – Crypto News

-

Business1 week ago

Fed’s Stephen Miran Calls for Rapid Rate Cuts Amid U.S.-China Trade Tensions – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoIs Wave 5 Still Coming or a New Bull Trend Emerging? – Crypto News

-

Technology5 days ago

Technology5 days agoChatGPT remains the most popular chatbot globally but Google’s Gemini is catching up fast – Crypto News

-

others4 days ago

‘Floki Is The CEO’: FLOKI Surges Over 20% After Elon Musk’s Name Drop – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago$23 Billion XRP Milestone Spotlighted by CME Group: Details – Crypto News

-

Technology1 week ago

Technology1 week agoAMD strengthens AI push: Oracle to deploy 50,000 MI450 AI chips in data centers starting 2026 – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Continues to Offer Superior Returns and Diversification: Franklin Templeton – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBeyond Bitcoin: How Asia’s new crypto playbook is breaking from the west – Crypto News

-

Business1 week ago

Pi Coin Price Gears for Recovery as DEX and AMM Launch Revives Utility Hopes – Crypto News

-

Technology1 week ago

XRP Price Crashes as Whales Dump 2.23B Tokens — Is $2 the Next Stop? – Crypto News

-

others1 week ago

others1 week agoSeems ‘prudent’ to cut rates further given lower inflation risks – Crypto News

-

Metaverse1 week ago

Metaverse1 week ago‘Erotica for verified adults’: OpenAI to allow mature content on ChatGPT; Sam Altman vows to treat adults like adults – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCelestia price reclaims $1 after crash to $0.27: TIA forecast – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoMint Explainer | Why Big Tech is rushing to build AI data centres across India – Crypto News

-

Technology1 week ago

XRP News: Ripple Strikes Deal with Absa, Expanding Custody Footprint To Africa – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoChatGPT ‘adult model’ plan: OpenAI’s Sam Altman reacts to criticism, says ‘not elected moral police’ – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoVisa Says Stablecoins Are Powering ‘a New Lending Space’ – Crypto News

-

Business1 week ago

Building Through the Downturn – Why Smart Money Is Watching XYZVerse – Crypto News

-

Business1 week ago

Gold vs Bitcoin – Peter Schiff Declares BTC Has Failed as Digital Gold, CZ Reacts – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoGhana Moves Toward Crypto Regulation Amid Rising User Adoption – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoCrypto markets turn red after Trump threatens to halt cooking oil imports from China – Crypto News

-

others7 days ago

Cardano’s Charles Hoskinson Addresses Allegations of Diverting Treasury Funds – Crypto News

-

others1 week ago

others1 week agoEUR/GBP weakens to near 0.8700, French government plans to postpone pension reforms – Crypto News

-

![Nifty 50 Index Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/05/Nifty-50-Index-Elliott-Wave-technical-analysis-Video-Crypto-400x240.jpg)

![Nifty 50 Index Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/05/Nifty-50-Index-Elliott-Wave-technical-analysis-Video-Crypto-80x80.jpg) others1 week ago

others1 week agoDow Jones holds onto recovery levels as investors focus on earnings – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Slides for Second Day as Bitcoin Dips Amid Geopolitical Tensions – Crypto News

-

De-fi1 week ago

De-fi1 week agoLighter Distributes Points to Users Affected by Platform Outage – Crypto News

-

De-fi7 days ago

De-fi7 days agoSony Enters U.S. Crypto Banking Race Amid Growing Institutional Interest – Crypto News

-

others6 days ago

Stripe-backed Tempo Hires Ethereum Researcher Dankrad Feist After $500M Funding – Crypto News

-

others4 days ago

others4 days agoRisk-off sentiment drives selective equity positioning – BNY – Crypto News

-

others3 days ago

Ethereum Price Targets $8K Amid John Bollinger’s ‘W’ Bottom Signal and VanEck Staked ETF Filing – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Continues to Offer Superior Returns and Diversification: Franklin Templeton – Crypto News

-

others1 week ago

Sui Price Targets $9.5 as Figure Brings SEC-Approved Yield Token YLDS to Sui – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCoinbase Plans to List Surging BNB After Previously Delisting Binance Stablecoin – Crypto News

-

De-fi1 week ago

De-fi1 week agoWhat Is a 51% Attack, and How Does It Work? – Crypto News

-

Metaverse7 days ago

Metaverse7 days agoAll About AI Tech4Good Awards are back for the second edition. Apply Now! – Crypto News

-

others7 days ago

others7 days agoUSD/JPY strengthens as Trump’s softer stance on China boosts US Dollar demand – Crypto News

-

De-fi6 days ago

De-fi6 days agoCoinbase Says It Plans to List BNB amid Binance Listing Fee Saga – Crypto News