others

US Dollar sees traders taking profit with PCE not eking out more gains for the Greenback – Crypto News

- The US Dollar has struck a double-whammy with positive US data and a disappointing ECB on Thursday.

- Traders see the PCE print not really suprising or calling for a rate cut in the coming months.

- The US Dollar Index breaks out of a range and could finally be able to trade away from it.

The US Dollar (USD) is paring back some gains that got collected in the aftermath of the US tripod print of US Gross Domestic Product – Durable Goods – Jobless Claims on Thursday. At that same time on Thursday the European Central Bank (ECB) disappointed the market by not sticking out its neck and providing forward guidance to the markets on rate cuts. Traders though are starting to take some profit on the move, seeing it not advancing any further this Friday.

On the economic front, traders have little to get excited about with the Personal Consumption Expenditures (PCE) falling perfectly in line with expecations. Only element that tilts to a bit of US Dollar weakness is the Core PCE number on the yearly timeframe that heads from 3.2% ot 2.9%, where 3% was expected. Though, traders are not betting on this 10 basis points undershooting of estimate will be enough for the US Federal Reserve to start cutting in March already.

Daily digest market movers: That’s all folks!

- Sweden is set to join NATO once Hungary ratifies the agreement in parliament after Turkey already did earlier this week.

- US Treasury Secretary Janet Yellen said during an interview with ABC that she sees “no reason” for a recession this year.

- The Personal Consumption Expenditures (PCE) data for December has been released:

- Monthly Headline PCE went from -0.1% to 0.2%.

- Yearly Headline PCE came ou, as expected, at 2.6%, unchanged.

- Monthly Core PCE is heading from 0.1% to 0.2%.

- Yearly Core PCE was the only main surprise, declining from 3.2% to 2.9%.

- Personal Income went from 0.4% to 0.3%.

- Personal Spending went from a revised up 0.4% to 0.7%.

- Last data point for this Friday comes near 15:00 with Pending Home Sales, expected to head from 0% to 1.5% for December versus November.

- Equity markets are in the red this last day of the week with in Asia all indices down over 1% for Japan and China. European equities are shooting higher by 1%. US Futures are quickly reversing earlier losses towards the opening of the US trading session.

- The CME Group’s FedWatch Tool shows that markets are pricing in a 97.4% possibility for an unchanged rate decision on January 31, with a slim 2.6% chance of a cut.

- The benchmark 10-year US Treasury Note trades near 4.14%, and ties up with the higher levels of earlier this week.

US Dollar Index Technical Analysis: PCE out of the way

The US Dollar Index (DXY) is having a copy-paste moment from earlier this week of last week’s performance. Again the DXY is able to snap above the 200-day Simple Moving Average (SMA) near 103.51, though could face headwinds from the PCE print later this Friday. If the DXY is unable to close off this Friday or this week for that matter, above the 200-day SMA, expect to see another downfall with a test at 103 for a break lower.

In case the DXY would be able to run further away from the 200-day SMA, more upside is in the tank. Look for 104.41 as the first resistance level on the upside, in the form of the 100-day SMA. If that gets breached as well, nothing will hold the DXY from heading to either 105.88 or 107.20 – the high of September.

With the repetition of another break above the 200-day SMA, yet again, a bull trap could get formed once prices would start sliding below the same moving average. This would see a long squeeze with US Dollar bulls being forced to start selling around 103.14 at the 55-day SMA. Once below it, the downturn is open towards 102.00.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhale Sells $407K TRUMP, Loses $1.37M in Exit – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoRobinhood Dealing With Fallout of Tokenized Equities Offering – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoSatoshi-Era Bitcoin Whale Moves Another $2.42 Billion, What’s Happening? – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoRipple and Ctrl Alt Team to Support Real Estate Tokenization – Crypto News

-

Technology6 days ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCardano’s $1.22 target: Why traders should be aware of THIS ADA setup – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin Breaches $120K, Institutional FOMO Takes and House Debate Propel Gains – Crypto News

-

Technology6 days ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Cryptocurrency1 week ago

Why Is Bitcoin Up Today? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoStrategy Resumes Bitcoin Buys, Boosting Holdings to Over $72 Billion in BTC – Crypto News

-

Business1 week ago

Pepe Coin Rich List June 2025: Who’s Holding Highest PEPE as it Nears Half a Million Holders? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoIt’s a Statement, Says Bitfinex Alpha – Crypto News

-

others6 days ago

others6 days agoEUR/USD recovers with trade talks and Fed independence in focus – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoBitcoin trades near $119K after new all-time high; Coinbase rebrands wallet to ‘Base App’ – Crypto News

-

Business5 days ago

XLM Is More Bullish Than ETH, SOL, And XRP, Peter Brandt Declares – Crypto News

-

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://dripp.zone/news/wp-content/uploads/2025/07/Stellar-XLM-bulls-exhausted-after-rally-Is-a-pullback.webp-400x240.webp)

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://dripp.zone/news/wp-content/uploads/2025/07/Stellar-XLM-bulls-exhausted-after-rally-Is-a-pullback.webp-80x80.webp) Cryptocurrency1 week ago

Cryptocurrency1 week agoStellar [XLM] bulls exhausted after rally – Is a pullback nearby? – Crypto News

-

others6 days ago

others6 days agoTop Crypto Exchange by Trading Volume Binance Announces Airdrop for New Ethereum (ETH) Ecosystem Altcoin – Crypto News

-

others6 days ago

others6 days agoVanEck Details Key Drivers Boosting Bitcoin Price, Including Corporate Treasury Demand, ETF Flows and More – Crypto News

-

Business6 days ago

XRP Lawsuit Update: Ripple Paid $125M in Cash, Settlement Hinges on Appeal – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoZiglu Faces $2.7M Shortfall as Crypto Fintech Enters Special Administration – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoUK Banks Should not Issue Stablecoins – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoDonald Trump Jr. backs social media startup aiming to become a crypto powerhouse – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoThe Bitcoin Liquidity Supercycle Has Just Begun: Hedge Fund CEO – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle, Anthropic, OpenAI and xAI join US defence to tackle national security with AI – Crypto News

-

Business1 week ago

CME XRP Futures Hit $1.6B In Total Trading Volume Since Launch – Crypto News

-

Cryptocurrency1 week ago

Fed’s Hammack Raises Inflation Concerns Amid Push For Interest Rate Cut – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoWhy voice is emerging as India’s next frontier for AI interaction – Crypto News

-

Metaverse7 days ago

Metaverse7 days agoNvidia’s Jensen Huang says AI ‘fundamental like electricity’, praises Chinese models as ‘catalyst for global progress’ – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

Business6 days ago

Ethereum Price Prediction- Bulls Target $3,700 As ETH Treasury Accumulation Soars – Crypto News

-

others5 days ago

others5 days agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

others5 days ago

others5 days agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoAnarchy, crime and stablecoins – Blockworks – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoFriday charts: The rise of zero-sum thinking – Crypto News

-

others1 week ago

others1 week agoCrypto Hacker Who Drained $42,000,000 From GMX Goes White Hat, Returns Funds in Exchange for $5,000,000 Bounty – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoPump.fun Concludes $500M ICO in 12 Minutes — But Something Doesn’t Add Up – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Are So Many Crypto Games Shutting Down? Experts Weigh In – Crypto News

-

De-fi1 week ago

De-fi1 week agoRobinhood Opens Ether and Solana Staking to US Users – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTop 3 altcoins under $1 worth watching: Sei, Ethena, Arbitrum – Crypto News

-

De-fi1 week ago

De-fi1 week agoRipple’s RLUSD Market Cap Passes $515M, Flips TrueUSD – Crypto News

-

others1 week ago

Bitcoin Critic Vanguard Becomes Strategy’s (MSTR) Largest Shareholder – Crypto News

-

De-fi6 days ago

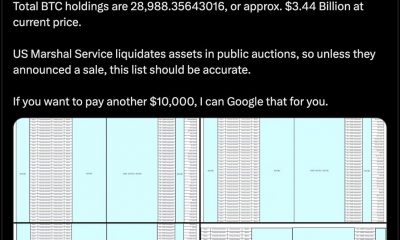

De-fi6 days agoU.S. Marshals Peg Federal Bitcoin Holdings at 28,988 Tokens Worth $3.4 B – Crypto News

-

Cryptocurrency5 days ago

Russia’s $85 Billion Sberbank to Launch Crypto Custody Services – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoNasdaq Exchange Files SEC Form to List Staking Ethereum ETF – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoAltcoins Chase New Highs After Bitcoin Hits $123,000 – Crypto News

-

Technology1 week ago

Technology1 week agoV Guard INSIGHT-G BLDC fan review: Cool performer with a premium look – Crypto News

-

Cryptocurrency1 week ago

Fed’s Hammack Raises Inflation Concerns Amid Push For Interest Rate Cut – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoOmni Network skyrockets 180% as Bitcoin hits $118K: is $10 next? – Crypto News

-

De-fi1 week ago

De-fi1 week agoDeFi TVL Surges Past $126B, Up Over 45% Since April – Crypto News