others

US flash S&P Global Composite PMI recedes in February – Crypto News

The latest flash estimate shows the US S&P Global Composite PMI dropped to 50.4 in February, down from 52.7 in January. This points to a weaker expansion in overall business activity across the private sector.

Meanwhile, the S&P Global Manufacturing PMI edged higher from 51.2 to 51.6, still indicating that manufacturing is expanding. In contrast, the Services PMI decreased from 52.9 to 49.7, reflecting losing momentum in the services sector.

Followinfg the news release, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence argued: “Optimism about the year ahead has slumped from the near-three-year highs seen at the turn of the year to one of the gloomiest since the pandemic. Companies report widespread concerns about the impact of federal government policies, ranging from spending cuts to tariffs and geopolitical developments”.

Market reaction

The US Dollar Index (DXY) continues to trim earlier gains and slips back to teh 106.40 zone, up modestly for the day, in the wake of the release of mixed advanced US business activity reports in February.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.19% | 0.11% | 0.12% | 0.06% | 0.23% | 0.03% | 0.05% | |

| EUR | -0.19% | -0.08% | -0.06% | -0.13% | 0.04% | -0.16% | -0.14% | |

| GBP | -0.11% | 0.08% | 0.04% | -0.05% | 0.12% | -0.09% | -0.07% | |

| JPY | -0.12% | 0.06% | -0.04% | -0.04% | 0.11% | -0.11% | -0.07% | |

| CAD | -0.06% | 0.13% | 0.05% | 0.04% | 0.16% | -0.04% | -0.02% | |

| AUD | -0.23% | -0.04% | -0.12% | -0.11% | -0.16% | -0.20% | -0.19% | |

| NZD | -0.03% | 0.16% | 0.09% | 0.11% | 0.04% | 0.20% | 0.02% | |

| CHF | -0.05% | 0.14% | 0.07% | 0.07% | 0.02% | 0.19% | -0.02% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

This section below was published as a preview of the US S&P Global PMI data at 09:00 GMT.

- The S&P Global preliminary PMIs for February are likely to show little variation from the January final readings.

- The Federal Reserve may resume its easing cycle in July.

- EUR/USD’s near-term outlook remains negative ahead of PMIs.

S&P Global is set to release its early estimates for the United States (US) Purchasing Managers Indexes (PMIs) for February this Friday. These PMIs are based on surveys of top private-sector executives and offer a snapshot of the overall economic health by looking at key factors like GDP, inflation, exports, capacity use, employment, and inventories.

There are three indexes to watch: the Manufacturing PMI, the Services PMI, and the Composite PMI—a weighted average of the two. A reading above 50 signals that economic activity is expanding, while a figure below 50 indicates contraction. Because these figures are published monthly, well before many other official stats, they provide an early look at how the economy is performing.

In January, the Composite PMI came in at 52.7, the lowest level since April 2024, although still indicating a solid performance in business activity. According to S&P Global, “A renewed increase in manufacturing production coincided with a slower rise in services activity. The rate of expansion in new business also eased in January, but the pace of job creation quickened and was the strongest since June 2022. Meanwhile, both input costs and output prices rose at faster rates”.

What can we expect from the next S&P Global PMI report?

Investors expect the flash Manufacturing PMI to nudge up slightly from 51.2 to 51.5 in February, while the Services PMI is anticipated to rise a bit from 52.9 to 53.0.

Even though the manufacturing sector’s performance may not be a surprise, this small improvement could ease worries—especially if the Services sector continues to show strong growth.

Everyone will be closely watching the surveys’ findings on inflation and employment. After Fed Chair Jerome Powell’s cautious comments about easing policies further in his semiannual testimonies, market expectations now place another rate cut in July.

Powell pointed out that there’s no rush to cut rates, thanks to steady economic growth, a solid job market, and inflation that still runs above the 2% target. “We do not need to be in a hurry to adjust policy”, he reiterated.

If the Services PMI unexpectedly falls below 50, it could spark a quick selloff of the US Dollar (USD). On the other hand, if the Services PMI stays on track and the Manufacturing PMI rises above 50 into expansion territory, the USD might strengthen against its rivals.

Looking ahead, if the PMI surveys reveal rising input costs in the service sector alongside a strong labor market, the idea of a tighter-for-longer Fed might be reinforced. Conversely, softer price pressures and weak private sector job growth could renew hopes for further easing, which might put pressure on the USD.

When will the January flash US S&P Global PMIs be released and how could they affect EUR/USD?

The S&P Global Manufacturing, Services and Composite PMIs report will be released on Friday at 14:45 GMT and is expected to show US business activity remaining in the expansion territory.

Ahead of the release, Pablo Piovano, Senior Analyst at FXStreet, notes: “If bulls manage to regain the initiative, EUR/USD could challenge the February peak of 1.0513 recorded on February 14, which is closely followed by the 2025 high of 1.0532 reached on January 27. Should spot break through this barrier, traders might see a spirited climb toward the December 2024 top of 1.0629 (set on December 6) once the Fibonacci retracement of the September-January decline at 1.0572 is cleared.”

“The resurgence of a sustained downward trend, instead, should put the pair en route to revisit the February low of 1.0209 hit on February 3, prior to its 2025 bottom of 1.0176 established on January 13. The breakdown of this level could signal a bearish turn back to the crucial parity zone,” Piovano adds.

“The ongoing negative outlook is expected to persist as long as spot trades below its critical 200-day SMA at 1.0743. Further indicators note that the Relative Strength Index (RSI) remains around the 55 zone, indicating some constructive momentum, although the Average Directional Index (ADX) below 15 denotes a weakening trend,” Piovano concludes.

Economic Indicator

S&P Global Composite PMI

The S&P Global Composite Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging US private-business activity in the manufacturing and services sector. The data is derived from surveys to senior executives. Each response is weighted according to the size of the company and its contribution to total manufacturing or services output accounted for by the sub-sector to which that company belongs. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation. The index varies between 0 and 100, with levels of 50.0 signaling no change over the previous month. A reading above 50 indicates that the private economy is generally expanding, a bullish sign for the US Dollar (USD). Meanwhile, a reading below 50 signals that activity is generally declining, which is seen as bearish for USD.

Last release: Wed Feb 05, 2025 14:45

Frequency: Monthly

Actual: 52.7

Consensus: 52.4

Previous: 52.4

Source: S&P Global

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

-

Technology1 week ago

Technology1 week agoChip Designer Arm Plans to Become Chip Manufacturer – Crypto News

-

Cryptocurrency3 days ago

Cryptocurrency3 days agoSUI eyes 24% rally as bullish price action gains strength – Crypto News

-

others6 days ago

others6 days agoJapanese Yen remains depressed amid modest USD strength; downside seems limited – Crypto News

-

Technology1 week ago

Technology1 week agoMacBook Air M3 15-inch model gets a ₹12,000 price drop on Amazon: Deal explained – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoCoinbase scores major win as SEC set to drop lawsuit – Crypto News

-

others1 week ago

Japan Foreign Investment in Japan Stocks declined to ¥-384.4B in February 7 from previous ¥-315.2B – Crypto News

-

Technology1 week ago

Technology1 week agoPerplexity takes on ChatGPT and Gemini with new Deep Research AI that completes most tasks in under 3 minutes – Crypto News

-

Technology1 week ago

Technology1 week agoLava Pro Watch X with 1.44-inch AMOLED display, in-built GPS launched in India at ₹4,499 – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoXRP Set To Outshine Gold? Analyst Predicts 1,000% Surge – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoAdvisers on crypto: Takeaways from another survey – Crypto News

-

others1 week ago

others1 week agoRemains subdued below 1.4200 near falling wedge’s lower threshold – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago0xLoky Introduces AI-powered Intel for Crypto Data & On-chain Insights – Crypto News

-

Technology1 week ago

Technology1 week agoFactbox-China’s AI firms take spotlight with deals, low-cost models – Crypto News

-

Technology1 week ago

Technology1 week agoMassive price drops on Samsung Galaxy devices: Up to ₹10000 discount on Watch Ultra, Tab S10 Plus, and more – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTether Acquires a Minority Stake in Italian Football Giant Juventus – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP To 3 Digits? The ‘Signs’ That Could Confirm It, Basketball Analyst Says – Crypto News

-

others1 week ago

others1 week agoAustralian Dollar jumps to highs since December on USD weakness – Crypto News

-

Technology1 week ago

Technology1 week agoWeekly Tech Recap: JioHotstar launched, Sam Altman vs Elon Musk feud intensifies, Perplexity takes on ChatGPT and more – Crypto News

-

Technology1 week ago

Technology1 week agoWhat will it take for India to become a global data centre hub? – Crypto News

-

Technology1 week ago

Technology1 week agoChatGPT vs Perplexity: Sam Altman praises Aravind Srinivas’ Deep Research AI; ‘Proud of you’ – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoNEAR Breaks Below Parallel Channel: Key Levels To Watch – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoWill BTC Rebound Or Drop To $76,000? – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoXRP Price Settles After Gains—Is a Fresh Upside Move Coming? – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoHow AI will divide the best from the rest – Crypto News

-

Business6 days ago

Business6 days agoWhat Will be KAITO Price At Launch? – Crypto News

-

Business6 days ago

Business6 days agoElon Musk’s DOGE Launches Probe into US SEC, Ripple Lawsuit To End? – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoXRP Price Pulls Back From Highs—Are Bulls Still in Control? – Crypto News

-

Business5 days ago

Business5 days agoWhales Move From Shiba Inu to FXGuys – Here’s Why – Crypto News

-

Technology1 week ago

Technology1 week agoBest phones under ₹20,000 in February 2025: Poco X7, Motorola Edge 50 Neo and more – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoPopular Investor Says Memecoin More Superior With ‘World’s Best Chart’ – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWho is Satoshi Nakamoto, The Creator of Bitcoin? – Crypto News

-

Technology1 week ago

Technology1 week agoGrok 3 is coming! Elon Musk announces launch date, promises ‘smartest AI on Earth’ – Crypto News

-

Technology7 days ago

Technology7 days agoUnion Minister Ashwini Vaishnaw to launch India AI Mission portal soon, 10 companies set to provide 14,000 GPUs – Crypto News

-

Business6 days ago

Business6 days agoThese 3 Altcoins Will Help You Capitalize on Stellar’s Recent DIp – Crypto News

-

others6 days ago

others6 days agoForex Today: What if the RBA…? – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoHayden Davis crypto scandal deepens as LIBRA memecoin faces fraud allegations – Crypto News

-

Technology5 days ago

Technology5 days agoLuminious inverters for your home to never see darkness again – Crypto News

-

Technology3 days ago

Technology3 days agoStellantis Debuts System to Handle ‘Routine Driving Tasks’ – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoStrange Love: why people are falling for their AI companions – Crypto News

-

Technology1 week ago

Technology1 week agoFormer Google CEO warns of ‘Bin Laden scenario’ for AI: ‘They could misuse it and do real harm’ – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoYap-to-earn takes over Twitter – Blockworks – Crypto News

-

Technology1 week ago

Technology1 week agoCyber fraud alert: Doctor duped of ₹15.50 lakh via fake trading app; here’s what happened – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCrypto narratives as we await next market move – Crypto News

-

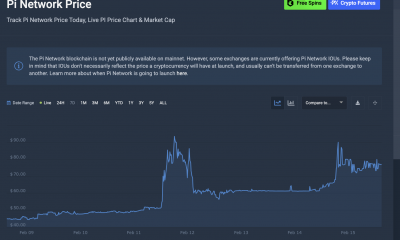

Business1 week ago

Business1 week agoHow Will It Affect Pi Coin Price? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoGameStop Stock Price Pumps After Report of Bitcoin Buying Plans – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Bullish Pennant Targets $15-$17 But Confirmation Is Required – Crypto News

-

Business6 days ago

Business6 days agoWhy Ethereum (ETH) Price Revival Could Start Soon After Solana Mess? – Crypto News

-

Business6 days ago

Business6 days agoMarket Veteran Predicts XRP Price If Ripple Completes Cup and Handle Pattern – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoBitcoin Sees $430M in Outflows as Market Responds to Fed’s Hawkish Stance – Crypto News

-

Cryptocurrency4 days ago

Cryptocurrency4 days agoRipple Whale Bags 20M Coins Amid Recent Dip, What’s Happening? – Crypto News