others

US JOLTS job openings data expected to signal resilient demand for labor – Crypto News

- The US JOLTS data will be watched closely by investors ahead of the December jobs report.

- Job openings are forecast to edge higher to 8.85 million on the last business day of November.

- Further loosening in labor market conditions could ramp up expectations of a Fed rate cut in March.

The Job Openings and Labor Turnover Survey (JOLTS) will be released on Wednesday by the US Bureau of Labor Statistics (BLS). The publication will provide data about the change in the number of job openings in November, alongside the number of layoffs and quits.

JOLTS data will be scrutinized by market participants and Federal Reserve (Fed) policymakers because it could provide valuable insights regarding the supply-demand dynamics in the labor market, a key factor impacting salaries and inflation. While job openings have been trending down during 2023 – a sign of cooling demand for labor – these remain well above pre-pandemic levels.

What to expect in the next JOLTS report?

“Over the month, the number of hires and total separations changed little at 5.9 million and 5.6 million, respectively,” the BLS noted in the October report and added: “Within separations, quits (3.6 million) and layoffs and discharges (1.6 million) changed little.”

After declining steadily from 10.3 million to 8.9 million in the April-July period, job openings rose to 9.49 million in August. In September, this number retreated to 9.3 million and dropped to its lowest level since March 2021 at 8.7 million in October. For the upcoming November data, markets expect another slight uptick to 8.85 million. Meanwhile, Nonfarm Payrolls increased by only 150,000 in October and by 199,000 in November.

Following the Federal Reserve’s (Fed) December policy meeting, the US Dollar (USD) has been struggling to stay resilient against its rivals. The USD Index fell over 2% on a monthly basis and touched its weakest level in five months at 100.60 in the last week of 2023. The Fed’s revised Summary of Economic Projections (SEP) showed that policymakers saw a total of 75 basis points (bps) rate cuts in 2024. Meanwhile, Fed Chairman Jerome Powell said in the post-meeting press conference that policymakers were talking about when it will be appropriate to lower the policy rate and added that they are very focused on “not making the mistake of keeping rates too high too long.” According to the CME Group FedWatch Tool, markets are pricing in an 85% probability that the Fed will lower the policy rate by 25 bps in March.

FXStreet Analyst Eren Sengezer shares his view on the JOLTS Job Openings data and the potential market reaction:

“JOLTS Job Openings data for October surprised to the downside and suggested that labor market conditions continued to loosen following unexpected increases in openings in August and September. A reading at or above 9 million could cause investors to scale back dovish bets and help the USD find demand. On the other hand, a print between 8 and 8.5 million could make it difficult for the currency to hold its ground. However, a significant decline could also hurt the risk mood and trigger a sell-off in US stocks. In this scenario, the USD’s losses could remain limited.”

When will the JOLTS report be released and how could it affect EUR/USD?

Job openings numbers will be published at 15:00 GMT. Eren points out key technical levels to watch for EUR/USD ahead of JOLTS data:

“EUR/USD started the new year under bearish pressure and declined below the lower limit of the ascending regression channel coming from early October, currently located near 1.1000. At the same time, the Relative Strength Index (RSI) retreated toward 50, reflecting a loss of bullish momentum. The 1.0950 level (Fibonacci 23.6% retracement of the October-December downtrend) aligns as the first support for the pair. If this level fails and starts acting as resistance, 1.0850 (200-day Simple Moving Average (SMA), Fibonacci 38.2% retracement) could be set as the next bearish target.

On the upside, buyers could show interest in case EUR/USD returns within the ascending channel by flipping 1.1000 into support. In this scenario, 1.1100 (mid-point of the ascending channel) could be seen as the next resistance before 1.1140 (December 28 high).”

US Dollar price in the last 30 days

The table below shows the percentage change of US Dollar (USD) against listed major currencies in the last 30 days. US Dollar was the weakest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.78% | 0.32% | -1.68% | -1.98% | -3.52% | -1.15% | -2.47% | |

| EUR | 0.72% | 1.06% | -0.85% | -1.23% | -2.77% | -0.43% | -1.56% | |

| GBP | -0.32% | -1.05% | -1.91% | -2.30% | -3.83% | -1.48% | -2.79% | |

| CAD | 1.67% | 0.86% | 1.95% | -0.39% | -1.79% | 0.43% | -0.79% | |

| AUD | 1.94% | 1.24% | 2.25% | 0.30% | -1.50% | 0.82% | -0.52% | |

| JPY | 3.39% | 2.69% | 3.69% | 1.85% | 1.47% | 2.27% | 1.08% | |

| NZD | 1.15% | 0.45% | 1.45% | -0.54% | -0.82% | -2.33% | -1.15% | |

| CHF | 2.94% | 1.57% | 2.70% | 0.71% | 0.49% | -1.15% | 1.28% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money.

When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions.

The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

-

Blockchain1 week ago

Blockchain1 week agoRipple and Ctrl Alt Team to Support Real Estate Tokenization – Crypto News

-

others1 week ago

others1 week agoEUR/USD recovers with trade talks and Fed independence in focus – Crypto News

-

Technology1 week ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoIt’s a Statement, Says Bitfinex Alpha – Crypto News

-

Technology1 week ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Business1 week ago

XLM Is More Bullish Than ETH, SOL, And XRP, Peter Brandt Declares – Crypto News

-

Business1 week ago

Pepe Coin Rich List June 2025: Who’s Holding Highest PEPE as it Nears Half a Million Holders? – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoWhy voice is emerging as India’s next frontier for AI interaction – Crypto News

-

others1 week ago

others1 week agoTop Crypto Exchange by Trading Volume Binance Announces Airdrop for New Ethereum (ETH) Ecosystem Altcoin – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin trades near $119K after new all-time high; Coinbase rebrands wallet to ‘Base App’ – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoAnarchy, crime and stablecoins – Blockworks – Crypto News

-

Technology1 week ago

Technology1 week agoV Guard INSIGHT-G BLDC fan review: Cool performer with a premium look – Crypto News

-

Cryptocurrency1 week ago

Fed’s Hammack Raises Inflation Concerns Amid Push For Interest Rate Cut – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

others1 week ago

others1 week agoVanEck Details Key Drivers Boosting Bitcoin Price, Including Corporate Treasury Demand, ETF Flows and More – Crypto News

-

Business1 week ago

XRP Lawsuit Update: Ripple Paid $125M in Cash, Settlement Hinges on Appeal – Crypto News

-

Technology6 days ago

“Decentralized Ponzi Scheme”- Gold Bug Peter Schiff Slams Landmark Crypto Bills – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoShytoshi Kusama Breaks Silence on New SHIB AI Whitepaper and Transformed Future – Crypto News

-

Technology1 week ago

XLM Price Forecast: Why Stellar Lumens May Crash After 80% Rally in Last 7 Days – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHypercharged Exposure to XRP and Solana Now Available With These Two ETFs – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitMine Shares Rallied After Peter Thiel Investment. – Crypto News

-

others1 week ago

others1 week agoScammer Drains $10,000,000 From IRS in International Tax Fraud and Identity Theft Scheme: DOJ – Crypto News

-

Business1 week ago

Ethereum Price Prediction- Bulls Target $3,700 As ETH Treasury Accumulation Soars – Crypto News

-

others1 week ago

others1 week agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

others1 week ago

others1 week agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

Cryptocurrency1 week ago

Russia’s $85 Billion Sberbank to Launch Crypto Custody Services – Crypto News

-

De-fi7 days ago

De-fi7 days agoBNB Chain Teases New Blockchain with Privacy Features to Compete With Crypto Exchanges – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoXRP Price Spikes to Record Highs As Momentum Signals Extended Gains – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoUS House passes three key crypto bills; market reaction muted as Bitcoin dips – Crypto News

-

De-fi6 days ago

De-fi6 days agoCrypto Market Cap Hits $4 Trillion Milestone as US House Passes Landmark Bills – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoCalifornia Sheriffs Believe 74-Year-Old’s Disappearance Linked to Son’s Crypto Fortune – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoAltseason heats up, but Bitcoin could face short-term pullback – How? – Crypto News

-

Blockchain3 days ago

Blockchain3 days agoInstitutional Demand Surges As Ethereum Sets New Inflow Records – Crypto News

-

De-fi1 week ago

De-fi1 week agoDeFi TVL Surges Past $126B, Up Over 45% Since April – Crypto News

-

De-fi1 week ago

De-fi1 week agoSolana RWA Growth Outpaces Ethereum in 2025 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoNothing Burger or Crypto Catalyst? – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoNvidia’s Jensen Huang says AI ‘fundamental like electricity’, praises Chinese models as ‘catalyst for global progress’ – Crypto News

-

Business1 week ago

$800 Billion JPMorgan To Rival Tether, Circle, and Ripple In Stablecoin Race – Crypto News

-

others1 week ago

Crypto Exchange Hack: BigONE Users Lose A Massive $27 Million In Recent Exploit – Crypto News

-

De-fi1 week ago

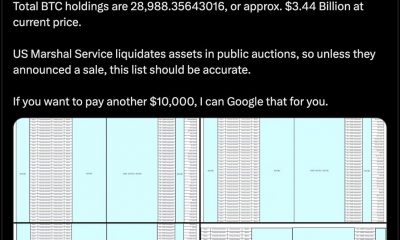

De-fi1 week agoU.S. Marshals Peg Federal Bitcoin Holdings at 28,988 Tokens Worth $3.4 B – Crypto News

-

De-fi7 days ago

De-fi7 days agoU.S. House Passes Clarity, GENIUS, and Anti-CBDC Acts With Historic Bipartisan Support for Crypto – Crypto News

-

Technology7 days ago

Technology7 days agoMalicious code found in fake coding extensions used to steal crypto – Crypto News

-

Technology6 days ago

Technology6 days agoMeta’s AI Studio: Red flag or red herring? – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoWhy Bitcoin self-custody is declining in the ETF era – Crypto News

-

Technology6 days ago

Breaking: GENIUS Act Becomes First Major Crypto Legislation as Trump Signs Bill – Crypto News

-

De-fi6 days ago

De-fi6 days agoCrypto Market Cap Hits $4 Trillion Milestone as US House Passes Landmark Bills – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoArthur Hayes-linked wallet bags $2M worth of AAVE and LDO in an OTC deal – Crypto News

-

others4 days ago

Why Is The Crypto Market Rising Today? – Crypto News

-

Cryptocurrency4 days ago

Cryptocurrency4 days agoXRP Price Hits All-Time High at $3.66 — Can It Smash Through $4 After Trump Win & SEC Shake-Up? – Crypto News