others

USD/CAD juggles above 1.3560 ahead of US/Canada Employment data, oil consolidates – Crypto News

- USD/CAD struggles to find direction as investors seek Canadian employment data for fresh cues.

- A resilient US labor market is likely to support the Fed’s decision of continuation of hawkish policy for a longer period.

- Canada’s Employment Change for December is seen lower at 8K against 10.1K released earlier.

The USD/CAD The pair is oscillating in a narrow range of 1.3560-1.3580 in the early Asian session. The Loonie asset has turned sideways after a rally from the psychological support of 1.3500. The US Dollar witnessed firmer strength from the market participants after the upbeat United States Automatic Data Processing (ADP) Employment Change data triggered a risk-aversion theme.

The US Dollar Index (DXY) soared to the crucial resistance of 105.00 as accelerating expectations of a secular hawkish monetary policy by the Federal Reserve (Fed) improved the safe-haven’s appeal. Also, it provided support for the 10-year US Treasury yields and pushed them above 3.72%. Meanwhile, S&P500 futures have picked up some demand after a sell-off on Thursday, portraying a minor recovery in investors’ risk appetite,

As per the US ADP agency, the United States economy has generated employment for 235K job aspirants against the consensus of 150K. No doubt, firmer labor demand shows strength in an economy but in times of red-hot inflation it provides a meaningful reason to the Fed for avoiding consideration of interest rate cut-approach in the near time.

For more clarity on the status of the US labor market, investors will scrutinize the release of the US Nonfarm Payrolls (NFP) data, which will release on Friday.

Meanwhile, the Canadian Dollar will also display action on the release of the Employment data. According to the estimates, net addition in payrolls for December stands at 8K against 10.1K released earlier. The unemployment rate may escalate marginally to 5.2%.

On the oil front, the oil price is displaying a rangebound action ahead of the release of the official US Employment data. The black golden could pick up strength as the Covid-19 situation might find its peak sooner. It is worth noting that Canada is a leading exporter of oil to the US and higher oil prices support the Canadian Dollar.

-

Technology1 week ago

Technology1 week agoSam Altman says OpenAI is developing a ‘legitimate AI researcher’ by 2028 that can discover new science on its own – Crypto News

-

Technology1 week ago

Technology1 week agoGiving Nvidias Blackwell chip to China would slash USs AI advantage, experts say – Crypto News

-

Technology1 week ago

Technology1 week agoBenQ MA270U review: A 4K monitor that actually gets MacBook users right – Crypto News

-

others1 week ago

others1 week agoBank of Canada set to cut interest rate for second consecutive meeting – Crypto News

-

De-fi1 week ago

De-fi1 week agoBittensor Rallies Ahead of First TAO Halving – Crypto News

-

De-fi1 week ago

De-fi1 week agoAI Sector Rebounds as Agent Payment Systems Gain Traction – Crypto News

-

Business1 week ago

Crypto Market Rally: BTC, ETH, SOL, DOGE Jump 3-7% as US China Trade Talks Progress – Crypto News

-

Business1 week ago

Business1 week agoStarbucks Says Turnaround Strategy Drives Growth in Global Sales – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoIBM Set to Launch Platform for Managing Digital Assets – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoWhat Happens When You Don’t Report Your Crypto Taxes to the IRS – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana Eyes $210 Before Its Next Major Move—Uptrend Or Fakeout Ahead? – Crypto News

-

De-fi1 week ago

De-fi1 week agoREP Jumps 50% in a Week as Dev Gets Community Support for Augur Fork – Crypto News

-

Technology1 week ago

Technology1 week agoDonald Trump as Halo Master Chief? White House joins GameStop’s ‘End of Console Wars’ celebration – Crypto News

-

Technology1 week ago

Pi Coin Price Jumps 24% as 10M Tokens Exit Exchanges – Can Bulls Sustain the Momentum? – Crypto News

-

others1 week ago

others1 week agoGBP/USD floats around 1.3320 as softer US CPI reinforces Fed cut bets – Crypto News

-

others5 days ago

others5 days agoMETA stock has lower gaps to fill – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Phones Struggle as Solana Quietly Pulls Plug on Saga – Crypto News

-

Business1 week ago

Crypto ETFs Attract $1B in Fresh Capital Ahead of Expected Fed Rate Cut This Week – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Edges Lower While US Stocks Hit New Highs – Crypto News

-

others1 week ago

Pi Coin Gains Another 15% As Pi Network Joins ISO 20022 For Seamless Banking Integration – Crypto News

-

others1 week ago

Crypto Market Tumbles as Jerome Powell Says December Rate Cut ‘Far From Certain’ – Crypto News

-

Cryptocurrency1 day ago

Cryptocurrency1 day agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

De-fi1 week ago

De-fi1 week agoBitcoin Dips Under $110,000 After Fed Cuts Rates – Crypto News

-

De-fi1 week ago

De-fi1 week agoMetaMask Fuels Airdrop Buzz With Token Claim Domain Registration – Crypto News

-

De-fi1 week ago

De-fi1 week agoTokenized Nasdaq Futures Enter Top 10 by Volume on Hyperliquid – Crypto News

-

others1 week ago

Is Changpeng “CZ” Zhao Returning To Binance? Probably Not – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCitigroup and Coinbase partner to expand digital-asset payment capabilities – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoInside Bitwise’s milestone solana ETF launch – Crypto News

-

others1 week ago

Can ASTER Price Rebound 50% as Whale Activity and Bullish Pattern Align? – Crypto News

-

Cryptocurrency10 hours ago

Cryptocurrency10 hours agoMany Crypto Treasury Companies Were a Get-Rich-Quick Trap, Warns Columbia Professor – Crypto News

-

others1 week ago

others1 week agoGold weakens as US-China trade optimism lifts risk sentiment, focus turns to Fed – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoGold Price Forecast 2025, 2030, 2040 & Investment Outlook – Crypto News

-

Metaverse1 week ago

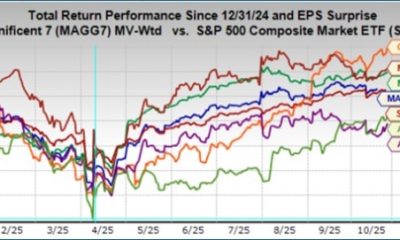

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

De-fi1 week ago

De-fi1 week agoCRO Jumps After Trump’s Truth Social Announces Prediction Market Partnership with Crypto.Com – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoKERNEL price goes vertical on Upbit listing, hits $0.23 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Is Pi Network’s (PI) Price Up by Double Digits Today? – Crypto News

-

Cryptocurrency5 days ago

After 1,993% Burn Spike, Is Shiba Inu Price Set for a Major Trend Reversal? – Crypto News

-

Cryptocurrency1 day ago

Cryptocurrency1 day agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCrypto Analyst Shows The Possibility Of The Ethereum Price Reaching $16,000 – Crypto News

-

Business1 week ago

$2.5T Citigroup Partners With Coinbase to Enable Stablecoin Payments – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoArgentine Stablecoin Use Surged Ahead of President Milei’s Midterm Election Win – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

Cryptocurrency1 week ago

Is Stock Tokenization Really Exploding? Not Even 0.01% – Crypto News

-

Technology1 week ago

Breaking: $2.6B Western Union Announces Plans for Solana-Powered Stablecoin by 2026 – Crypto News

-

Business1 week ago

BNB Chain’s Future Growth Won’t Come From DEXs – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoVisa To Support Four Stablecoins on Four Blockchains – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoZIGChain eyes gains as Nasdaq-Listed SEGG Media backs ZIG – Crypto News

-

Cryptocurrency1 week ago

XRP News: Ripple-Backed Evernorth Amasses Over $1B in XRP Ahead of Nasdaq Listing – Crypto News

-

others1 week ago

others1 week agoPreviewing Mag 7 earnings: What investors should know – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoHayes’ Zcash ‘Vibe Check’ Sparks 30% Moonshot – Crypto News