others

USD/CAD moves away from one-week low, retakes 1.4300 ahead of US/Canadian jobs reports – Crypto News

USD/CAD attracts some buyers and snaps a three-day losing streak to over a one-week trough.

Bearish Oil prices undermine the Loonie and support the pair amid some repositioning trade.

Traders now look forward to employment details from the US and Canada for a fresh impetus.

The USD/CAD pair builds on the overnight bounce from the 1.4240-1.4235 region, or a one-and-half-week low, and gains some positive traction during the Asian session on Friday. This marks the first day of a positive move in the previous three and lifts spot prices back above the 1.4300 round figure in the last hour.

Bearish Crude Oil prices undermine the commodity-linked Loonie and act as a tailwind for the USD/CAD pair. Apart from this, the uptick could be attributed to some repositioning trade ahead of the crucial employment details from the US and Canada, due later during the North American session. Any meaningful appreciating move, however, still seems elusive amid sustained US Dollar (USD) selling bias.

Worries that US President Donald Trump’s trade tariffs could slow the US economic growth in the long run and force the Federal Reserve (Fed) to cut interest rates several times this year dragged the buck to its lowest level since early November on Thursday. Moreover, investors remain uncertain about Trump’s trade policies, especially after another U-turn on the recently imposed tariffs on Mexico and Canada.

Trump on Thursday exempted goods from both Canada and Mexico that comply with the US–Mexico–Canada Agreement for a month from the steep 25% tariffs that he had imposed earlier this week. This helps ease trade war fears, which, along with bets the Bank of Canada (BoC) will pause rate cuts at its upcoming meeting later this month, could support the Canadian Dollar (CAD) and cap the USD/CAD pair.

Traders might also opt to wait for the release of the closely-watched US Nonfarm Payrolls (NFP) report, which will play a key role in influencing the near-term USD price dynamics. Apart from this, Canadian jobs data should provide some meaningful impetus to the USD/CAD pair. Nevertheless, spot prices remain on track to register weekly losses, and the fundamental backdrop warrants caution for bullish traders.

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

-

Metaverse6 days ago

Metaverse6 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoThe Quantum Clock Is Ticking on Blockchain Security – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoStop panicking about AI. Start preparing – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTether Launches Dollar-Backed Stablecoin USAT – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoKalshi Expands Political Footprint with DC Office, Democratic Hire – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCourt Crushes Lawsuit Against Ripple – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTrump family-backed American Bitcoin achieves 116% BTC yield – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRiver price defies market downturn, explodes 40% to new ATH – Crypto News

-

Blockchain22 hours ago

Blockchain22 hours agoPolymarket Taps Circle to Support Dollar-Denominated Settlements – Crypto News

-

Business1 week ago

XRP Payments Utility Expands as Ripple Launches Treasury Platform – Crypto News

-

Technology1 week ago

Technology1 week agoElon Musk says ‘WhatsApp is not secure’ amid Meta privacy lawsuit; Sridhar Vembu cites ‘conflict of interest’ – Crypto News

-

others1 week ago

others1 week agoUS Dollar hits 2022 lows as ‘Sell America’ trade intensifies ahead of Fed’s decision – Crypto News

-

Technology1 week ago

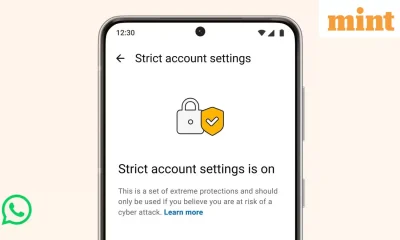

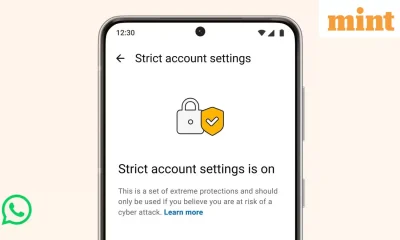

Technology1 week agoWhatsApp launches ‘Strict Account Settings’: How to enable the new lockdown-style mode? – Crypto News

-

others1 week ago

others1 week agoMichael Saylor’s Strategy Buys Another $264,100,000 in Bitcoin (BTC) Amid Crypto Market Downturn – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCrypto Laundering On Centralized Exchanges Declines: Report – Crypto News

-

others1 week ago

others1 week agoFundstrat’s Tom Lee Says Earnings Growth, Dollar Weakness Primed To Drive Stocks Higher – Here’s His Target – Crypto News

-

others1 week ago

others1 week agoQXMP Labs Announces Activation of RWA Liquidity Architecture and $1.1 Trillion On-Chain Asset Registration – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoHow to avoid common AI pitfalls in the workplace – Crypto News

-

others1 week ago

Jerome Powell Speech Tomorrow: What to Expect From Fed Meeting for Crypto Market? – Crypto News

-

Business1 week ago

Strategic Bitcoin Reserve: South Dakota Introduces Bill to Invest in BTC as U.S. States Explore Crypto – Crypto News

-

Business1 week ago

Trump’s Crypto Adviser Confirms Probe Into Alleged Theft From U.S. Crypto Reserve – Crypto News

-

Technology1 week ago

Technology1 week agoWhatsApp launches ‘Strict Account Settings’: How to enable the new lockdown-style mode? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHyperliquid: The frontend wars – Blockworks – Crypto News

-

Technology1 week ago

Solana Price Targets $200 as $152B WisdomTree Joins the Ecosystem – Crypto News

-

others1 week ago

others1 week agoCrypto Exchange Kraken Announces DeFi-Level Yields for Users in US, EU and Canada – Crypto News

-

Technology4 days ago

Fed Rate Cut Uncertainty Mounts as BLS Delays Jobs Report Amid Shutdown – Crypto News

-

others2 days ago

Crypto Market Bill Set to Progress as Senate Democrats Resume Talks After Markup Delay – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBNB Chain’s Prediction Markets Soar As Volume Crosses $20B – Crypto News

-

Technology1 week ago

Trump Speech in Iowa Today: Possible Impact on Stocks and Crypto Market – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin, Ethereum, Crypto News & Price Indexes – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEthereum Price Breaks Back To $3K As Traders Question Follow-Through – Crypto News

-

others1 week ago

Shiba Inu Price Outlook As SHIB Burn Rate Explodes 2800% in 24 Hours – Crypto News

-

Blockchain1 week ago

Blockchain1 week ago4 In 10 US Merchants Now Accept Crypto – Crypto News

-

Business1 week ago

XRP Price Prediction After Ripple Treasury launch – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoWhat’s Going On With The US Dollar And How Does It Affect Bitcoin, Ethereum Prices? – Crypto News

-

Technology1 week ago

Technology1 week agoMicrosoft shares slide as AI spending surges – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoMetaplanet boosts forecasts despite Bitcoin write-down clouding annual results – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoETH price prediction as Ethereum prepares for ERC-8004 mainnet rollout – Crypto News

-

Technology1 week ago

Technology1 week agoEconomic Survey calls for age-based limits on social media access, urges curbs to tackle digital addiction – Crypto News

-

Technology1 week ago

Technology1 week agoSAP Stock Sees Biggest Drop Since 2020 Over Cloud Concerns – Crypto News

-

Technology1 week ago

Technology1 week agoSAP Stock Sees Biggest Drop Since 2020 Over Cloud Concerns – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoAI Tool of the Week: When translation understands context – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoETH Staking Skyrockets as 30% of Total Supply Now Staked in Historic Move – Crypto News

-

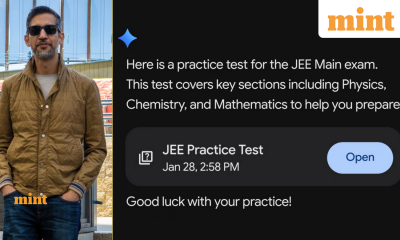

Metaverse5 days ago

Metaverse5 days agoGoogle Gemini launches JEE Main mock test papers: IIT Kharagpur alumnus Sundar Pichai goes nostalgic, ‘If I could…’ – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoChiliz price drops 15% amid sharp altcoin pullback – Crypto News

-

others4 days ago

others4 days agoGBP targets further gains as BoE, NFP loom – Crypto News

-

Business4 days ago

Fed Rate Cut Uncertainty Mounts as BLS Delays Jobs Report Amid Shutdown – Crypto News

-

Technology3 days ago

GLXY Stock Price Falls as Mike Novogratz’s Galaxy Digital Reports $482 Million Q4 Loss – Crypto News