others

USD/INR gathers strength on renewed US Dollar demand, Fed’s Powell speech looms – Crypto News

- The Indian Rupee trades in negative territory in Tuesday’s Asian session.

- Higher US bond yields and further gains in crude oil prices weigh on the local currency.

- The Federal Reserve’s (Fed) Chairman Jerome Powell’s speech on Tuesday will be closely watched.

The Indian Rupee (INR) weakens on Tuesday amid the renewed US Dollar (USD) demand and higher US bond yields. Meanwhile, the further rise of crude oil prices amid fears of Middle East geopolitical risks exerts some selling pressure on the INR as India is the world’s third-largest oil consumer after the United States (US) and China.

Nonetheless, the optimism in the Indian economic outlook and portfolio inflows, including the country’s sovereign bonds on account of their inclusion in the JPMorgan emerging market debt index, might lift the local currency and cap the pair’s upside. Investors will closely watch the speech by Federal Reserve (Fed) Chairman Jerome Powell on Tuesday for fresh impetus. On Wednesday, the attention will shift to India’s HSBC Services Purchasing Managers Index (PMI) for June. Any signs of further expansion in the Indian services sector might boost the Indian Rupee and create a headwind for the pair.

Daily Digest Market Movers: Indian Rupee edges lower amid higher crude oil prices and US bond yields

- India’s HSBC Manufacturing PMI rose to 58.3 in June from the previous reading of 57.5, weaker than the expectation of 58.5.

- Indian Manufacturing PMI growth was boosted by a record-high rate of job creation. The employment rate was supported by buoyant demand conditions that fueled expansions in new orders, output levels, and procurement activities across the sector.

- Foreign investors bought 16.54 billion rupees ($198.4 million) in Indian bonds under the Fully Accessible Route, lower than the market expected.

- US Manufacturing PMI for June declined to 48.5 from 48.7 in May. This figure came in weaker than the estimation of 49.1, the Institute for Supply Management (ISM) reported Monday.

- Financial markets are now pricing in nearly 59.5% chance of 25 basis points (bps) of Fed rate cut in September, up from 58.2% last Friday, according to CME FedWatch Tool.

Technical analysis: USD/INR might face consolidation or downside in the near term

The Indian Rupee trades weaker on the day. The USD/INR pair remains stuck within the familiar trading range on the daily chart. The bullish trend of the pair remains intact above the key 100-day Exponential Moving Average (EMA). However, further consolidation or downside cannot be ruled out as the 14-day Relative Strength Index (RSI) holds in bearish territory below the 50-midline.

Consistent trading above 83.65, a high of June 26, may take USD/INR back to the all-time high of 83.75. An upside breakout might extend its upswing to the 84.00 psychological level.

On the downside, any follow-through selling below the 100-day EMA of 83.35 might drag the pair lower to the 83.00 round figure. A breach of this level will see a drop to 82.82, a low of January 12.

US Dollar price today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.03% | 0.06% | 0.08% | 0.16% | 0.06% | 0.18% | 0.04% | |

| EUR | -0.03% | 0.01% | 0.04% | 0.13% | 0.01% | 0.15% | 0.01% | |

| GBP | -0.05% | -0.01% | 0.02% | 0.12% | -0.01% | 0.14% | -0.01% | |

| CAD | -0.06% | -0.03% | -0.01% | 0.09% | -0.02% | 0.12% | -0.02% | |

| AUD | -0.17% | -0.13% | -0.11% | -0.10% | -0.12% | 0.01% | -0.14% | |

| JPY | -0.05% | -0.02% | 0.01% | 0.02% | 0.11% | 0.13% | 0.00% | |

| NZD | -0.18% | -0.15% | -0.13% | -0.11% | -0.01% | -0.14% | -0.14% | |

| CHF | -0.05% | -0.01% | 0.00% | 0.03% | 0.13% | 0.00% | 0.14% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Indian Rupee FAQs

The Indian Rupee (INR) is one of the most sensitive currencies to external factors. The price of Crude Oil (the country is highly dependent on imported Oil), the value of the US Dollar – most trade is conducted in USD – and the level of foreign investment, are all influential. Direct intervention by the Reserve Bank of India (RBI) in FX markets to keep the exchange rate stable, as well as the level of interest rates set by the RBI, are further major influencing factors on the Rupee.

The Reserve Bank of India (RBI) actively intervenes in forex markets to maintain a stable exchange rate, to help facilitate trade. In addition, the RBI tries to maintain the inflation rate at its 4% target by adjusting interest rates. Higher interest rates usually strengthen the Rupee. This is due to the role of the ‘carry trade’ in which investors borrow in countries with lower interest rates so as to place their money in countries’ offering relatively higher interest rates and profit from the difference.

Macroeconomic factors that influence the value of the Rupee include inflation, interest rates, the economic growth rate (GDP), the balance of trade, and inflows from foreign investment. A higher growth rate can lead to more overseas investment, pushing up demand for the Rupee. A less negative balance of trade will eventually lead to a stronger Rupee. Higher interest rates, especially real rates (interest rates less inflation) are also positive for the Rupee. A risk-on environment can lead to greater inflows of Foreign Direct and Indirect Investment (FDI and FII), which also benefit the Rupee.

Higher inflation, particularly, if it is comparatively higher than India’s peers, is generally negative for the currency as it reflects devaluation through oversupply. Inflation also increases the cost of exports, leading to more Rupees being sold to purchase foreign imports, which is Rupee-negative. At the same time, higher inflation usually leads to the Reserve Bank of India (RBI) raising interest rates and this can be positive for the Rupee, due to increased demand from international investors. The opposite effect is true of lower inflation.

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoEthereum protocol update details plan to boost transaction capacity with blobs – Crypto News

-

Technology7 days ago

XRP Ledger Secures Major Win, Powering China’s Top Supply Chain Firm – Crypto News

-

De-fi1 week ago

De-fi1 week agoCoinbase Widens In-App DEX Trading in Bid to Become ‘Everything Exchange’ – Crypto News

-

Business1 week ago

Gemini Launches XRP Credit Card Amid Ripple-Backed IPO Plans – Crypto News

-

others6 days ago

Ripple’s RLUSD Launches on Aave’s Horizon RWA Market as Adoption Expands – Crypto News

-

others6 days ago

Ripple’s RLUSD Launches on Aave’s Horizon RWA Market as Adoption Expands – Crypto News

-

Business1 week ago

Agentic Commerce Can’t Rely on Credit Cards – Crypto Is the Only Way Forward – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle’s Gemini 2.5 Flash Image does it all – From blurring backgrounds to multi-image fusion – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle’s Gemini 2.5 Flash Image does it all – From blurring backgrounds to multi-image fusion – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoOne Year After Pavel Durov’s Arrest: What’s Ahead? – Crypto News

-

others1 week ago

United States CFTC S&P 500 NC Net Positions climbed from previous $-192.1K to $-171.5K – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHow stablecoin inflows are shaping the L1 price race – Crypto News

-

Technology1 week ago

Technology1 week agoPermit to Starlink bars copying, decryption of Indian data overseas: MoS Telecom – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Dives As On-Chain Data Shows Every Cohort Now Selling – Crypto News

-

others1 week ago

Breaking: U.S. Government to Begin Issuing GDP Data on Blockchain in Latest Crypto Push – Crypto News

-

Business1 week ago

BlackRock Buys $300M in Ethereum as Crypto ETF Inflows Return – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoDecoding Google’s Layer-1 blockchain: what it means and what we know – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoGoogle’s Rich Widmann shares LinkedIn update on Universal Ledger blockchain – Crypto News

-

Business2 days ago

Business2 days agoPYMNTS’ Summer of Big Quotes, From Tariffs to Trust Codes – Crypto News

-

Technology1 week ago

Technology1 week agoOpenAI exploring deal to roll out ChatGPT Plus subscription across THIS country – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEthereum Breaks 8-Year Resistance Against Bitcoin, Needs Confirmation On The 2W Timeframe – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle is working on Quick Share for iPhone: Here’s everything we know so far – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoAnimoca, Antler’s Ibex Launch Fund to Tokenize Japan’s IP – Crypto News

-

Technology1 week ago

Morgan Stanley Flips to September Rate Cut Call: Here’s What Changed – Crypto News

-

Business7 days ago

Pi Network Hackathon Winner Hints at Coinbase Listing Amid Pi Open Source Transition – Crypto News

-

Technology6 days ago

Technology6 days agoPUMP circulating supply shrinks as Pump.fun’s total buybacks surpass $58M – Crypto News

-

Technology1 week ago

Technology1 week ago18 months after surgery, Elon Musk’s first brain chip patient is playing Mario Kart and planning to start a business – Crypto News

-

Technology1 week ago

Technology1 week agoOpenAI posts first job openings for its New Delhi office: Check vacancies, eligibility and how to apply – Crypto News

-

Technology1 week ago

Technology1 week agoTop 9 premium smartwatches you should buy in 2025 if you’re focused on features, not just price – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTop Crypto Market Makers and How to Choose One – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCanary Capital Files “American-Made” Crypto ETF Amid SEC Delays – Crypto News

-

Business1 week ago

Pepe Price Forecast as $19M Net Outflows Signal Accumulation: Is a 130% Rally Next? – Crypto News

-

Blockchain1 week ago

Blockchain1 week ago215% PENGU Rally Incoming? Analyst Says Token ‘Inches’ From Next Leg Up – Crypto News

-

De-fi1 week ago

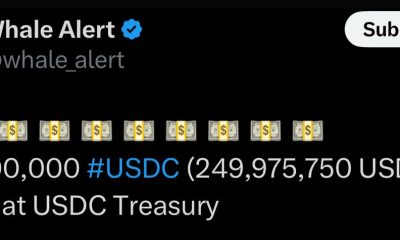

De-fi1 week agoCircle Mints $500 Million USDC in $250 Million Batches, Hits $25 Billion USDC on Solana in 2025 – Crypto News

-

Business1 week ago

CR7 Meme Coin Hits $5M Market Cap Then Dumps Following $143M Rug Pull – Crypto News

-

Business1 week ago

Morgan Stanley Flips to September Rate Cut Call: Here’s What Changed – Crypto News

-

Business1 week ago

Donald Trump Jr.’s VC Firm Invests ‘Millions’ in $1B Crypto Platform Polymarket – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoPhilippine Senator Suggests Putting National Budget On-chain – Crypto News

-

Business6 days ago

Scott Bessent Says 11 ‘Strong’ Candidates in Line to Replace Fed Chair Powell – Crypto News

-

Technology6 days ago

Technology6 days agoMint Explainer | A web for machines, not humans: Decoding ex-Twitter CEO Parag Agrawal’s next big move – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoSouth Korea Busts Hacking Syndicate After Multi-Million Dollar Crypto Losses – Crypto News

-

Technology1 week ago

Technology1 week ago‘Investing in OpenAI is high risk’: ChatGPT maker issues stark warning to investors – Crypto News

-

others1 week ago

others1 week agoUSD/CAD struggles to gain ground as Fed’s Powell turns dovish on interest rate outlook – Crypto News

-

De-fi1 week ago

De-fi1 week agoSBI Group Taps Chainlink to Tokenize Assets, Verify Stablecoins – Crypto News

-

Technology1 week ago

Technology1 week agoGemini taps Ripple to launch limited edition credit card with 4% XRP cashback – Crypto News

-

Technology1 week ago

SEC Delays WisdomTree XRP ETF Decision Until October – Crypto News

-

De-fi1 week ago

De-fi1 week agoPrediction Market Kalshi to Expand Onchain Presence – Crypto News

-

others1 week ago

SEC Pushes Back Decision on Grayscale’s Cardano ETF – Crypto News

-

De-fi1 week ago

De-fi1 week agoPantera Capital Seeks $1.25 Billion to Build Solana Investment Vehicle – Crypto News

-

De-fi1 week ago

De-fi1 week agoPantera Capital Seeks $1.25 Billion to Build Solana Investment Vehicle – Crypto News