others

USD/INR rebounds on weaker US Dollar, geopolitical tensions eyed – Crypto News

- Indian Rupee gains traction on Tuesday, backed by the softer US Dollar.

- Higher oil prices amid the rising tensions in the Middle East and Eastern Europe could weigh on the INR.

- US Conference Board Consumer Confidence Index, Durable Goods Orders, and House Price Index will be released on Tuesday.

Indian Rupee (INR) recovers some lost ground on Tuesday amid the weaker US Dollar (USD). Nonetheless, the INR fell to an all-time low of 83.48 on Friday due to broad weakness in its Asian peers and the aggressive local demand for the USD. Meanwhile, the renewed USD demand and higher oil prices amid the escalating geopolitical tensions in the Middle East and Eastern Europe might drag the INR lower and cap the INR’s upside for the time being.

The US Consumer Confidence report by the Conference Board, Durable Goods Orders, and the FHFA’s House Price Index are due on Tuesday. Later this week, the US Gross Domestic Product Annualized (Q4) will be released on Thursday, which is expected to remain steady at 3.2%. Attention will shift to the US Personal Consumption Expenditures Price Index (PCE) data for February. The headline PCE is estimated to show an increase of 0.4% MoM, while the Core PCE is projected to rise by 0.3% MoM. On the Indian docket, the Indian Current Account data will be released on Thursday.

Daily Digest Market Movers: Indian Rupee stays firm despite global headwinds

- India’s foreign exchange reserves reached an all-time high of $642.49 billion for the week ended March 15, according to the Reserve Bank of India (RBI).

- The rise in foreign exchange reserves was boosted by the maturity of a $5 billion Dollar/Rupee swap that matured on March 11.

- India’s Gross Domestic Product (GDP) growth estimate for the current fiscal year has revised to 7.6% from 7.3%, signaling the strength of the Indian economy.

- The RBI is likely to keep the repo rate on hold at 6.50% at least until the end of Q2 of 2024 and expects to cut interest rates by 25 basis points (bps) in Q3 2024.

- The US February New Home Sales dropped 0.3% MoM from a 1.7% gain in January, below market expectations for a 2.3% MoM rise.

- The Dallas Fed Manufacturing Survey fell to -14.4 in March from the previous reading of -11.3.

Technical Analysis: Indian Rupee resumes longer-term uptrend

Indian Rupee trades strongly on the day. However, USD/INR resumes its upside in the longer term since the pair surged above a multi-month-old descending trend channel last week.

In the near term, the bullish outlook of USD/INR remains intact as the pair holds above the key 100-day Exponential Moving Average (EMA) on the daily chart. Additionally, the 14-day Relative Strength Index lies above the 50 midline, indicating there is still room for near-term USD/INR appreciation.

An all-time high of 83.49 remains a tough nut to crack for USD/INR buyers. A decisive break above this level will pave the way to the 84.00 psychological level. On the flip side, the resistance-turned-support level at 83.20 acts as an initial support level. The crucial contention level is seen at the confluence of the 100-day EMA and the round figure of the 83.00 mark.

US Dollar price today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the New Zealand Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.05% | -0.04% | -0.05% | -0.13% | -0.05% | -0.14% | 0.02% | |

| EUR | 0.05% | 0.00% | -0.01% | -0.08% | 0.00% | -0.09% | 0.06% | |

| GBP | 0.04% | 0.01% | -0.01% | -0.08% | 0.00% | -0.08% | 0.06% | |

| CAD | 0.06% | 0.01% | 0.01% | -0.07% | 0.00% | -0.08% | 0.07% | |

| AUD | 0.12% | 0.08% | 0.08% | 0.07% | 0.09% | -0.01% | 0.14% | |

| JPY | 0.04% | 0.00% | -0.01% | -0.01% | -0.07% | -0.08% | 0.05% | |

| NZD | 0.14% | 0.09% | 0.10% | 0.09% | 0.01% | 0.10% | 0.16% | |

| CHF | -0.01% | -0.06% | -0.06% | -0.07% | -0.14% | -0.05% | -0.16% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Indian Rupee FAQs

The Indian Rupee (INR) is one of the most sensitive currencies to external factors. The price of Crude Oil (the country is highly dependent on imported Oil), the value of the US Dollar – most trade is conducted in USD – and the level of foreign investment, are all influential. Direct intervention by the Reserve Bank of India (RBI) in FX markets to keep the exchange rate stable, as well as the level of interest rates set by the RBI, are further major influencing factors on the Rupee.

The Reserve Bank of India (RBI) actively intervenes in forex markets to maintain a stable exchange rate, to help facilitate trade. In addition, the RBI tries to maintain the inflation rate at its 4% target by adjusting interest rates. Higher interest rates usually strengthen the Rupee. This is due to the role of the ‘carry trade’ in which investors borrow in countries with lower interest rates so as to place their money in countries’ offering relatively higher interest rates and profit from the difference.

Macroeconomic factors that influence the value of the Rupee include inflation, interest rates, the economic growth rate (GDP), the balance of trade, and inflows from foreign investment. A higher growth rate can lead to more overseas investment, pushing up demand for the Rupee. A less negative balance of trade will eventually lead to a stronger Rupee. Higher interest rates, especially real rates (interest rates less inflation) are also positive for the Rupee. A risk-on environment can lead to greater inflows of Foreign Direct and Indirect Investment (FDI and FII), which also benefit the Rupee.

Higher inflation, particularly, if it is comparatively higher than India’s peers, is generally negative for the currency as it reflects devaluation through oversupply. Inflation also increases the cost of exports, leading to more Rupees being sold to purchase foreign imports, which is Rupee-negative. At the same time, higher inflation usually leads to the Reserve Bank of India (RBI) raising interest rates and this can be positive for the Rupee, due to increased demand from international investors. The opposite effect is true of lower inflation.

-

Technology1 week ago

Technology1 week agoSam Altman says OpenAI is developing a ‘legitimate AI researcher’ by 2028 that can discover new science on its own – Crypto News

-

Technology1 week ago

Technology1 week agoGiving Nvidias Blackwell chip to China would slash USs AI advantage, experts say – Crypto News

-

Technology1 week ago

Technology1 week agoBenQ MA270U review: A 4K monitor that actually gets MacBook users right – Crypto News

-

others1 week ago

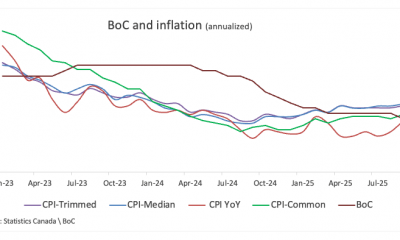

others1 week agoBank of Canada set to cut interest rate for second consecutive meeting – Crypto News

-

De-fi1 week ago

De-fi1 week agoBittensor Rallies Ahead of First TAO Halving – Crypto News

-

De-fi1 week ago

De-fi1 week agoAI Sector Rebounds as Agent Payment Systems Gain Traction – Crypto News

-

Business1 week ago

Business1 week agoStarbucks Says Turnaround Strategy Drives Growth in Global Sales – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoIBM Set to Launch Platform for Managing Digital Assets – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana Eyes $210 Before Its Next Major Move—Uptrend Or Fakeout Ahead? – Crypto News

-

De-fi1 week ago

De-fi1 week agoREP Jumps 50% in a Week as Dev Gets Community Support for Augur Fork – Crypto News

-

Technology1 week ago

Pi Coin Price Jumps 24% as 10M Tokens Exit Exchanges – Can Bulls Sustain the Momentum? – Crypto News

-

others1 week ago

others1 week agoGBP/USD floats around 1.3320 as softer US CPI reinforces Fed cut bets – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Edges Lower While US Stocks Hit New Highs – Crypto News

-

others6 days ago

others6 days agoMETA stock has lower gaps to fill – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Phones Struggle as Solana Quietly Pulls Plug on Saga – Crypto News

-

Business1 week ago

Crypto ETFs Attract $1B in Fresh Capital Ahead of Expected Fed Rate Cut This Week – Crypto News

-

others1 week ago

Pi Coin Gains Another 15% As Pi Network Joins ISO 20022 For Seamless Banking Integration – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

others1 week ago

Crypto Market Tumbles as Jerome Powell Says December Rate Cut ‘Far From Certain’ – Crypto News

-

De-fi1 week ago

De-fi1 week agoBitcoin Dips Under $110,000 After Fed Cuts Rates – Crypto News

-

De-fi1 week ago

De-fi1 week agoTokenized Nasdaq Futures Enter Top 10 by Volume on Hyperliquid – Crypto News

-

Cryptocurrency17 hours ago

Cryptocurrency17 hours agoMany Crypto Treasury Companies Were a Get-Rich-Quick Trap, Warns Columbia Professor – Crypto News

-

De-fi1 week ago

De-fi1 week agoMetaMask Fuels Airdrop Buzz With Token Claim Domain Registration – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCitigroup and Coinbase partner to expand digital-asset payment capabilities – Crypto News

-

others1 week ago

Can ASTER Price Rebound 50% as Whale Activity and Bullish Pattern Align? – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

De-fi1 week ago

De-fi1 week agoCRO Jumps After Trump’s Truth Social Announces Prediction Market Partnership with Crypto.Com – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoInside Bitwise’s milestone solana ETF launch – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Is Pi Network’s (PI) Price Up by Double Digits Today? – Crypto News

-

Cryptocurrency5 days ago

After 1,993% Burn Spike, Is Shiba Inu Price Set for a Major Trend Reversal? – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoGold Price Forecast 2025, 2030, 2040 & Investment Outlook – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoKERNEL price goes vertical on Upbit listing, hits $0.23 – Crypto News

-

Technology1 week ago

Breaking: $2.6B Western Union Announces Plans for Solana-Powered Stablecoin by 2026 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoVisa To Support Four Stablecoins on Four Blockchains – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCrypto Analyst Shows The Possibility Of The Ethereum Price Reaching $16,000 – Crypto News

-

Business1 week ago

$2.5T Citigroup Partners With Coinbase to Enable Stablecoin Payments – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoArgentine Stablecoin Use Surged Ahead of President Milei’s Midterm Election Win – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

others1 week ago

Gold and Silver continue to correct – Commerzbank – Crypto News

-

Cryptocurrency1 week ago

Is Stock Tokenization Really Exploding? Not Even 0.01% – Crypto News

-

Business1 week ago

BNB Chain’s Future Growth Won’t Come From DEXs – Crypto News

-

others1 week ago

When liquidity becomes the new frontier – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoZIGChain eyes gains as Nasdaq-Listed SEGG Media backs ZIG – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoLitecoin: $855K ETF inflow sparks new life – Next target is $105 IF… – Crypto News

-

Cryptocurrency1 day ago

Cryptocurrency1 day agoBitcoin tests $100K support after massive liquidation event rocks market – Crypto News

-

Cryptocurrency1 day ago

Cryptocurrency1 day agoStrategy IPO redefines corporate Bitcoin strategy with euro-denominated offering – Crypto News

-

Business1 week ago

Cardano Price Eyes 80% Rally as x402 Upgrade Sparks Hope for AI Payment Expansion – Crypto News

-

others1 week ago

Litecoin Price Jumps, What’s Behind the Sudden Rally? (28 oct) – Crypto News

-

Business1 week ago

Trump Media Launches Polymarket Rival, Eyes $9B Prediction Market with Crypto.com – Crypto News