others

USD/JPY pushes up to within touching distance of 152.00, analysts bullish – Crypto News

- USD/JPY rises up to within a hair’s breadth of 152.000 after comments from BoJ governor Ueda.

- His views suggest the BoJ is not in a hurry to raise interest rates, reducing the attractiveness of the Yen.

- Analysts are bullish USD/JPY despite the threat of intervention as US-Japan interest rates continue to diverge.

USD/JPY is edging higher into the 151.90s on Tuesday. The latest move comes after a speech by the Governor of the Bank of Japan (BoJ) Kazuo Ueda in which he suggested that any future interest rate hikes – a key FX-market driver – would be highly dependent on incoming data.

Prior to his comments, views had been mixed about the likelihood of the BoJ hiking interest rates in the future. Some analysts saw more interest-rate hikes on the horizon given that core inflation in Japan has remained above the BoJ’s target of 2.0% for 23 consecutive months.

Others have remained more circumspect, pointing to the fact that in Japan where deflation has ravaged for decades, inflation is actually seen as a positive and something to be fostered.

In his speech Ueda seemed to validate those who expect the BoJ to keep interest rates indefinitely low, by introducing doubt about the imminence of future hikes.

Inflation still below target, says Ueda

According to Ueda, “Trend Inflation”, a somewhat tricky gauge that differs from official headline and core measures, is still running below 2.0% and likely to do so for quite some time. A change in the BoJ’s policy stance, therefore, would be dependent on this measure of inflation rising.

“If trend inflation accelerates toward our 2% inflation target, it becomes possible to reduce degree of monetary stimulus somewhat,” said Ueda in his speech on Tuesday.

The two factors the BoJ would be closely monitoring in regards to inflationary pressures would be wage inflation and services inflation, Ueda added.

USD/JPY trading at historic highs

USD/JPY has been trading at historic highs due to the difference in interest rates in the two countries. In the US they are above 5.0% whereas in Japan they remain at around 0.0%.

The difference is significant as it favors the USD over the JPY since investors can reap higher interest payments simply by parking their money in the US.

The effect of the divergence was highlighted by Japanese Current Account data out on Monday, which showed a lower-than-expected level of net inflows into Japan in February. A surplus of over 3 billion JPY had been expected when actually the figure came out at 2.6 billion JPY.

Doubts over Federal Reserve plans

The effect of interest-rate divergence on USD/JPY has further been exacerbated by changing expectations of monetary policy in the US.

Whereas the US Federal Reserve (Fed) had expected to make three 0.25% reductions in interest rates in 2024 the start of the year, the persistence of stubbornly high inflation has led many to doubt this will be the case.

Strong US labor market data on Friday and an unexpected fall in the Unemployment Rate, have further suggested that inflation is likely to remain sticky as more workers earning are likely to also continue spending.

A key macroeconomic release on the calendar this week will be US Consumer Price Index (CPI) data out on Wednesday. If the data shows a rise above expectations it will further reduce the probability that the Fed will cut interest rates as much as previously expected.

The persistence of higher interest rates in the US and lower interest rates in Japan are likely to maintain upside pressure on USD/JPY.

Intervention Fears

The case of USD/JPY is further complicated by the Japanese government and BoJ’s habit of directly intervening in foreign exchange markets to prop up the Yen.

A quick glance at the charts will immediately suggest to the observer that the current level in the 151s is a level that has rejected price multiple times in the past – both in 2022, 2023 and now again in 2024. This is no coincidence.

The Japanese authorities have repeatedly said they will not tolerate the Yen weakening above this level as it harms businesses. So they tend to intervene at around the 150-152 band to push the exchange rate lower.

On Tuesday the Japanese Finance Minister Shunichi Suzuki said the authorities would not rule out any measures in dealing with excessive Yen moves, repeating warnings made in his previous statements, according to TradingEconomics.

This has been interpreted by markets as a verbal intervention. It raises the risk of a physical intervention, however, if the USD/JPY tests 152 or higher.

USD/JPY to 160, say analysts

Intervention can only achieve so much, however, and strategists at Bank of America Merill Lynch (BofA) recently said in a note that if the fundamentals continue to show such a wide interest-rate divergence, USD/JPY is likely to break higher regardless of the authorities’ attempts to intervene, and potentially make it to 160.

Such a scenario, however, would be dependent on the Fed scraping its plans for cutting interest rates in 2024, something currently not envisaged.

A combination of the BoJ holding back from raising interest rates in 2024 and the Fed delaying its plans to cut rates could continue exerting upside pressure on the pair.

A similar conclusion was reached by analysts at Brown Brothers Harriman (BBH) in a recent note in which they said “It’s only a matter of time before USD/JPY rises”. This, they put down to a combination of the BoJ’s very gradual attempts to raise interest rates and the Fed’s likely delay in making interest rate cuts.

-

Technology1 week ago

Technology1 week agoSam Altman says OpenAI is developing a ‘legitimate AI researcher’ by 2028 that can discover new science on its own – Crypto News

-

Technology1 week ago

Technology1 week agoGiving Nvidias Blackwell chip to China would slash USs AI advantage, experts say – Crypto News

-

De-fi1 week ago

De-fi1 week agoBittensor Rallies Ahead of First TAO Halving – Crypto News

-

others1 week ago

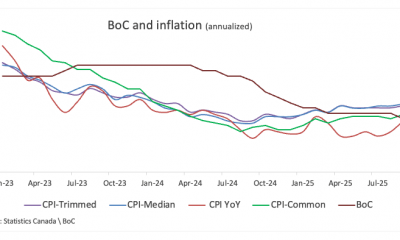

others1 week agoBank of Canada set to cut interest rate for second consecutive meeting – Crypto News

-

Business1 week ago

Business1 week agoStarbucks Says Turnaround Strategy Drives Growth in Global Sales – Crypto News

-

others1 week ago

others1 week agoMETA stock has lower gaps to fill – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Edges Lower While US Stocks Hit New Highs – Crypto News

-

others1 week ago

Pi Coin Gains Another 15% As Pi Network Joins ISO 20022 For Seamless Banking Integration – Crypto News

-

De-fi1 week ago

De-fi1 week agoBitcoin Dips Under $110,000 After Fed Cuts Rates – Crypto News

-

Cryptocurrency3 days ago

Cryptocurrency3 days agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

Cryptocurrency7 days ago

After 1,993% Burn Spike, Is Shiba Inu Price Set for a Major Trend Reversal? – Crypto News

-

others1 week ago

Crypto Market Tumbles as Jerome Powell Says December Rate Cut ‘Far From Certain’ – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSmart Money Buys the Dip – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoMany Crypto Treasury Companies Were a Get-Rich-Quick Trap, Warns Columbia Professor – Crypto News

-

Cryptocurrency3 days ago

Cryptocurrency3 days agoBitcoin tests $100K support after massive liquidation event rocks market – Crypto News

-

others1 week ago

Can ASTER Price Rebound 50% as Whale Activity and Bullish Pattern Align? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBasel Reportedly Aims for Friendlier Crypto Bank Guidelines – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoAI boom is just beginning – Nvidia CEO Jensen Huang explains what’s driving the virtuous cycle – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoZIGChain eyes gains as Nasdaq-Listed SEGG Media backs ZIG – Crypto News

-

Cryptocurrency3 days ago

Cryptocurrency3 days agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

Cryptocurrency3 days ago

Cryptocurrency3 days agoLitecoin: $855K ETF inflow sparks new life – Next target is $105 IF… – Crypto News

-

Cryptocurrency3 days ago

Cryptocurrency3 days agoStrategy IPO redefines corporate Bitcoin strategy with euro-denominated offering – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCZ Weighing Lawsuit Against US Senator over Money Laundering Claim: Report – Crypto News

-

Business1 week ago

Not L1s or Wallets – Who Generates the Bulk of Crypto’s $20B in Revenue? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoIs the Market Finally Learning to Handle Volatility? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Cost Basis Map Reveals Key War Zone Between Bulls & Bears – Crypto News

-

Business1 week ago

WLF Token Jumps 7% as Former Robinhood Counsel Joins Trump-Backed World Liberty Financial – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoArbitrum beats Ethereum in inflows: Yet ARB price lags – Here’s why – Crypto News

-

Technology1 week ago

Technology1 week agoInjective (INJ) completes its first community buyback worth $32 million – Crypto News

-

Technology1 week ago

Technology1 week agoEthereum Foundation launches institutional portal to boost enterprise adoption – Crypto News

-

Business1 week ago

Bitcoin Price Forecast as Trump Cuts Tariffs After US-China Trade Deal – Crypto News

-

others1 week ago

Cardano Price Risks 20% Crash Amid Death Cross and Falling ADA ETF Odds – Crypto News

-

Technology1 week ago

Canary XRP ETF Filing Removes SEC Delay Clause, Targets November Launch – Crypto News

-

De-fi1 week ago

De-fi1 week agoFourMeme Surpasses Pumpfun With $43 Million in Monthly Revenue – Crypto News

-

Technology1 week ago

XRP Price Outlook as ETF Nears Possible November 13 Launch – Crypto News

-

Technology1 week ago

Technology1 week agoCities Deploy Robots as Firefighters, Tour Guides and Lawnmowers – Crypto News

-

others7 days ago

Russia S&P Global Manufacturing PMI dipped from previous 48.2 to 48 in October – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoHBAR under pressure, Descending channel hints at 24% downside move – Crypto News

-

Metaverse7 days ago

Metaverse7 days agoPerplexity AI CEO Aravind Srinivas touts new feature revealing Indian politicians’ stock holdings—How will it work? – Crypto News

-

others7 days ago

Pi Coin Price Prediction After AI Investment Announcement – Is a Bull Run Ahead? – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoRipple Just Made XRP and RLUSD Tradeable Like Stocks: Here’s How – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoTokenized Treasuries cross $8.6B as banks and exchanges push collateral use – Crypto News

-

Blockchain4 days ago

Blockchain4 days agoStablecoin Orchestration Becomes FinTech Battleground – Crypto News

-

others4 days ago

“Never Had Plans to Sue Binance,” Wintermute CEO Evgeny Gaevoy Confirms – Crypto News

-

Cryptocurrency3 days ago

Cryptocurrency3 days agoBittensor (TAO) plunges 16% amid broader crypto sell-off – Crypto News

-

De-fi1 week ago

De-fi1 week agoNEAR Cuts Inflation Rate by Half Despite Failed Community Vote – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Chart Mirrors Gold Right Before Its Parabolic Run – Crypto News

-

others1 week ago

others1 week agoGBP/USD tests six months lows as Pound Sterling continues to sink – Crypto News

-

Technology1 week ago

Technology1 week agoGHOST extends rally as whale scoops 4.8 million tokens – Crypto News

-

others7 days ago

others7 days agoGBP/USD hits seven-month low as UK fiscal woes, Fed hawkishness weigh – Crypto News