others

USD/MXN stabilizes above 17.00 on firm US Dollar ahead of PMIs – Crypto News

- USD/MXN shifts comfortably above $17.00 as the US Dollar remains resilient.

- The appeal for risk-sensitive currencies remains weak due to the upside risks of a global slowdown.

- Investors await the interest rate decision from the Banxico, which will be announced next week.

The USD/MXN pair has shifted its auction above the crucial resistance of 17.00 on Friday. The asset strengthens as the US Dollar remains firm despite the Federal Reserve (Fed) announcing an unchanged interest rate decision on Wednesday as anticipated by market participants.

S&P500 futures added some gains in the European session, portraying an ease in the risk-off market mood. The broader trend is still opposing the appeal for risk-sensitive currencies due to the upside risks of a global slowdown.

The US Dollar Index (DXY) remains directionless near a six-month high around 105.70 amid uncertainty over the interest rate peak. Fed policymakers delivered a hawkish interest rate outlook at the Federal Open Market Committee (FOMC) meeting, hinting at one more interest rate increase of 25 basis points (bps), which will push interest rates to 5.50%-5.75%.

Meanwhile, investors will focus on the release of the preliminary S&P Global PMIs for September, which will be released at 13:15 GMT. The Manufacturing PMI is expected to improve marginally to 48.0 from the August reading of 47.9. The Services PMI, which tracks a sector that accounts for two-thirds of the US economy, is anticipated to rise to 50.6 from 50.5 in August.

On the Mexican Peso, investors focus on the interest rate decision from the Bank of Mexico (Banxico), which will be announced next week. The Mexico central bank has maintained interest rates unchanged at 11.25% in the past three monetary policies.

Economists at Société Générale cited strong growth outperformance and progress on inflation containment have helped MXN to eclipse the EM currency complex this year. However, headwinds are accumulating from currently rich valuations, shifts in the Developed Markets rates paradigm, and changes to domestic policies regarding currency intervention.

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoEthereum protocol update details plan to boost transaction capacity with blobs – Crypto News

-

Technology7 days ago

XRP Ledger Secures Major Win, Powering China’s Top Supply Chain Firm – Crypto News

-

De-fi1 week ago

De-fi1 week agoCoinbase Widens In-App DEX Trading in Bid to Become ‘Everything Exchange’ – Crypto News

-

Business1 week ago

Gemini Launches XRP Credit Card Amid Ripple-Backed IPO Plans – Crypto News

-

others6 days ago

Ripple’s RLUSD Launches on Aave’s Horizon RWA Market as Adoption Expands – Crypto News

-

others6 days ago

Ripple’s RLUSD Launches on Aave’s Horizon RWA Market as Adoption Expands – Crypto News

-

Business1 week ago

Agentic Commerce Can’t Rely on Credit Cards – Crypto Is the Only Way Forward – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle’s Gemini 2.5 Flash Image does it all – From blurring backgrounds to multi-image fusion – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle’s Gemini 2.5 Flash Image does it all – From blurring backgrounds to multi-image fusion – Crypto News

-

others1 week ago

United States CFTC S&P 500 NC Net Positions climbed from previous $-192.1K to $-171.5K – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHow stablecoin inflows are shaping the L1 price race – Crypto News

-

Technology1 week ago

Technology1 week agoPermit to Starlink bars copying, decryption of Indian data overseas: MoS Telecom – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Dives As On-Chain Data Shows Every Cohort Now Selling – Crypto News

-

others1 week ago

Breaking: U.S. Government to Begin Issuing GDP Data on Blockchain in Latest Crypto Push – Crypto News

-

Business1 week ago

BlackRock Buys $300M in Ethereum as Crypto ETF Inflows Return – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoDecoding Google’s Layer-1 blockchain: what it means and what we know – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoGoogle’s Rich Widmann shares LinkedIn update on Universal Ledger blockchain – Crypto News

-

Business2 days ago

Business2 days agoPYMNTS’ Summer of Big Quotes, From Tariffs to Trust Codes – Crypto News

-

Technology1 week ago

Technology1 week agoOpenAI exploring deal to roll out ChatGPT Plus subscription across THIS country – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoOne Year After Pavel Durov’s Arrest: What’s Ahead? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEthereum Breaks 8-Year Resistance Against Bitcoin, Needs Confirmation On The 2W Timeframe – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle is working on Quick Share for iPhone: Here’s everything we know so far – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoAnimoca, Antler’s Ibex Launch Fund to Tokenize Japan’s IP – Crypto News

-

Technology1 week ago

Morgan Stanley Flips to September Rate Cut Call: Here’s What Changed – Crypto News

-

Business7 days ago

Pi Network Hackathon Winner Hints at Coinbase Listing Amid Pi Open Source Transition – Crypto News

-

Technology6 days ago

Technology6 days agoPUMP circulating supply shrinks as Pump.fun’s total buybacks surpass $58M – Crypto News

-

Technology1 week ago

Technology1 week ago18 months after surgery, Elon Musk’s first brain chip patient is playing Mario Kart and planning to start a business – Crypto News

-

Technology1 week ago

Technology1 week agoOpenAI posts first job openings for its New Delhi office: Check vacancies, eligibility and how to apply – Crypto News

-

Technology1 week ago

Technology1 week agoTop 9 premium smartwatches you should buy in 2025 if you’re focused on features, not just price – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTop Crypto Market Makers and How to Choose One – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCanary Capital Files “American-Made” Crypto ETF Amid SEC Delays – Crypto News

-

Business1 week ago

Pepe Price Forecast as $19M Net Outflows Signal Accumulation: Is a 130% Rally Next? – Crypto News

-

Blockchain1 week ago

Blockchain1 week ago215% PENGU Rally Incoming? Analyst Says Token ‘Inches’ From Next Leg Up – Crypto News

-

De-fi1 week ago

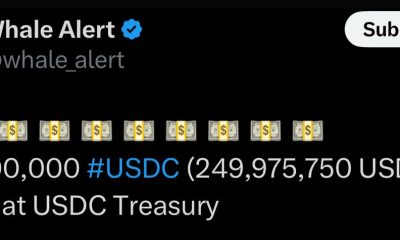

De-fi1 week agoCircle Mints $500 Million USDC in $250 Million Batches, Hits $25 Billion USDC on Solana in 2025 – Crypto News

-

Business1 week ago

CR7 Meme Coin Hits $5M Market Cap Then Dumps Following $143M Rug Pull – Crypto News

-

Business1 week ago

Morgan Stanley Flips to September Rate Cut Call: Here’s What Changed – Crypto News

-

Business1 week ago

Donald Trump Jr.’s VC Firm Invests ‘Millions’ in $1B Crypto Platform Polymarket – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoPhilippine Senator Suggests Putting National Budget On-chain – Crypto News

-

Business6 days ago

Scott Bessent Says 11 ‘Strong’ Candidates in Line to Replace Fed Chair Powell – Crypto News

-

Technology6 days ago

Technology6 days agoMint Explainer | A web for machines, not humans: Decoding ex-Twitter CEO Parag Agrawal’s next big move – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoSouth Korea Busts Hacking Syndicate After Multi-Million Dollar Crypto Losses – Crypto News

-

others1 week ago

others1 week agoUSD/CAD struggles to gain ground as Fed’s Powell turns dovish on interest rate outlook – Crypto News

-

De-fi1 week ago

De-fi1 week agoSBI Group Taps Chainlink to Tokenize Assets, Verify Stablecoins – Crypto News

-

Technology1 week ago

Technology1 week agoGemini taps Ripple to launch limited edition credit card with 4% XRP cashback – Crypto News

-

Technology1 week ago

SEC Delays WisdomTree XRP ETF Decision Until October – Crypto News

-

De-fi1 week ago

De-fi1 week agoPrediction Market Kalshi to Expand Onchain Presence – Crypto News

-

others1 week ago

SEC Pushes Back Decision on Grayscale’s Cardano ETF – Crypto News

-

De-fi1 week ago

De-fi1 week agoPantera Capital Seeks $1.25 Billion to Build Solana Investment Vehicle – Crypto News

-

De-fi1 week ago

De-fi1 week agoPantera Capital Seeks $1.25 Billion to Build Solana Investment Vehicle – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto and DeFi in 2026: Adoption, Innovation, and the Road Ahead – Crypto News