Cryptocurrency

What Chiliz traders should be on the lookout for before going long? – Crypto News

- After a quick push up the charts, CHZ whales withdrew about $3 million from Binance.

- CHZ direction could trade sideways in the short term as traders rush to long the token.

The first week of the new year brought some respite as altcoins including chili’s [CHZ] registered value increases. Between 4 January and the early hours of 5 January, the sports fan token was up 10%. This surge set whale action in motion as a few investors took to taking out some of their holdings, Lookonchain revealed.

how many CHZ tokens you can get for $1,

According to the “smartmoney” on-chain analyst, a total of $3 million worth of CHZ left the Binance exchange in two separate transactions.

After Upbit announced the addition of 7 new fan tokens and only supports Chiliz chain recharge, the price of $CHZ rose by 10%.

Whales begin to withdraw $CHZ from #Binance,

Address “0xb88e” withdrew 8,899,972 $CHZ($1.02M) and address “0x1c3a” withdrew 9,435,590 $CHZ($1.08M). pic.twitter.com/xoH9i8JRqF

— Lookonchain (@lookonchain) January 5, 2023

As strong as a bull

Contrary to what might have been expected, the exchange outflow did not result in a downtrend for CHZ. At press time CoinMarketCap data showed that the CHZ price maintained the green, putting up a 7.53% increase.

However, the CHZ trend did not stop with its price rise. The volume also increased by over 196% to $223 million. Normal circumstances would mean that it was still a good period to long CHZ. But what is the point of view of technical indicators?

According to the daily chart, CHZ was contracting in volatility. Around 15 December, the token volatility had risen based on the indications from the Bollinger Bands (BB).

A continuous price decrease also followed this extremely volatile spike. The contraction, however, began as the CHZ price increased. Notably, the price approached the upper band. In a scenario where it follows through with the movement, CHZ might become overbought. So, a price reversal could be likely.

Are your holdings flashing green? check the CHZ Profit Calculator

The Directional Movement Index [DMI] benchmarked a further movement in the bullish direction. This was due to the positive DMI (green) rising to 20.54.

The negative DMI (red), stumbled downwards to 23.86. Although the -DMI value was greater, the Average Directional Index (ADX) indicated better directional strength in favor of the +DMI. 41.20 was a point high enough to help CHZ maintain its uptick.

No hesitation in the market because…

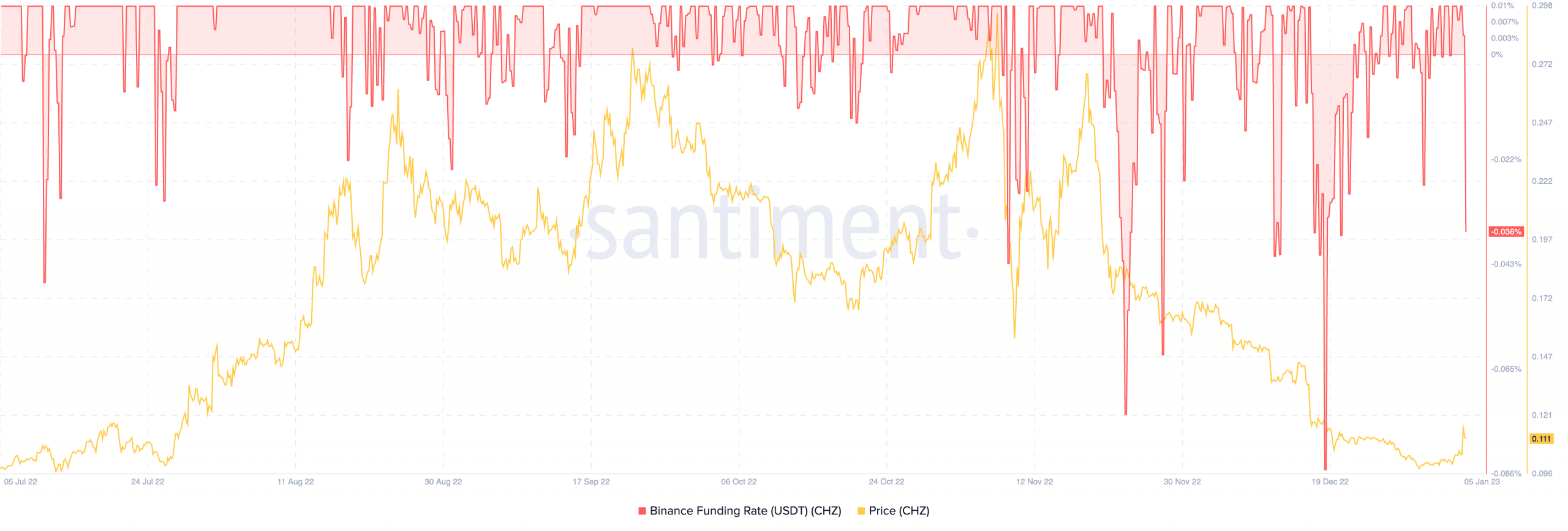

Meanwhile, the uptick has not driven traders to the derivatives market with the mission to open CHZ futures contract positions. This was because of the Binance funding rate had dropped -0.0036% while CHZ traded at $0.11.

The reason could be due to the inconsistent swing in direction and momentum revealed by the indicators.

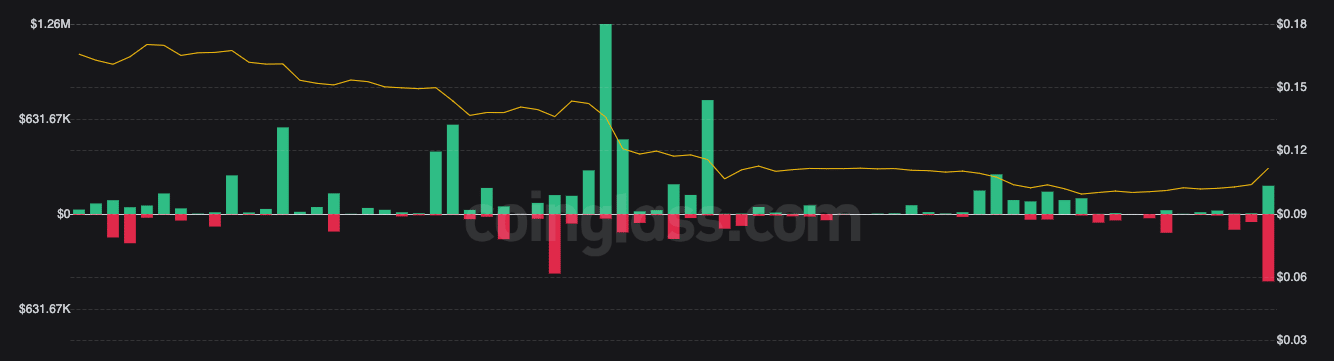

However, information from Coinglass showed that the CHZ futures open interest was in double-digit increase across the top exchanges in the last 24 hours.

This implied that a high number of contracts were opened by participants during the intraday trading. As expected, shorts were mostly victims of liquidationaccounting for $447,620 out of a possible $693,210.

-

Business1 week ago

Business1 week agoHow Mid-Sized Treasurers Are Managing Liquidity Amid Uncertainty – Crypto News

-

others4 days ago

others4 days agoUSD/CAD trades with negative bias around mid-1.3800s, just above two-week low – Crypto News

-

De-fi4 days ago

De-fi4 days agoBitcoin Hits $109,439 Ahead of 15th Anniversary of Laszlo Hanyecz’s 10,000 BTC Pizza Purchase – Crypto News

-

Technology4 days ago

Technology4 days agoBuild your own PC with up to 60% off on CPUs, GPUs, and more: No cost EMI starting at ₹99 – Crypto News

-

Business4 days ago

XRP ETF Odds Surge Amid CME Futures Growth: Can Approval Happen by June 17? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana Poised For Upside Move After A Bounce From $168 – Crypto News

-

De-fi4 days ago

De-fi4 days agoBitcoin Hits $109,439 Ahead of 15th Anniversary of Laszlo Hanyecz’s 10,000 BTC Pizza Purchase – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoStablecoin bill passes in Northern Marianas as House overrides veto – Crypto News

-

others1 week ago

Dogecoin On-Chain Metrics Hint At DOGE Mega Rally Ahead – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTop crypto to buy as Saudi Central Bank reveals exposure to MSTR – Crypto News

-

others1 week ago

Kekius Maximus Token Jumps 119% as Elon Musk Changes X Profile – Crypto News

-

others4 days ago

others4 days agoFeds Charge Atlanta Man for Allegedly Applying for Over $3,390,000 in Fraudulent Small Business Loans During COVID – Crypto News

-

Blockchain2 days ago

Blockchain2 days agoWhy Equity Markets Are Being Tokenized – Crypto News

-

Technology1 week ago

Technology1 week agoIs Apple Pay down? Users report widespread payment failures – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitfinex Bitcoin longs total $6.8B while shorts stand at $25M — Time for BTC to rally? – Crypto News

-

Technology1 week ago

Technology1 week agoCoinbase estimates $400M cost after data breach and crypto scam – Crypto News

-

Technology1 week ago

Technology1 week agoInfinix Note 50s 5G Review: Most balanced phone under ₹20,000 – Crypto News

-

Technology1 week ago

XRP Price Impact If GENIUS Act Boosts Ripple’s RLUSD Market Cap to 50% of Tether’s $150B – Crypto News

-

others7 days ago

Here’s Dogecoin Price Prediction if Saudi Arabia Central Bank Drives BTC to $250,000 – Crypto News

-

others4 days ago

Shiba Inu Price Surges as Whales Buy 530 Trillion SHIB – Breakout Imminent? – Crypto News

-

others1 week ago

others1 week agoCrypto Trader Prints 517x Profit on Solana-Based Altcoin That’s Exploded 7,000% in Just One Week: Lookonchain – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCardano Price Down Again On Broader Market Decline. Here’s The Way Back Up – Crypto News

-

others1 week ago

others1 week agoUSD/INR climbs on renewed US Dollar demand – Crypto News

-

Technology1 week ago

Technology1 week agoSave big on smart TVs: Up to 70% off on top models from best selling brands like Samsung, Sony, LG and more – Crypto News

-

Blockchain1 week ago

Blockchain1 week ago90% of institutions ‘taking action’ on stablecoins: Fireblocks survey – Crypto News

-

Business1 week ago

XRP Futures ETF Goes Live on May 19: Will It Beat ETH And BTC Debut? – Crypto News

-

others1 week ago

XRP Futures ETF Goes Live on May 19: Will It Beat ETH And BTC Debut? – Crypto News

-

others1 week ago

others1 week agoUS Senators Make Potential Progress on Stablecoin Bill Amid Partisan Negotiations: Report – Crypto News

-

De-fi1 week ago

De-fi1 week agoPresident Trump Urges U.S. to Engage with Bitcoin as Wall Street and Trillion-Dollar Firms Show Interest – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoUK confirms crypto tax data rules under CARF; first deadline set for May 2027 – Crypto News

-

Business1 week ago

World Liberty Financial Partners Chainlink To Enable USD1 Stablecoin Cross-Chain Transfers – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Panic Buying? Eric Trump Says the World Is Stockpiling BTC – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRipple’s XRP may enable BRICS to ditch dollar and settle trade in gold – Crypto News

-

others1 week ago

others1 week agoFBI Issues New Scam Warning, Says Fraudsters Have Been Impersonating ‘Senior US Officials’ in Text and Voice Messages – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoGalaxy Digital secures Nasdaq listing after 4 years: ‘$GLXY’ – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoNFTs rise 69%, hit new $4.8B high: What’s driving the 2025 surge? – Crypto News

-

others1 week ago

others1 week agoMexican peso trims some losses from Banxico interest-rate cut – Crypto News

-

others1 week ago

others1 week agoDow Jones finds fresh weekly highs as investor sentiment holds firm – Crypto News

-

others1 week ago

others1 week agoHow Blockchain Technology Is Revolutionizing Data Security Across Industries – Crypto News

-

others1 week ago

United States Baker Hughes US Oil Rig Count fell from previous 474 to 473 – Crypto News

-

Business1 week ago

XRP DeFi Milestone: Vaultro Launches First Decentralised Index Fund Dashboard on XRPL – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoMint Explainer: Microsoft envisions a web driven by AI agents. What will it look like? – Crypto News

-

De-fi5 days ago

De-fi5 days agoBinance Moves to Dismiss FTX’s $1.76B Clawback Suit, Citing Hong Kong Law and Sam Bankman-Fried’s 25-Year Sentence – Crypto News

-

Metaverse4 days ago

Metaverse4 days agoIndian companies lag in workforce upskilling amid AI disruption, job cuts – Crypto News

-

Technology4 days ago

Technology4 days agoGoogle supercharges Gemini with new AI features at I/O 2025: 13 Updates you should not miss – Crypto News

-

Cryptocurrency4 days ago

Cryptocurrency4 days agoBitcoin’s realized cap adds $3B – Here’s why BTC’s rally isn’t over – Crypto News

-

Technology1 week ago

XRP Price Cracks 5% After Kickbacks in Ripple-SEC Lawsuit, What’s Next? – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoAI Tool of the Week: How to get end-to-end tasks done using Genspark Super Agent – Crypto News

-

Technology5 days ago

Technology5 days agoApple Desperately Needs the AI Help It’s Seeking – Crypto News

-

De-fi5 days ago

De-fi5 days agoJPMorgan, With $3 Trillion in Assets, Lets Clients Buy Bitcoin Near $105,300 Without Custody Service – Crypto News