Technology

Why Is Bitcoin Price Up Despite US Stock Market Crash? – Crypto News

Despite the bloodbath on Wall Street this week, Bitcoin price and the broader crypto market have been showing massive strength, firmly holding around $83,000 and not being part of the volatility induced by Trump tariff wars. In the US stock market crash over the last two days, the Nasdaq Index has plunged over 2000 points, or 11.4% drop, the steepest fall since COVID-19 crash.

Bitcoin Price Resilience Confirms Hedge to US Stock Market?

This BTC resilience to the falling US equity market has got everyone discussing that the asset is now truly emerging as a hedge against the global market uncertainties. Since the Trump reciprocal tariffs kicked in on April 2 Liberation Day, Bitcoin has been the only asset in Green when compared to Gold, Silver, and Magnificent 7 stocks.

Returns Since Liberation Day:

🟢 BTC: +2.2%

🔴 Gold: -2.9%

🔴 SPY: -10.5%

🔴 QQQ: -11.2%Magnificent Seven:

🔴 MSFT: -5.8%

🔴 GOOGL: -7.3%

🔴 AMZN: -12.8%

🔴 META: -13.6%

🔴 NVDA: -14.6%

🔴 TSLA: -15.3%

🔴 AAPL: -15.9%— Ryan Rasmussen (@RasterlyRock) April 4, 2025

Despite the Bitcoin price facing rejection at $89,000, it has held firmly around the support of $82,000. As of press time, BTC is trading 0.6% up at $83,669 with a market cap of $1.660 trillion, with daily trading volumes up 42% to $42.5 billion. However, investors still remains hopeful of $90K BTC breakout from here.

Experts Have Mixed Opinion on BTC

Bitcoin appears to be showing signs of decoupling from traditional financial markets, according to prominent Bitcoin contributor and Blockstream CEO Adam Back.

In a recent post on X, Back suggested that the long-observed correlation between Bitcoin and traditional equities may have been artificially maintained. He speculated that market makers could be using Bitcoin’s liquidity conditions—particularly the shortage of fiat liquidity—to create an automatic correlation during U.S. market hours. However, Jeff Dorman, CIO of Arca institutional investment said:

“Everyone is talking about BTC strength in the face of a 2-day, 10%+ stock sell-off, even as gold falls. But this has nothing to do with stocks Bitcoin is NOT, & never has been, a market hedge. It is a gov’t/bank hedge. This selloff is due to a loss of trust in global gov’t”.

Where’s BTC Heading Next?

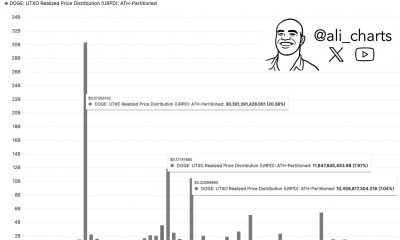

Despite the strong Bitcoin price performance recently, investors still need to be watchful of the on-chain metric here. Crypto analyst Ali Martinez has flagged a notable decline in Bitcoin’s exchange-related activity, suggesting a possible dip in investor sentiment and network engagement.

Another popular analyst Kyledoops stated: “Someone for sure bidding BTC here, either it’s a mega trap and going to mark down, or when equities bounce crypto will giga send. There’s a lack of edge here because its 50/50”. Our Bitcoin price prediction indicator shows BTC to continue the consolidation above $82,000 levels over the next month.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

others1 week ago

others1 week agoHere’s What Bitcoin Needs To Do To Confirm Bullish Breakout, According to Trader Who Nailed 2024 BTC Correction – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP MVRV Ratio Dips Below The 200-Day MA – Trend Shift Underway? – Crypto News

-

others6 days ago

others6 days agoBybit Shuts Down Its NFT Marketplace As Crypto Sector Struggles To Recover – Crypto News

-

others1 week ago

others1 week agoGold extends bullish trend amid rising trade tensions; fresh record high and counting – Crypto News

-

Business1 week ago

Business1 week agoCan Pi Coin Price Hit $1 Soon? – Crypto News

-

others1 week ago

others1 week agoHere’s What Bitcoin Needs To Do To Confirm Bullish Breakout, According to Trader Who Nailed 2024 BTC Correction – Crypto News

-

others1 week ago

others1 week agoHere’s What Bitcoin Needs To Do To Confirm Bullish Breakout, According to Trader Who Nailed 2024 BTC Correction – Crypto News

-

others1 week ago

others1 week agoXRP and Three Other Altcoins Could Witness Another Sell-Off Event, According to Crypto Strategist – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoSony Singapore Now Lets Shoppers Pay in USDC Through Crypto.com – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoDogecoin Breaking These Levels Could Be The Catalyst For Next Bull Run, Analyst Says – Crypto News

-

Business1 week ago

Business1 week agoXRP, BTC, ETH Price Prediction As Inflation Data Sparks Downturn in U.S. Stocks – Crypto News

-

Blockchain1 week ago

Blockchain1 week agozkLend hacker claims losing stolen ETH to Tornado Cash phishing site – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSpaceX flight bankrolled by crypto investor launches first manned polar orbit – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoWill Bitcoin Downtrend Continue? This Metric Suggests Yes – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBinance ends Tether USDT trading in Europe to comply with MiCA rules – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBinance ends Tether USDT trading in Europe to comply with MiCA rules – Crypto News

-

others1 week ago

Austria Unemployment fell from previous 347.4K to 316.3K in March – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoAnalyst Calls Dogecoin Chart A ‘Beauty’ As Key Indicators Align – Crypto News

-

Technology6 days ago

Technology6 days agoXRP Price Predicted to Reach $10 in April if US Congress Stablecoin Bill Promotes Ripple’s RLUSD – Crypto News

-

Business6 days ago

Business6 days agoXRP Price Predicted to Reach $10 in April if US Congress Stablecoin Bill Promotes Ripple’s RLUSD – Crypto News

-

Technology6 days ago

Technology6 days agoApple Intelligence debuts on Vision Pro with visionOS 2.4 update: AI-powered features, spatial content and more – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoUS equities slip after job openings disappointment – Crypto News

-

others6 days ago

others6 days agoWill BNB Price Rally to ATH After VanEck BNB ETF Filing? – Crypto News

-

others6 days ago

others6 days agoPound Sterling consolidates against US Dollar ahead of Trump’s tariffs announcement – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoFLOKI price poised for 20% rally, Here’s why – Crypto News

-

others6 days ago

others6 days agoPENDLE Price Jumps 8% Today Amid Huge Whale Accumulation – Crypto News

-

others6 days ago

others6 days agoFundstrat’s Tom Lee Calls for Imminent Stock Market Reversal, Says US Has the ‘Right Pieces’ for a Bottom – Crypto News

-

Technology6 days ago

Technology6 days agoEuropean regulators warn of financial risks from US crypto integration – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoIs Bitcoin’s rebound near as key area rises? Assessing… – Crypto News

-

Business1 week ago

Business1 week agoBuilder.ai Announces Third-Party Audit After Allegations – Crypto News

-

others1 week ago

others1 week agoWill the RBA hint at further interest rate hikes at its policy meeting? – Crypto News

-

Technology1 week ago

Technology1 week agoOver 60 pc broadband, fiber, DSL users surveyed flag problems with connection: LocalCircles poll – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTether Boosts Bitcoin Holdings By 8,888 BTC In Q1 2025 – Crypto News

-

Technology1 week ago

Technology1 week agoBumper discounts in Amazon Gaming Fest! Up to 70% off on gaming laptops, monitors, vlog cameras and more – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoHayes Predicts $250,000 Bitcoin As Fed Caves To QE Pressure – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoXRP, DOGE Shoot up as BTC Price Reclaims $84K Level (Market Watch) – Crypto News

-

Technology7 days ago

Technology7 days agoBest washing machines under ₹10000 in April 2025 to boost your laundry routine without overspending – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoBitcoin traders are overstating the impact of the US-led tariff war on BTC price – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoBitcoin Price Bounces Back—Can It Finally Break Resistance? – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoUS equities slip after job openings disappointment – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoUK trade bodies ask government to make crypto a ‘strategic priority’ – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoSeveral Altcoins Crash Up To 50% On Binance, What’s Going On? – Crypto News

-

Business6 days ago

Business6 days agoWhat to Expect From XRP Price as Trump’s ‘Liberation Day’ Tariffs Go Into Effect Today – Crypto News

-

Technology6 days ago

Technology6 days agoFranklin Templeton Eyes Crypto ETP Launch In Europe After BlackRock & 21Shares – Crypto News

-

Technology1 week ago

Technology1 week agoChatGPT finally allows free users to create Ghibli-style AI images: Check our step-by-step guide – Crypto News

-

Technology1 week ago

Technology1 week agoElon Musk’s Grok AI calls him ‘top misinformation spreader’, sparks debate on ‘AI freedom’ – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWill the $80K Support Level Hold BTC After Recent Rejection? – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoMint Primer | Resistance is futile: AI is now writing code – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoThe Tools of Tomorrow: What Lies Ahead with the AI Revolution – Crypto News

-

Business1 week ago

Business1 week agoMicroStrategy Acquires 22,048 Bitcoin For $1.92 Billion – Crypto News

✓ Share: